Both cards offer an array of impressive perks, but they cater to different needs and lifestyles. The Platinum Card® from American Express is a luxury card that shines with its extensive travel benefits, higher earning potential, and versatile rewards program, making it a top choice for frequent travelers looking for luxury and flexibility.

If you’re a loyal United Airlines traveler looking for a card with a lower annual fee and great travel benefits, the United Club℠ Infinite Card is definitely worth considering.

In this review, we’ll go over the main features of each card to help you decide which one aligns best with your needs and priorities.

General Comparison: United Infinite vs Amex Platinum

|

| ||

|---|---|---|---|

The Amex Platinum Card | United Club℠ Infinite | ||

Annual Fee | $695. See Rates and Fees. | $525 | |

Rewards | 5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases. Terms Apply. | 4x miles on United Airlines purchases, 2x miles on all other travel purchases, dining and eligible delivery services and 1x miles on all other purchases | |

Welcome bonus | 175,000 Membership Rewards® Points after spending $8,000 in eligible purchases on your new Card in your first 6 months of Membership. |

| |

0% Intro APR | None | N/A | |

Foreign Transaction Fee | $0 | ||

Purchase APR | See Pay Over Time APR | 20.24%–28.74% variable

| |

Read Review | Read Review |

Compare Rewards: Which Card Gives More?

Everyone’s spending habits are different, but if you frequently spend on airlines, the United card could be a great way to maximize your rewards.

However, if your spending covers a broader range of expenses like hotels and groceries, the Amex Platinum card might be a better fit.

