Rewards Plan

Sign up Bonus

Our Rating

0% Intro

Annual Fee

APR

- Cash Back Rewards

- Sign Up Bonus

- No Bonus Categories

- Foreign Transaction Fee

Rewards Plan

Sign up Bonus

Our Rating

PROS

- Cash Back Rewards

- Sign Up Bonus

CONS

- No Bonus Categories

- Foreign Transaction Fee

APR

18.74%–28.24% variable

Annual Fee

$0

0% Intro

15 months on purchases and balance transfers

Credit Requirements

Good – Excellent

- Our Verdict

- FAQ

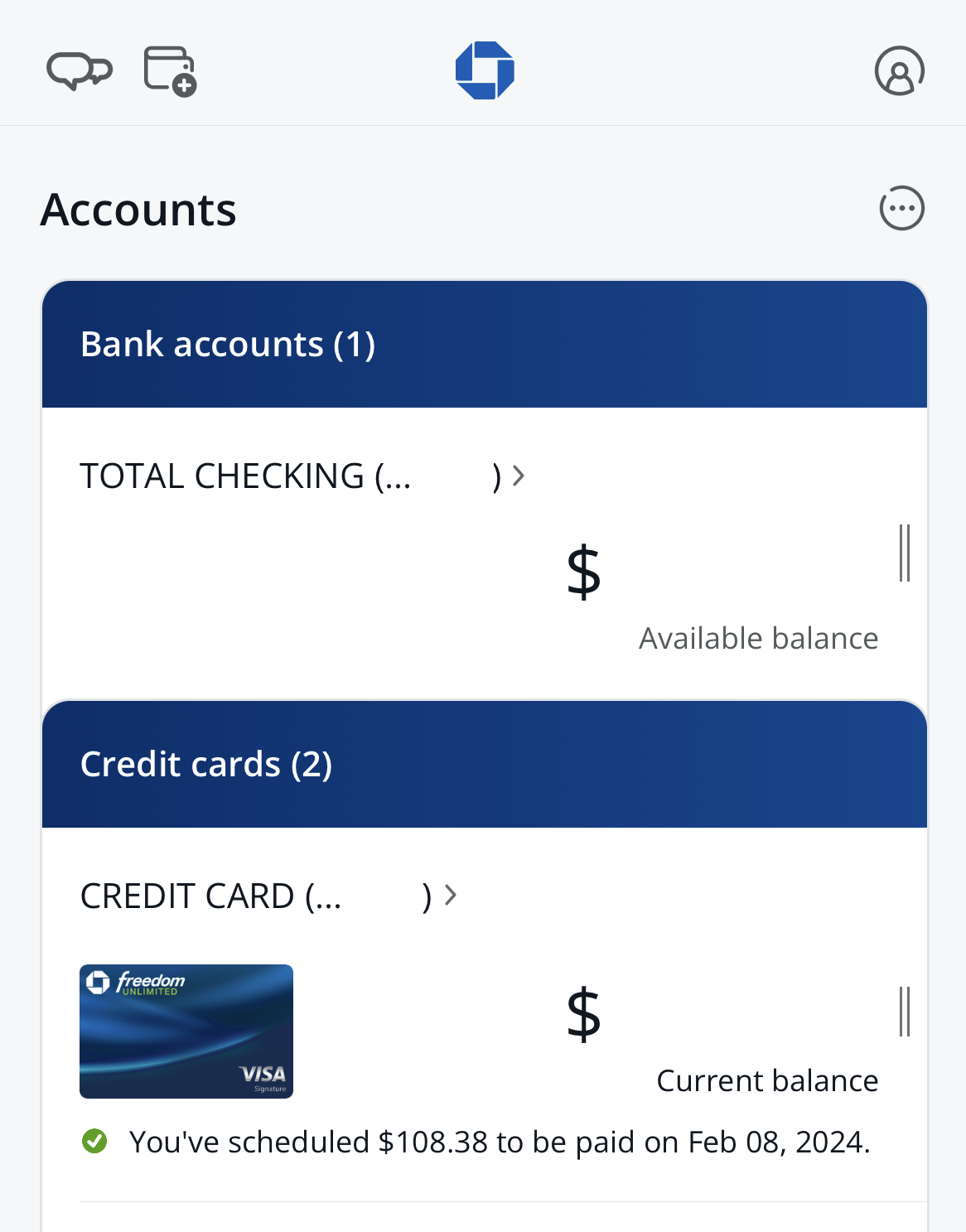

The Chase Freedom Unlimited® card, issued by Chase Bank, is an excellent cash back option for those with good to excellent credit. It offers 5% cash back on travel booked through Chase Ultimate Rewards, 3% on dining (including takeout and eligible delivery), 3% on drugstore purchases, and 1.5% on all other purchases.

Despite lacking an annual fee, the Freedom Unlimited provides decent benefits, including rental car protection, trip cancellation/interruption insurance, roadside dispatch, extended warranty, and purchase protection.

In addition, you can earn a decent sign up bonus – Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.. Lastly, the Chase Freedom Unlimited offers generous intro APR on purchases and balance transfers.

