If you enjoy staying in Marriott hotels and resorts, it stands to reason that you’ve considered the Marriott Bonvoy loyalty program. However, what you may not have considered is the best Marriott cards that can give your loyalty point balance a boost.

Fortunately, there are several cards to choose from that can help you determine which Marriott credit card is right for you.

Marriott Bonvoy Boundless® Credit Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Marriott Bonvoy Boundless® Credit Card is a compelling option for Marriott loyalists, offering valuable perks that can offset its $95 annual fee.

Cardholders receive a free night certificate every year upon renewal, valid for a one-night stay at properties requiring 35,000 points or less, often exceeding the card's annual fee.

Additionally, the card grants 15 Elite Night Credits annually, contributing to Silver Elite status and making it easier to reach Gold Elite status through stays or spending.

Lastly, it includes an automatic Silver Elite status, trip delay and lost luggage insurance, and no foreign transaction fees.

- APR: 19.74%–28.24% variable

- Annual fee: $95

- Balance Transfer Fee: $5 or 5%

- Foreign Transaction Fee: $0

- Rewards Plan: 6X points for every $1 spent at over 7,000 hotels participating in Marriott Bonvoy® with the Marriott Bonvoy Boundless® credit card. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. Earn 3X points for every $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining. Earn 2X points for every $1 you spend on all other purchases.

- Sign Up bonus: “Earn 125,000 Bonus Points + 1 Free Night Award after spending $3,000 on eligible purchases within 3 months of account opening.* Each Free Night Award valued up to 50,000 points. Certain hotels have resort fees.”

- 0% APR Introductory Rate period: None

- Free Night Certificate

- Automatic Silver Elite Status

- Travel Benefits

- Elite Night Credits

- Weaker Rewards for Non-Marriott Spending

- Limited Perks Compared to Premium Cards

- Annual Fee

Can the free night certificate be used at any Marriott property?

The certificate is valid for a one-night stay at properties requiring 35,000 points or less within the Marriott Bonvoy program.

How does the card contribute to elite status with Marriott Bonvoy?

The card grants automatic Silver Elite status and provides 15 Elite Night Credits annually, making it easier to achieve higher status levels.

Are there foreign transaction fees with this card?

No, the card has no foreign transaction fees, making it suitable for international travel.

Can points earned with the card be used for options other than hotel stays?

Yes, points can be redeemed for flights, car rentals, special experiences (Marriott Bonvoy Moments), and gift cards within the Marriott Bonvoy program.

Is there a pathway to Gold Elite status with the card?

Yes, cardholders can achieve Gold Elite status by spending $35,000 in a calendar year.

How does the card compare to other Marriott credit cards?

The Boundless card is an entry-level, mid-tier option, distinguishing itself with a lower annual fee and valuable perks.

Marriott Bonvoy Bold Credit Card

Reward details

3X Bonvoy points per $1 spent at over 7,000 hotels participating in Marriott Bonvoy. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. 2X Bonvoy points for every $1 spent on other travel purchases (from airfare to taxis and trains). 1X point for every $1 spent on all other purchases.

Current Offer

60,000 Bonus Points after spending $1,000 on eligible purchases within the first 3 months from account opening.

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Marriott Bonvoy Bold® Credit Card is a no-annual-fee card designed for Marriott enthusiasts seeking rewards without the financial commitment.

Cardholders earn 3X Bonvoy points per $1 spent at over 7,000 hotels participating in Marriott Bonvoy. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. 2X Bonvoy points for every $1 spent on other travel purchases (from airfare to taxis and trains). 1X point for every $1 spent on all other purchases..

While the card lacks major benefits, its advantages lie in the absence of an annual fee and the automatic complimentary Silver Elite status. The welcome bonus of 60,000 Bonus Points after spending $1,000 on eligible purchases within the first 3 months from account opening. , can be valuable for free night awards.

The card offers additional benefits uncommon for a no-annual-fee hotel card, including purchase protection, baggage delay insurance, lost luggage reimbursement, and trip delay reimbursement.

- APR: 19.74%–28.24% variable

- Annual fee: $0

- Balance Transfer Fee: $5 or 5%, whichever is greater.

- Foreign Transaction Fee: $0

- Rewards Plan: 3X Bonvoy points per $1 spent at over 7,000 hotels participating in Marriott Bonvoy. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. 2X Bonvoy points for every $1 spent on other travel purchases (from airfare to taxis and trains). 1X point for every $1 spent on all other purchases.

- Sign Up bonus: 60,000 Bonus Points after spending $1,000 on eligible purchases within the first 3 months from account opening.