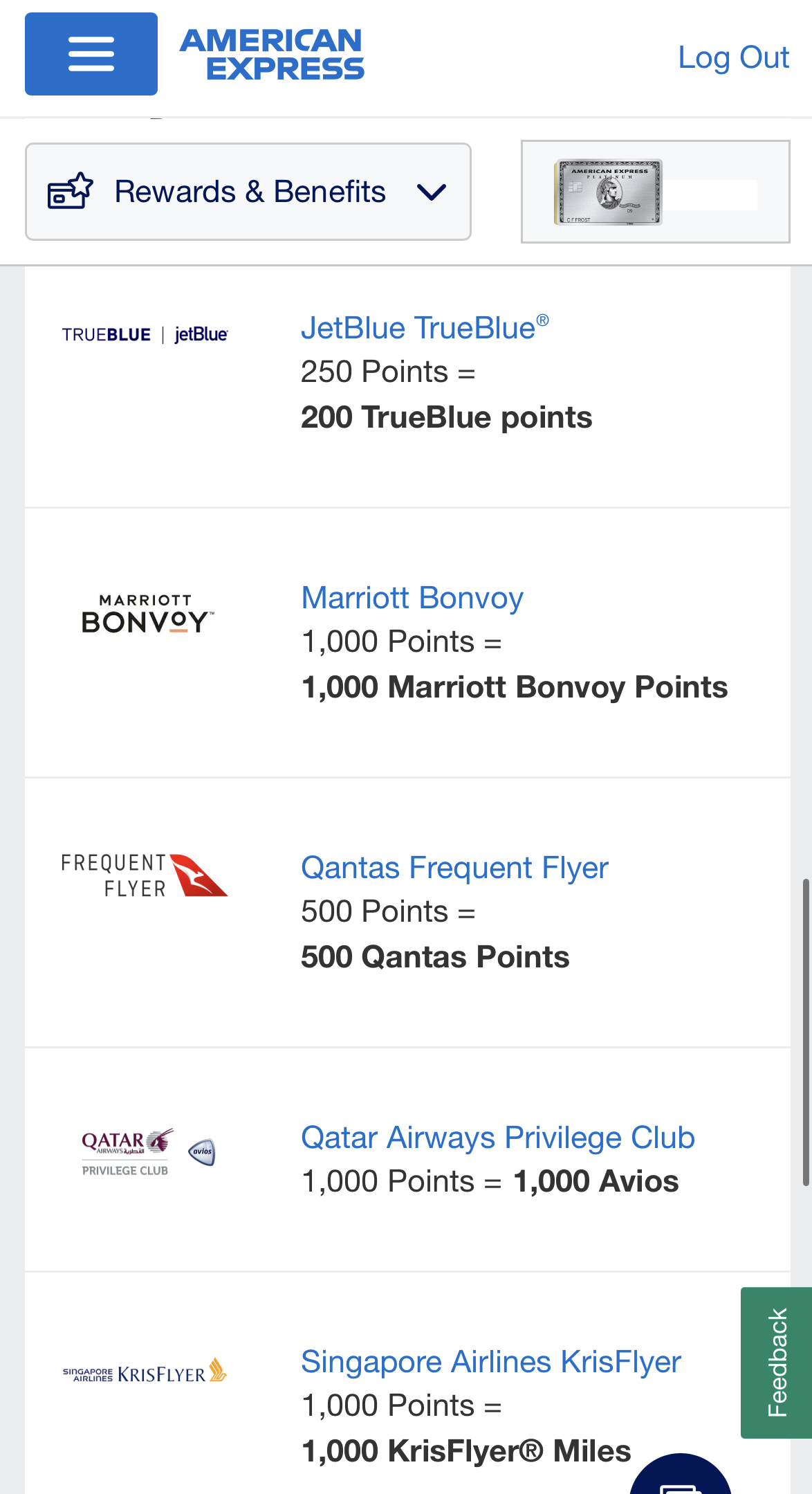

With the Amex Platinum, you can use your Membership Rewards points for travel, statement credits, or gift cards. Plus, you can transfer points to airline and hotel partners or redeem them for exclusive experiences and events.”

|

| |

|---|---|---|

Spend Per Category | The Platinum Card® | United Club℠ Infinite |

$10,000 – U.S Supermarkets | 10,000 points (100,000 in the first 6 months) | 10,000 miles |

$5,000 – Restaurants | 5,000 points | 10,000 miles |

$6,000 – Hotels | 30,000 points | 12,000 miles |

$8,000 – Airline

| 40,000 points | 32,000 miles |

$4,000 – Gas | 4,000 points | 4,000 points |

Total Points | 89,000 points | 68,000 miles |

Estimated Redemption Value | 1 point ~ 0.6 – 1.6 cents | 1 point ~ 1.5 cents |

Estimated Annual Value | $534 – $1,424 | $1,020 |

With Amex Platinum, you can redeem Membership Rewards points for travel, statement credits, or gift cards. Cardholders can also transferring points to airline and hotel partners, or using them for premium experiences like exclusive events.

United Infinite offers versatile redemption options, allowing members to use miles for flights, upgrades, hotels, car rentals, and experiences.

United Infinite vs Amex Platinum: Benefits Comparison

There are some additional types of perks that you will see with both of these cards.

The Amex Platinum Card

- Dedicated Service Team: You will get access to a customer service team that is operational 24/7, so you can resolve any issues instantly.

- Up to $200/$120 in Uber Cash. You can also become an Uber VIP to be matched with top rated drivers without needing to meet any minimum ride requirements. Up to $200 if you carry the Platinum Card and $120 for Gold Cards. Enrollment Required.

- Preferred Seating at sporting and cultural events, subject to availability

- Up to $100 experience credit – receive a $100 experience credit when you reserve The Hotel Collection through American Express Travel for a delightful getaway of at least two nights. The specific value of the experience credit may vary depending on the property you choose.

- Extra Cards: Both of these cards allow you to add additional cards to your locknut with no additional fees. This allows you to earn rewards when other people make purchases, such as your spouse, children, or employees.

- Marriott Bonvoy Gold Elite Status: As a Platinum Card member, you have the opportunity to enroll in complimentary Bonvoy Gold Elite status.

- Priority Pass: Platinum Card members enjoy a complimentary membership in Priority Pass Select, granting them access to over 1,400 lounges across the globe. It's important to note that this membership does not include access to Priority Pass restaurant lounges.

- Up to $100 Fee Credit for Global Entry or TSA PreCheck®: Get reimbursed for the application fee for Global Entry or TSA PreCheck every 4 years.

- Signature perks at upscale hotels, which are part of the Amex Hotel Collection and you book through American Express Travel.

- Fraud Protection: You will not have to be responsible for any fraudulent charges. If you see a charge that is suspicious, just get in touch with the Amex team.

