Both Bank of America Premium Rewards Credit Card and Chase Sapphire Preferred Card offer generous welcome bonuses, good rewards rates, and a variety of travel benefits. But which card is right for you?

General Comparison

While both cards have a similar annual fees, Chase offers much better rewards than the Bank of America Premium Rewards – the point rewards ratio is higher for all categories, even the strongest categories of the BofA Premium Rewards card.

| ||

|---|---|---|

BoFa Premium Rewards | Chase Sapphire Preferred | |

Annual Fee | $95 | $95

|

Rewards | Unlimited 2X points on travel and dining purchases. Unlimited 1.5X points on all other purchases | 5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

|

Welcome bonus | 60,000 online bonus points after spending $4,000 on purchases in the first 90 days. | 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening |

0% Intro APR | N/A | N/A

|

Foreign Transaction Fee | $0 | $0 |

Purchase APR | 20.74% – 28.74% Variable APR | 19.99% – 28.24% variable APR |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Rewards Battle: BofA Premium Rewards vs. Chase Preferred

When comparing rewards earning, there's a clear standout: the Sapphire Preferred card sets itself apart with its exceptional point rewards rates, especially for groceries, supermarket purchases, and travel expenses.

| ||

|---|---|---|

Spend Per Category | BoFa Premium Rewards | Chase Sapphire Preferred |

$15,000 – U.S Supermarkets | 22,500 points | 45,000 points |

$5,000 – Restaurants

| 10,000 points | 15,000 points |

$5,000 – Airline | 10,000 points | 25,000 points |

$5,000 – Hotels | 10,000 points | 25,000 points |

$4,000 – Gas | 6,000 points | 4,000 points |

Total Points | 58,500 points | 114,000 points |

Estimated Redemption Value | 1 point ~ 1 cent | 1 point ~ 1 – 1.5 cent |

Estimated Annual Value | $585 | $1,140 – $1,710 |

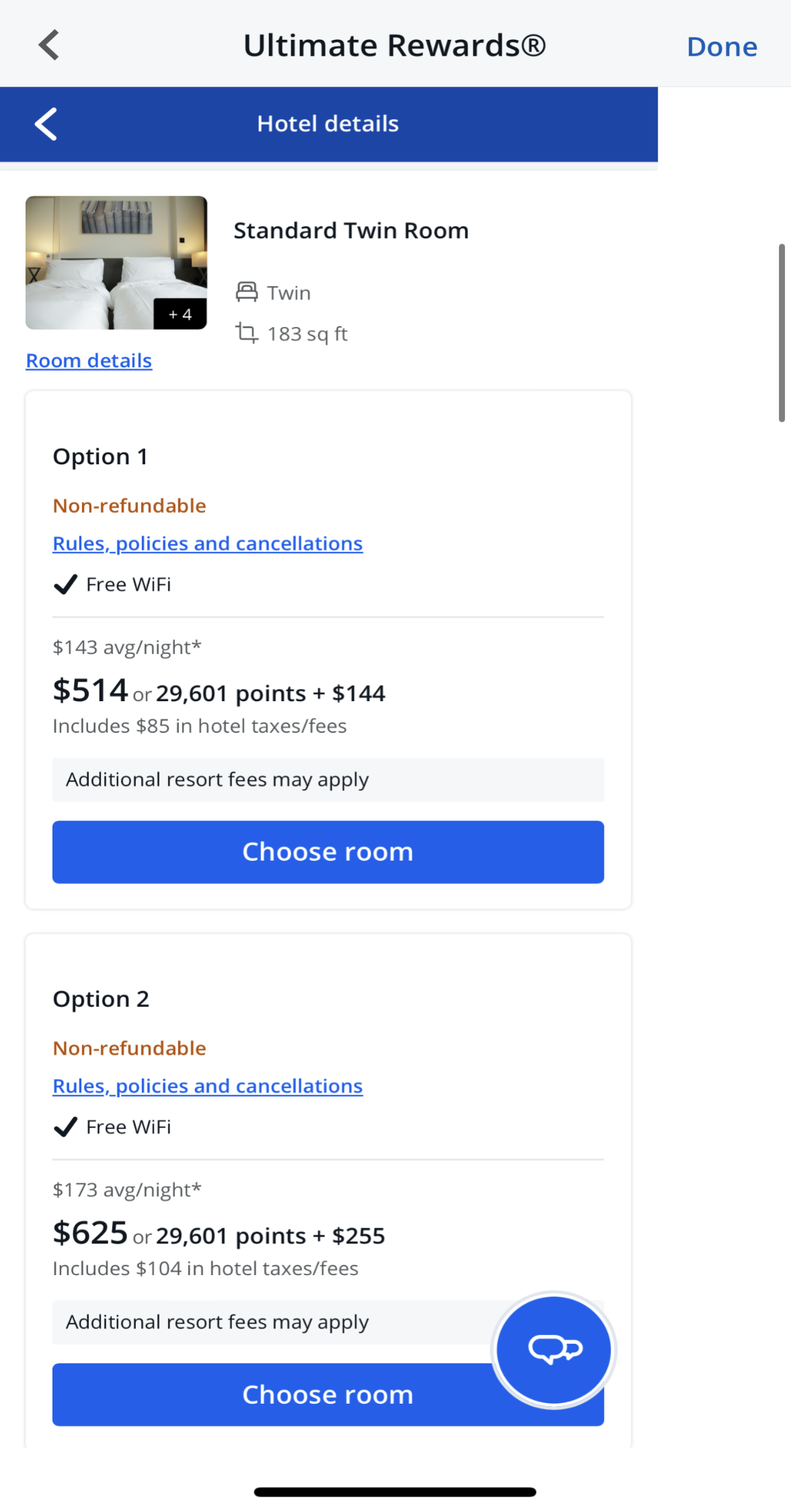

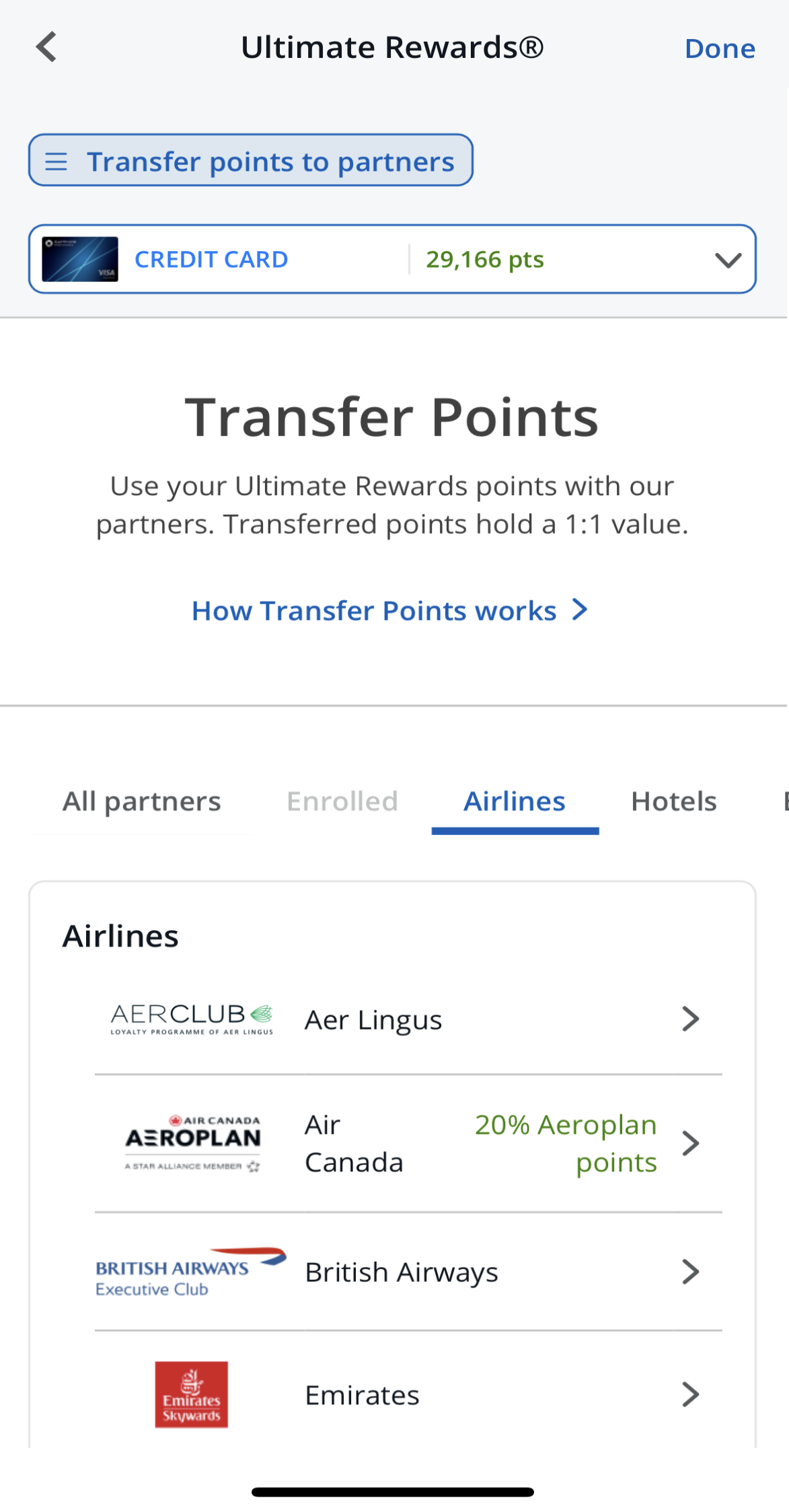

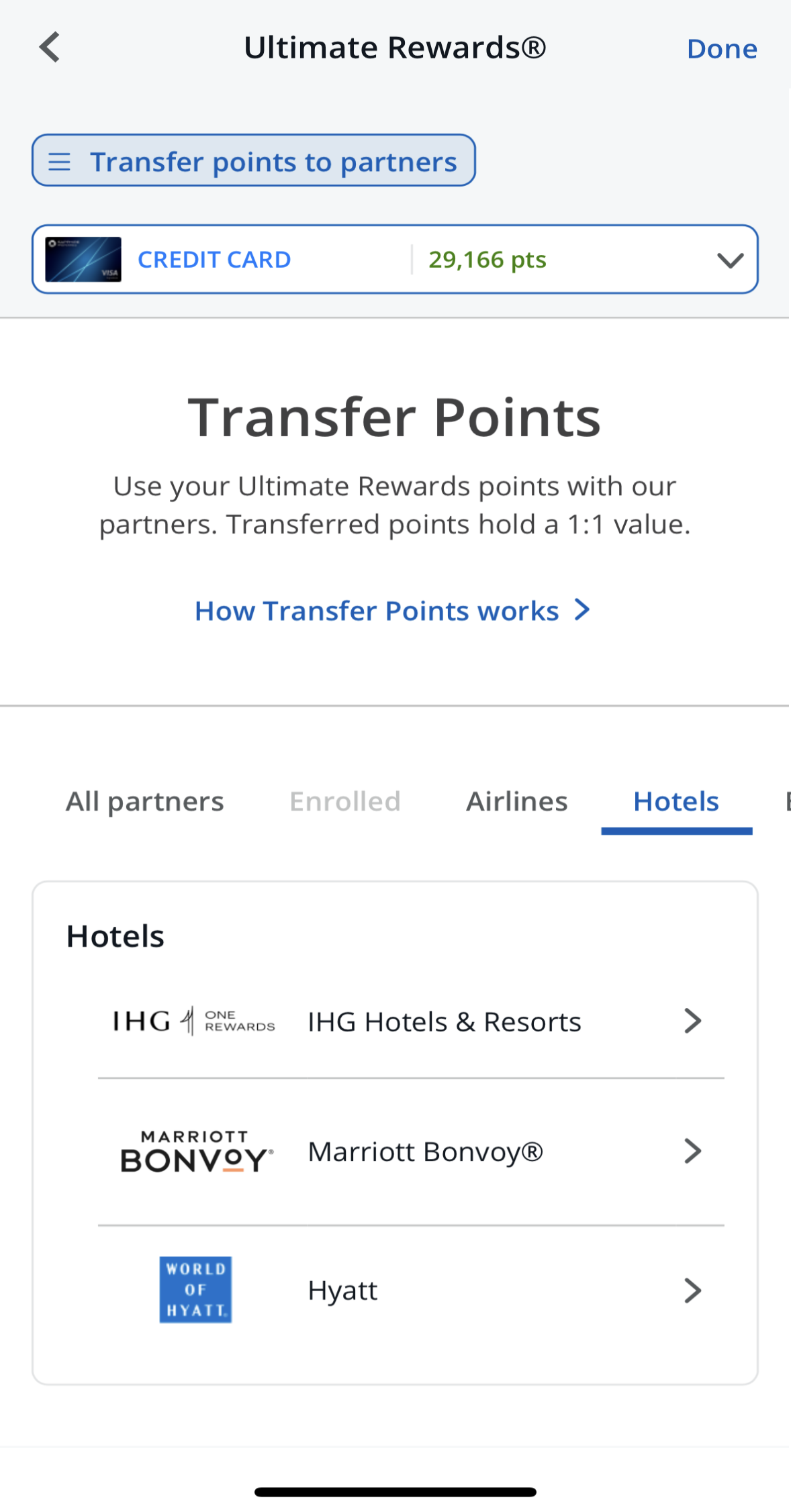

