The Citi Custom Cash Card and the American Express Blue Cash Everyday® Card are two of the most popular basic cash back credit cards on the market.

Both cards offer competitive rewards rates and introductory APR offers, but they have some key differences that may make one a better fit for you than the other.

General Comparison: Custom Cash vs. Blue Cash Everyday

The Citi Custom Cash Card, issued by Citibank, offers a unique rewards structure that adjusts to your spending habits. It automatically selects the category where you spend the most, ensuring you earn the highest cashback in that area. The card makes earning rewards simple and straightforward.

In contrast, the Amex Blue Cash Everyday Card from American Express is great for everyday purchases like groceries and gas. It provides solid cashback rates and is a reliable option for families or anyone focused on earning rewards for essential expenses.

|  | |

|---|---|---|

Amex Blue Cash Everyday | Citi Custom Cash Card | |

Annual Fee | $0 | |

Rewards | 3% Cash Back at U.S. supermarkets / U.S. online retail purchases/ U.S. gas stations on up to $6,000 per year in purchases, then 1%.Terms Apply. | 5% cash back on your highest eligible spend category each billing cycle up to the first $500 spent and 1% cash back thereafter. |

Welcome bonus | $200 statement credit after you spend $2,000 in purchases on your new Card within the first 6 months.

| $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening (20,000 ThankYou® Points, which can be redeemed for $200 cash back). |

0% Intro APR | 15 months on purchases and balance transfers from the date of account opening, then 17.99% – 27.99% (Variable)

APR | 15 months on purchases and balance transfers, then 17.99% – 27.99% (Variable)

APR |

Foreign Transaction Fee | 2.7%. See Rates & Fees. | 3% |

Purchase APR | 19.99%-28.99% Variable

| 17.99% – 27.99% (Variable)

|

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Credit Card Cashback Battle: A Side-by-Side Analysis

Overall, most consumers can expect to earn a similar amount of cashback with both cards. The Citi Custom Cash is especially handy for those who spend more in specific categories.

However, if you spend over $4,000 annually on gas, the Blue Cash Preferred might be a better fit, depending on your overall spending habits.

|  | |

|---|---|---|

Spend Per Category | Amex Blue Cash Everyday | Citi Custom Cash Card |

$15,000 – U.S Supermarkets | $270 | $390 |

$5,000 – Restaurants

| $50 | $50 |

$4,000 – Airline | $40 | $40 |

$3,000 – Hotels | $30 | $30 |

$4,000 – Gas | $120 | $40 |

Estimated Annual Value | $510 | $550 |

Which Extra Benefits You'll Get With Each Card?

Both of these cards come with some added benefits that you may find useful. The Blue Cash Everyday offers credit statements, which could be a deciding factor if they align with your specific requirements.

Amex Blue Cash Everyday

- Additional Car Rental Insurance: When you use your Blue Cash Preferred card to reserve and pay for your car rental, you’ll receive additional car rental loss, damage, and theft insurance.

- Purchase Return Protection: You can enjoy return protection on eligible items with up to $300 per item and a cap of $1,000 per year. You must make your purchases with your card and negotiate with the seller first.

- $84 Disney Bundle Credit: Earn an $84 Disney Bundle Credit by receiving a monthly $7 statement credit when you use your enrolled Blue Cash Preferred® Card to make monthly subscription payments of $9.99 or more.

- Amex Plan It: Plan It® is a payment feature that allows you to break down purchases of $100 or more into monthly installments with a predetermined fee.

