Picking the right hotel credit card is crucial if you want to earn free stays around the world while traveling.

One of the main things to look at is the earning potential. Look at the number of points you’ll earn for stays at the hotels as well as other bonus categories.

Some credit cards offer much easier ways to earn points than others. Some also offer different ratios.

You also want to consider whether you want a brand-specific card or a generic travel credit card.

- If you aren’t ready to commit to a certain hotel chain, then choose a general travel credit card.

- If you already have a hotel chain you love and always use, consider getting a credit card for that chain.

Here are our recommended credit cards for hotel rewards:

Card | Rewards | Bonus | Annual Fee |

| Capital One Venture Rewards Credit Card | 2X – 5X

2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel

| 75,000 miles

75,000 miles once they spend $4,000 on purchases within 3 months from account opening

| $95 | Review |

|---|---|---|---|---|---|

| The World of Hyatt | 1X – 4X

4 Bonus Points per $1 spent on purchases at all Hyatt hotels. Plus, 5 Base Points from Hyatt per eligible $1 spent for being a World of Hyatt member. 2x Bonus Points per $1 spent at restaurants, on airline tickets purchased directly from the airline, local transit and commuting as well as fitness club and gym memberships. Plus, earn 1 Bonus Point per $1 spent on all other purchases.

| 2 free nights + 25,000 Points

2 free nights at any Category 1–4 Hyatt hotel or resort after you spend $4,000 on purchases in the first 3 months from the account opening. Plus, 25,000 Bonus Points after you spend $12,000 on purchases in the first 6 months from account opening

| $95 | Review |

| IHG® Rewards Club Premier Credit Card | 3X – 10X

Up to 10X points from IHG® on stays for being an IHG One Rewards member. Up to 6X points from IHG® on stays with Platinum Elite Status. 5X total points on travel, dining, and at gas stations and 3X points per $1 spent on all other purchases.

| 140,000 Bonus Points

Earn 140,000 Bonus Points After you spend $3,000 on purchases in the first 3 months from account opening

| $99 | Review |

| >Hilton Honors Card from American Express | 3X – 7X

7X Hilton Honors Bonus Points for each dollar of eligible purchases charged directly with hotels and resorts within the Hilton portfolio, 5x points at U.S. restaurants (including takeout and delivery) U.S.supermarkets, U.S. gas stations and 3x points for each dollar on other eligible purchases

| 100,000 points

100,000 Hilton Honors Bonus Points after you spend $2,000 in purchases on the Card in the first 6 months of Card Membership

| $0 (Rates & Fees) | Review |

The Platinum Card® from American Express | 1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

| 175,000 points

175,000 Membership Rewards® Points after spending $8,000 in eligible purchases on your new Card in your first 6 months of Membership

| $695 (Rates & Fees) | Review | |

Marriott Bonvoy Boundless® Credit Card | 1x – 6X

6X points for every $1 spent at over 7,000 hotels participating in Marriott Bonvoy® with the Marriott Bonvoy Boundless® credit card. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. Earn 3X points for every $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining. Earn 2X points for every $1 you spend on all other purchases.

| 3 Free Night Awards after spending $3,000 on eligible purchases within 3 months of account opening.

Earn 3 Free Night Awards

after spending $3,000 on eligible purchases within 3 months of account opening.* Each Free Night Award valued up to 50,000 points – that's a total value of up to 150,000 points! Certain hotels have resort fees.

| $95 | Review | |

Chase Sapphire Preferred® Card | 2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

| 75,000 points

75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening

| $95

| Review |

Capital One Venture Rewards Credit Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

This card has one of the best offers for easily redeeming points with hotel chains. One of the best parts is that you are not restricted to working with one specific hotel chain like many of the other hotel credit cards.

You will book your own travel and then redeem the hotel points using points you have collected with the card. You also get 5X miles for any hotels you book throughout Capital One Travel.

The only drawback is you don’t get hotel-specific perks such as late checkout or room upgrades. If you want to be loyal to one hotel to get these perks, you might want to consider getting a card for that hotel line instead of this more basic one.

- APR: 19.99% – 29.74% (Variable)

- Annual fee: $95

- Balance Transfer Fee: N/A

- Foreign Transaction Fee: $0

- Rewards Plan: 2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel

- Sign Up bonus: 75,000 miles once they spend $4,000 on purchases within 3 months from account opening

- 0% APR Introductory Rate period: N/A

- Flexible Rewards Redemption

- Great Sign-Up Bonus

- No Blackout/Expiration Dates

- No Accumulation Limit on Miles

- High Variable APR

- Airline Partners Limitations

- $95 Annual Fee

- Redeem Points for a Statement Credit

- What are Capital One Venture card income requirements? Capital One often required monthly income to be at least $800. Sometimes, you will need to show some proof of income.

- Does rewards points expire? They do not expire.

- Can I get pre-approved on card Capital One Venture Card? Yes, you can get pre-approval.

- What is the initial credit limit ? The minimum credit limit is set at $5,000.

- How do I redeem cash back? You can do so in a number of ways, such as spending your accumulated miles directly on travel purchases, or redeem as cash, using at participating retailers, and so on.

- What purchases don't earn cash back with the Capital One Venture Card? Every purchase earns cashback.

- Should You Move to Capital One Venture Card? If you spent a decent amount of time and money on travel expenses.

- Why did Capital One Venture Card deny me? What to Do Next? You might not have met all of the requirements. You can enquire as to where your application fell short. If you cannot proceed, you can look at some of the other available options.

The World of Hyatt Credit Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

If you frequently stay at Hyatt hotels, this card could be a great fit for you. It offers some of the best point redemption values and grants you Discoverist elite status for as long as you're a cardholder. You'll also receive a free anniversary night at a Category 1-4 hotel or resort each year. Plus, you can enjoy room upgrades and late checkouts for most of your stays.

The only drawback is that Hyatt is a much smaller chain of hotels than Marriott and other hotels. This limits the number of options you get for hotel choices.

- Rewards Plan: 4 Bonus Points per $1 spent on purchases at all Hyatt hotels. Plus, 5 Base Points from Hyatt per eligible $1 spent for being a World of Hyatt member. 2x Bonus Points per $1 spent at restaurants, on airline tickets purchased directly from the airline, local transit and commuting as well as fitness club and gym memberships. Plus, earn 1 Bonus Point per $1 spent on all other purchases.