Chase Sapphire Preferred® points offer more than just cash back. You can use them to book flights, hotels, or car rentals through the Chase Ultimate Rewards portal. Plus, you have the option to transfer points to airline and hotel partners for even more flexibility.

In addition to travel, you can redeem points for other rewards, like statement credits, gift cards, or exclusive experiences through Chase Ultimate Rewards.

The Bank of America® Premium Rewards® Card presents diverse redemption avenues. Within Travel, leverage the Bank of America Travel Center for convenient bookings at a 1 cent per point rate. Although not the highest value, it offers simplicity.

Transferring points to partner programs, like Air France-KLM Flying Blue and British Airways Avios, at a 1:1 ratio expands flexibility.

For Cash Back, opt for immediate relief by redeeming points as Statement Credits at 1 cent per point or consider depositing points into eligible Bank of America accounts.

If you have a Merrill Lynch investment account, points can be transferred for potential investment opportunities. Gift Cards provide spending flexibility, while the “Experiences” portal offers unique events for added excitement and variety.

Which Extra Benefits You'll Get With Each Card?

When it comes to extra benefits, the Bank of America Premium Rewards offer more statement credits. Here's the comparison:

Bank of America Premium Rewards

- $100 Airline Incidental Statement Credits: Receive up to $100 annually for eligible purchases like seat upgrades, baggage fees, in-flight services, and airline lounge fees, automatically applied to your card statement.

- $100 TSA PreCheck® or Global Entry: Get up to $100 for TSA PreCheck® or Global Entry application fees every four years, providing a convenient way to streamline your airport security experience.

- Visa Signature Luxury Hotel Collection: Enjoy premium benefits with your Premium Rewards® card when booking through this exclusive hotel collection.

- Balance Connect® for Overdraft Protection: Link your eligible Bank of America® checking account to your credit card to prevent declined purchases, returned checks, or other overdrafts with this optional service.

