Table of Content

As there are so many different credit cards out on the market today, there can be a lot of choices that people need to make. This comparison will look at the similarities and differences between the Capital One Venture and Quicksilver cards.

Both of these options have some key differences. Some people might be better suited to one of these options over the other. By reading this comparison article, you can ask yourself the right questions and figure out what is optimal for your needs.

General Comparison

|  | |

|---|---|---|

Capital One Venture Rewards Credit Card | Capital One Quicksilver Cash Rewards Credit Card | |

Annual Fee | $95 | $0 |

Rewards | 2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel | 5% percent cash back on hotels and rental cars booked through Capital One Travel and 1.5% cash back on all purchases everyday. |

Welcome bonus | 75,000 miles once they spend $4,000 on purchases within 3 months from account opening | $200 cash bonus once you spend $500 on purchases within 3 months from account opening |

0% Intro APR | N/A | 15 months on balance transfers and purchases |

Foreign Transaction Fee | $0 | $0 |

Purchase APR | 19.99% – 29.74% (Variable) | 19.74% – 29.74% (Variable) |

Learn More | Learn More |

Compare Rewards: Which Card Gives More?

There are going to be different areas where credit cards stand out when it comes to cashback rewards.

Here is a look at an example of what you could expect when it comes to these two Capital One cards:

|  | |

|---|---|---|

Spend Per Category | Capital One Venture | Capital One Quicksilver |

$12,000 – U.S Supermarkets | 24,000 miles | $225

|

$5,000 – Restaurants | 10,000 miles | $75 |

$4,000 – Hotels | 20,000 miles | $60 |

$4,000 – Airline

| 8,000 miles | $60 |

$5,000 – Gas | 10,000 miles | $75

|

Points/Miles | 72,000 miles | |

Redemption Value | 1 point = 1 cent | |

Annual Value – First Year | $1,320 | $695 |

Annual Value | $720 | $495 |

The Capital One Venture card is best suited for travel-related purchases and you will get the best value when you spend the resulting miles on travel-related expenses rather than cashback.

On a pure cash basis, the Venture card will be preferred if you are looking for a card that covers a lot of bases when it comes to making purchases.

Compare Welcome Bonus And Fees

For new cardholders, you will get 75,000 miles once they spend $4,000 on purchases within 3 months from account opening. It's one of the best sign up bonus available for basic travel cards.

The Quicksilver card will give you a $200 cash bonus once you spend $500 on purchases within 3 months from account opening.

For the Quicksilver card, you will get 0% intro APR for 15 months on balance transfers and purchases. After that points, there will be APR of 19.74% – 29.74% (Variable). For balance transfers, there will be a 3% fee in place after initial 0% APR period. You will not have to pay any foreign transaction fees.

The Capital One Venture does not have an intro APR, so you will be looking at 19.99% – 29.74% (Variable) rates. There are also no foreign transaction fees associated with this option.

Compare The Perks

As well as the APR rates, fees, and bonus offers, there are some unique features associated with different cards, as well as similarities.

Here are the additional benefits you'll get on both cards:

24-Hour Travel Assistance: If you have any issues while traveling, you have access to 24/7 customer support. You can arrange for a cash advance and an emergency replacement card if needed.

- Redeem rewards via PayPal or Amazon.com

- Capital One Shopping tool to automatically apply coupon codes to your orders

- Complimentary Concierge Services in travel, entertainment, and dining 24/7, 365 days a year.

Extended Warranty: There will be an extended warranty provider on eligible purchases through your credit card.

Fraud Protection: You will not have any liability if your card is stolen and charges are made to your card.

Mobile App: The Capital One mobile app is very good as it gives you the chance to manage your account from anywhere and connect it to your Capital One bank account. This includes viewing account balances, paying bills, and looking at transactions.

- Automatic travel accident insurance when you purchase fares with the card.

The Venture card offers some unique features:

Capital One Lounge: You get access to Capital One Lounges at airports across the world.