- APR: 21.49%–28.49% variable

- Annual fee: $95

- Balance Transfer Fee: $5 or 5% (whichever is greater)

- Foreign Transaction Fee: $0

- Sign Up bonus: 2 free nights at any Category 1–4 Hyatt hotel or resort after you spend $4,000 on purchases in the first 3 months from the account opening. Plus, 25,000 Bonus Points after you spend $12,000 on purchases in the first 6 months from account opening

- 0% APR Introductory Rate: N/A

- Travel Rewards & Welcome Bonus

- One Free Night Every Year

- Monthly Bonus Category

- Discoverist Status

- Annual Fee

- No Discounts For Multi-Night Stays

- Better For Off Season

Does the Hyatt card have a point rewards limit?

There is no points reward limit on either card, but there is an introductory offer with either card that requires you meet a spending limit to get bonus points.

Can I get car rental insurance?

No, the World of Hyatt card does not offer a car rental insurance.

Can I redeem for flights with airline partners?

World of Hyatt is partnered with 25 airlines including Delta SkyMiles, American Airlines AAdvantage, and British Airways Executive Club. Generally, the transfer rate is a 5:2 ratio. This means that 5,000 points is worth 2,000 of the airline miles, but this can vary depending on the airline miles program

Can I get pre approved?

Typically, Chase does not have pre approval for its cards including the World of Hyatt card. This means that when you complete the online application form, it will trigger a hard credit search.

Does it offer flight cancellation insurance?

No, the World of Hyatt card doesn't offer flight cancellation/interruption or delay insurance.

What are the top reasons not to get it?

If you don’t typically care what hotel you stay in when you are on vacation, you’ll find this card a bit restrictive. In this scenario, you would be better off with a miles or other type of rewards card that allows you to redeem your rewards for flights, hotel stays and other travel perks.

IHG One Rewards Premier Credit Card

Reward Details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Card Features

- Pros & Cons

The IHG card offers some great perks, including a free anniversary night at IHG hotels and Platinum Elite status for as long as you hold the card. You’ll also earn a free reward night after staying four nights or more. With Elite status, you’ll enjoy benefits like free internet, late checkouts, occasional room upgrades, and discounted room rates.

Just like with all-room branded cards, you have to be willing to always travel and stay at IHG hotels to get points. Make sure you are always booking your rooms with the card to earn your points.

- APR: 20.99% – 27.99% variable

- Annual fee: $99

- Balance Transfer Fee: $5 or 5%

- Foreign Transaction Fee: $0

- Rewards Plan: Up to 10X points from IHG® on stays for being an IHG One Rewards member. Up to 6X points from IHG® on stays with Platinum Elite Status. 5X total points on travel, dining, and at gas stations and 3X points per $1 spent on all other purchases.

- Sign Up bonus: Earn 140,000 Bonus Points After you spend $3,000 on purchases in the first 3 months from account opening

- 0% APR Introductory Rate period: N/A

- Big Rewards on All IGH Purchases

- Many Hotels to Choose From

- Quality Sign-up Bonus

- Automatic Platinum Status

- Annual Fee

- Rewards Limited to Hotel Redemption

- Not For Everyday Purchases

Hilton Honors American Express Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

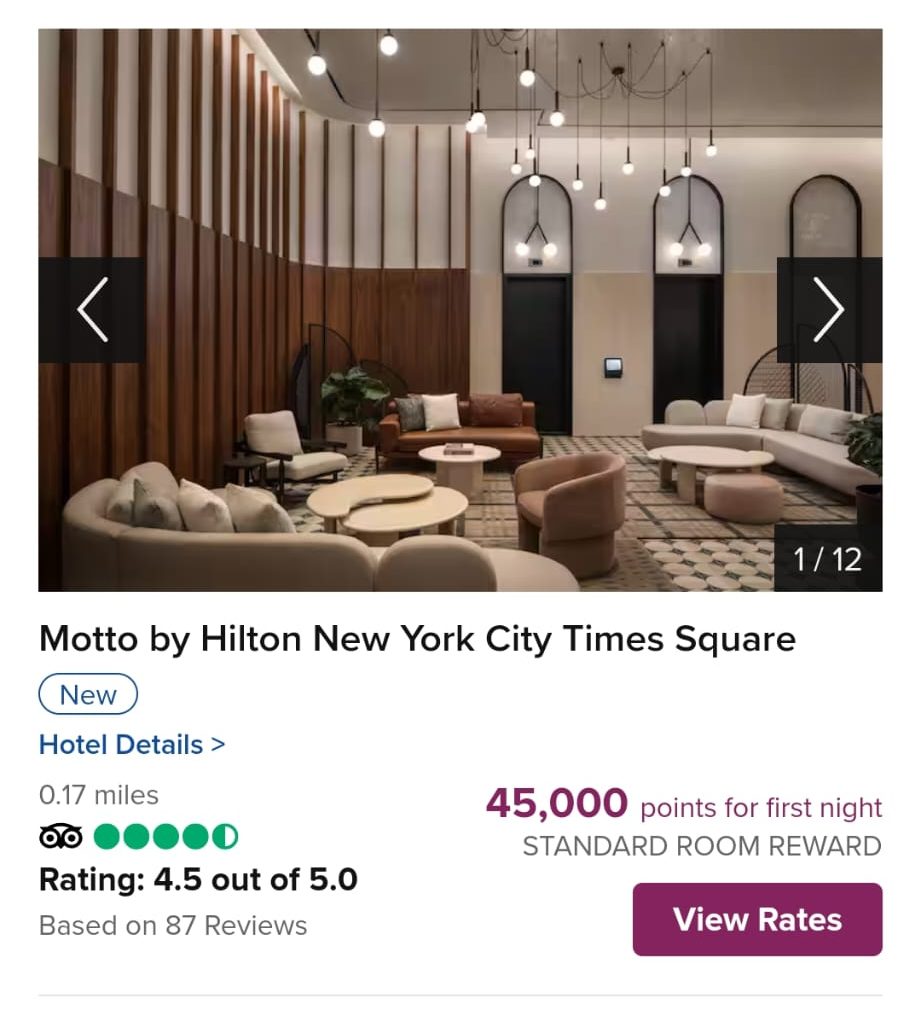

The Hilton Honors Card from American Express card has low rewards point values, but it can still help you get upgraded stays and cheaper room rates if you are loyal and dedicated to Hilton hotels and their partner hotels.

Everyone gets the Gold status automatically so you will be able to get rewards and earn free stays from the very start of your status as a cardholder.

This card gives you the ability to earn and redeem points in hotels in more than 109 countries with over 5,500 hotels to choose from.

You also get free breakfast with every stay, room upgrades, and a free fifth night at every Hilton portfolio hotel. Here we compare the Hilton Honors and the World of Hyatt Card.

