Rewards Plan

Welcome Bonus

Our Rating

0% Intro

Annual Fee

APR

- Variety of Airline Partners

- Premium Perks

- Annual Fee

- Not For Everyday Spending

Rewards Plan

Welcome Bonus

Our Rating

PROS

- Variety of Airline Partners

- Premium Perks

CONS

- Annual Fee

- Not For Everyday Spending

APR

See Pay Over Time APR

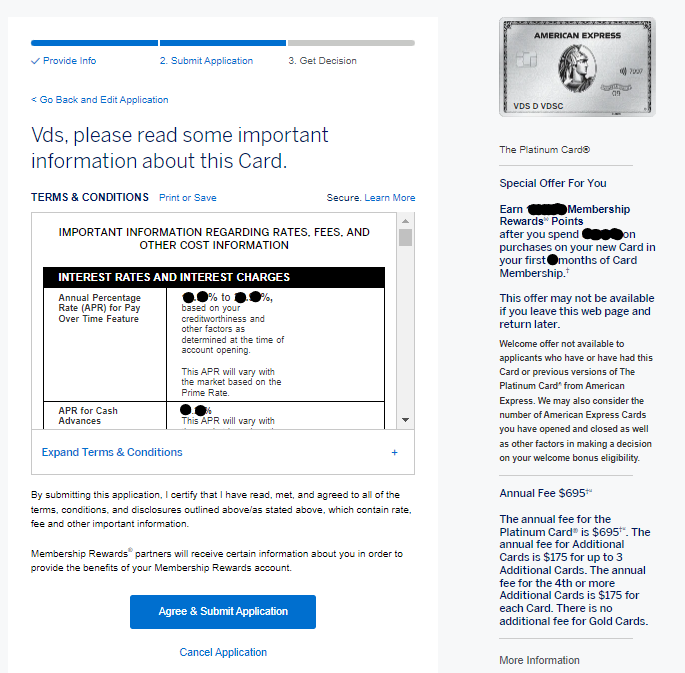

Annual Fee

$695

0% Intro APR

N/A

Credit Requirements

Excellent

- Our Verdict

- FAQ

The Platinum Card® from American Express is one of the best travel premium cards existing in the market, featuring high rewards for travelers but includes a high annual fee of $695 (See rates & fees).

This card stands out with a variety of valuable benefits and credits. You can enjoy over $1,500 in annual statement credits for different purchases, access to the American Express Global Lounge Collection, cell phone protection, and exclusive event access through programs like By Invitation Only. However, the card does come with a high annual fee, so it's important to take full advantage of its perks to make the cost worthwhile.

The Platinum Card's drawbacks include its high annual fee, limited rewards earning outside of travel spending, and the challenge of fully utilizing the numerous credits provided.

The card is suitable for frequent travelers who can take advantage of its airport lounge access, elite hotel status perks, and annual credits. It may not be ideal for occasional travelers or those focused on maximizing rewards on specific spending categories.

How to maximize rewards on Amex Platinum Card?

There is a points-based system. You can redeem the points for a variety of rewards that are showcased on the Amex website. These include statement credit, gift cards, paying for certain services etc.

What are the top reasons NOT to get the Amex Platinum Card?

If you do not travel a lot or you do not spend a lot of money when traveling. If you are looking for a card that covers a wide range of purchases at premium cashback rates.

Is there a limit to rewards?

There is a cap in place with the Amex Platinum card on getting the premium rate of cashback on certain types of purchases.

Can I get car rental insurance with Amex Platinum?

Yes, you will get car rental insurance with Amex Platinum automatically once you decline the car insurance from the rental company and you pay the full rental charge using this card.

Does card rewards points expire?

The Amex points do not have an expiration date as long as your account is live, so you no need to worry about it.

Can I get pre-approved?

Yes, you can get pre-approval for the Amex Platinum card. This is a very simple process and does not require a hard credit check.

What is the initial credit limit?

The minimum credit limit you will get with the Amex Platinum card will be $5,000. The exact limit that you get depends on the financial situation you are in.

How do I redeem points?