Credits: You will get up to $100 in credit for TSA PreCheck or Global Entry with the Capital One Venture card.

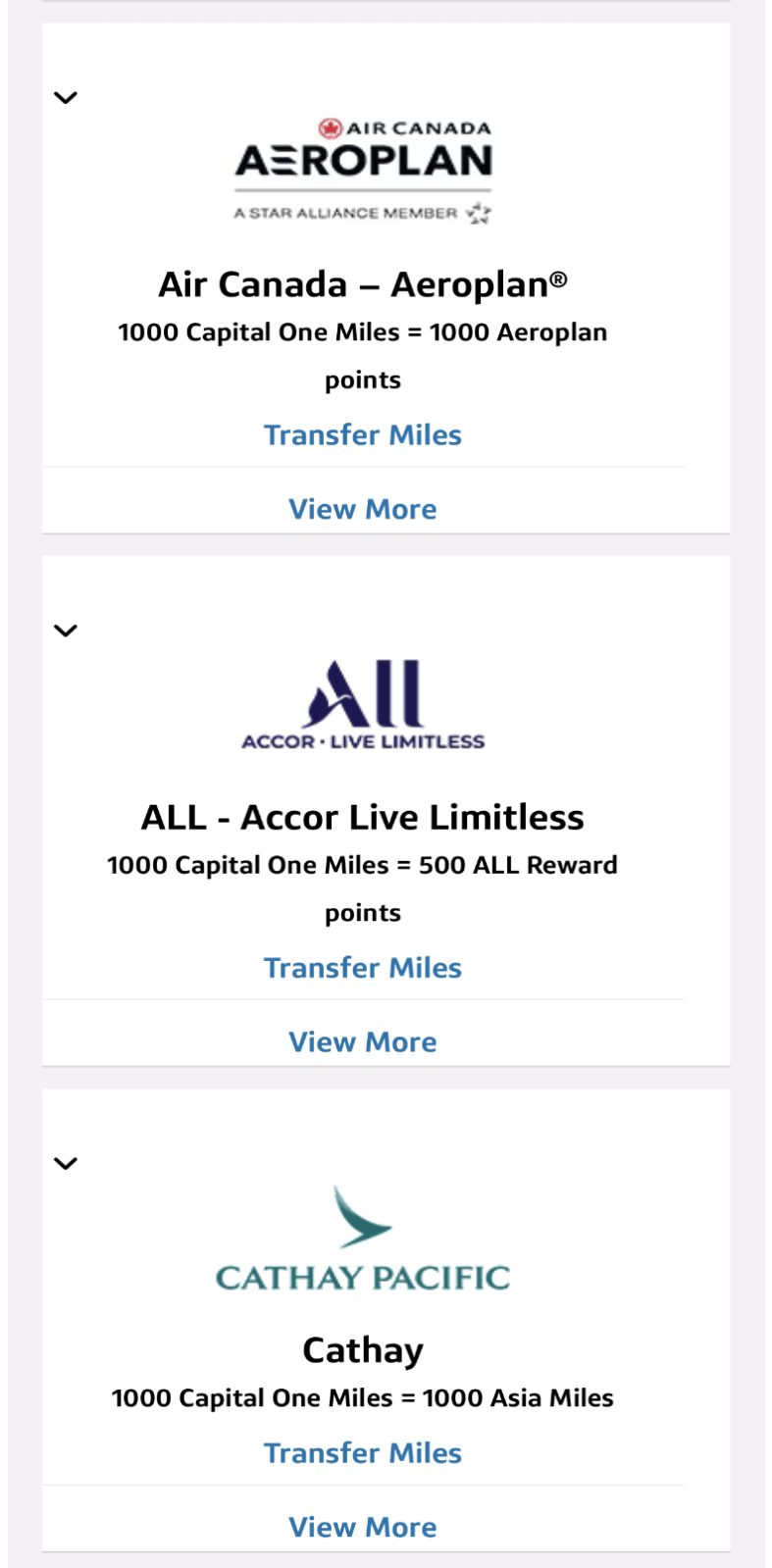

- Transfer Miles: You will be able to transfer your Capital One Venture miles to more than 15 different travel loyalty programs. Here's an example of some:

Compare The Drawbacks

Of course, no credit card is perfect, so it is important to be aware of the potential drawbacks before you make your final card decision.