- Rewards Plan: 7X Hilton Honors Bonus Points for each dollar of eligible purchases charged directly with hotels and resorts within the Hilton portfolio, 5x points at U.S. restaurants (including takeout and delivery) U.S.supermarkets, U.S. gas stations and 3x points for each dollar on other eligible purchases

- APR: 20.24% – 29.24% variable APR

- Annual fee: $0

- Balance Transfer Fee: n/a

- Foreign Transaction Fee: $0

- Sign Up bonus:100,000 Hilton Honors Bonus Points after you spend $2,000 in purchases on the Card in the first 6 months of Card Membership

- 0% APR Introductory Rate: N/A

- Welcome Bonus & Rewards

- No Annual Fee

- No Foreign Transaction Fees

- Loyalty Program

- Too Niche

- Low Redeeming Rate

- High APR

Can I redeem for flights with airline partners?

Hilton Honors allows swapping points for miles with almost all of the major domestic airlines and some international carriers including British Airways and Air Canada. However, the transfer ration is typically 10:1. This means you’ll need 10,000 Hilton Honors points to get 1,000 miles.

Do the travel reward points expire?

Hilton Honors points do not actually expire, but if your account is inactive for 24 months, any points balance will be forfeited.

Can I get pre approved?

American Express does allow pre approval for the Hilton Honors card. This takes only 30 seconds and you’ll need to supply some basic information. You can then make an informed decision without impacting your credit.

What is the initial credit limit?

The card limit for the Hilton Honors American Express is $1,000 to $20,000, based on your score and other factors.

Should you move to the Hilton Honors Card?

If you are brand loyal to a particular hotel chain, getting a rewards card dedicated to this hotel chain is a good idea. You can not only earn free stays, but you can also enjoy other perks. So, if you love Hilton hotels, these cards could be a good option for you.

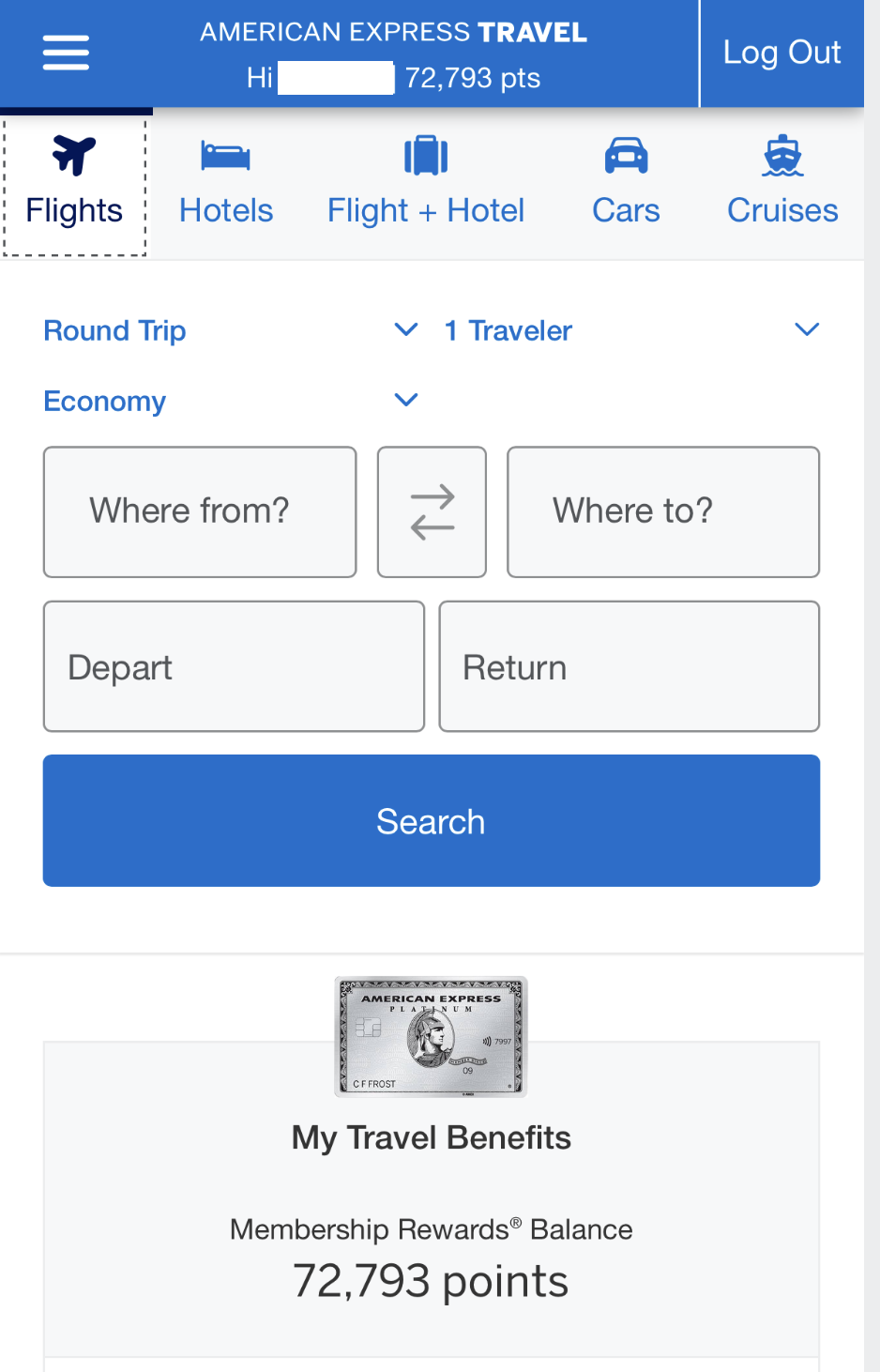

The Platinum Card® from American Express

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Special Perks

- Pros & Cons

- FAQ

The Platinum Card® from American Express is one of the best luxury cards available, offering extra ordinary benefits especially when it comes to travel.

The card offers 5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases. Terms Apply.

Also, you can enjoy a welcome bonus of 175,000 Membership Rewards® Points after spending $8,000 in eligible purchases on your new Card in your first 6 months of Membership, as well as a lot of extra premium perks such as a dedicated service team and baggage insurance for up to $500 for checked baggage and $1,250 for carry on.

Here you can compare the Amex platinum with the Chase Reserve card to see which premium card is besty for you.

- Up to $200 hotel credit per year when you book select prepaid hotels using your Platinum card via American Express Travel. Enrollment Required.

- Up to $240 or $20 per month in Digital Entertainment Credit when you pay for one or more The New York Times, Peacock, SiriusXM or Audible products with your card. Enrollment Required.

- Up to $155 in Walmart+ credit. When you use your card to pay for your monthly Walmart+ membership, you’ll get the full cost back every month. Enrollment Required.

- Up to $200 in Airline fee credit per year when you charge incidental travel fees from selected airlines on your card. Enrollment Required.

