All information about American Express Everyday® Card has been collected independently by The Smart Investor. American Express Everyday® Card is no longer available through The Smart Investor.

Table of Content

As the names suggest, both the American Express Everyday® Card and Chase Freedom Unlimited® are credit cards designed for your day to day use. Unlike many cards that offer the best rewards for travelers, these cards offer the highest bonuses on everyday items like groceries, gas, and eating out.

However, there are some important differences between the two options that we will examine in more detail, so you can determine which card is the best fit for you and your lifestyle.

General Comparison

|

| |

|---|---|---|

American Express Everyday® Card | Chase Freedom Unlimited® | |

Annual Fee | $0. See Rates and Fees. | $0 |

Rewards | 2X points at U.S. supermarkets (up to $6,000 per year, then 1X), 2X points on prepaid rental cars booked through American Express Travel and 1X points on all other purchases | 5% cash back on travel booked through Chase Ultimate Rewards, 3% on dining (including takeout and eligible delivery), 3% on drugstore purchases, and 1.5% on all other purchases |

Welcome bonus | 10,000 points after spending $2,000 on purchases within the first three months | Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening. |

0% Intro APR | 15 months on purchases and balance transfers | 15 months on purchases and balance transfers |

Foreign Transaction Fee | 2.7%. See Rates and Fees. | 3% |

Purchase APR | 17.74% – 28.74% Variable | 18.74%–28.24% variable

|

Read Review | Read Review |

Compare Rewards: Which Card Gives More?

Although we’ve looked at a variety of the card features, understanding the real cash benefits can be tricky without a direct scenario comparison. Since both of these cards are designed for everyday spending, we’ll look at typical monthly spending to see what rewards the cards offer, so you can see what rewards you could earn with similar spending.

However, keep in mind to adjust the numbers to your regular spending categories, which may be different – so the exact calculation depends on your personal habits.

|

| |

|---|---|---|

Spend Per Category | American Express Everyday® Card | Chase Freedom Unlimited |

$15,000 – U.S Supermarkets | 21,000 points | $225 |

$5,000 – Restaurants

| 5,000 points | $150 |

$1,000 – Airline | 1,000 points | $50 |

$1,000 – Hotels | 1,000 points | $50 |

$4,000 – Gas | 4,000 points | $60 |

Total Points | 32,000 points | / |

Estimated Redemption Value | 0.6 – 1.6 cent | / |

Estimated Annual Value | $192 – $512 | $475 |

Editorial Note: Terms apply to American Express benefits and offers. Enrollments may be required for select benefits. Visit americanexpress.com to learn more

Compare Welcome Bonus And Fees

Both cards have a sign up bonus that takes the form of cash, rather than points you’ll need to calculate and redeem. The Amex Everyday card offers 10,000 points after spending $2,000 on purchases within the first three months.

Chase has an even more attractive introductory bonus scheme for its Freedom Unlimited Card – Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening..

This is an area where the Amex Everyday and Chase Freedom Unlimited are very similar. Neither card has an annual fee, which is a great saving compared to other cards offered Amex or by Chase. Both card issuers also offer 0% intro APR.

The foreign transaction fees for the cards are also similar. Amex charges 2.7% and Chase charges 3%, with both percentages applying after the conversion to dollars. The only key difference is that while Amex does not allow balance transfers, Chase charges $5 or 5%, but this is reduced to $5 or 3% for the first 60 days.

Compare The Perks

Amex Everyday Card

- Exclusive access to ticket presales. American Express Experiences provide card member only events in cities and exclusive ticket presale access. You can browse concert tours, sporting events and even Broadway shows for exclusive deals.

- Car Rental Damage and Loss Insurance: When you use your card to reserve and pay for the entire rental, if you decline the rental company collision damage waiver, you’ll be covered for Damage or theft in covered territories.

- Send and Split: This allows you to split purchases with other PayPal or Venmo users directly using the Amex App and your Everyday card.

Top Offers

Top Offers From Our Partners

Terms apply to American Express benefits and offers.

Chase Freedom Unlimited

Instacart+ Benefit: The Freedom Unlimited card provide a complimentary 3-month Instacart+ membership, offering unlimited deliveries with $0 delivery fees and reduced service fees on eligible orders.