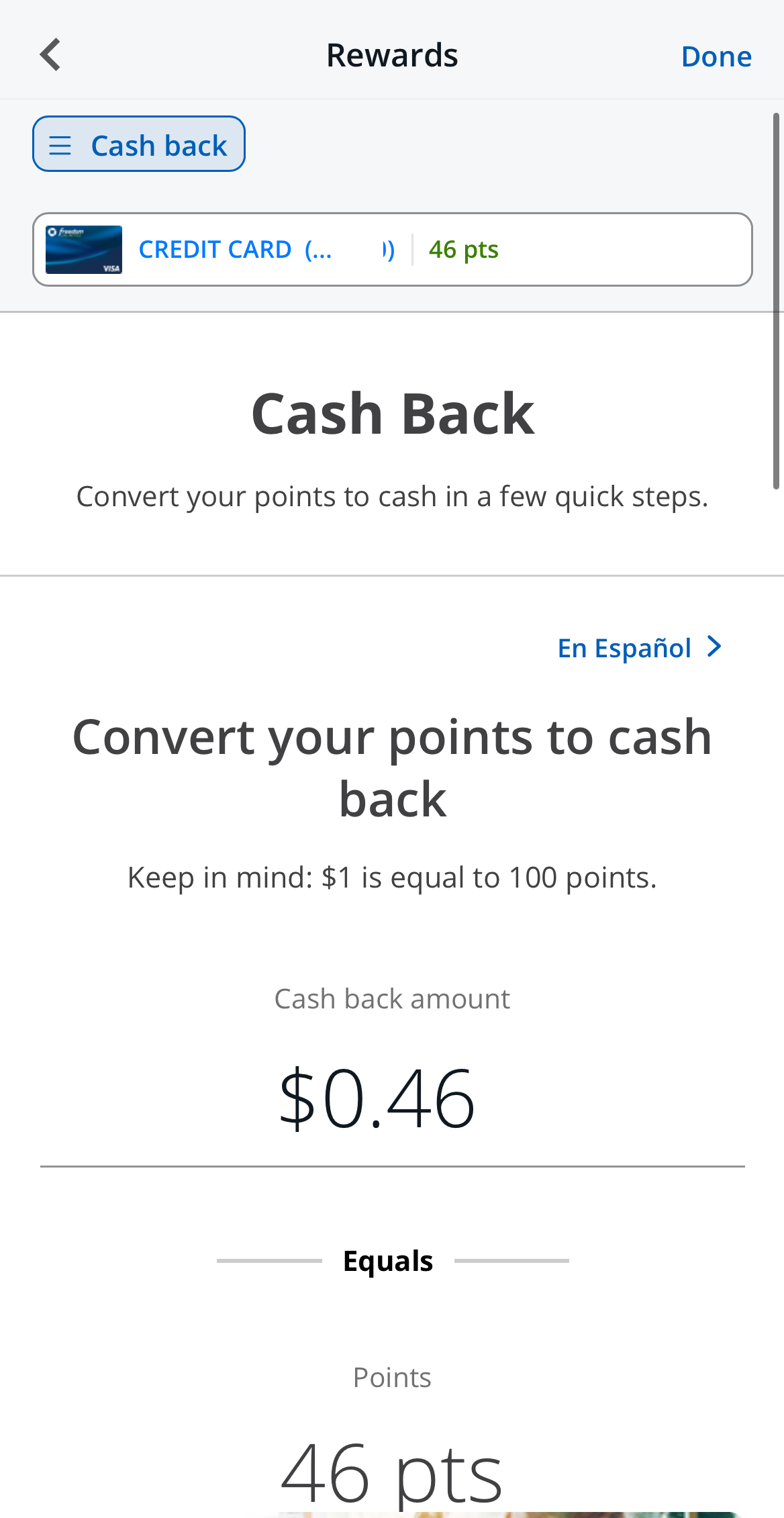

Redeeming rewards is flexible, allowing for statement credits, direct deposits, gift cards, and travel bookings through the Ultimate Rewards portal. Rewards can also be transferred to other Chase cards for enhanced value.

However, its regular 1.5% cash back rate on general purchases is lower than some competitors. The card lacks direct transfers to travel partners unless paired with other Chase cards. Additionally, its foreign transaction fee of 3% makes it less favorable for international travelers.

How hard is it to get a Chase Freedom Unlimited card?

It is not very hard to get this type of card once you meet all of the straightforward requirements. Therefore, you will be able to get up and running with this type of card in no time.

Should you move to Chase Freedom Unlimited card?

This is a good fit for people who are looking for good cashback rates that do not change. It provides them with a level of predictability when making purchases.

What are the top reasons NOT to get it?

If you are looking for higher flat cashback rates. You may also travel a lot and not want to pay the 3% foreign exchange transaction charge that comes with this card.

In This Review..

Pros & Cons

Let’s take a look at the benefits and drawbacks of the Chase Freedom Unlimited card and see if it’s the right one for your wallet or not.

Pros | Cons |

|---|---|

Cash Back Rewards

| Balance Transfer Fee |

Sign Up Bonus | Lower Flat Cash-Back Rate |

0% APR Intro | Foreign Transaction Fee |

No Annual Fee | No Direct Transfer to Travel Partners |

Flexible Redemption Options | |

Complementary Benefits |

- Sign Up Bonus

You can get a Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening. bonus after signing up by spending . This bonus has a low threshold compared to other cards.

- 0% APR Intro

If you are looking to save money on interest, the Chase Freedom Unlimited card offers 15 months on purchases and balance transfers. Then, the APR will be 18.74%–28.24% variable .

- No Annual Fee

Many of the rewards cards that offer higher rewards than Chase Freedom Unlimited have annual fees which end up eating into the rewards. The Chase Freedom Unlimited card does not have an annual fee.

- Cash Back Rewards

The card offers 5% cash back on travel booked through Chase Ultimate Rewards, 3% on dining (including takeout and eligible delivery), 3% on drugstore purchases, and 1.5% on all other purchases. There is no specific purchase needed to earn the reward, it is on every purchase. You also do not have to wait to use that cash.