- Up to $300 back every year for eligible Equinox memberships when you enroll and pay using your card.

- Up to $189 back per year when you use your card to pay for a CLEAR® membership. Enrollment Required.

- Welcome Bonus + Premium Point Rewards Rate (Terms Apply)

- No Foreign Transaction Fees

- Special Premium Status Perks

- High Annual Fee

- High Requirements

- Why did Amex Platinum Card deny me? What to Do Next? You might not have met one of the requirements. You can ask the customer support team if there is something you can do to change this eventuality. Otherwise, you can look for an alternative card.

- How hard is it to get Amex Platinum Card? You need to meet the credit score and income requirements, which are higher than a lot of other cards.

- What is the initial credit limit? The minimum credit limit you will get with this card will be $5,000.

- How do I redeem cash back? There is a points-based system. You can redeem the points for a variety of rewards that are showcased on the Amex website. These include statement credit, gift cards, paying for certain services etc.

- What purchases don't earn cash back? Every type of purchase through this card will earn cashback points.

- Should You Move to Amex Platinum Card? It is a good fit if you spend a lot of money on travel-related expenses and want to avail yourself of some great travel perks.

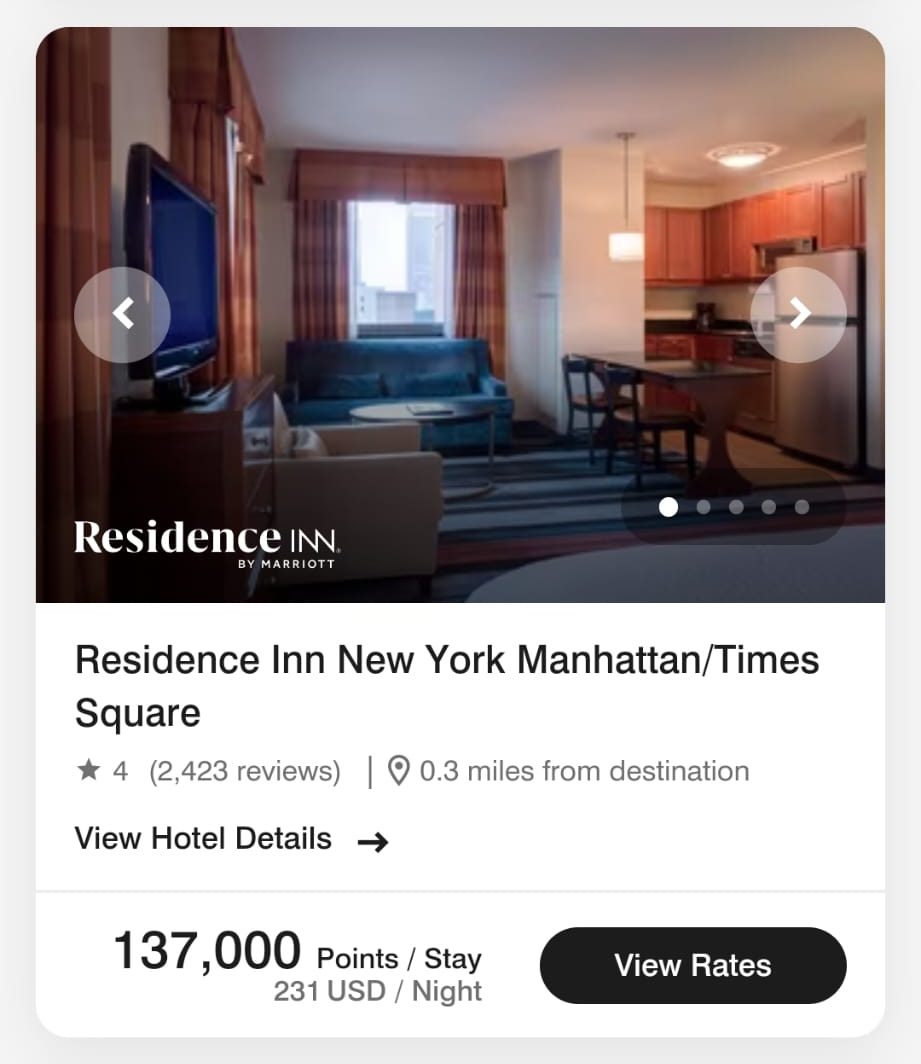

Marriott Bonvoy Boundless® Credit Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

Marriott Bonvoy Boundless Card has a huge annual fee, so make sure you use your free night at the Marriott hotels every year to make the annual fee up.

Marriott has a large selection of locations around the world, so you aren’t limited with this card when you travel. Marriott owns 30 hotel brands in over 129 countries.

You get bonus points for every stay as well as other perks like late checkout and room upgrades to suites or more upscale rooms.

The card is only good for Marriott hotels, so make sure you’re loyal to this brand. You can also consider the Marriott Bonvoy Brilliant™ American Express® Card.

- Rewards Plan: 6X points for every $1 spent at over 7,000 hotels participating in Marriott Bonvoy® with the Marriott Bonvoy Boundless® credit card. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. Earn 3X points for every $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining. Earn 2X points for every $1 you spend on all other purchases.

- APR: 21.49%–28.49% variable

- Annual fee: $95

- Balance Transfer Fee: $5 or 5%

- Foreign Transaction Fee: $0

- Sign Up bonus: Earn 3 Free Night Awards after spending $3,000 on eligible purchases within 3 months of account opening.* Each Free Night Award valued up to 50,000 points – that's a total value of up to 150,000 points! Certain hotels have resort fees.

- 0% APR Introductory Rate period: None

- Sign-Up Bonus

- Annual Reward

- Ongoing Points Rewards

- Transfer to Airline Points

- Automatic Silver Status

- Chase Restrictions

- Confusing Rewards

- Annual Fee

- No 0% Intro

Wyndham Rewards Earner Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Wyndham Rewards Earner Card is an entry-level hotel card ideal for budget-conscious travelers.

The rewards structure includes 5X points on eligible purchases made at Hotels by Wyndham as well as on qualifying gas purchases. Earn 2X points on eligible dining and grocery store purchases (excluding Target® and Walmart®) and 1X points on all other purchases (excluding Wyndham Vacation Club down payments). .

The welcome offer of Earn 45,000 bonus points after spending $2,000 on purchases in the first 180 days, is competitive within its category.

The card allows for flexible redemptions, with Wyndham Rewards points valued at an estimated 1.1 cents each. Additional benefits include no annual fee, automatic Gold elite status, and a 10% discount on points for free nights.

While it lacks some features present in the Wyndham Rewards Earner Plus Card, its versatility makes it suitable for those not committed to a single hotel brand.

