When it comes to choosing a credit card that aligns with your shopping preferences, two popular options often come into play: the Target Red Card and the Capital One Walmart Rewards card. Both cards cater to frequent shoppers, offering unique perks and rewards tailored to their respective retail giants.

Let's delve into a side by aide comparison.

General Comparison: Target vs. Walmart Credit Card

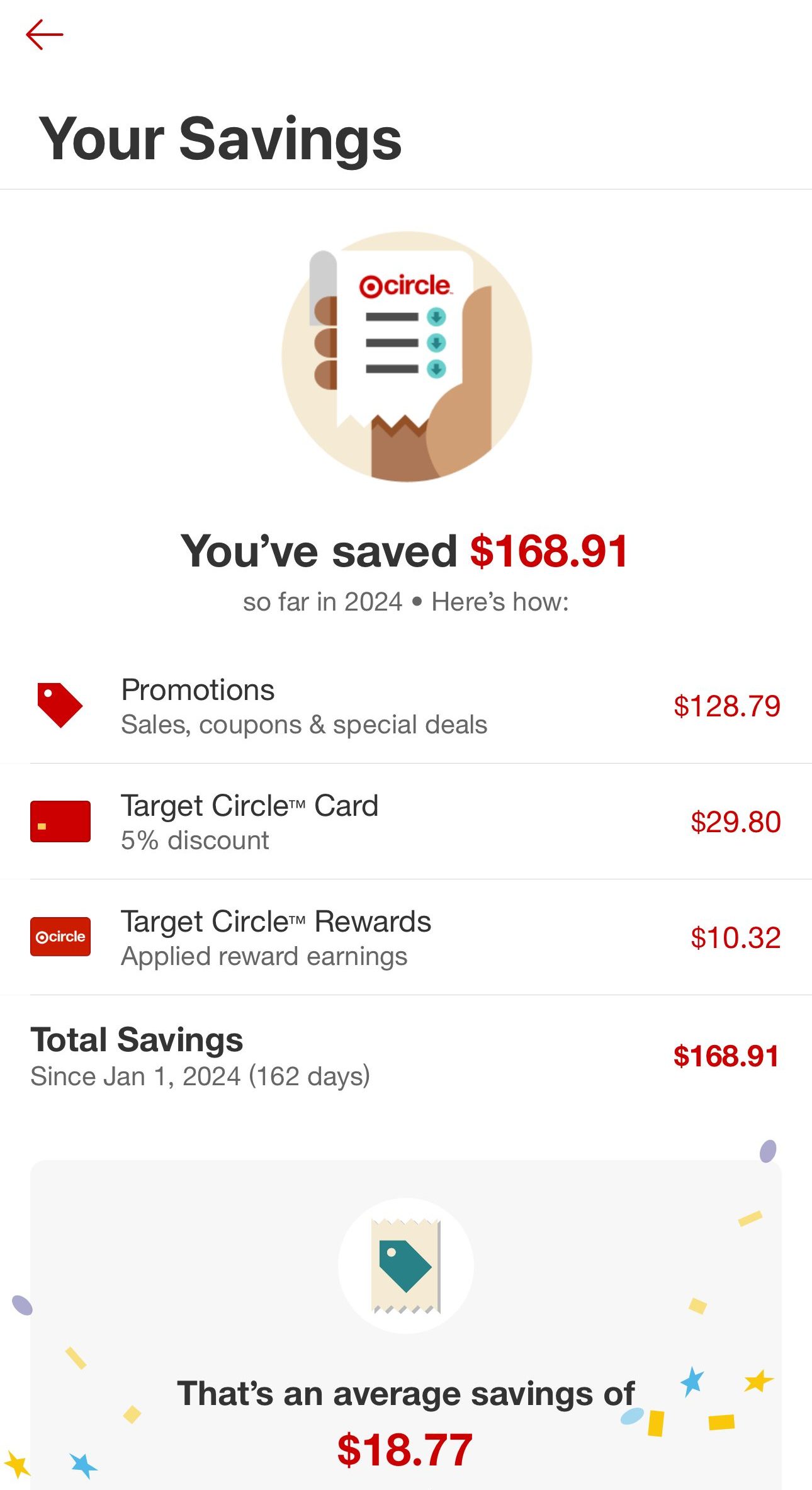

The Target RedCard is a store-branded credit card that offers cardholders a 5% discount on most purchases made at Target and Target.com. This instant discount at checkout can lead to significant savings for frequent Target shoppers. Plus, RedCard holders get free shipping on online orders and an extended return period.

The Walmart Rewards Mastercard, on the other hand, is geared towards rewarding Walmart-related spending. Cardholders earn 5% back on purchases made at Walmart.com, including grocery pickup and delivery, and 2% back on in-store purchases. This card could be a better choice for those who primarily shop online rather than in-store.

Capital One Walmart Rewards Card | Target RedCard Credit Card | |

Annual Fee | $0 | $0 |

Rewards | 5% cash back at Walmart.com (including pickup and delivery), 2% cash back in Walmart stores and gas stations, at restaurants and on travel plus 1% cash back everywhere else Mastercard is accepted | 5% off at Target and target.com, 2% on dining and gas purchases and 1% everywhere else outside of Target |

Welcome bonus | 5% cash back for the first 12 months when you use your card with Walmart Pay for in-store purchases, upon approval | None |

0% Intro APR | N/A | None |

Foreign Transaction Fee | Unknown | $0 |

Purchase APR | 17.99% – 28.99% (Variable) | 29.45% Variable |

Read Review | Read Review |

Cashback Analysis: Target vs. Walmart Credit Card

Assuming all supermarket and gas purchases are made via Walmart.com or Target – the Walmart card will drive you a bit more cash back, but the difference is insignificant.

Your specific spending habits can drastically impact the cashback comparison.

Spend Per Category | Capital One Walmart Rewards Card | Target RedCard Credit Card |