Amex has its own points-based system. You can redeem the points for a variety of rewards that are showcased on the Amex website. These include statement credit, gift cards, paying for certain services etc.

What purchases don't earn cash back?

Every type of purchase through this card will earn cashback points.

In this Review

Pros and Cons

Let’s take a look at the pros and cons of the Amex Platinum card:

Pros | Cons |

|---|---|

$200 Hotel Credit | Annual Fee |

Lounge Access | Some Credit Are Difficult to Redeem |

Marriott Bonvoy Gold Elite Status | Niche Credits Usage |

$240 Digital Entertainment Credit | Excellent Credit Needed |

$200 Airline Fee Credit | |

Global Entry or TSA Precheck | |

$100 Experience Credit | |

No Foreign Transaction Fees |

- $200 Hotel Credit

Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings.

This requires a minimum two-night stay, through American Express Travel when you pay with your Platinum Card®. Enrollment Required.

- Lounge Access

When you’re traveling, you also get access to all the American Express Global Lounges.

Also, Platinum Card members receive a complimentary Priority Pass Select membership, granting access to over 1,400 lounges worldwide (excluding Priority Pass restaurant lounges).

- Marriott Bonvoy Gold Elite Status

Cardholders can enroll in complimentary Marriott Bonvoy Gold Elite status, which comes with various hotel perks and benefits.

- $240 Digital Entertainment Credit

Up to $240 or $20 per month in Digital Entertainment statement credit when you pay for one or more The New York Times, Peacock, or SiriusXM with your card. Enrollment Required.

- $200 Airline Fee Credit

Up to $200 in Airline fee credit per year when you charge incidental travel fees from selected airlines on your card. Enrollment Required.

- Global Entry or TSA Precheck

For a 5-year plan, receive either a $100 statement credit for Global Entry or an up to $85 statement credit for TSA PreCheck® through any Authorized Enrollment Provider.

In addition, if you are approved for Global Entry, you will be granted free access to TSA PreCheck.

- $100 Experience Credit

Cardholders get a $100 experience credit to use during stay. However, there is a minimum of 2-night stay to redeem this benefit.

- No Foreign Transaction Fees

The Amex platinum card doesn't charge a foreign transaction fee.

- High Annual Fee

The platinum card annual fee is one of the highest in the market.

Despite the card offers some great perks for travelers, potential cardholders should make sure their use can cover the fee before applying.

- Some Credit Are Difficult to Redeem

Some of the credits can also be difficult to redeem including the airline fee credit. Many people describe the American Express rewards as complicated and confusing to redeem.

When you are ready to use the airline credit, you need to make sure you are giving yourself enough time to redeem it and to figure out how you can use it.

- Niche Credits Usage

Some of the annual credits, such as Equinox gym memberships or CLEAR membership, may have limited utility for users who don't live in areas with these services.

- Excellent Credit Needed

The American Express Platinum also requires good to excellent credit. If your credit score is below 660, you might not be eligible for the card.

American Express is pretty strict on who gets their cards, so the credit score is usually non-negotiable even if your debt-to-income ratio is low and the rest of your finances are in order.

Additional Benefits

The Amex Platinum card offers additional travel benefits, including:

- Dedicated Service Team: Access to a 24/7 customer service team for quick issue resolution.

- Uber Cash: Cardholders can receive up to $200 in Uber Cash (or $120 for Gold Card members) and become an Uber VIP for top-rated drivers without meeting minimum ride requirements.

- Preferred Seating: Enjoy preferred seating at sporting and cultural events (subject to availability).

- Extra Cards: Add additional cards to your account at no extra cost, allowing others to earn rewards on their purchases.

- Signature Perks at Upscale Hotels: Enjoy signature perks at upscale hotels part of the Amex Hotel Collection when booking through American Express Travel.

- Walmart+ Credit: Cardholders can receive up to $155 in Walmart+ credits by using their card to pay for their monthly Walmart+ membership.

- Equinox Membership Credit: Receive up to $300 in statement credit for eligible Equinox memberships when enrolling and paying with your card, subject to auto-renewal.

- CLEAR® Plus Membership Credit: Get up to $199 back per year when using your card to pay for a CLEAR® Plus membership.