The card provides a straightforward rewards structure, making it an attractive option for those seeking simplicity and value in a hotel loyalty card.

- Rewards Plan: 5X points on eligible purchases made at Hotels by Wyndham as well as on qualifying gas purchases. Earn 2X points on eligible dining and grocery store purchases (excluding Target® and Walmart®) and 1X points on all other purchases (excluding Wyndham Vacation Club down payments).

- APR: 20.99% – 29.99% variable

- Annual fee: $0

- Balance Transfer Fee: 5% or $5, whichever is greater

- Foreign Transaction Fee: $0

- Sign Up bonus: Earn 45,000 bonus points after spending $2,000 on purchases in the first 180 days

- 0% APR Introductory Rate period: 15 months on balance transfers made within 45 days of account opening

- No Annual Fee

- Automatic Gold Elite Status

- Anniversary Bonus Points

- No Foreign Transaction Fees

- Limited Award Nights

- Points Do Not Cover Resort Fees

- Limited Transfer Partners

Are there balance transfer options available with this card?

A: Yes, the card offers a 0% introductory APR for 15 months on balance transfers made within 45 days of account opening (then a variable APR OF 20.99% – 29.99% variable applies).

How do I redeem Wyndham Rewards points for free nights?

Wyndham Rewards points can be redeemed for “go free” award stays at participating hotels, with redemption tiers of 7,500, 15,000, and 30,000 points per night.

Are there restrictions on the availability of “Go Free” awards at participating hotels?

Yes, the availability of “Go Free” awards may vary, and cardholders may encounter limitations, especially during peak times or specific locations.

Can points be redeemed for stays at Wyndham Timeshare properties?

Yes, Wyndham Rewards points can be used to book stays at Wyndham Timeshare properties, with pricing determined per bedroom.

Can I use Wyndham Rewards points for non-hotel redemptions?

Yes, Wyndham Rewards points can be redeemed for various purposes, including gift card purchases, charitable donations, merchandise, and even special activities or tours.

What are the Visa Signature perks associated with this card?

As a Visa Signature card, it comes with additional travel benefits and protections, including auto rental coverage, emergency assistance, and extended warranty protection.

Hilton Honors Aspire American Express Card

Reward details

Current Offer

175,000 Hilton Honors Bonus Points after you spend $6,000 in purchases on the Card within your first 3 Months of Card Membership

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Hilton Honors American Express Aspire Card is a premium hotel credit card offering exclusive benefits, caters to frequent Hilton guests, providing substantial benefits that can outweigh the card's annual fee.

It offers 14X Hilton Honors bonus points when you make eligible purchases on your card at participating hotels or resorts within the Hilton Portfolio, 7X Hilton Honors bonus points on eligible purchases on your card for: Flights booked directly with airlines or amextravel.com, car rentals booked directly from select car rental companies and U.S. restaurants, 3X Hilton Honors bonus points on other eligible purchases .

Also, the welcome offer includes 175,000 Hilton Honors Bonus Points after you spend $6,000 in purchases on the Card within your first 3 Months of Card Membership.

With an annual fee of $550, the card provides Hilton Diamond status for as long as it's held, one free weekend night, up to $400 in Hilton resort credits, and up to $200 in airline credits annually.

- APR: 20.24% – 29.24% Variable

- Annual fee: $550

- Balance Transfer Fee: N/A

- Foreign Transaction Fee: $0

- Rewards Plan: 14X Hilton Honors bonus points when you make eligible purchases on your card at participating hotels or resorts within the Hilton Portfolio, 7X Hilton Honors bonus points on eligible purchases on your card for: Flights booked directly with airlines or amextravel.com, car rentals booked directly from select car rental companies and U.S. restaurants, 3X Hilton Honors bonus points on other eligible purchases

- Sign Up bonus: 175,000 Hilton Honors Bonus Points after you spend $6,000 in purchases on the Card within your first 3 Months of Card Membership

- 0% APR Introductory Rate period: N/A

- Hilton diamond status

- Travel credits

- One free weekend night

- Cellphone protection

- High annual fee

- Enrollment required for some benefits

- Airline credits are capped at $50 per quarter

What kind of travel protections does the Hilton Aspire Card provide?

The card offers travel protections, including trip delay reimbursement, trip cancellation, and interruption insurance, providing coverage for eligible situations when travel is charged to the card.

Can I share Hilton Honors points with family members?

Yes, Hilton Honors offers points pooling, allowing up to ten friends and family members to combine and share points.

What benefits does Hilton Diamond status provide?

Hilton Diamond status offers perks such as bonus points, lounge access, free breakfast, and room upgrades.

How many reward nights can I earn annually?

Cardholders can earn up to three reward nights each year – one at the account opening, one on the cardmember anniversary, and an additional night with qualifying spending.

Can I use the airline credits for any airline purchases?

The card provides up to $200 in annual airline credits, distributed as $50 per quarter, for eligible airfare purchases directly from airlines or through AmexTravel.com.

How do I use the annual free weekend night award?

The free weekend night can be redeemed at almost any Hilton property worldwide, providing flexibility for your stay.

Choice Privileges® Mastercard®

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Choice Privileges® Mastercard® offers a lucrative opportunity for travelers to earn free hotel stays at over 7,000 Choice Hotels worldwide.

Cardholders earn 5X points on stays at participating Choice Hotels plus on choice privileges point purchases properties, 3X points on purchases at gas stations, grocery stores, home improvement stores and phone plan services and 1X points on other purchases.

New cardmembers can enjoy a welcome bonus of 40,000 bonus points when you spend $1,000 in purchases in the first three months – enough to redeem up to five Rewards nights at select Choice Hotel® properties..

Additionally, the card provides Choice Privileges Gold Elite status, offering perks like a 10% bonus on points, early check-in, and late check-out. Apart from the rewards, cardholders benefit from Mastercard World Elite perks

While the card excels in its bonus categories, it may not offer the highest earnings for non-bonus spending. The Choice Hotels portfolio tends to favor budget and mid-range properties, especially in the U.S.

- Rewards Plan: 5X points on stays at participating Choice Hotels plus on choice privileges point purchases properties, 3X points on purchases at gas stations, grocery stores, home improvement stores and phone plan services and 1X points on other purchases

- APR: 20.24% – 29.49% Variable APR

- Annual fee: $0

- Balance Transfer Fee: 5% or $5, the greater

- Foreign Transaction Fee: $0

- Sign Up bonus: 40,000 bonus points when you spend $1,000 in purchases in the first three months – enough to redeem up to five Rewards nights at select Choice Hotel® properties.