Capital One Venture

- Annual Fee

You need to pay an annual fee of $95 with this card. If you're looking for a travel card, most cards require a fee. For example, the Chase Sapphire Preferred annual fee is quite similar ($95 ).

- Not the Best Rates

The cashback rates aren’t the best when compared to other cards.

Capital One Quicksilver

- Lack of Premium Rewards Rates

You will not get access to good bonus rewards rates.

Compare Redemption Options

With the Capital One Venture card, you can earn 5 miles per dollar on purchases made through Capital One Travel for things like hotels and car rentals. For all other purchases, you'll earn 2 miles per dollar. On the other hand, the Quicksilver card offers a straightforward 1.5% cash back on every purchase, with no earning limit.

For the Quicksilver cashback rewards, you are able to get a check, as statement credit, or redeem them with certain retailers. The Capital One Venture card miles can be redeemed for account credit, gift cards, cash, or travel expenses.

The value of these miles varies depending on what you are using them for. For example, one mile will equal $0.01 each when used for travel, $0.008 for gift cards, and $0.005 for cashback.

Top Offers

Top Offers

Top Offers From Our Partners

How to Maximize Cards Benefits?

If you want to make the best use of your Capital One Venture card, there are some tips to help you:

Use Miles for Travel: You will get the most bang for your accumulated miles if you use them for travel-related expenses, as each mile equals $0.01.

Use Card for Travel: This card gives you a boost to the cashback you can earn when making travel-related purchases.

If you want to make the best use of your Capital One Quicksilver card, there are some tips to help you:

Fill the Gaps: You might have a credit card that has premium rates for certain purchases, but not for others. This card can fill any gaps as it has a decent low-level cashback rate on all purchases.

Maximize the rewards: You can redeem the cashback for the likes of cash, a statement credit, and gift cards. Some of these will give you a better bang for your buck than others.

Customer Reviews: Which Card Wins?

The Capital One website provides you with access to thousands of customer reviews for each of these card types, which is very useful for people trying to get an insight as to what they might expect by signing up for one of these cards.

The Capital One Venture card has a 4.7/5 rating and people usually hail the great travel-related perks, as well as the rewards being easy to use. Many of the negative reviews complain the lack travel rewards compared to other travel rewards cards.

The Quicksilver card has a 4.6/5 rating. Positive reviews talk about the useful reward system, as well as it being a good fit for day-to-day purchases. In terms of negative reviews, there are once again mainly concerns about the interest rates on offer.

When You Might Want the Venture Card?

The Capital one Venture Card is a flexible option that could be good if you:

Travel a Lot: If you travel a lot, then you can take advantage of the perks associated with the Capital One Venture, as well as get some good rewards.

Good Bonus: You have a good bonus offer to take advantage of after signing up for an account.

Plenty of Redemption Options: There are many different ways in which you can redeem your rewards from using the Capital One Venture card.

Top Offers

Top Offers From Our Partners

When the Quicksilver Card Wins?

The Capital One Quicksilver also has some great benefits. It could be a good fit for you if you:

Need Predictability: With this card, you will be getting the same cashback rate for every purchase, so you do not need to keep checking to see if a certain type of purchase falls into a certain category.

Good Returns: the rewards program offered through this card provides you with a decent return.

Compare The Alternatives

Each of these cards offers its own unique advantages. The Capital One Venture card is a great choice for travelers, thanks to its generous bonus rewards tailored for travel expenses.