5% Cash Back/5x Points on Lyft Rides: The card offers enhanced rewards for Lyft rides through March 31, 2025, giving you 5% cash back or 5x points on these purchases.

Purchase Protection: It offer purchase protection, covering your new purchases for 120 days against damage or theft, up to $500 per claim and $50,000 per account.

Extended Warranty Protection: Both cards extend the time period of the U.S. manufacturer's warranty by an additional year on eligible warranties of three years or less.

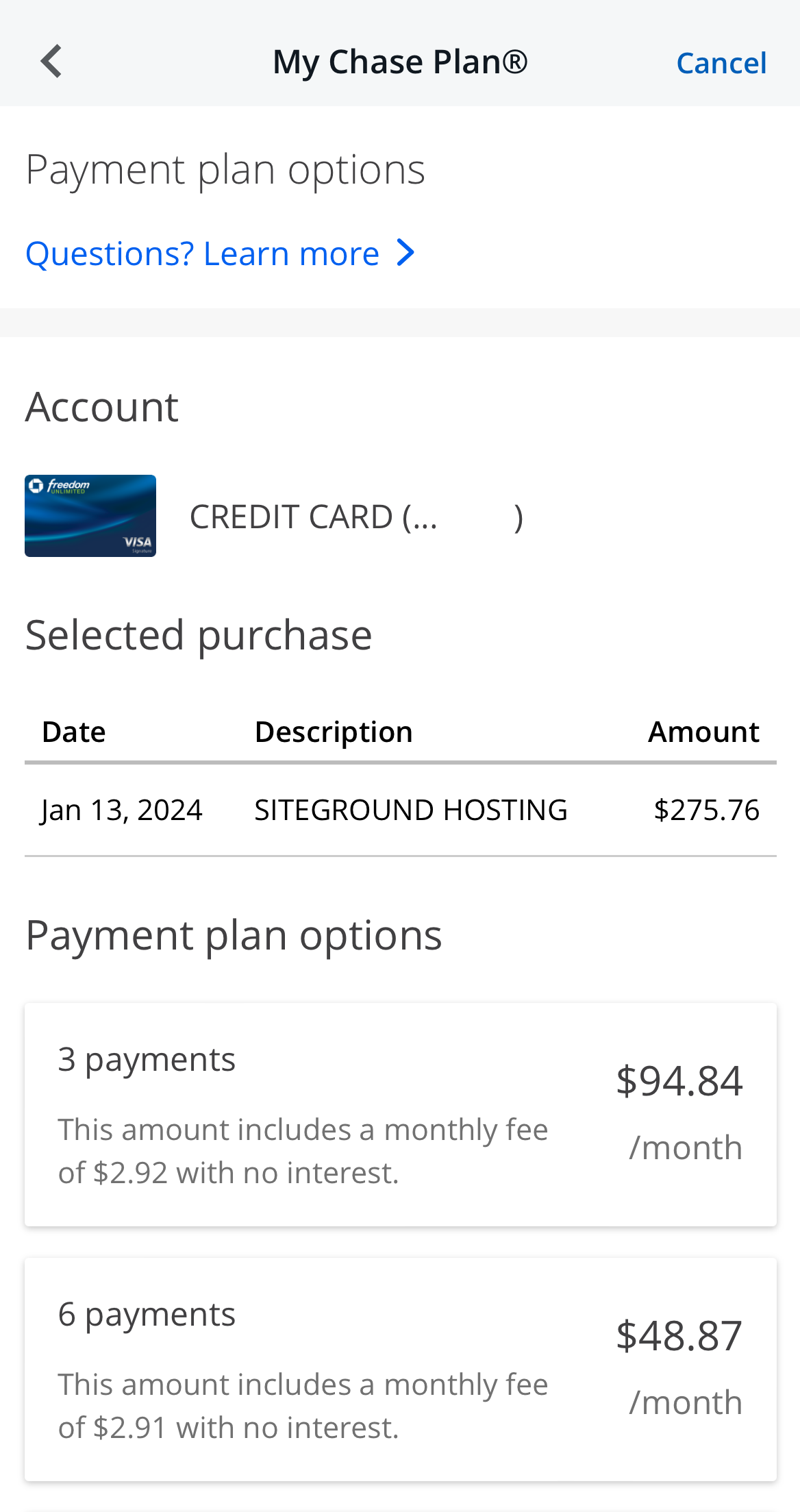

My Chase Plan: Use My Chase Plan, allowing you to pay off eligible purchases of $100 or more in equal monthly payments with no interest, just a fixed monthly fee.