- 0% APR Introductory Rate period: N/A

- No Annual Fee

- Choice Privileges Gold Elite Status

- Points Transfer Options

- Global Hotel Network

- No Foreign Transaction Fees

- Subpar Earnings Outside Bonus Categories

- Limited Advance Booking for Award Stays

- Points Plus Cash Copay Requirement

- Emphasis on Budget and Mid-Range Properties

Can I transfer points from other credit card programs to Choice Privileges®?

Yes, the card allows point transfers from programs like American Express Membership Rewards and Capital One Miles.

What is Choice Privileges Gold Elite status?

Gold Elite status provides a 10% bonus on points, early check-in, late check-out, reserved parking, and a welcome gift at select Choice Hotels.

How soon can I book award stays with Choice Privileges Rewards?

Award stays can be booked up to 100 days in advance through the Choice Privileges Rewards program.

Are there any limitations on the Choice Hotels portfolio?

The portfolio leans towards budget and mid-range properties, with fewer options for luxury accommodations, especially in the U.S.

What is the Points Plus Cash option for bookings?

It allows cardholders to use a combination of points and a cash copay for making bookings.

Can I book award stays with Choice Privileges Rewards Exchange partners?

Yes, some airlines include Alaska Mileage Plan, Aeromexico Rewards, Qantas Frequent Flyer, United MileagePlus, Air Canada Aeroplan, and Southwest Rapid Rewards.

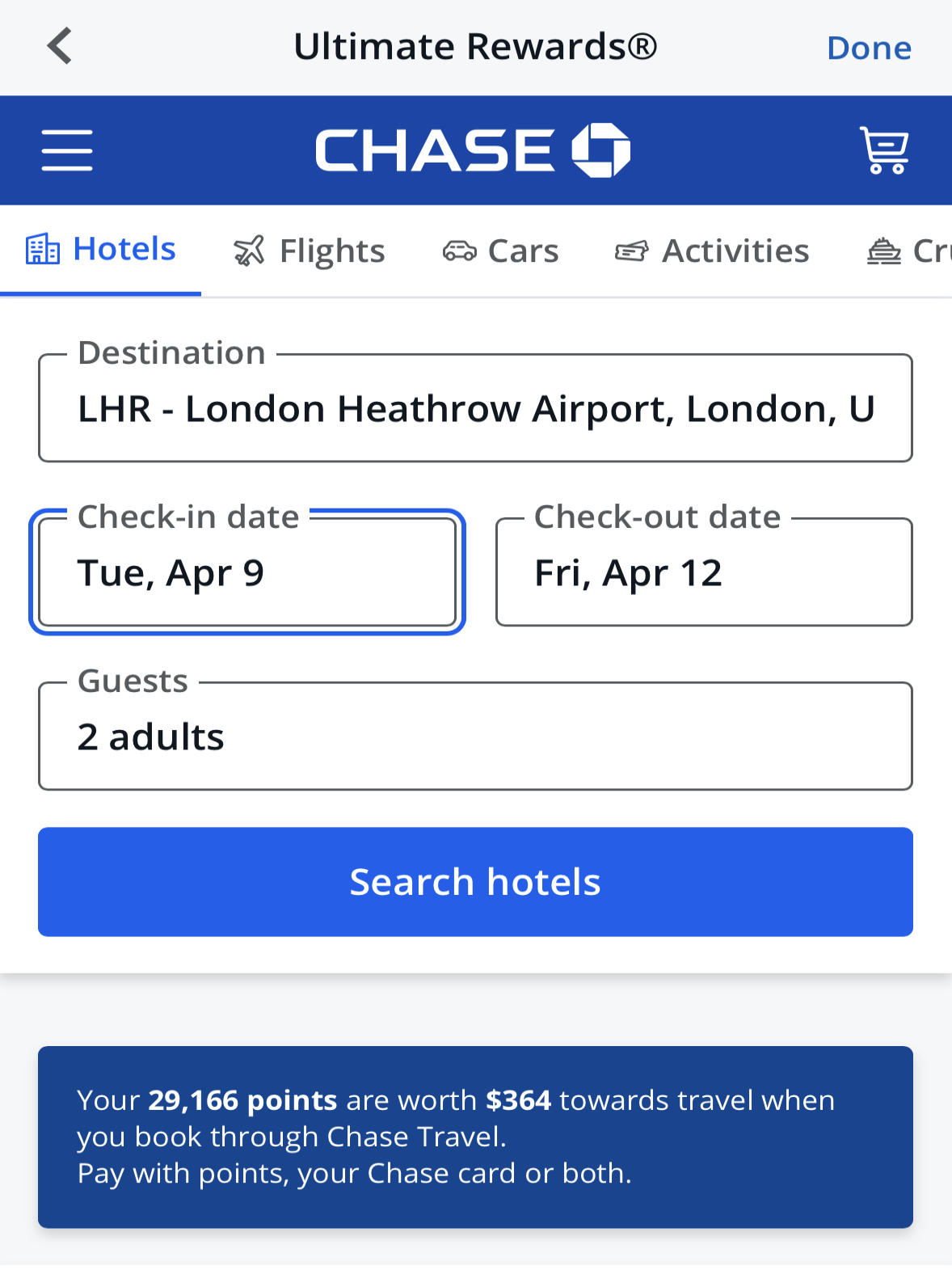

Chase Sapphire Preferred® Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

This is a great card to have if you don’t want a hotel-specific card with more flexibility in transferring points and redeeming points with a wide variety of companies.

As with many of the general travel cards, you won’t get specific hotel perks such as room upgrades and early check-ins.

If you book hotels directly through the Chase Ultimate Rewards you can transfer the points you have to a loyalty program with a specific hotel including IHG, Hyatt, and Marriott.

You will be able to transfer them at a 1:1 rate. You can also compare the Preferred with the reserve card to see what works best for you.

- Rewards Plan: 5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

- APR: 19.99% – 28.24% variable APR

- Annual fee: $95

- Balance Transfer Fee: 5% or $5, whichever is greater

- Foreign Transaction Fee: $0

- Sign Up bonus: 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening

- 0% APR Introductory Rate: N/A

- Point Sign-Up Bonus

- Bonus Points

- No Blackout Dates

- 25% More through Ultimate Chase Rewards

- No Foreign Transaction Fee

- $95 Annual Fee

- Low Merchandise Rewards

- No Introductory 0%

- Balance Transfer Fee – 5% or $5, whichever is greater

- Does the travel rewards points expire? Your points won’t expire once you keep the credit card account open.

- Does card Chase Sapphire Preferred offer pre-approval? Yes, you are able to pre-qualify for this card.

- What is the initial credit limit? The minimum credit limit that you can get with this card type is usually $5,000.

- How do I redeem cash back? You can redeem your points in a variety of ways through the Chase credit card reward portal. Some of the perks you can get include cash, travel credit, statement credit, and gift cards.