Top Offers

Top Offers

Top Offers From Our Partners

Amex Platinum Travel Insurance & Protections

The Amex Platinum card offers various travel protections, including:

- Fraud Protection: You're protected from fraudulent charges, and if you spot any suspicious transactions, simply contact Amex.

- Baggage Insurance: When you use your card to purchase your fare, you'll have baggage insurance covering up to $500 for checked baggage and $1,250 for carry-on if they're lost, stolen, or damaged.

- Cell Phone Protection: Get reimbursed for cell phone repair or replacement (including cracked screens) up to $800 per claim, with a maximum of 2 approved claims per 12-month period, provided your cell phone line is on a wireless bill paid by your Eligible Card Account, subject to a $50 deductible.

- Return Protection: You can return eligible purchases to Amex if the seller won't accept them, within 90 days from the date of purchase, for a refund of up to $300 per item, with a maximum of $1,000 per calendar year per Card account, when purchased entirely with your eligible Amex Card.

- Purchase Protection: Covered Purchases made with your Eligible Card are protected for up to 90 days from the purchase date.

- Extended Warranty: For Covered Purchases, your Eligible Card extends the original manufacturer's warranty by up to one additional year, applicable to warranties of 5 years or less, up to $10,000 per item and $50,000 per calendar year.

- Car Rental Loss and Damage Insurance: When you use your Eligible Card to reserve and pay for the entire rental, and decline the rental company's CDW, you're covered for Damage to or Theft of a Rental Vehicle in a Covered Territory, with some exclusions and restrictions.

- Trip Delay Insurance: If your round-trip is paid for entirely with your Eligible Card and a covered reason delays your trip more than 6 hours, Trip Delay Insurance can reimburse certain additional expenses, up to $500 per trip, with a maximum of 2 claims per Eligible Card per 12 consecutive months.

- Trip Cancellation and Interruption Insurance: When you purchase a round-trip with your Eligible Card and a covered reason cancels or interrupts your trip, you can reimburse non-refundable expenses, up to $10,000 per trip and up to $20,000 per Eligible Card per 12 consecutive months, subject to terms and conditions.

How Much Rewards Do You Really Earn?

The best way to determine if the Amex Platinum Card is the right fit for you is to calculate the rewards and benefits you expect to earn.

Remember, this is a general breakdown, so be sure to tailor it to your personal spending habits and preferences.