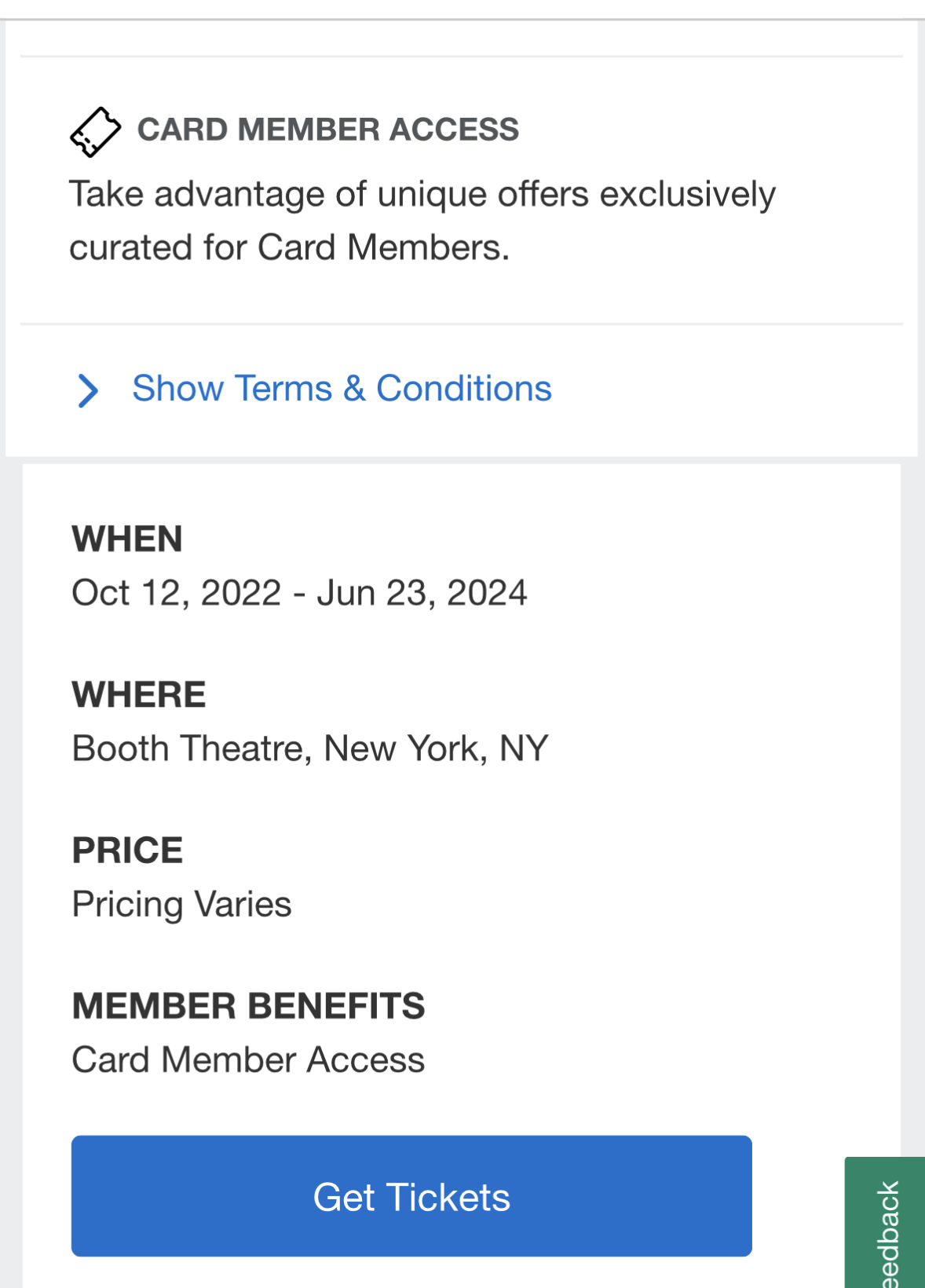

- Exclusive Ticket Presale Access: Via American Express Experiences, you can obtain exclusive access to card member only events and ticket presales for concerts, sporting events, shows, and family events. Terms Apply.

- $180 Home Chef Credit: Receive a $180 Home Chef credit when you select the ideal Home Chef meal kit. You'll enjoy up to $15 in statement credits monthly when you use your enrolled Blue Cash Everyday® Card to subscribe to Home Chef.

Citi Custom Cash Card

$0 Liability for Unauthorized Charges: Rest assured with comprehensive protection against unauthorized charges on your Citi account. You won't be held accountable for any charges you didn't authorize, whether they occur online or otherwise.