$15,000 – U.S Supermarkets | $750 | $750 |

$5,000 – Restaurants | $100 | $100 |

$4,000 – Travel

| $80 | $40 |

$4,000 – Gas | $80 | $80 |

Estimated Annual Cashback | $1,010 | $970 |

* Assuming all supermarkets purchases made via Walmart.com/Target

Top Offers

Top Offers From Our Partners

Top Offers

Target vs. Walmart Credit Card: Benefits Comparison

When it comes to extra benefits, the Target card is the clear winner as it offers a bunch of extra benefits for cardholders.

Capital One Walmart Rewards Card

Security Alerts: Receive text, email, and phone notifications from Capital One® if potential suspicious activity is detected on your account.

$0 Fraud Liability: In the event of a lost or stolen card, you won't be held responsible for any unauthorized charges, providing a safeguard against financial loss.

Target RedCard Credit Card

- Free 2-day shipping: Enjoy the convenience of swift delivery with free 2-day shipping on an extensive selection of items when shopping on Target.com.

- RedCard Exclusives: Gain access to special items and exclusive offers available only to RedCard holders, enhancing your shopping experience with unique perks.

- Extended Return Time: Benefit from an additional 30 days for returns and exchanges at Target, providing flexibility and peace of mind for your purchases.

- Starbucks Discount: Save 5% on your purchases at any in-store Starbucks location when using your Target Red Card, adding an extra perk for coffee enthusiasts.

- Specialty Gift Cards Savings: Receive a 5% discount on specialty gift cards for travel, restaurants, movie tickets, and more, allowing you to save on a variety of experiences and purchases beyond Target.

When You Might Prefer The Target RedCard?

Here are scenarios where you might prefer the Target RedCard over the Capital One Walmart Rewards Mastercard:

- You're A Frequent Target Shopper: If you're a regular Target customer, the RedCard's 5% discount on most purchases at Target and Target.com can provide immediate and consistent savings. This is especially beneficial if a significant portion of your shopping is done at Target.