- 0% APR Introductory Rate period: 15 months on purchases and balance transfers

- Silver Elite Status

- No Foreign Transaction Fee

- Elite Night Credits

- No Annual Fee

- Limited Rewards Categories

- No Major Hotel Perks

- Limited Earning Potential

What benefits does Silver Elite status offer?

Silver Elite status includes perks such as late checkout, an ultimate reservation guarantee, and a 10% bonus on points earned from paid Marriott stays.

What are the major drawbacks of Silver Elite status?

Silver Elite status lacks significant hotel perks such as free breakfast or complimentary upgrades.

What you can do with Marriott Bonvoy points?

Marriott Bonvoy points can be used for hotel stays, travel partners, and Marriott Bonvoy Moments event packages.

Can I transfer balances to the Marriott Bonvoy Bold® Credit Card?

Yes, but there is a fee of $5 or 5%, whichever is greater. of the transfer amount, whichever is greater.

Marriott Bonvoy Brilliant® American Express® Card

Marriott Bonvoy Brilliant® American Express® Card

Reward details

6 Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in the Marriott Bonvoy™ program, 3 points at Worldwide restaurants and on flights booked directly with airlines and 2 points on all other eligible purchases

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Special Perks

- Pros & Cons

- FAQ

The Amex Bonvoy Brilliant card emerges as an excellent choice for those deeply committed to the Marriott brand, offering 6 Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in the Marriott Bonvoy™ program, 3 points at Worldwide restaurants and on flights booked directly with airlines and 2 points on all other eligible purchases.

Despite its high annual fee ($650), this luxury card provides substantial travel perks and ample opportunities to earn Marriott rewards.

With a higher redemption cap compared to other Bonvoy cards, the Bonvoy Brilliant allows you to maximize the value of your annual free night award.

As an American Express card, it also grants access to exclusive Amex benefits, making it the ideal premium Marriott Bonvoy credit card for avid spenders, frequent travelers, and loyal Bonvoy enthusiasts.

- Every year following the month of your card renewal, you will receive 1 free night.

- At participating hotels, a Marriott Bonvoy Platinum Elite member will earn 50% additional points on qualified transactions.

- Get up to $300 in statement credits per calendar year (up to $25 per month) for qualified restaurant purchases each time your card is renewed.

- Regardless of the airline or flight class you are travelling, sign up for Priority Pass Select, which allows unrestricted access to more than 1,200 lounges in over 130 destinations.

- You can earn 25 Elite Night Credits toward the subsequent level of Marriott Bonvoy Elite membership each year. Per Marriott Bonvoy member account, restrictions apply.

- Protection for cell phones: You may be compensated for the costs of replacing or repairing a damaged or stolen cell phone.

- You can be covered for Damage to or Theft of a Rental Vehicle in a Covered Territory when you use your Eligible Card to book and pay for the Entire Rental and decline the collision damage waiver (CDW) at the Rental Company counter.

- When you pay the entire fare for a ticket for a common carrier vehicle (such as a plane, train, ship, or bus), you are covered for lost, damaged, or stolen baggage.

- Terms apply

- Annual Marriott Bonvoy Credit

- Gold Elite Status

- Global Entry/TSA PreCheck Credit

- No Foreign Transaction Fees

- Property Credit

- Free Night Award

- Airport Lounge Access

- Purchase and Travel Protections

- Annual Fee

- Limited Elite Status

- Specialized Rewards

Does the Marriott Bonvoy Brilliant Card offer a Global Entry or TSA PreCheck application fee credit?

Yes, the card provides a credit of up to $100 for either Global Entry or TSA PreCheck every four years.