Complimentary Access to your FICO® Score: Effortlessly monitor your FICO® Score without impacting your credit score. Your score is updated monthly and easily accessible through the Citi Mobile® App and Citi® Online, allowing you to examine the key factors influencing your credit score and more.

24/7 Customer Service: Enjoy around-the-clock support from our customer service representatives, available 24 hours a day, 7 days a week, to promptly address your inquiries and concerns.

When You Might Prefer the Blue Cash Everyday?

You might lean towards choosing the Blue Cash Everyday Card over the Citi Custom Cash Card in several scenarios:

- Grocery Shopping And Gas Expenses: The Blue Cash Everyday Card offers generous cashback rewards on groceries and gas , making it an excellent choice for those who frequently shop for food, gas and household essentials.

- Better Extra Benefits: You want a card that offers other benefits, such as purchase protection and extended warranty protection. The Blue Cash Everyday Card offers a number of other benefits, such as purchase protection, extended warranty protection, and return protection. The Citi Custom Cash Card does not offer these benefits.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Prefer The Citi Custom Cash Card?

Opting for the Citi Custom Cash Card over the Blue Cash Everyday Card could be the right choice in the following situations:

- Changing Spending Habits: If your spending patterns vary across different categories, the Citi Custom Cash Card's dynamic cashback categories can adapt to your evolving needs, ensuring you earn the most rewards where you currently spend the most.

- You Have Fair Or Good Credit. The Citi Custom Cash Card is available to people with fair or good credit (FICO scores of 630 or higher). The Blue Cash Everyday Card is available to people with good or excellent credit (FICO scores of 680 or higher).

Compare The Alternatives

Before submitting your application, you might want to explore a few other options:

|

|

| |

|---|---|---|---|

Chase Freedom Flex℠ Card | Capital One Venture Rewards Credit Card | American Express EveryDay® Card | |

Annual Fee | $0

| $95

| $0

|

Rewards |

1-5%

|

2X – 5X

2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel

|

1X – 2X

2X points at U.S. supermarkets (up to $6,000 per year, then 1X), 2X points on prepaid rental cars booked through American Express Travel and 1X points on all other purchases

|

Welcome bonus |

$200

|

75,000 miles

75,000 miles once they spend $4,000 on purchases within 3 months from account opening

|

10,000 points

10,000 points after spending $2,000 on purchases within the first three months

|

Foreign Transaction Fee | 3%

| $0

| 2.7%

|

Purchase APR | 18.74% – 28.24% variable

| 19.99% – 28.99% (Variable)

| 17.74% – 28.74% Variable

|

Compare American Express Blue Cash Everyday

If you can maximize supermarket benefits, the Amex Blue Cash Preferred may be more suitable than the Everyday card despite the annual fee.

American Express Blue Cash Everyday vs. Preferred: Side By Side Comparison

The Amex Blue Cash Everyday is the winner if you need gas and grocery purchases, while the Freedom Unlimited offers better travel rewards.

Compare Citi Custom Cash Card

If you're a high spender, the Citi Double Cash Card can give you more. But what if you're just looking for everyday rewards?

Citi® Double Cash Card vs Citi Custom Cash℠ Card : Which Card Wins?

The Citi Custom cash offers high cashback on your preferred category, but it's very limited in rewards compared to the Blue Cash Preferred

Amex Blue Cash Preferred vs. Citi Custom Cash Card: Which Card Is Best?

When it comes to cashback potential, the Chase Freedom Unlimited wins, especially for those who frequently engage in travel-related expenses

Chase Freedom Unlimited vs. Citi Custom Cash Card: Which Card Is Best?

Both cards provide comparable cashback terms, with Citi Custom Cash being more flexible as it autonomously selects your preferred category.

Citi Custom Cash Card and the BofA Customized Cash Rewards have similar reward structures but some significant differences. How they compare?

Citi Custom Cash Card vs. BofA Customized Cash Rewards: Which Card Is Best?