Auto Rental Collision Damage Waiver: The Freedom Unlimited card offer coverage for theft and collision damage when you decline the rental company's insurance and charge the entire rental cost to your card, applicable to most cars in the U.S. and abroad.

Trip Cancellation/Interruption Insurance: It also provide reimbursement for pre-paid, non-refundable passenger fares up to $1,500 per person and $6,000 per trip if your trip is canceled or interrupted due to covered situations.

Top Offers

Top Offers

Top Offers From Our Partners

Compare Redemption Options

Both Amex and Chase offers several ways to redeem your rewards. These include:

- Statement credit or a direct deposit: There is no minimum to redeem your rewards in this way and direct deposits are acceptable for most U.S checking and savings accounts.

- Amazon shopping: You can also use your rewards to pay for all or part of eligible Amazon.com orders when you link your card to your Amazon account.

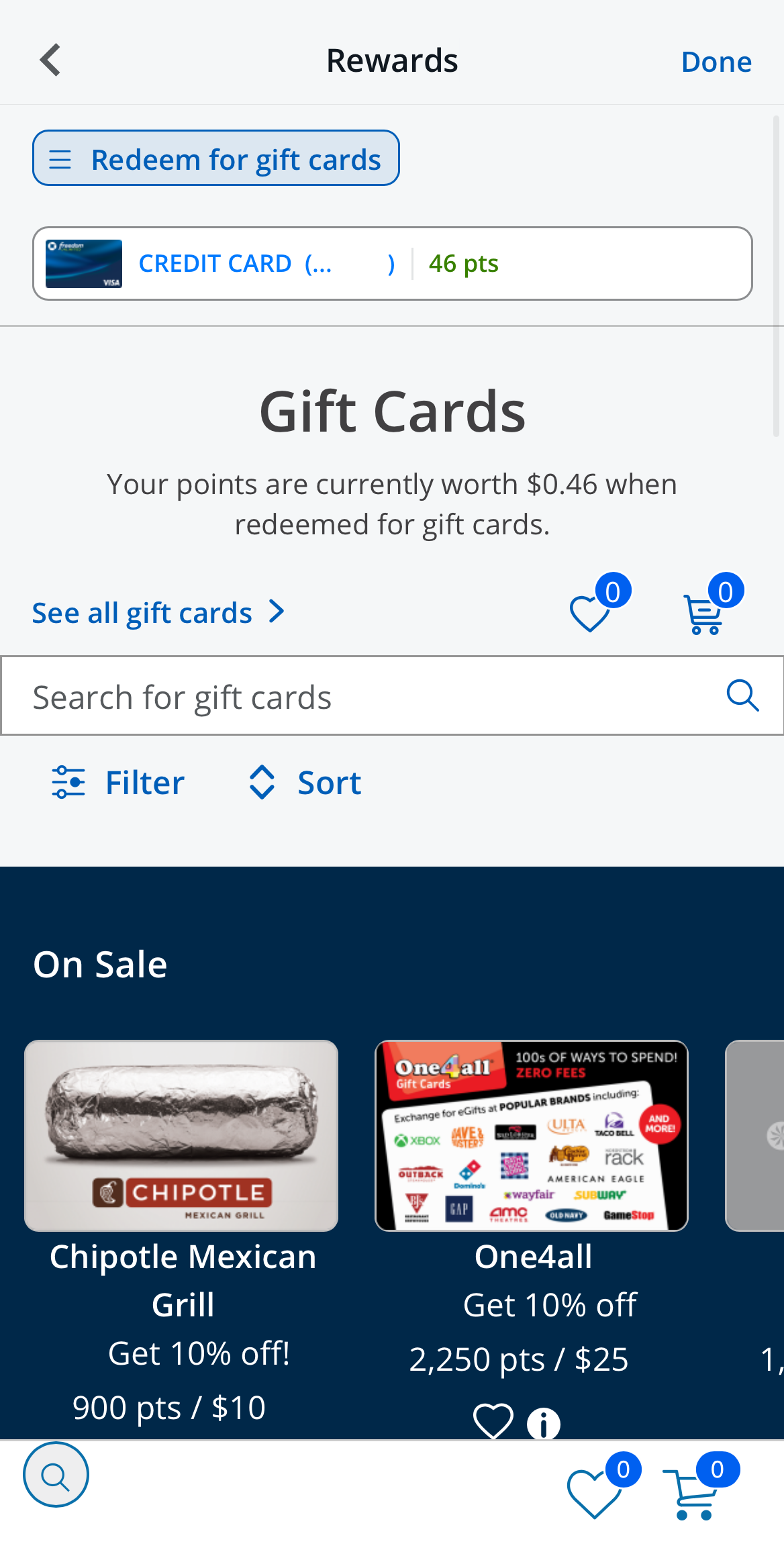

- Gift cards: Chase has a variety of gift card options including for dining, entertainment and shopping.

- Travel rewards. You can use the Chase Ultimate Rewards platform to access competitive rates for travel products including hotel stays and flights.

Customer Reviews: Which Card Wins?

Amex Everyday | Chase Freedom Unlimited | |

|---|---|---|

App Rating (iOS)

| 4.9 | 4.8 |

App Rating (Android) | 4.2 | 4.4 |

BBB Rating (A-F) | A+ | B+ |

WalletHub | 3.5 | 3.5 |

Contect Options | phone/social | phone/social |

Availability | 24/7 | 7 AM – 11 PM |

Satisfied customers report that the Amex Everyday is a great card to negate the rising cost of groceries. While there is a cap of $6,000 per year, you can earn 3% cash back on your grocery bills. The other highlights include an easy to qualify for introductory cash bonus.

Negative reviews report frustration that there is no balance transfer option. Although there is a long 0% introductory rate, this is only for purchases, so you cannot consolidate your credit card balances on this card.

Satisfied borrowers report the Chase Freedom Unlimited offers some great rewards for everyday spending. This means that you can maximize your rewards without needing to drastically change your spending habits. Cardholders also appreciate the 0% introductory rate for the first 15 months.