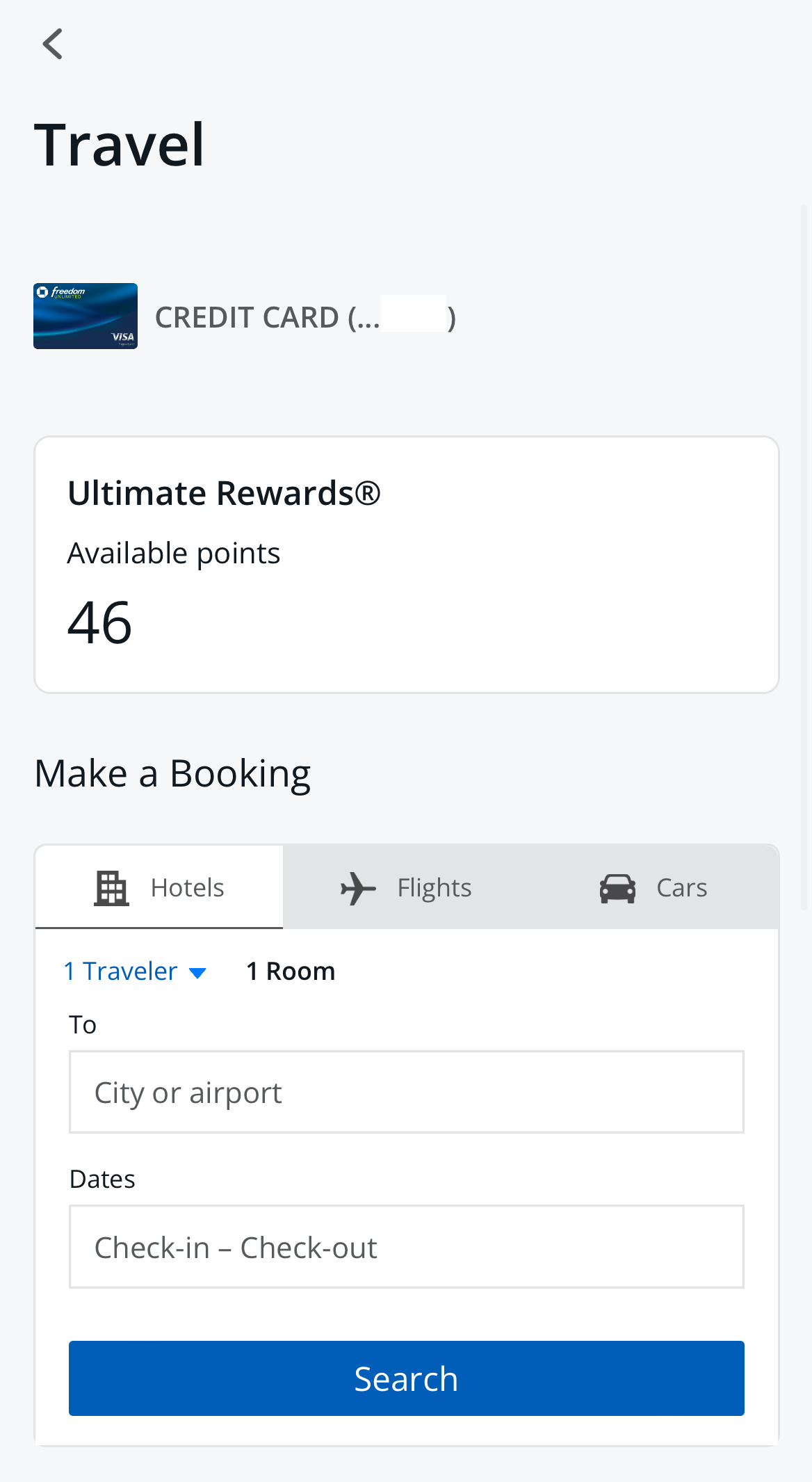

- Flexible Redemption Options

Cardholders can redeem cash back as a statement credit, direct deposit, for travel, gift cards, or even use it for charitable contributions, providing versatility in how they use their rewards.

- Complementary Benefits

Despite being a no-annual-fee card, the Freedom Unlimited comes with valuable perks, including rental car protection, trip cancellation/interruption insurance, roadside dispatch, extended warranty, and purchase protection.

Top Offers

Top Offers From Our Partners

- Balance Transfer Fee

There is a balance transfer fee required if you want to take advantage of the introductory 0% APR rate. The intro fee is $5 or 3% of the amount of each transfer, whichever is greater, on transfers made within 60 days of account opening

After that, the regular fee is $5 or 5% of the transfer, whichever is bigger. This fee is upfront and will be added to your debt load when transferred.

- No Direct Transfer to Travel Partners

The Freedom Unlimited card, on its own, doesn't allow direct transfers of rewards to travel partners. Users need to pair it with other Chase cards to unlock this feature. However, cardholders can use cash back rewards to redeem flights and hotels on Chase travel.

- Foreign Transaction Fee

Chase Freedom Unlimited has a 3% fee for each transaction in another country. If you are traveling outside of the US you may want to leave this card at home.