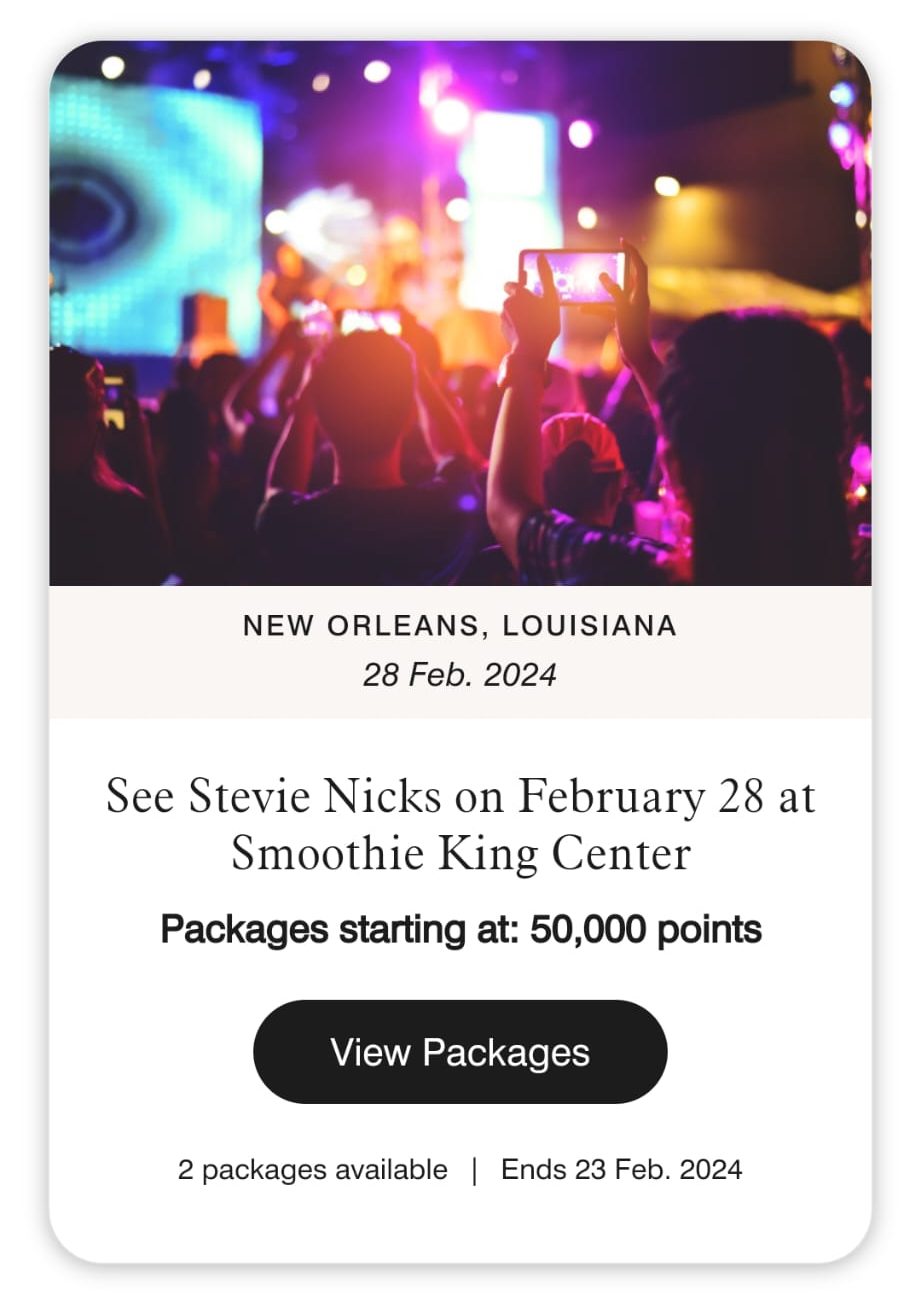

Can you use Marriott Bonvoy points for experiences through Marriott Bonvoy Moments?

Yes, cardholders can redeem points for unique culinary, arts, and entertainment experiences.

What is the value of Marriott Bonvoy points when redeemed for free stays?

Point values vary, but on average, Marriott Bonvoy points are estimated to be worth 0.8 cent each.

What are the alternatives to the Marriott Bonvoy Brilliant Card for hotel rewards?

Alternatives include the Hilton Honors American Express Aspire Card and The Platinum Card from American Express, each offering unique benefits.

What are the perks of Marriott Platinum Elite status offered by the Bonvoy Brilliant Card?

Platinum Elite status includes benefits like room upgrades, complimentary breakfast, and lounge access at Marriott properties.

Can you transfer Marriott Bonvoy points to airline partners with the Bonvoy Brilliant Card?

Yes, you can transfer points to more than 35 airline partners, but it's generally not the most value-efficient option.

Marriott Bonvoy Bevy® American Express® Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Marriott Bonvoy Bevy American Express Card is a mid-tier hotel credit card with lucrative perks for Marriott loyalists, but it may lack long-term value and flexibility.

The card offers 6X points on purchases at hotels participating in Marriott Bonvoy, 4X points at restaurants worldwide (including takeout and delivery in the U.S.) and U.S. supermarkets (up to $15,000 in combined purchases per year, then 2X points), 2X points on all other purchases.