- Concierge Service: Visa Signature® offers access to concierges who can assist with travel planning, provide restaurant recommendations, and make event reservations, enhancing your overall experience.

Chase Sapphire Preferred

- $50 Anniversary Statement Credit: Every year on your card anniversary, you have the opportunity to earn up to $50 in statement credits for hotel stays made through the Chase Ultimate Rewards portal.

- %25 Travel Bonus: When you redeem your reward points for travel through the Chase Ultimate Rewards portal, you'll receive a 25% bonus, enhancing the value of your points.

- %10 Anniversary Bonus: Chase offers a 10% bonus on your total purchases from the previous year as an anniversary gift. For example, if you earned 20,000 points in the first year, you'll receive a 2,000-point bonus in the second year.

- DoorDash Perks: Upon registration, you'll receive a one-year DoorDash subscription, DashPass, which offers reduced service fees and $0 delivery fees for orders over $12.

- Lyft Rides: During the promotional period, you'll earn extra points on Lyft rides, currently available until March 2025.

- Instacart+ Subscription: Linking your card to Instacart grants you a six-month Instacart+ subscription for free. As a member, you can earn up to $15 in statement credits per quarter until July 2024.

Which Card Offers Better Travel Insurance?

Both cards offer the following insurance and protections:

- Purchase Protection: Safeguard your new purchases from damage or theft with comprehensive coverage.

- Extended Warranty Protection: Extend the existing U.S. manufacturer's warranty by an additional year for eligible warranties lasting three years or less.

- 24-Hour Travel Assistance Services: In the event of a lost or stolen credit card, access emergency services such as an immediate replacement card and cash advance.

- Auto Rental Collision Damage Waiver: Offers primary coverage for theft and collision damage for most rental cars in the U.S. and abroad when you decline the rental company's insurance, with reimbursement up to the actual cash value of the vehicle.

- Baggage Delay Insurance: Reimburses up to $100 per day for essential purchases like toiletries and clothing when your baggage is delayed by a passenger carrier for more than 6 hours, up to a total of 5 days.

Trip Delay Reimbursement: Covers unreimbursed expenses, such as meals and lodging, up to $500 per ticket when your common carrier travel is delayed for more than 12 hours or necessitates an overnight stay.

- Trip Cancellation Reimbursement: If your trip is canceled or shortened due to covered situations like illness.

However. the Bank of America Premium Rewards card offers better travel insurance with different types of protections:

- Emergency Evacuation and Transportation Coverage: ensures that you and your immediate family receive financial support for eligible medical services and transportation in the event of injury or illness during a trip far from home.

- Return Protection: offers reimbursement for dissatisfactory eligible items within 90 days of purchase, when the retailer won't accept the return.

- Roadside Assistance: The card provides a 24/7 on-demand referral dispatch network, ensuring emergency roadside assistance, towing, and locksmith services are readily available, offering peace of mind for cardholders while on the road.

- Lost Luggage Reimbursement: Provides coverage for damaged or lost luggage checked or carried on by you or an immediate family member when traveling.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Prefer The Chase Sapphire Preferred?

You might prefer the Chase Sapphire Preferred card if:

- Better Points Rewards Ratio: Based on our analysis, the Chase Sapphire Preferred offers more points for the same spend and delivers a higher annual value of points compared to the Bank of America Premium Rewards card.

- More Redemption Options: Chase Ultimate Rewards provides a wider range of redemption choices, offering more flexibility than what’s available with Bank of America.

When You Might Prefer The BofA Premium Rewards Card?

You might prefer the regular BofA Premium Rewards card if:

- You Want Broader Travel Insurance: As we can see above, the BofA Premium Rewards offers offers a broader coverage so if you prioritize this aspect, it may be a better choice.