- Baggage insurance for up to $500 for checked baggage and $1,250 for carry on, if it is lost, stolen, or damaged when you purchase your fare using your card*.

- Up to $200 hotel credit in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings, which requires a minimum two-night stay, through American Express Travel when you pay with your Platinum Card®. Enrollment Required.

- Up to $240 or $20 per month in Digital Entertainment in statement credit when you pay for one or more The New York Times, Peacock or SiriusXM with your card. Enrollment Required.

- Up to $155 in Walmart+ credit. When you use your card to pay for your monthly Walmart+ membership, you’ll get the full cost back every month. Enrollment Required.

- Up to $200 in Airline fee credit per year when you charge incidental travel fees from selected airlines on your card. Enrollment Required.

- Up to $300 back every year in statement credit for eligible Equinox memberships when you enroll and pay using your card (subject to auto-renewal).

- Up to $199 back per year when you use your card to pay for a CLEAR® plus membership. Enrollment Required.

Terms apply to American Express benefits and offers.

United Club℠ Infinite

United Club Membership: This offers you a place to enjoy complimentary snacks and beverages, work or relax before you fly. You and your eligible travel companions can enjoy access across all United Club locations worldwide. This benefit has a value of up to $650 per year.

- Free Check Bags: The primary cardmember and a travel companion on the same reservation can receive their first and second standard bags checked for free. This represents savings of up to $320 per round trip.

- Statement Credit for United Inflight Purchases: You can get 25% back when you buy food, drinks, WiFi and other onboard purchases with your United Club Infinite on United operated flights.

- Premier Access Travel Services: You can get preferential treatment at the airport including priority check in, boarding, security screening and baggage handling.

- Global Entry or TSA PreCheck Reimbursement: You can get up to $100 statement credit every four years as a reimbursement for your application fee for Global Entry or TSA PreCheck when you charge your subscription to your card.

- IHG Rewards Platinum Elite: Primary cardmembers are eligible for Platinum Elite status with the IHG Rewards platform. This includes extended check out, complimentary room upgrades and other perks.

- Luxury Hotel & Resorts Collection: As with other Chase Travel cards, you can access the Luxury Hotel & Resorts Collection. This provides access to complimentary breakfasts, early check in, room upgrades and other amenities in over 1,000 luxury hotels and resorts around the world.