- Lower Flat Cash-Back Rate

The standard 1.5% flat cash-back rate on general purchases is relatively lower compared to some other flat-rate rewards cards in the market.

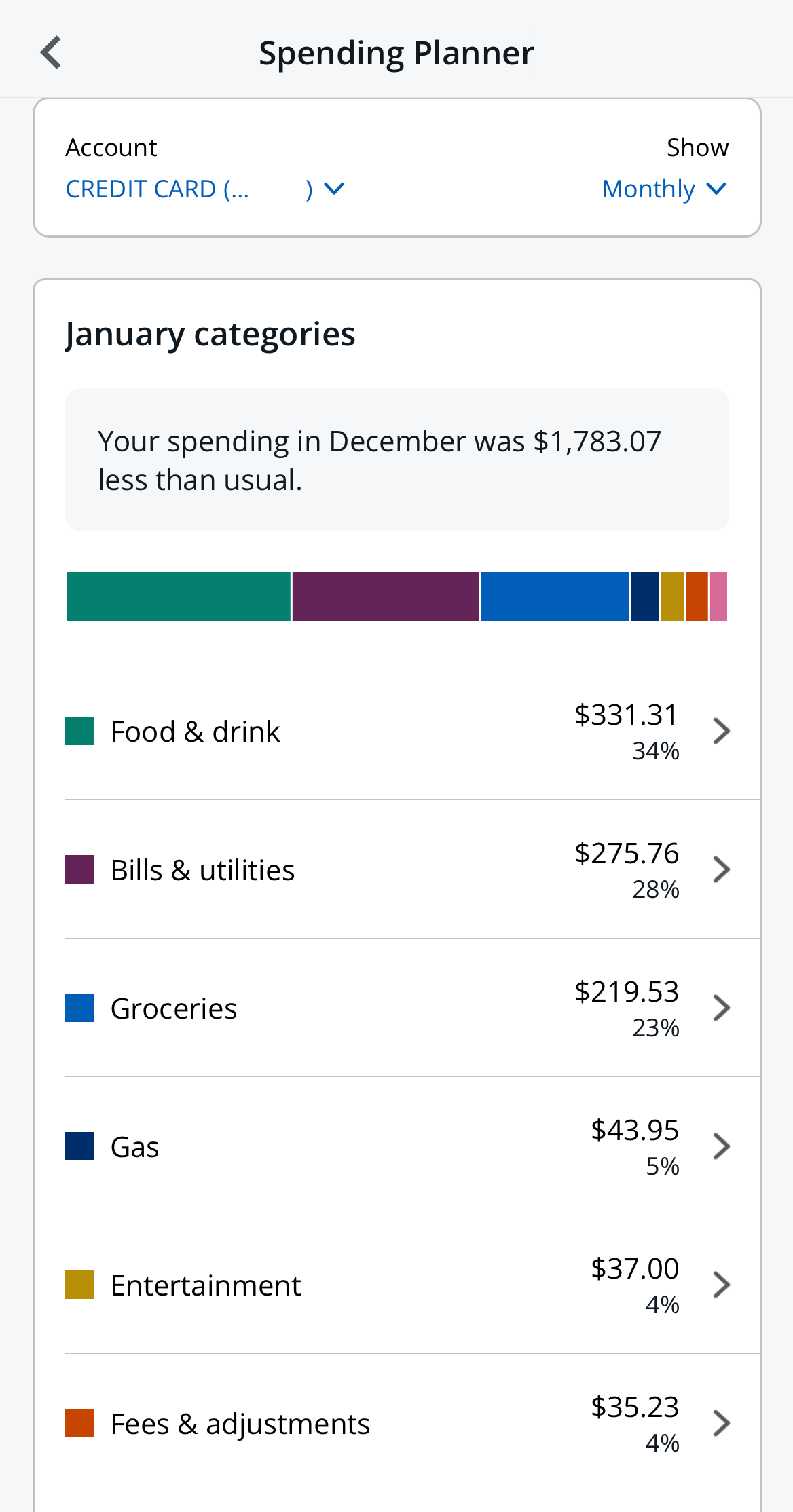

Rewards Simulation: How Much You Can Earn?