- You Want Exclusive Deals and Offers: The RedCard provides access to RedCard Exclusives, including special items and offers. If you appreciate exclusive discounts and promotions, this can be a compelling reason to choose the Target RedCard.

When You Might Prefer The Walmart Rewards Card?

Choosing the Capital One Walmart Rewards Mastercard over the Target RedCard may be more advantageous in certain scenarios:

- You Like To Shop On Walmart.com: If you frequently make online purchases, especially through Walmart.com, the Capital One Walmart Rewards Mastercard's 5% cash back on such transactions can make it a more attractive choice for maximizing rewards.

- You Want Many Redemption Options: The rewards earned with the Capital One Walmart Rewards Mastercard can be redeemed for statement credits, covering a wide array of expenses, including travel. If you prefer the flexibility of using your rewards for different purposes, this card offers a broader range of redemption options.

Top Offers

Top Offers From Our Partners

Top Offers

Compare The Alternatives

If you're looking for a store credit card with great rewards for online shopping – there are some good alternatives you may want to consider:

Costco Anywhere Visa® Card by Citi | Apple Credit Card | Amazon Prime Rewards Visa Signature Card | |

Annual Fee | $0 ($60 Costco membership fee required) | $0

| $0 ($139 Amazon Prime subscription required)

|

Rewards |

1-4%

4% cash back on on eligible gas and EV charging purchases for the first $7,000 per year and then 1% thereafter, 3% cash back on restaurants and most travel purchases, 2% cash back at Costco and Costco.com, 1% cash back on all other purchases

| 1% – 3%

3% cash back at Apple and select Apple pay partners. 3% Daily Cash back at Ace Hardware, Duane Reade, Exxon, Mobil, Nike, Panera Bread, T-Mobile, Uber, Uber Eats, and Walgreens. 2% on other Apple pay purchases, and 1% on all other purchases

|

1-5%

5% back on Amazon.com, Amazon Fresh, Whole Foods Market, and Chase Travel purchases. Plus, you’ll get 2% back at gas stations, restaurants, and on local transit, and 1% on all other purchases

|

Welcome bonus |

None

None

| N/A |

$200

Get a $200 Amazon Gift Card

|

Foreign Transaction Fee | $0

| $0 | $0

|

Purchase APR | 19.99% – 27.99% (Variable)

| 15.99% – 26.99% Variable

| 19.99% – 28.74% Variable

|

Compare Capital One Walmart Rewards Card

Both can be a perfect choice if you're looking for a store card. What are the main things you should know before applying, and how much can you save? Here's our analysis.

Costco Anywhere Visa vs Capital One Walmart Rewards Card: Which Card Is Best?

Both Sam's Club and Walmart cards cater to the retail giant's customer base, offering perks for frequent shoppers. Here's our comparison

Sam’s Club Mastercard vs Walmart Rewards Mastercard: How They Compare?

Both the Prime Visa and the Capital One Walmart card offer similar cashback rewards ratios. Here's why Walmart is our winner:

Prime Visa vs: Capital One Walmart Rewards: How They Compare?

Compare Target Red Card

While Target RedCard offers a less attractive cashback rewards ratio than Amazon, it still may be a better option for some. Let's compare.

If you focus on groceries – the Target RedCard wins, but if you focus on travel or gas – you may want the Costco credit card.

Target Red Card vs. Costco Anywhere Visa Card: How They Compare?

If you do all your grocery and fuel shopping at either Target or Sam's Club, the cashback you get from both credit cards is pretty similar.

The target RedCard is our clear winner, with a higher cash-back rate and estimated annual value. Here's what you can get with each card.

The Target RedCard is our winner especially if you focus on groceries and dining, with much better cashback rates than Macy's Credit Card.

Target Red Card vs. Macy's Credit Card: What Store Card Offers The Highest Rewards?