- You Want Better Travel Perks: the BofA Premium Rewards offers a bit more enticing extra travel perks compared to the Chase Sapphire Preferred:

Compare The Alternatives

Whether you're seeking travel rewards, a straightforward cashback system, or specific perks tailored to your lifestyle, these alternatives have something for everyone.

|

| ||

|---|---|---|---|

Bank of America® Travel Rewards credit card | Capital One Venture Rewards Credit Card | Wells Fargo Autograph℠ Card | |

Annual Fee | $0 | $95 | $0

|

Rewards |

1.5X

1.5 points for every $1 you spend on all purchases everywhere, every time and no expiration on points

|

2X – 5X

2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel

| 1X – 3X

3X points on restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Also, earn 1X points on other purchases

|

Welcome bonus |

25,000 points

25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – which can be redeemed for a $250 statement credit toward travel purchases

|

75,000 miles

| 20,000 Points

20,000 bonus points when you spend $1,000 in purchases in the first 3 months

|

Foreign Transaction Fee | $0 | $0 | $0

|

Purchase APR | 18.24% – 28.24% Variable APR

| 19.99% – 29.74% (Variable)

| 19.49% – 29.49% Variable APR

|

Compare BofA Premium Rewards Card

The BoFa Premium Rewards Elite offers better travel perks, but is it worth the difference in the annual fee? We don't think so. Here's why.

Bank of America Premium Rewards vs. Elite: How They Compare?

The BofA Premium Rewards is the winner when it comes to travel benefits, but there are cases when you'll prefer the BofA Travel Rewards.

Bank of America Premium Rewards vs. Travel Rewards: Comparison

Compare Chase Sapphire Preferred

When it comes to the annual fee, there is a clear winner. But is it worth the exclusive travel rewards you'll get? Here's our analysis.

When it comes to travel benefits, there is a clear winner. But what about if you're looking for rewards on everyday spending?

Amex Blue Cash Preferred vs Chase Sapphire Preferred: Which Card Is Best?

While the Chase Sapphire Preferred Card has more benefits, the Capital One Venture card offers unique features. Which travel card is better?

Capital One Venture vs Chase Sapphire Preferred: Which Card Is Best?

While the Amex gold card is best for everyday spending, the Chase sapphire preferred may be better as a travel card. Here's our comparison:

American Express Gold Card Vs. Chase Sapphire Preferred: Which Is Best?

The Chase Sapphire Preferred offers better travel perks and protections, but unlike the Autograph card – you'll need to pay an annual fee.

Wells Fargo Autograph Vs. Chase Sapphire Preferred: Which Card Is Best?

The Chase Sapphire Preferred offers costs more and offer more benefits than the Freedom Unlimited. Is it worth the annual fee?

Chase Freedom Unlimited Vs. Sapphire Preferred: Compare Side By Side

The Chase Sapphire Preferred is more versatile and offers better travel rewards than the Explorer card. But what if you're loyal to United?

United Explorer Card vs Chase Sapphire Preferred: Side By Side Comparison

The Venture X card offers better travel perks than the Sapphire Preferred, such as annual credit and lounge access. But is it worth the fee?

Capital One Venture X vs. Chase Sapphire Preferred: Comparison

The Marriott Boundless offers great perks for Marriot lovers, while the Preferred card wins when it comes to general travel-related rewards.

Marriott Bonvoy Boundless vs. Chase Sapphire Preferred: Comparison

The Capital One Savor is better for everyday spending, but the Chase Preferred card is the winner when it comes to travel and protections.

While the Chase Sapphire Preferred is our winner due to its various perks, the Aeroplan card offers high cashback value and airline perks.

Chase Sapphire Preferred vs. Air Canada Aeroplan Card: How They Compare?

The Chase Sapphire Preferred is our winner due to its higher annual cashback value and various redemption options compared to Alaska card

Chase Sapphire Preferred vs. Alaska Airlines Visa Signature Card: How They Compare?

While we really like both cards, the Chase Sapphire Preferred is our winner due to its diverse redemption options and high rewards rate.

Chase Sapphire Preferred vs. JetBlue Plus Card: Side By Side Comparison