Spend Per Category | The Platinum Card® |

$10,000 – U.S Supermarkets | 10,000 points |

$5,000 – Restaurants | 5,000 points |

$6,000 – Hotels | 30,000 points |

$6,000 – Airline

| 30,000 points |

$4,000 – Gas | 4,000 points |

Total Points | 79,000 points |

Estimated Redemption Value | 1 point ~ 0.6 – 1.6 cents |

Estimated Annual Value | $474 – $1,264 |

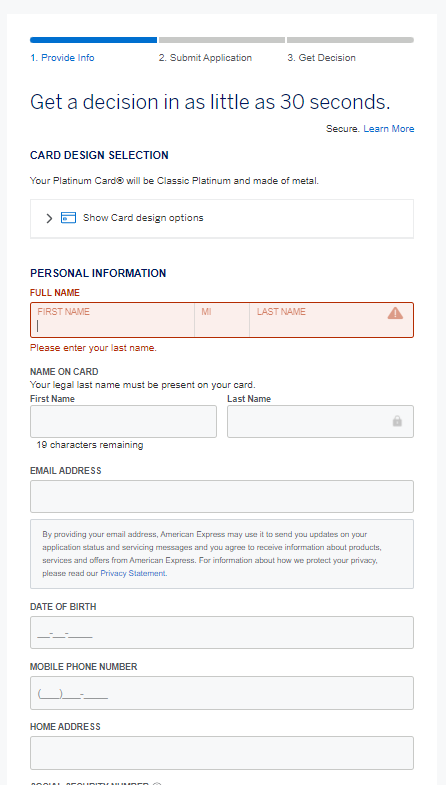

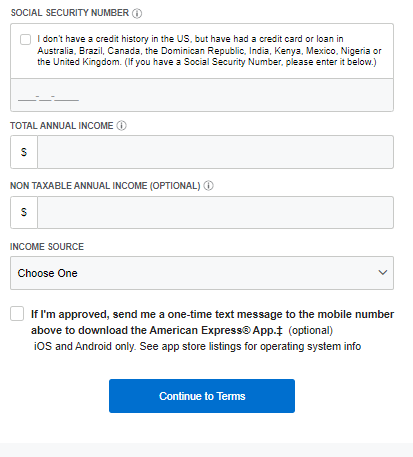

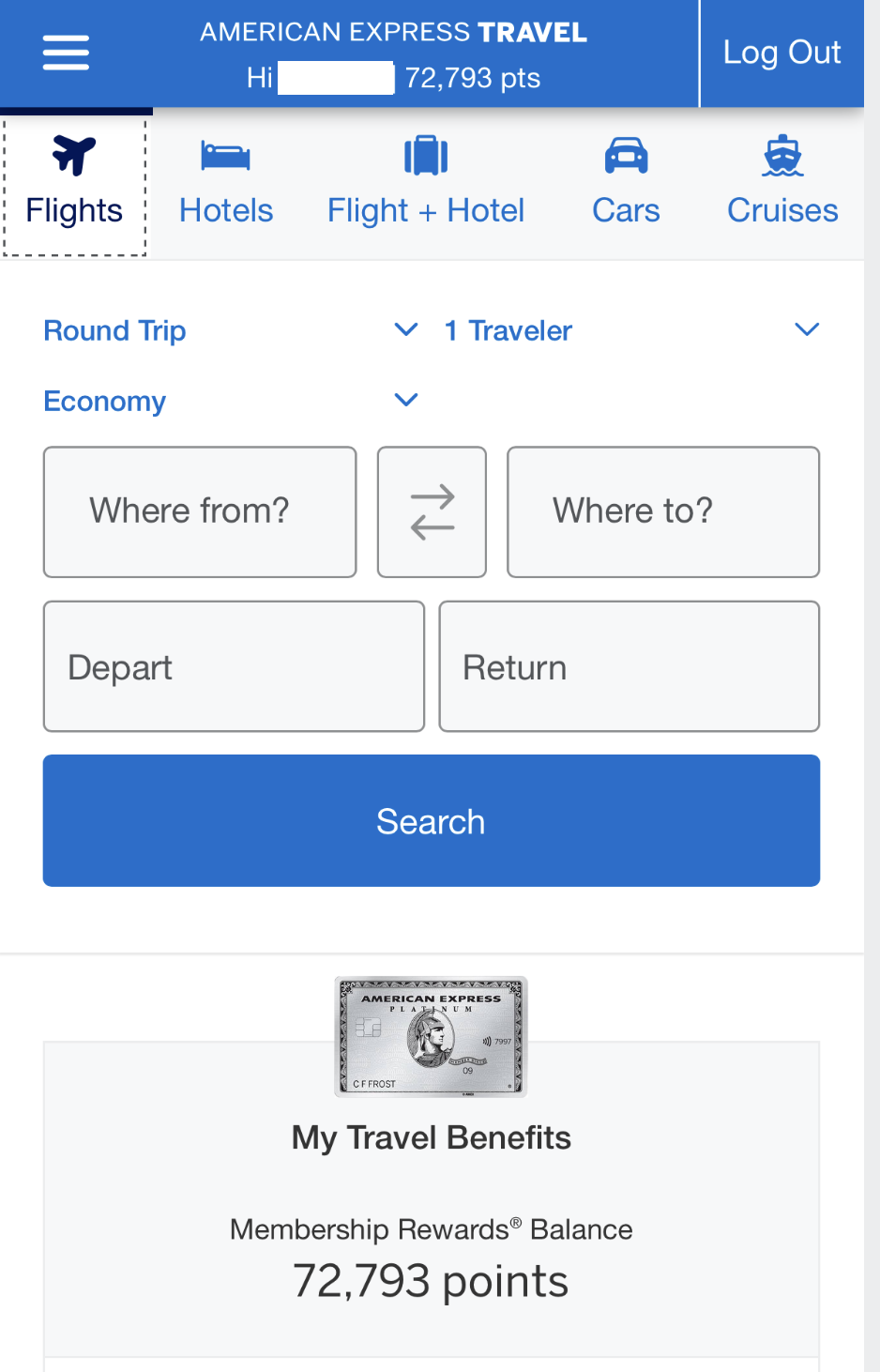

How To Apply For Amex Platinum Card?