One of its key attractions is the automatic complimentary Gold Elite Status in the Marriott Bonvoy program, providing cardholders with enhanced benefits such as bonus points, room upgrades, and exclusive member rates.

The card's co-branding with American Express opens up access to additional Amex perks, including Plan It® for convenient payment plans and exclusive offers through Amex Experiences.

However, the $250 annual fee might be steep for infrequent travelers, and the card misses some features common in other hotel cards, such as TSA PreCheck credits or lounge access.

- APR: 19.99%-28.99% Variable

- Annual fee: $250

- Balance Transfer Fee: N/A

- Foreign Transaction Fee: 0%

- Rewards Plan: 6X points on purchases at hotels participating in Marriott Bonvoy, 4X points at restaurants worldwide (including takeout and delivery in the U.S.) and U.S. supermarkets (up to $15,000 in combined purchases per year, then 2X points), 2X points on all other purchases

- Sign Up bonus: 85,000 Marriott Bonvoy® bonus points after you use your new Card to make $5,000 in purchases within the first 6 months of Card Membership.

- 0% APR Introductory Rate period: N/A

- Competitive Rewards Structure

- Complimentary Gold Elite Status

- Annual Free Night Award Upon Spending

- Redemption Options

- High Annual Fee

- Limited Benefits Compared to Higher-Tier Marriott Cards

- Lack of TSA PreCheck or Lounge Access

- Is there a limit to cashback rewards? There is no cap.

- Can I get car rental insurance with a Chase Freedom Unlimited card? Yes, when you rent the car and pay for all of it with this card and do not accept coverage from the rental company.

- Should You Move to Chase Freedom Unlimited card? This is a good fit for people who are looking for no annual fee card including good cashback rates that do not change.

- Why did Chase Freedom Unlimited card deny me? You might not have met one of the requirements for this card. You can talk with a member of the customer support team to see what the issue is and how you might be able to rectify it.

- How hard is it to get a Chase Freedom Unlimited card? It is not very hard to get this type of card once you meet all of the straightforward requirements.

- How to maximize rewards on the Chase Freedom Unlimited card?

- You can choose between the options as to how you utilize the rewards. To maximize rewards, you should make the most of the signup bonus and also be aware of which of your credit cards have the best cashback for a particular type of purchase.

- Top reasons NOT to get the Chase Freedom Unlimited card? If you are looking for higher flat cashback rates. You may also travel a lot and not want to pay the 3% foreign exchange transaction charge that comes with this card.

- Does Chase ask for proof of income? There is no specific income requirements and it does not usually ask for proof of income requirements.

- Does the card offer pre-approval? Yes, you can get pre-approval.

- What is the initial credit limit? The initial credit limit varies, but can often be between $1,000 and $5,000.

- How do I redeem cashback? Go to the Ultimate Rewards section that Chase offers and you can choose between the options as to how you utilize the rewards.

- What purchases don't earn cashback with the Freedom Unlimited card? All purchases earn cashback with this card.

Marriott Bonvoy Bountiful™ Credit Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

N/A

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Marriott Bonvoy Bountiful™ Credit Card is positioned as a mid-tier Marriott rewards card, providing users with a range of benefits and rewards. With a $250 annual fee, it offers Automatic Gold Elite status, a valuable Free Night Award, and the opportunity to earn 85,000 Points as a welcome offer.

The card's rewards rate includes 6X points for every $1 spent at hotels participating in Marriott Bonvoy, 4X points on the first $15,000 spent in combined purchases each year on grocery stores and dining, 2X points on other purchases.

Pros of the card include the Automatic Gold Elite status, a strong Free Night Award, and a competitive welcome bonus. However, drawbacks include the high annual fee, the requirement to spend $15,000 for the Free Night Award, and the card's limited perks compared to its annual fee.

- APR: 19.74%–28.24% variable

- Annual fee: $250

- Balance Transfer Fee: $5 or 5%, whichever is greater.

- Foreign Transaction Fee: $0

- Rewards Plan: 6X points for every $1 spent at hotels participating in Marriott Bonvoy, 4X points on the first $15,000 spent in combined purchases each year on grocery stores and dining, 2X points on other purchases.

- Sign Up bonus: 85,000 Bonus Points after you spend $4,000 in purchases in your first 3 months from your account opening

- 0% APR Introductory Rate period: N/A

- High Rewards Rates

- Automatic Gold Elite Status

- Free Night Award Upon Spending

- Exclusive Marriott Bonvoy Stay Points

- Limited Perks for Annual Fee

- Drawback for Occasional Travelers

- Average Rewards on Non-Marriott Purchases

- Limited Elite Status Benefits

Are there any blackout dates for redeeming points?