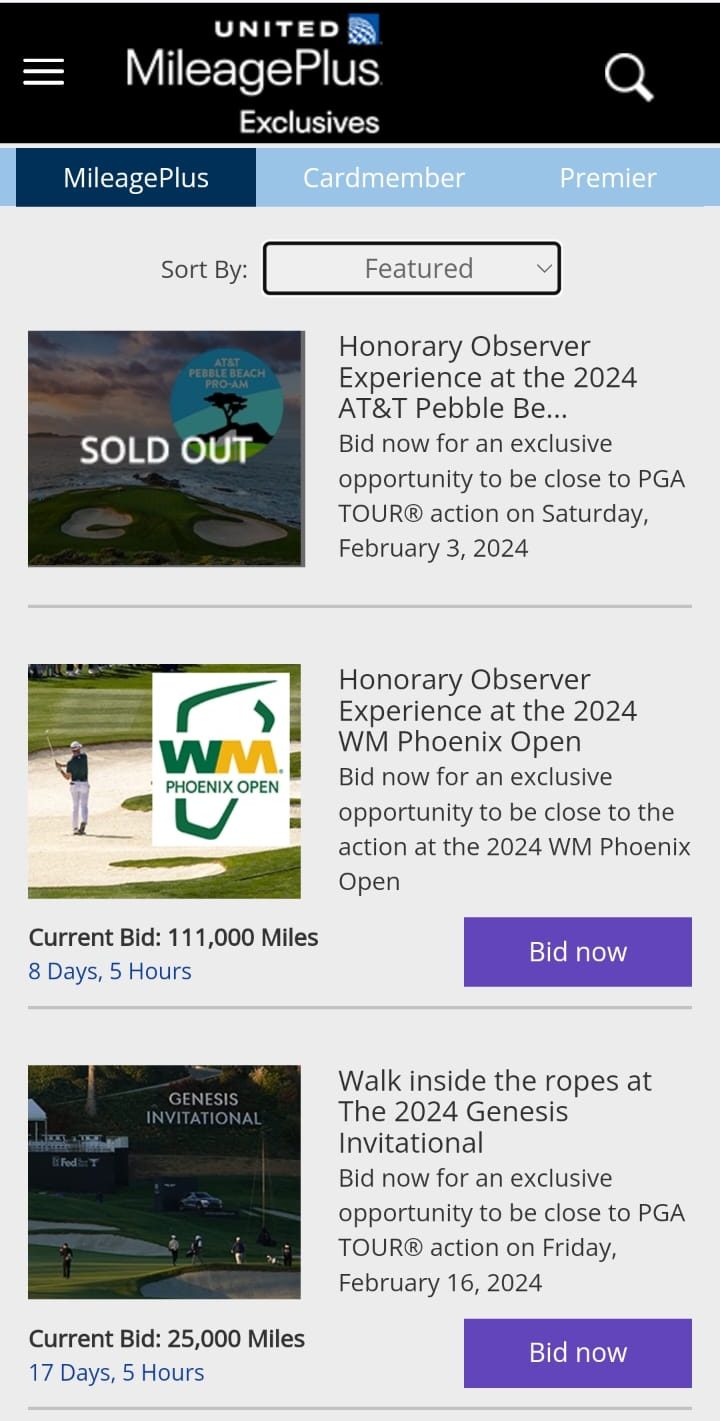

- Chase United Card Events: This allows you to purchase curated, private once in a lifetime experiences. These range from sporting events to celebrity meet and greets.

- Premier qualifying points: customers can earn 500 PQP for every $12,000 you spend on purchases with your United Club Card (up to 8,000 PQP in a calendar year) that can be applied toward your Premier status qualification, up to the Premier 1K® level

- Trip Interruption/Cancellation Insurance: If your trip is cut short or canceled due to severe weather, sickness or another covered situation, you have up to $20,000 per trip and up to $10,000 per person.

- Trip Delay Reimbursement: If your common carrier travel has a 12 hour plus delay, you’ll be covered for unreimbursed expenses such as meals and accommodation for up to $500 per ticket.

- Baggage Insurance: If your baggage is delayed by your passenger carrier for over six hours, you can get reimbursement for essential purchases up to $100 per day for three days.

- Visa Infinite Concierge Service: This provides complimentary access to 24 hour concierge services to help you send gifts, find tickets to top events or make restaurant reservations.

- Auto Rental Collision Damage Waiver: If you charge the full rental cost to your card and decline the rental company collision insurance, you’ll enjoy primary coverage for collision damage or theft for most rental cars here and abroad.

- Purchase Protections: New purchases are covered for 120 days for up to $50,000 per year against theft or damage.

Main Drawbacks: Comparison

American Express Platinum Card

- High Annual Fee

The Amex Platinum comes with a steep annual fee of $695, which can be a significant drawback for some potential cardholders.

- Restrictions

Although it offers travel benefits, the card's perks may not fully align with the preferences of travelers loyal to specific airlines or hotel chains.

- Travel-Focused

While great for travelers, the Amex Platinum's focus on travel benefits may not be as appealing to individuals who don't frequently engage in travel-related spending.

United Club℠ Infinite

- Limited Non United Flying Redemptions

This card's rewards system is primarily geared towards United Airlines and Star Alliance flights, limiting flexibility for other travel options.

- No Anniversary Awards

Unlike some other premium cards, the United Club℠ Infinite doesn't offer anniversary bonuses or awards.

- Few Credits

It provides fewer credits for travel expenses and incidentals compared to some other premium cards.

When You Might Want the Amex Platinum?

You might want the Amex Platinum card if:

- You're a Frequent Traveler: The Amex Platinum offers a range of travel benefits, including airport lounge access, airline fee credits, and extensive travel insurance, making it an excellent choice for individuals who travel frequently.

- You Value Luxury and Perks: If you appreciate premium travel experiences, such as access to Centurion Lounges, Fine Hotels & Resorts program, and concierge services, the Amex Platinum card provides these luxurious perks.

- You Use Multiple Airlines and Hotels: The card's flexibility in transferring Membership Rewards points to various airline and hotel partners can be a major advantage if you often switch between different brands and loyalty programs.