The best way to determine if the Freedom Unlimited® Card is right for you is to calculate the rewards and benefits you expect to earn.

Remember, this is just a general breakdown of expenses, so be sure to adjust it based on your personal spending habits and preferences.

| |

|---|---|

Spend Per Category | Chase Freedom Unlimited |

$15,000 – U.S Supermarkets | $225 |

$3,000 – Restaurants

| $90 |

$1,500 – Airline | $75 |

$1,500 – Hotels | $75 |

$4,000 – Gas | $60 |

Estimated Annual Value | $665 |

Where to Redeem Your Rewards?

With the Freedom Unlimited card, cardholders earn 5% cash back on travel booked through Chase Ultimate Rewards, 3% on dining (including takeout and eligible delivery), 3% on drugstore purchases, and 1.5% on all other purchases.

Chase offers several ways to redeem your rewards. These include:

- Statement credit or a direct deposit: There is no minimum to redeem your rewards as a statement credit and direct deposits are acceptable for most U.S checking and savings accounts.

- Travel rewards. You can use the Chase Ultimate Rewards platform to access competitive rates for travel products including hotel stays and flights.

- Gift cards: Chase has a variety of gift card options including for dining, entertainment and shopping.

- Amazon shopping: You can also use your rewards to pay for all or part of eligible Amazon.com orders when you link your card to your Amazon account.

Top Offers

Top Offers

Top Offers From Our Partners

Leverage Your Card Smartly

Here are some pointers to help you make the most of your Chase Freedom Unlimited:

- Spend on top tier rewards: Because the cashback rates remain constant, you can easily plan ahead of time with this credit card. As a result, you can plan your purchases and calculate how much cashback you will receive.

- Introduce Chase to your family and friends. You can earn $100 for each referral who obtains a Chase credit card that is part of the program.

- Try Chase Ultimate Rewards – Chase offers a couple of great travel benefits and redemption ratio through the Chase rewards portal – if you tend to travel, it can save you money.

How It Compared To Other No Annual Fee Cash Back Cards?

The Chase Freedom Unlimited card stands out among no annual fee cash-back cards, offering a compelling blend of features and rewards. While the card offers a competitive flat rate, some competitors may provide higher cash-back percentages in specific spending categories.

Alternative options to consider include the Chase Freedom Flex, which offers rotating 5% cash back categories, the Blue Cash Everyday Card from American Express with its strong rewards at U.S. supermarkets and gas stations, or the Citi Custom cash card that offer 5% cash back (with cap, not unlimited) on your top spending category .

There are also cards with flat rate cashback higher than the Unlimited card, such as the Citi Double Cash card or the Wells Fargo Active Cash. Each of these cards has its unique advantages, and the choice ultimately depends on individual spending habits and preferences.

Is the Chase Freedom Unlimited Right for You?

If you don't have time for calculations, you spend more than $1,500 monthly and you don't have specific places where you spend you money, the Chase Freedom Unlimited can be a great option for you.

It sets itself apart because it has, on average, a higher percentage of cash back, 1.5% on each purchase, as well as higher cash back for specific categories. It also has a good sign up bonus and an introductory rate of 0% APR.

Compare The Alternatives

There are other credit cards that do offer comparable cash back rewards – we’ve summarized the most popular cards which can use as an alternative to the Chase Freedom Unlimited card:

|

|

| |

|---|---|---|---|

Capital One Quicksilver Cash Rewards Credit Card | Blue Cash Preferred® Card from American Express | Chase Sapphire Preferred® Card | |

Annual Fee | $0

| $95 ($0 intro for the first year)

| $95

|

Rewards |

1.5% – 5%

5% percent cash back on hotels and rental cars booked through Capital One Travel and 1.5% cash back on all purchases everyday.

|

1-6%

6% cash back at U.S. supermarkets (up to $6,000 per year in purchases, then 1%) and selected U.S. streaming subscriptions, 3% cash back on transit

and U.S. gas stations, 1% cash back on other purchases

|

2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

|

Welcome bonus |

Earn $300 in welcome bonuses. Enjoy a $100 credit to use towards flights, stays and rental cars booked through Capital One Travel during your first cardholder year. Plus, earn a $200 cash bonus once you spend $500 on purchases within the first 3 months from account opening.