Since the American Express Platinum requires stellar credit, you might want to check your credit score before you apply for this card. If it’s below 660 or 700, you might not want to apply right away as the credit card application will do a hard check of your credit and this can cause your score to drop even lower.

Step 1. If your credit score is high enough, then you can start the application on the American Express website. Make sure you enter in all the personal information that’s asked for including your full name, date of birth, address, and email. Make sure the name and date of birth you enter are the same on the ID you plan to use for the next step.

Step 2: You will also need to submit your social security number so that the company can run a check on your credit. Amex will also require you to share your total annual income, non taxable income and your income source.

Step 3: Lastly, you'll need to review the terms and conditions and submit your application. The, Amex will review your details and let you know whether you're approved or not.

Amex Platinum Redemption Options

The Platinum Card® from American Express offers various redemption options for its Membership Rewards® points, providing flexibility for cardholders to use their accumulated rewards in ways that suit their preferences.

Here are the key redemption options:

- Travel Redemptions: Cardholders can use their points to book flights, hotels, car rentals, and other travel-related expenses directly through the American Express Travel portal.

Points redeemed this way are typically worth 1 cent per point. Also, membership Rewards points can be transferred to a variety of airline and hotel loyalty programs, potentially providing higher value for specific redemption options.

- Pay with Points at Checkout: Cardholders can use their Membership Rewards points to pay for eligible purchases directly with select partners, such as Amazon, Best Buy, and PayPal. The value per point may vary but is generally around 0.7 cents.

- Gift Cards: Redemption for gift cards is an option, allowing cardholders to use their points for gift cards from a range of retailers, restaurants, and hotel brands.

The value of points when redeemed for gift cards typically falls within the range of 0.7 to 1 cent per point.

- Statement Credits: Cardholders can redeem points for statement credits, offsetting eligible charges on their card. However, this redemption option usually offers a lower value, typically around 0.6 cents per point.

- Shopping: Membership Rewards points can be used to shop for various products and merchandise through the American Express online shopping portal.

- Experiences: American Express may offer exclusive experiences and events that cardholders can access using their Membership Rewards points.

- Charitable Contributions: Cardholders can choose to donate their points to eligible charitable organizations through the American Express Giving program.

How to Maximize Rewards?

There are a couple of small tips that can help you to earn the most of the Platinum card:

- Leverage Credit Perks – The best way to maximize the American Express credit card is to make sure you are using all the credits that are offered to you.

For example, make sure you are using the Uber credit every month. The credits do not roll over from month to month, so make sure you are using the credit before the end of the month.

- Use your Gold Elite status at Hilton and Marriott. The elite status makes it easy to get free hotel perks like late checkout or upgraded rooms such as suites. You might also be able to get a free night if you book so many nights in a row.

- Use Global Entry or TSA PreCheck. You get free credit for one of these things when you have the card. Make sure to apply for one or the other and take advantage of it since American Express will reimburse you for the cost. This makes travel easier and much more convenient.

Top Offers

Top Offers From Our Partners

How It Compared To Other Luxury Travel Cards?

The Platinum Card® from American Express stands among the elite in the realm of luxury travel cards, but several competitors offer unique advantages catering to distinct customer profiles.

Its most popular competitor is the Chase Sapphire Reserve, which targets a broad luxury audience with a robust rewards structure.

It excels in versatility, offering 3X points on dining and travel, a $300 annual travel credit, and redemption flexibility.

This card caters to individuals who value diverse rewards and those who prioritize earning points on everyday spending.

The Capital One Venture X Rewards Credit Card comes with a focus on simplicity and flexibility.

Boasting a competitive rewards structure and travel statement credits, this card targets a broad audience of travelers who appreciate earning straightforward and versatile rewards without navigating complex redemption options.