- You Can Maximize Statement Credits: If you can take full advantage of the annual travel credits, Uber credits, and other statement credits offered by the card, it can help offset the annual fee and enhance its overall value.

When You Might Want the United Infinite Card?

You might want the United Club℠ Infinite card if:

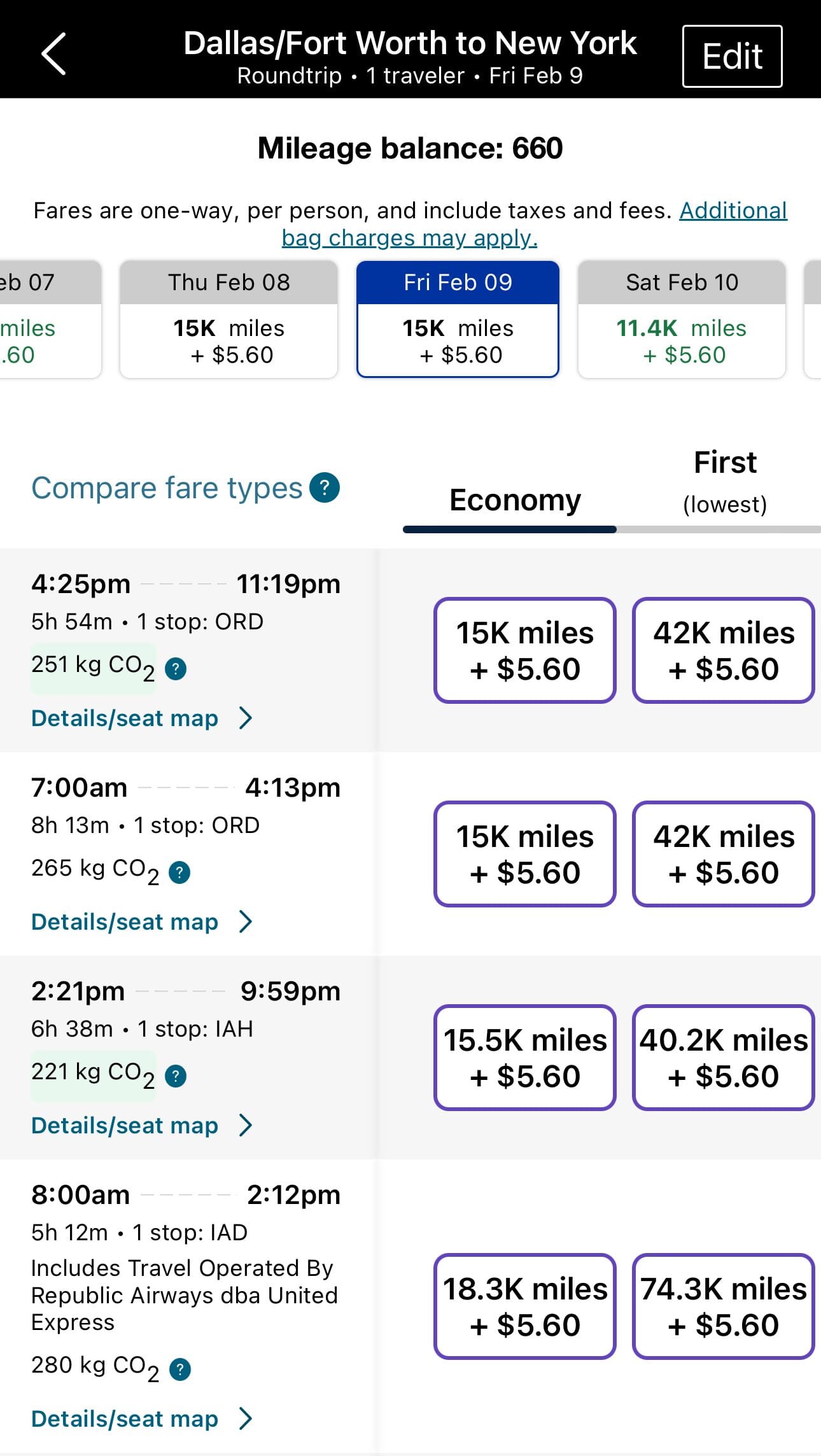

- You're a Loyal United Airlines Flyer: If you frequently fly with United Airlines or within the Star Alliance network, this card can offer you substantial benefits, including United Club membership and priority access.