Negative reviews report frustration at the lack of fee free balance transfers. While the card is set up to allow you to access a 0% rate on purchases and balance transfers, there are no fee free balance transfers. Also, there are some comments about the temporary nature of some of the card benefits.

Top Offers

Top Offers From Our Partners

When You Might Want the Everyday Card?

The Amex Everyday Card could be a solid choice for you if:

- You typically spend $500 or more a month on groceries, as you'll earn higher cash back up to a $6,000 annual cap. After that, you'll earn 1%.

- You enjoy attending concerts, sporting events, and other ticketed events, and would take advantage of the Amex ticket presale platform.

- You plan to make $2,000 in purchases within the first six months to qualify for the cash back bonus.

When You Might Want the Chase Freedom Unlimited?

The Chase Freedom Unlimited Card is a great option if:

- You plan to spend at least $20,000 in the first year to maximize the sign-up bonus.

- You enjoy dining out, as you'll earn 3% back on those purchases.

- You want to earn higher cash back on various purchases, especially those made through Chase Ultimate Rewards.

Bottom Line

Both the Amex Everyday and the Chase Freedom Unlimited offer some nice rewards, particularly since neither card has an annual fee.

However, the differences between these cards will influence which one will be better suited to you and your circumstances.

FAQ

You can get the premium cashback rate on groceries until you have annual purchases in this area of $6,000. The rate then goes to 1%.

No transparent income requirements or proof of income requests are laid out when it comes to applying for the Amex Blue Cash Everyday Card.

Yes, you can get pre-approval on Chase website. This means that you can figure out if you can qualify for this card or not without having to submit to a hard credit check.

All purchases earn cashback with this card. This means that it is going to be ideal for those people who want a card that fits into a wide range of different types of purchases.

Compare The Alternatives

Both cards offer some interesting rewards, particularly for every day purchases.