Earn $300 in welcome bonuses. Enjoy a $100 credit to use towards flights, stays and rental cars booked through Capital One Travel during your first cardholder year. Plus, earn a $200 cash bonus once you spend $500 on purchases within the first 3 months from account opening.

|

$250

$250 statement credit after you spend $3,000 in purchases on your new Card within the first 6 months

|

75,000 points

75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening

|

Foreign Transaction Fee | $0 | 2.70% | $0

|

Purchase APR | 18.99% – 28.99% (Variable)

| 19.99%-28.99% Variable

| 19.74%–27.99% variable

|

FAQ

There is no limit in place for the Chase Freedom Unlimited card, which allows you to use up your rewards over the course of time without having to worry about no longer being able to earn rewards.

Yes, when you rent the car and pay for all of its cost with this card and do not accept coverage from the rental company. Please review the terms and conditions before to make sure you're covered.

There are no specific income requirements in place when you are using this type of card and it does not usually ask for proof of income requirements from you.

You go to the Ultimate Rewards section that Chase offers and you can choose between the options as to how exactly you utilize the rewards.

Compare Chase Freedom Unlimited

While both cards offer great cash back rewards and considered among the best Chase cards, there are some major differences. Which is better?

Chase Freedom Flex vs Chase Freedom Unlimited: Which Card Is Best?

While both cards offer decent cash back rewards with no annual fee, there is a clear winner between the two. And here's why we think so.

American Express Everyday® Card vs Chase Freedom Unlimited®: Which Card Wins?

While both cards offer great cash back rewards and considered among the best Chase cards, there are some major differences. Which is better?

Chase Freedom Flex vs Chase Freedom Unlimited: Which Card Is Best?

The flat rate cash back on Citi Double Cash Card is higher – but usually, it may not be the best option. Here's The Smart Investor analysis.

Citi Double Cash Card vs Chase Freedom Unlimited: Which Card Wins?

The Chase Sapphire Preferred offers costs more and offer more benefits than the Freedom Unlimited. Is it worth the annual fee?

Chase Freedom Unlimited Vs. Sapphire Preferred: Compare Side By Side

The Freedom Unlimited beckons with its cash-back rewards, but the Amex Gold exudes luxury, boasting robust rewards on dining and groceries.

Chase Freedom Unlimited vs. Amex Gold Card: Which Card Wins?

The Amex Blue Cash Everyday is the winner if you need gas and grocery purchases, while the Freedom Unlimited offers better travel rewards

Amex Blue Cash Everyday vs. Chase Freedom Unlimited: Which Card Wins?

When it comes to cashback potential, the Chase Freedom Unlimited wins, especially for those who frequently engage in travel-related expenses.

Chase Freedom Unlimited vs. Citi Custom Cash Card: Which Card Wins?

The Savor card is ideal for dining out and entertainment, while the Freedom Unlimited is best for travelers and those who need 0% intro APR.

Capital One Savor vs. Chase Freedom Unlimited: Side By Side Comparison

The BofA Customized Cash Rewards is more flexible, but the Chase Unlimited card will drive more rewards and benefits. Here's why.

Bank of America Customized Cash Rewards vs Chase Freedom Unlimited: Which Card Wins?

The Active Cash card offers flat-rate cashback, while the Unlimited card is the winner for travel. Here's a side-by-side comparison

Wells Fargo Active Cash vs. Chase Freedom Unlimited: Which Card Wins?

The Apple Card offers competitive cashback rewards on Apple purchases and services – but if you travel frequently, the Unlimited card wins.

The Costco Card is a great for Costco shoppers, gas and grocery purchases, while the Freedom Unlimited stands out for its travel benefits.

Costco Anywhere Visa Card vs Chase Freedom Unlimited: Comparison

Review Cash Back Credit Cards

Chase Freedom Flex