Generally, there are no blackout dates for redeeming points, providing flexibility in booking stays.

Can I share my Elite Night Credits with others?

No, Elite Night Credits earned through the Marriott Bonvoy Boundless Credit Card are not shareable and are tied to the primary cardholder's account.

Are there restrictions on using the Free Night Award?

The Free Night Award is limited to participating Marriott Bonvoy hotels with a redemption value of up to 50,000 points per night.

Do Marriott Bonvoy points expire?

Marriott Bonvoy points do not expire as long as there is account activity (earning or redeeming points) every 24 months.

What are Elite Night Credits, and how do they work?

Elite Night Credits are credits that count toward achieving higher elite status in the Marriott Bonvoy program, and the card provides 15 Elite Night Credits each calendar year.

What is Gold Elite status, and what benefits does it offer?

Gold Elite status provides perks like a 25% points bonus on hotel purchases, late checkout, room upgrades, and enhanced internet access at Marriott properties.

Table Of Content

Requirements for Marriott Credit Cards

As with all credit cards, there are some requirements that you’ll need to meet to qualify. These include:

- Credit Score: While these four cards have different characteristics, they all require a good to excellent credit score to qualify. This means you’ll need a FICO score of at least 690.

- The Number of Credit Cards: Both American Express and Chase have rules about the number of credit cards you can hold, which will influence your chances of approval. American Express only allows customers to hold a maximum of five Amex cards at any time. So, if you already have several, you may struggle to qualify. Chase has its 5/24 rule, which means that if you’ve opened five new credit card accounts, with any issuer in the last 24 months, you won’t be approved for a new Chase card.

- Your Income: Although your credit score factors in your income to debt ratio, the card issuers will also check your income to determine that you have sufficient income to support your new card.

Pros and Cons of Marriott Cards

As with any financial product, there are positives and potential negatives associated with Marriott cards. It is important to be aware of both before you make a decision about opening a new account.

Pros | Cons |

|---|---|

Elite Status | Good to Excellent Credit Required |

Brand Specific Perks | Hotel Specific Benefits |

Card Options |

Marriott Specific Rewards |

Great Welcome Bonuses |

- Elite Status

With all of these cards, you’ll automatically qualify for at least silver Elite status, which can be a bonus for those who struggle to qualify or have difficulty achieving the higher status levels.

With automatic status, you can concentrate on working on building your level or enjoying the perks associated with your new level.

- Brand Specific Perks

As you would expect with a co-branded credit card, there are some nice brand specific perks. Even something as simple as complimentary premium WiFi during your stay can enhance your Marriott experience.

- Card Options

With four co-branded card choices, there is a Marriott card to suit almost every type of traveler.

Whether you tend to travel infrequently and don’t want to worry about an annual fee or are a frequent traveler who enjoys a premium experience, there is a card for you.

- Great Welcome Bonuses

Each of the cards offers a welcome bonus if you meet the spend requirement, which adds even more perks to your new account.

- Good to Excellent Credit Required

Although the cards have different features and rewards, all the Marriott cards require good to excellent credit. So, if your credit score is less than 690, you’re unlikely to qualify.

- Hotel Specific Benefits

As you would expect with a co-branded card, with a few exceptions, the benefits and perks of these cards are quite hotel specific.

So, if you’re not completely brand loyal to Marriott, you may find the cards frustrating.

- Marriott Specific Rewards

Additionally, the rewards for these cards are tailored for the Marriott Bonvoy loyal customer.

While other redemption methods are possible, if you want the best value for your accumulated points, you’ll need to stick to Marriott Bonvoy purchases.

Top Offers

Top Offers

Top Offers From Our Partners

How to Choose a Marriott Credit Card

With a choice of cards, you may be struggling to decide which is the best pick for you. Fortunately, there are some factors to consider which can narrow down your choices.

-

The Annual Fee

All four cards have distinctly different annual fees from $0 to hundreds of dollars. So, you will need to think about what annual fee you’re comfortable paying.

Typically a higher annual fee means more benefits, but you’ll need to use the card enough to easily cover the annual fee.

-

Benefit Value

On paper, the benefits package of each card should more than offset the annual fee, but you need to think about the value of the benefits for you personally. Think about how much you will benefit from the card perks and whether they have value for you.

-

Spending Requirements

Whether you're aiming for the welcome bonus or looking at the card's benefits, there's usually a spending requirement to qualify.