However, there are some alternatives that you should know as well before making a decision of what's best choice for you.

|

|

| |

|---|---|---|---|

Capital One Quicksilver Cash Rewards Credit Card | Blue Cash Preferred® Card from American Express | Chase Sapphire Preferred® Card | |

Annual Fee | $0

| $95 ($0 intro for the first year)

| $95

|

Rewards |

1.5% – 5%

5% percent cash back on hotels and rental cars booked through Capital One Travel and 1.5% cash back on all purchases everyday.

|

1-6%

6% cash back at U.S. supermarkets (up to $6,000 per year in purchases, then 1%) and selected U.S. streaming subscriptions, 3% cash back on transit

and U.S. gas stations, 1% cash back on other purchases

|

2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

|

Welcome bonus |

Earn $300 in welcome bonuses. Enjoy a $100 credit to use towards flights, stays and rental cars booked through Capital One Travel during your first cardholder year. Plus, earn a $200 cash bonus once you spend $500 on purchases within the first 3 months from account opening.

Earn $300 in welcome bonuses. Enjoy a $100 credit to use towards flights, stays and rental cars booked through Capital One Travel during your first cardholder year. Plus, earn a $200 cash bonus once you spend $500 on purchases within the first 3 months from account opening.

|

$250

$250 statement credit after you spend $3,000 in purchases on your new Card within the first 6 months

|

75,000 points

75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening

|

Foreign Transaction Fee | $0 | 2.70% | $0

|

Purchase APR | 18.99% – 28.99% (Variable)

| 19.99%-28.99% Variable

| 19.74%–27.99% variable

|

Compare American Express Everyday Card

Cash back or Amex membership rewards? Annual fee with higher rewards or no annual fee? Here's our full analysis – which is better for you?

Amex Everyday Card vs Blue Cash Preferred Card from American Express: Which Card Is Best?

Compare Chase Freedom Unlimited

While both cards offer great cash back rewards and considered among the best Chase cards, there are some major differences. Which is better?

Chase Freedom Flex vs Chase Freedom Unlimited: Which Card Is Best?

While both cards offer great cash back rewards and considered among the best Chase cards, there are some major differences. Which is better?

Chase Freedom Flex vs Chase Freedom Unlimited: Which Card Is Best?

The flat rate cash back on Citi Double Cash Card is higher – but usually, it may not be the best option. Here's The Smart Investor analysis.

Citi Double Cash Card vs Chase Freedom Unlimited: Which Card Wins?

The Chase Sapphire Preferred offers costs more and offer more benefits than the Freedom Unlimited. Is it worth the annual fee?

Chase Freedom Unlimited Vs. Sapphire Preferred: Compare Side By Side

The Freedom Unlimited beckons with its cash-back rewards, but the Amex Gold exudes luxury, boasting robust rewards on dining and groceries.

Chase Freedom Unlimited vs. Amex Gold Card: Which Card Wins?

The Amex Blue Cash Everyday is the winner if you need gas and grocery purchases, while the Freedom Unlimited offers better travel rewards

Amex Blue Cash Everyday vs. Chase Freedom Unlimited: Which Card Wins?

When it comes to cashback potential, the Chase Freedom Unlimited wins, especially for those who frequently engage in travel-related expenses.

Chase Freedom Unlimited vs. Citi Custom Cash Card: Which Card Wins?

The Savor card is ideal for dining out and entertainment, while the Freedom Unlimited is best for travelers and those who need 0% intro APR.

Capital One Savor vs. Chase Freedom Unlimited: Side By Side Comparison

The BofA Customized Cash Rewards is more flexible, but the Chase Unlimited card will drive more rewards and benefits. Here's why.

Bank of America Customized Cash Rewards vs Chase Freedom Unlimited: Which Card Wins?

The Active Cash card offers flat-rate cashback, while the Unlimited card is the winner for travel. Here's a side-by-side comparison

Wells Fargo Active Cash vs. Chase Freedom Unlimited: Which Card Wins?

The Apple Card offers competitive cashback rewards on Apple purchases and services – but if you travel frequently, the Unlimited card wins.

The Costco Card is a great for Costco shoppers, gas and grocery purchases, while the Freedom Unlimited stands out for its travel benefits.

Costco Anywhere Visa Card vs Chase Freedom Unlimited: Comparison

Review Cash Back Credit Cards

Chase Freedom Flex