- You Want a Card Tailored to United Airlines: If United Airlines is your preferred carrier, and you want a credit card that complements your loyalty, the United Club℠ Infinite can be an excellent choice.

- You Want Simplicity in Redemption: If your travel needs primarily involve United Airlines and you prefer a straightforward rewards program, this card's focus on United redemptions can be a plus.

Compare The Alternatives

If you're looking for a premium travel credit card with airline rewards – there are some good alternatives you may want to consider:

|

|

| |

|---|---|---|---|

Capital One Venture X | Chase Sapphire Reserve® | Citi®/AAdvantage® Platinum Select® World Elite Mastercard® | |

Annual Fee | $395 | $550 | $99 (waived for the first 12 months)

|

Rewards |

1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases |

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

|

1X – 2X

Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases and 1 AAdvantage® mile for every $1 spent on other purchases. Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases.

|

Welcome bonus |

75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening |

Earn 125,000 points after you spend $6,000 in purchases in the first 3 months from account opening

Earn 125,000 points after you spend $6,000 in purchases in the first 3 months from account opening

|

50,000 miles

50,000 American Airlines AAdvantage® bonus miles after spending $2,500 in purchases within the first 3 months of account opening.

|

Foreign Transaction Fee | $0 | $0 | $0 |

Purchase APR | 19.99% – 28.99% (Variable)

| 19.99%–28.49% variable

| 19.99% – 29.99% (Variable)

|

Compare American Express Platinum Card

If you're looking for everyday spending rewards, the Amex Gold Card offers more. But for travel rewards benefits, there is a clear winner.

When it comes to premium travel rewards, both may be the best cards in the market. But who is the winner between the two? Here's our analysis.

American Express Platinum vs Chase Sapphire Reserve: Which Luxury Card Is Best?

While the Amex Platinum offers extensive travel perks and redemption options, the Marriott Brilliant Card has better hotel-specific perks.

While the Amex Platinum Card offers extensive travel perks and redemption options, the Delta Reserve Card has better airline-specific perks.

Amex Platinum Card vs. Delta SkyMiles Reserve: Which Luxury Card Is Best?

The Amex Platinum wins when it comes to redemption options and protections, but the Venture X is cheaper and offers great travel benefits.

Amex Platinum Card vs. Capital One Venture X: Which Luxury Card Is Best?

The Hilton Aspire is surprising with its higher estimated annual cashback value, but the Platinum card wins at premium travel perks.

Amex Platinum Card vs. Hilton Amex Aspire: Side By Side Comparison

If you need premium travel perks and versatility – the Amex Platinum wins. Need airline benefits and lower fees? Consider the Delta Platinum.

Amex Platinum Card vs. Delta SkyMiles Platinum: Which Luxury Card Is Best?

The AAdvantage Executive card offers higher cashback value, but when it comes to premium travel perks, the Amex Platinum is the winner.

Citi/AAdvantage Executive World Elite vs. Amex Platinum Card

The Amex Platinum card is a clear winner as it offers much higher annual cashback value, luxury travel perks, and various travel protections.

Amex Platinum Card vs. Emirates Skywards Premium World Elite Mastercard: How They Compare?

The Amex Platinum is our winner due to its higher annual cashback value, redemption options, and better luxury perks than the Altitude Reserve.

U.S. Bank Altitude Reserve Visa Infinite vs. Amex Platinum Card: How They Compare?

Compare United Club Infinite Card

In this comparison, we will delve into the key features, benefits, and considerations of both the United Explorer and Infinite Card.

The United Infinite card offers luxury benefits that the Quest card doesn't, but for most consumers, it is not worth the higher annual fee.

These two are considered as one of the best exclusive airline cards out there. What are the differences between them and is it worth it?

United Club Infinite vs Delta SkyMiles® Reserve: Which Gives You More?

When it comes to premium travel cards, these two offer nice perks and benefits. But who is the winner between the two? Here's our analysis.

United Club Infinite vs AAdvantage Executive Elite Mastercard: Which Card Is Best?

Related Posts

Review Travel Credit Cards

- Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.