On the other hand, the Quicksilver Card provides a more versatile and consistent option, ideal for those who value predictability and straightforward rewards on everyday purchases.

Before applying, it’s also worth exploring some alternative options to see which card best fits your needs.

Wells Fargo Active Cash℠ Card | Chase Freedom Unlimited® | Bank of America® Customized Cash Rewards credit card | |

Annual Fee | $0

| $0

| $0

|

Rewards |

2%

2% cash rewards on purchases (unlimited)

|

1.5% – 5%

5% cash back on travel booked through Chase Ultimate Rewards, 3% on dining (including takeout and eligible delivery), 3% on drugstore purchases, and 1.5% on all other purchases

|

1% – 5%

3% cash back in the category of your choice: gas, online shopping, dining, travel, drug stores, or home improvement/furnishings, 2% cash back at grocery stores and wholesale clubs and 1% cash back on all other purchases. The 3% and 2% cash back available on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter (then 1%)

|

Welcome bonus |

$200

$200 cash rewards bonus when you spend $500 in purchases in the first 3 months

|

$250

Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.

|

$200

$200 cash rewards bonus after making at least $1,000 in purchases in the first 90 days of your account opening

|

Foreign Transaction Fee | 3%

| 3%

| 3%

|

Purchase APR | 19.49% – 29.49% Variable APR

| 19.99 – 28.74% variable

| 18.24% – 28.24% Variable APR on purchases and balance transfers

|

FAQ

Usually, the minimum credit limit is set at $4,000 for the Capital One Venture card. This is significantly higher than a lot of the other credit cards that you will come across.

Yes, you can get pre-approval for a Capital One Venture card. This allows you to not have to subject yourself initially to a hard credit check.

There is no limit in place as to how many rewards you are able to earn when you are making purchases through the use of the Capital One Quicksilver Card.

All purchases are covered when you are using the Capital One Quicksilver Card to pay for them. Therefore, you will not find any excluded categories

Compare Capital One Venture Card

While the Chase Sapphire Preferred Card has more benefits, the Capital One Venture card offers unique features. Which travel card is better?

Capital One Venture vs Chase Sapphire Preferred: Which Card Is Best?

While Amex Gold Card offers statements credits and everyday spending benefits, the Venture card is cheaper and include decent travel perks.

The Venture card offers better travel perks and rewards ratio than the VentureOne, but lacks 0% intro APR. Here's our side-by-side comparison

The Capital One Venture is designed for avid travelers, while the Savor card caters to foodies and entertainment lovers. How do they compare?

The Capital One Venture offers a better points rewards ratio and travel benefits than the BofA Travel rewards. Is it worth the annual fee?

BofA Travel Rewards vs. Capital One Venture Card: How They Compare?

The Capital One Venture is a clear winner as it offers a better miles rewards ratio and extra travel benefits. But it charges an annual fee.

Discover it Miles vs. Capital One Venture Card: How They Compare?

The Capital One Venture is a clear winner as it offers higher annual cashback value and better travel perks than the Alaska Visa Signature

Alaska Visa Signature vs Capital One Venture: Side By Side Comparison

Top Offers

Top Offers

Top Offers From Our Partners

Compare Capital One Quicksilver Card

If you're looking for travel rewards, it's an easy decision. But what about if you're looking to get rewards on everyday spending?

Capital One Venture vs Capital One Quicksilver: Which Card Wins?

If you like Discover rotating categories, it's an easy choice. If not – our analysis will help you understand which card is better for you.

Capital One Quicksilver vs Discover it Cash Back: Which Card Is Best?

The Savor card is ideal for dining out and entertainment while the Quicksilver is a simple card with a flat rate cashback. How They Compare?

While the Quicksilver card offers unlimited flat-rate cashback rewards, the Active Cash card offers a higher cashback ratio. Let's compare.

Capital One Quicksilver vs. Wells Fargo Active Cash: Which Card Wins?

Review Cash Back Credit Cards

Chase Freedom Flex