- What purchases don't earn cash back? All purchases will earn cashback through this card.

- Should You Move to Chase Sapphire Preferred card? If you travel frequently and do not want to pay a large annual fee.

- Why did the Chase deny me? You might not have met one of its requirements. You will usually find out where you fell short. You might be able to rectify the issue or you might have to look elsewhere.

- How hard is it to get a Chase Sapphire Preferred card? If you meet all of the requirements, then it is relatively straightforward to get a Chase Sapphire Preferred card. The requirements are easier compared to Chase Sapphire Reserve card.

- Is there a limit to rewards/cash back on the Chase Sapphire Preferred card? No limit

- Can I get car rental insurance with a Chase Sapphire Preferred card? how? Yes, you can get car rental insurance with this card if you decline the collision cover of the rental company and pay for the entire cost of the rental car with this card.

What is a Hotel Credit Card?

There are two different types of hotel credit cards. A co-branded hotel credit card will have a specific hotel chain's name on it, such as Marriott or Hyatt.

You will get amazing perks and bonus rewards to that company’s hotels, but you won’t get options to book with other hotels. You may be able to book with their sister or partner airlines though if the card offers that choice.

General travel credit cards are not tied to a certain hotel, but you still get hotel rewards and points to redeem at many different hotel chains. You get more flexible rewards, but not as many perks as with specific hotel credit cards.

How to Maximize Hotel Credit Cards?

Maximizing your hotel credit card is essential to make sure you aren’t overpaying for it. Making the most of your hotel credits can be done by following these steps:

- Take advantage of all hotels offers and free nights

Most hotel credit cards give you a fourth or fifth free night after you book so many days. Always make sure you make room in your schedule to use this free night.

- Don’t waste your points

It’s easy to get busy during the year and not use your points before they expire. Try not to let this happen. Book an end-of-the-year trip or family vacation so you can use all your points.

- Be flexible with hotels and travel dates

Less fancy hotels will use fewer points. If you plan to travel often, make sure you aren’t staying at the most luxurious hotels every time. This also allows you to stay more nights at your destination since you are spending less at the hotels.

- Always book through the travel portal

Usually, you only get perks and free upgrades if you book through the hotel’s travel portal. This also gives you a 1:1 transfer ratio for most cards. Booking through the credit card’s travel portal such as the Chase Ultimate rewards or the Amex memebership club is the easiest way to redeem points automatically and get free perks.

5 Surprising Features You Can Find In Our Best Hotel Cards

The best hotel cards will usually have these 5 amazing features to give you the best perks and vacation time:

- Free anniversary nights. Most branded hotel credit cards give you a free night on your anniversary of holding the credit card.

- Free nights in the hotel. Good credit cards will give you a free fifth night if you book 4 nights. This allows you to extend your vacation by one day for free.

- More travel options. Most hotel credit cards will also give you options to redeem points for other travel-related expenses like airline fees and free Global Entry. This makes your vacation cheaper in many ways.

- Who doesn’t want to travel if you’re getting free upgrades? Hotel credit cards will give you free suite upgrades or more upscale fancy rooms for the same price.

- Extra Perks. Enjoy extra perks like free breakfast, free WIFI, early check-in, and early check-out to make your vacation more enjoyable.

Pros and Cons of Hotel Credit Cards

Before making a decision, it's important to be aware of both the advantages and potential drawbacks associated with hotel credit cards.

Pros | Cons |

|---|---|

Free Hotel Stays | Annual Fees |

Free Hotel Stays | Limited Redemption Options |

Bonus Points for Hotel Spending | Brand Restrictions |

Anniversary Bonuses | |

Elite Status |

- Free Hotel Stays

Many hotel credit cards provide complimentary nights or points that can be redeemed for free stays at affiliated hotels, allowing you to save money on accommodation.

- Rewards and Perks

These cards often come with loyalty program memberships, offering rewards like room upgrades, early check-in, late check-out, and other exclusive perks.

- Bonus Points for Hotel Spending

You usually earn more points or rewards for spending directly related to hotel bookings and expenses.

- Anniversary Bonuses

Certain cards offer annual bonuses, such as free nights or additional reward points, as a reward for keeping the card active.

- Elite Status

Holding a hotel credit card may grant you automatic elite status within the hotel's loyalty program, leading to more benefits during your stays.

- Annual Fees

Many hotel credit cards come with annual fees, and these fees can sometimes be higher than those of general-purpose rewards cards.

- Limited Redemption Options

While these cards offer great rewards for hotel-related spending, the redemption options may be limited compared to general travel rewards cards.

- Brand Restrictions

Some hotel credit cards tie you to a specific hotel chain or brand, limiting your choices when it comes to redeeming rewards.