It's important to be realistic about whether you can comfortably meet or exceed that minimum spend. There’s no benefit in choosing a card with a huge bonus, like the Marriott Bonvoy Brilliant, if you’ll have trouble hitting the spending target in the first three months.

How the Marriott Loyalty Program Works

As a member of the Marriott Bonvoy loyalty program, you can earn points with stays in Marriott Bonvoy locations, participating restaurants and of course your Marriott credit card. You’ll have several redemption options for your accumulated points including free nights at Marriott locations, Marriott Moments experiences, rental cars, gift cards and shopping.

Marriott Bonvoy has its own “Shop with Points” platform, which is a shopping portal with a variety of tech and fashion items. You will see a points price for each item, but there is no cash value, so you’ll need to check the retailer price to ensure you’re getting the best redemption deal.

The value of your Marriott Bonvoy points depends on your redemption method. The average value is 0.7 cents per point, but hotel stays offer the highest redemption rates. The award nights have dynamic pricing, so you can shop around for the best deal for your points.

Another important aspect of the loyalty program is Elite status. There are five tiers of Elite status with higher levels offering greater perks. This includes things like getting more reward points, room upgrades, and welcome gifts.

The Main Benefits of Marriott Cards

In addition to Marriott specific benefits and rewards, you can also access other benefits with your new Marriott card. These include:

- No Foreign Transaction Fees: Regardless of whether you opt for a Chase or Amex co-branded card, there are no foreign transaction fees. This means that you can use your card abroad without worrying about getting hit with the typical 3% fee.

- Baggage Insurance: The Chase cards offer baggage delay insurance offering up to $100 per day for five days if your baggage is delayed for more than six hours by your carrier. There is also lost or damaged baggage insurance. The Amex cards offer coverage if your baggage is lost, damaged or stolen.

- Trip Delay Coverage: Both Chase and Amex offer trip delay reimbursement if your travel is delayed by over 12 hours or requires an overnight stay. However, while Chase cards have a cap of $500 per ticket, Amex is capped at $300 or $500 depending on your card.

- Trip Cancellation/Interruption Insurance: This is offered with the Amex Marriott Bonvoy Brilliant for up to $10k per trip.

- Car Rental Coverage: Both Amex cards offer car rental coverage for loss of or damage to your rental car when you pay for the entire rental with your card.

- Reimbursement for Global Entry or TSA PreCheck: With the Marriott Bonvoy Brilliant, Amex will provide a statement credit if you pay for your Global Entry or TSA PreCheck using your card.

- Lounge Access: The Marriott Bonvoy Brilliant also provides a Priority Pass Select, which allows unlimited lounge visits for yourself and up to two guests at 1,200 plus airport lounges across the globe.

- Purchase Protections: Both Amex and Chase offer purchase protections with Marriott Bonvoy cards.

- Helpline/Concierge: The Chase cards offer access to Visa Concierge services, while Amex offers its Global Assist Helpline for cardholders.

Top Offers

Top Offers

Top Offers From Our Partners

Redemption Options For Marriot Cards

As we touched on earlier, there are several redemption options for your Marriott Bonvoy points. These include:

-

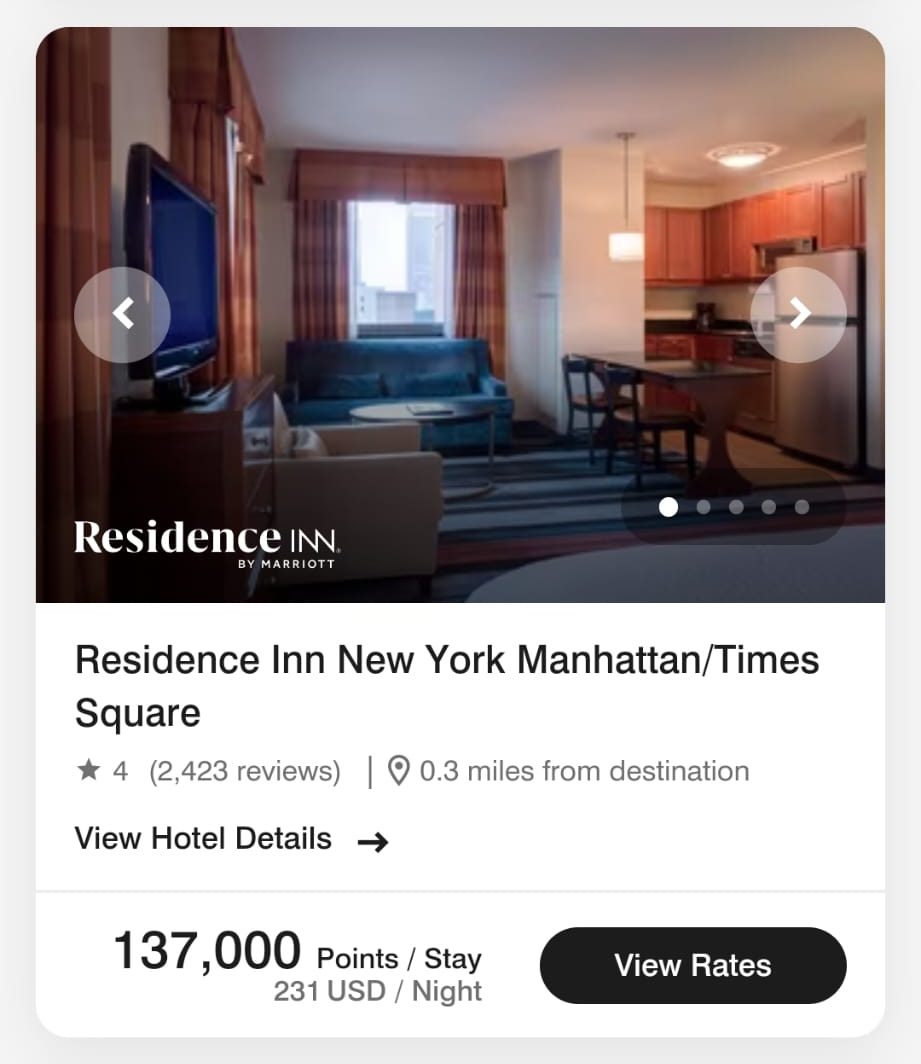

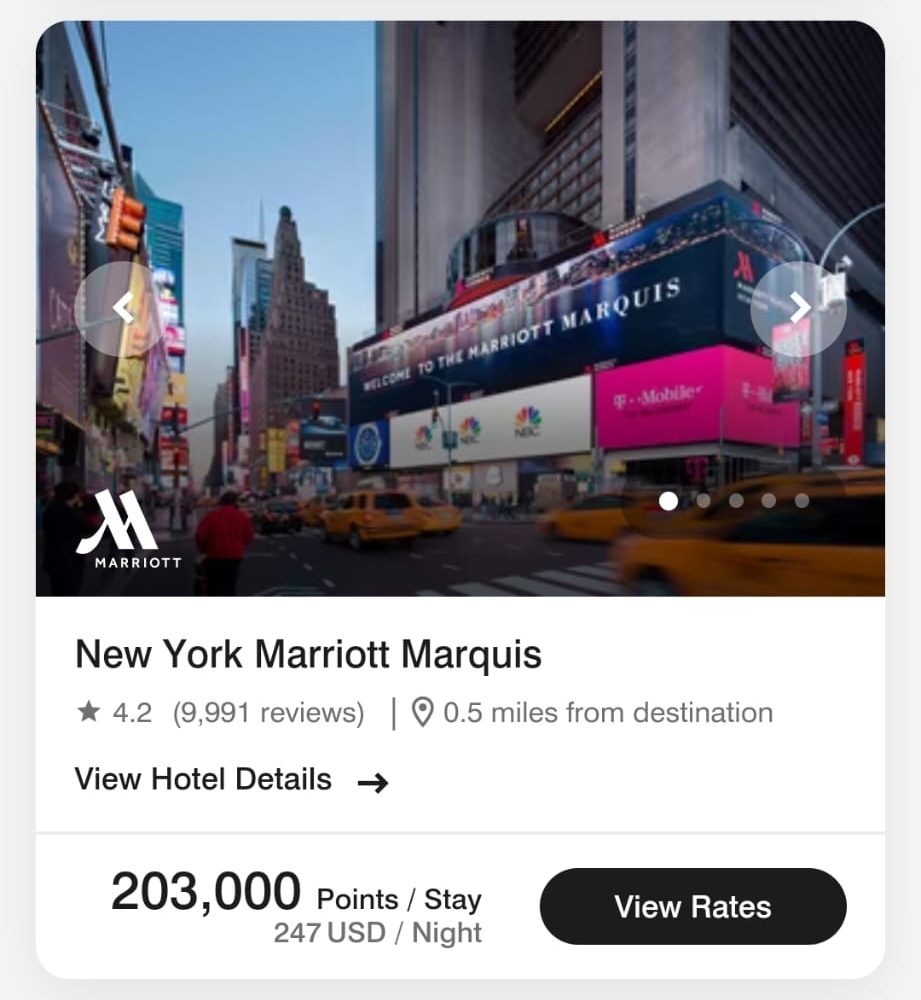

Hotels

As you would expect, the best value for your Marriott Bonvoy points is when you use them to book free nights at Marriott properties. You can search for award nights on the Marriott Bonvoy website according to your dates, destination and hotel preferences.