With a lower annual fee of $395, the Venture X appeals to those seeking valuable benefits and rewards without the premium cost of some competitors.

The U.S. Bank Altitude Reserve card and the Bank of America Premium Rewards Elite are another worth mentioning premium travel cards.

Their annual fee is lower compared to the Reserve card, and hiwle they offer premium perks such as lounge access and annual credit – the benefits are less enticing compared to the other luxury travel cards.

In Which Cases It’s Better to Skip?

If you don’t think you can afford the steep annual fee, you might want to consider another card.

Even though you get many different perks and access to luxury travel with this card, the fee is only worth it if you can use the card often and if you can comfortably afford the annual fee. It might also be better to skip this card if you have a low credit score.

Compare The Alternatives

There are more cards with premium travel benefits worth mentioning as alternatives to the Amex platinum card:

The Platinum Card® from American Express | Chase Sapphire Reserve® | Capital One Venture X Rewards | |

Annual Fee | $695. See Rates & Fees | $550 | $395 |

Rewards |

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

| 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

Welcome bonus |

80,000 points

80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership

|

60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| 75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

|

Foreign Transaction Fee | $0. See Rates & Fees | $0 | $0

|

Purchase APR | See Pay Over Time APR | 21.99% – 28.99% variable APR | 19.99% – 29.74% (Variable) |

FAQ

The Amex platinum card is a good fit if you spend a lot of money on travel-related expenses and want to avail yourself of some great travel perks.

If you do not travel a lot or you do not spend a lot of money when traveling or if you are looking for a card that covers a wide range of purchases at premium cashback rates – it night not be the best card for your needs.

You might not have met one of the requirements. You can ask the customer support team if there is something you can do to change this eventuality. Otherwise, you can look for an alternative card.

You need to meet the credit score and income requirements, which are higher than a lot of other cards.

You need to have an income of at least $50,000 usually and might need to provide proof of income.

Compare American Express Platinum Card

If you're looking for everyday spending rewards, the Amex Gold Card offers more. But for travel rewards benefits, there is a clear winner.

When it comes to premium travel rewards, both may be the best cards in the market. But who is the winner between the two? Here's our analysis.

American Express Platinum vs Chase Sapphire Reserve: Which Luxury Card Is Best?

The Infinite Card is tailored for frequent United flyers, while the Amex Platinum offers a more lucrative, comprehensive rewards program.

While the Amex Platinum offers extensive travel perks and redemption options, the Marriott Brilliant Card has better hotel-specific perks.

While the Amex Platinum Card offers extensive travel perks and redemption options, the Delta Reserve Card has better airline-specific perks.

Amex Platinum Card vs. Delta SkyMiles Reserve: Which Luxury Card Is Best?

The Amex Platinum wins when it comes to redemption options and protections, but the Venture X is cheaper and offers great travel benefits.

Amex Platinum Card vs. Capital One Venture X: Which Luxury Card Is Best?

The Hilton Aspire is surprising with its higher estimated annual cashback value, but the Platinum card wins at premium travel perks.

Amex Platinum Card vs. Hilton Amex Aspire: Side By Side Comparison

If you need premium travel perks and versatility – the Amex Platinum wins. Need airline benefits and lower fees? Consider the Delta Platinum.

Amex Platinum Card vs. Delta SkyMiles Platinum: Which Luxury Card Is Best?

The AAdvantage Executive card offers higher cashback value, but when it comes to premium travel perks, the Amex Platinum is the winner.

Citi/AAdvantage Executive World Elite vs. Amex Platinum Card

The Amex Platinum card is a clear winner as it offers much higher annual cashback value, luxury travel perks, and various travel protections.

Amex Platinum Card vs. Emirates Skywards Premium World Elite Mastercard: How They Compare?

The Amex Platinum is our winner due to its higher annual cashback value, redemption options, and better luxury perks than the Altitude Reserve.

U.S. Bank Altitude Reserve Visa Infinite vs. Amex Platinum Card: How They Compare?

Top Offers

Top Offers

Top Offers From Our Partners

Review American Express Credit Cards

- Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.