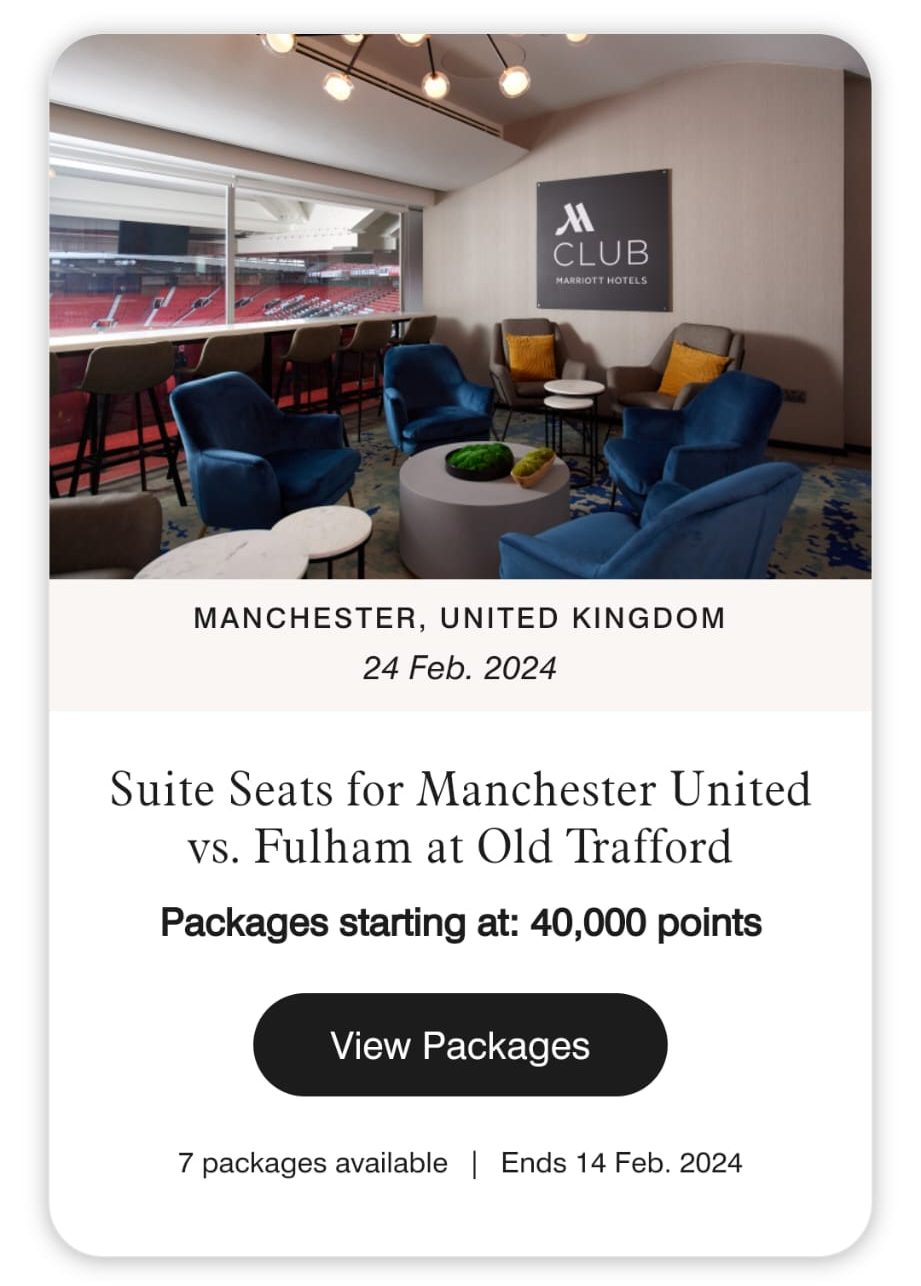

What Are The Main Hotel Loyalty Programs?

Hotel loyalty programs are designed to foster customer loyalty by offering rewards for repeat business. Members earn points or miles based on spending, unlocking benefits like free nights, room upgrades, and exclusive rates.

Programs often feature tiered memberships with escalating perks, such as early check-in and late check-out. Loyalty members may enjoy partnerships with airlines and car rental companies, expanding their point-earning and redemption options.

Special promotions, flexible redemption choices, and co-branded credit cards further enhance the member experience.

Here are the main hotel loyalty programs:

-

Marriott Bonvoy

Marriott Bonvoy is one of the largest and most diverse hotel loyalty programs. It encompasses a vast network of over 7,000 properties worldwide, ranging from budget to luxury accommodations. Members earn points for every stay, which can be redeemed for free nights, room upgrades, and even experiences.

The program offers elite status tiers with additional benefits like late check-out and lounge access. Marriott Bonvoy also has co-branded credit cards that accelerate point accumulation.

-

Hilton Honors

Hilton Honors Rewards Program boasts a wide range of hotels under its umbrella, including brands like Hilton, Conrad, and Waldorf Astoria. Members earn points based on the price of the stay, and these points can be used for free nights or to purchase various products and services.

Hilton Honors also features elite status levels, offering perks like complimentary breakfast and room upgrades. The program stands out for its partnerships, allowing members to earn points through various activities beyond hotel stays.

-

IHG Rewards Club

InterContinental Hotels Group (IHG) Rewards Club covers a diverse portfolio of brands like Holiday Inn and InterContinental. Members earn points for stays, and these can be redeemed for free nights or merchandise.

IHG's loyalty program is known for its regular promotions, providing opportunities for members to earn bonus points. Additionally, the program allows for points and cash combinations, offering flexibility in booking.

-

World of Hyatt

World of Hyatt focuses on quality over quantity, with a more exclusive collection of hotels. Members earn points for each stay, and elite status unlocks perks such as complimentary upgrades and lounge access.

Hyatt also stands out for its unique partnerships, allowing members to earn and redeem points with various luxury brands and even on experiences like wellness retreats.

-

Choice Privileges

Choice Privileges is the loyalty program for Choice Hotels, which includes brands like Comfort Inn and Quality Inn. Members earn points for stays and can redeem them for free nights, gift cards, or other rewards.

Choice Privileges is known for its straightforward earning structure and accessible redemption options, making it a popular choice for budget-conscious travelers.

-

Wyndham Rewards

Wyndham Rewards covers a wide range of hotel brands, from economy to upscale, with over 9,000 properties globally.

Members earn points for stays, and the program is notable for its simple redemption system—one flat rate for free nights, regardless of the hotel category. Wyndham Rewards also allows members to earn and redeem points with partners, including car rentals and shopping.

How We Chose the Best Hotel Cards?

Choosing the best hotel cards mainly depends on the point earning potential. The best cards will give you points for everyday purchases such as groceries, dining out, and transportation. With these cards, you can earn points just going about your daily activities.

We also pick cards that offer more than one point for every dollar, such as cards that give 2 points for every dollar spent at supermarkets or certain restaurants. We also choose the best hotel cards based on how easy it is to get your annual fee back with free perks.

Top Offers

Top Offers

Top Offers From Our Partners

How We Picked The Best Hotel Credit Cards: Methodology

To identify the best hotel credit cards, our team thoroughly researched credit cards from various issuers, focusing on major banks, hotel chains, and financial institutions. We rated these cards based on four key categories tailored for consumers seeking hotel rewards:

Hotel Rewards & Benefits (40%): We evaluate the hotel rewards program, including points or miles earned per dollar spent on hotel purchases, bonus categories for accelerated rewards, and redemption options such as free nights, room upgrades, or hotel-specific perks. Cards with generous rewards rates, versatile redemption choices, and valuable benefits like elite status or complimentary nights score higher in this category.

Features & Offers (30%): This category assesses additional features that enhance the overall value of the card for hotel stays, such as introductory APR offers, absence of foreign transaction fees, complimentary elite status with the hotel chain, free anniversary nights, and travel benefits like travel insurance or concierge services. Cards offering a comprehensive range of benefits without excessive fees earn higher scores.

Cardholder Experience (20%): We examine the ease of redeeming hotel stays, customer service quality, and online account management tools. Cards with responsive customer support and user-friendly mobile apps receive higher ratings, ensuring a seamless experience for cardholders.

Issuer Reputation (10%): We scrutinize each issuer's reputation, considering customer feedback, financial stability, and regulatory standing. Issuers with positive reviews from cardholders and a track record of providing excellent hotel rewards products and customer service receive higher ratings in this category.

This comprehensive evaluation ensures that the best hotel credit cards offer attractive rewards, benefits, and a seamless user experience for consumers seeking to maximize their hotel stays and additional credit card rewards.