There is no set point conversion rate as the award cost depends on the specific location, dates and other factors. So if the cash price for a stay is higher, it is likely to cost you more points compared to a budget location. This does create the potential to search for the best deal, particularly if you’re flexible on your dates.

-

Travel Partners

Marriott Bonvoy has partnership agreements with approximately 40 airlines, so you can also exchange your points for miles towards your airfare. Depending on the specific airline program, you will need to transfer 3,000 plus points with a typical transfer rate of 3:1. So, for every three Marriott points, you’ll get one mile.

However, there are some exceptions. For example, with Air New Zealand, you’ll need 200 Marriott Points for every mile.

You’ll need to associate your Marriott Bonvoy account with the particular airline’s frequent flier program to make transfers, but with most loyalty plans there is a miles bonus if you’re transferring 60,000 Marriott points.

-

Other Redemption Options

There are also a few other ways to use your Marriott Bonvoy points including:

- Shopping: We’ve touched on this earlier, but you can browse the offers on the “Shops with Points” platform.

- Rental Cars: You can use the Marriott Bonvoy website to search for rental car deals with Hertz, Dollar and Thrifty.

- Hotel and Air Packages: The search feature also allows you to look for hotel and air packages with dozens of partner programs.

- Gift Cards: Finally, you can search the Marriott Bonvoy platform for your preferred gift card options. There is a fairly comprehensive choice of popular merchants including Best Buy, Macy’s Bloomingdales, Starbucks and Red Lobster. However this option does not offer the best redemption rates.

FAQs

Can you track the arrival of a Marriott Bonvoy credit card?

Depending on whether you’ve applied for a Chase or an Amex Marriott Bonvoy card, you’ll need to log into the appropriate website and “check on application status.” Alternatively, you can call the Chase or Amex helpline.

Do gift cards count as purchases with Marriott credit cards?

Gift cards and other cash equivalent products typically don’t attract rewards with either the Chase or Amex Marriott credit cards.

How can I upgrade my Marriott credit card?

If you have an Amex Marriott card, you can go to the “Offers and Benefits” section on your dashboard to see if there are any targeted upgrade offers. If you find one, just click “Request an Upgrade.”

To upgrade a Chase Marriott card, the best option is to call the Chase helpline. A representative will review your details and let you know if you qualify for an upgrade.

How do I earn elite nights through Marriott credit cards?

You’ll receive elite night credits automatically with your Marriott credit card, but some also provide additional Elite Nights if you meet the spending requirement. For example, the Marriott Bonvoy Boundless offers one additional Elite Night for every $5,000 you spend with your card.

How do I tie a Marriott credit card to reward accounts?

When you apply for your Marriott credit card, you’ll see a field for your Marriott Bonvoy number.

If you’re already enrolled in the rewards program, you simply need to enter the number on your application and the card issuer will tie them together for you.

New loyalty program members are automatically enrolled when their card application is approved.

What credit score is needed for a Chase Marriott card?

You’ll need a good to excellent credit score for any of the Chase Marriott credit cards. This means a FICO score of at least 690.

Who carries Marriott credit cards?

Marriott credit cards are co-branded with either Chase or American Express. The Marriott Bonvoy Bold and Boundless are Chase cards, while the Marriott Bonvoy Bevy and Brilliant cards are issued by American Express.

How We Picked The Best Marriot Credit Cards: Methodology

To identify the best Marriot credit cards, our team researched Marriot cards available in the market. We rated these cards based on four key categories tailored for consumers seeking Marriot rewards:

Marriot Rewards & Benefits (50%): We evaluate the rewards program specific to Marriot , including points earned per dollar spent on Marriot purchases, bonus categories for accelerated rewards at Marriot properties, and redemption options such as free nights, room upgrades, or vacation packages. Cards offering generous rewards rates, versatile redemption choices, and valuable benefits like elite status or annual free nights score higher in this category.

Card Features & Offers (50%): This category assesses additional features that enhance the overall value of the card for Marriot enthusiasts, such as annual fees, foreign transaction fees, free night certificates, anniversary bonuses, and travel benefits like travel insurance or airport lounge access. Cards offering a comprehensive range of benefits without excessive fees earn higher scores.