In this comparison, we will delve into the key features, benefits, and considerations of both the United Explorer Card and the United Infinite Card, helping you make an informed decision on which card suits your financial goals and travel aspirations best.

United Explorer vs Infinite: General Comparison

Naturally, the Infinite card offers a much better rewards ratio and unique travel benefits, but its annual fee is higher.

If you're a devoted United Airlines flyer and seek a United card with decent perks, the United Explorer Card may be the better fit.

However, if you value flexibility and want to explore a broader range of travel options and rewards partners, the Infinite Card might be the card of choice.

|

| ||

|---|---|---|---|

United Explorer Card | United Club℠ Infinite | ||

Annual Fee | $95 ($0 first year) | $525 | |

Rewards | 2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases | 4x miles on United Airlines purchases, 2x miles on all other travel purchases, dining and eligible delivery services and 1x miles on all other purchases | |

Welcome bonus | Earn 60,000 bonus miles after qualifying purchases |

| |

0% Intro APR | N/A | N/A | |

Foreign Transaction Fee | $0 | $0 | |

Purchase APR | 21.49% – 28.49% variable APR | 21.49% – 28.49% variable APR | |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Comparing Rewards: United Explorer vs Infinite

When comparing credit card rewards, the significant advantage of the Infinite Card is the high ratio of United Airlines purchases.

The more you fly United – the more significant the difference in point rewards between the cards.

|

| |

|---|---|---|

Spend Per Category | United℠ Explorer Card | United Club℠ Infinite |

$15,000 – U.S Supermarkets | 15,000 miles | 15,000 miles |

$5,000 – Restaurants

| 10,000 miles | 10,000 miles |

$4,000 – Airline | 8,000 miles | 16,000 miles |

$3,000 – Hotels | 6,000 miles | 6,000 miles |

$4,000 – Gas | 4,000 miles | 4,000 miles |

Total Points | 43,000 miles | 51,000 miles |

Estimated Redemption Value | 1 point = ~1.2 cents

| 1 point = ~1.2 cents

|

Estimated Annual Value | $516 | $612 |

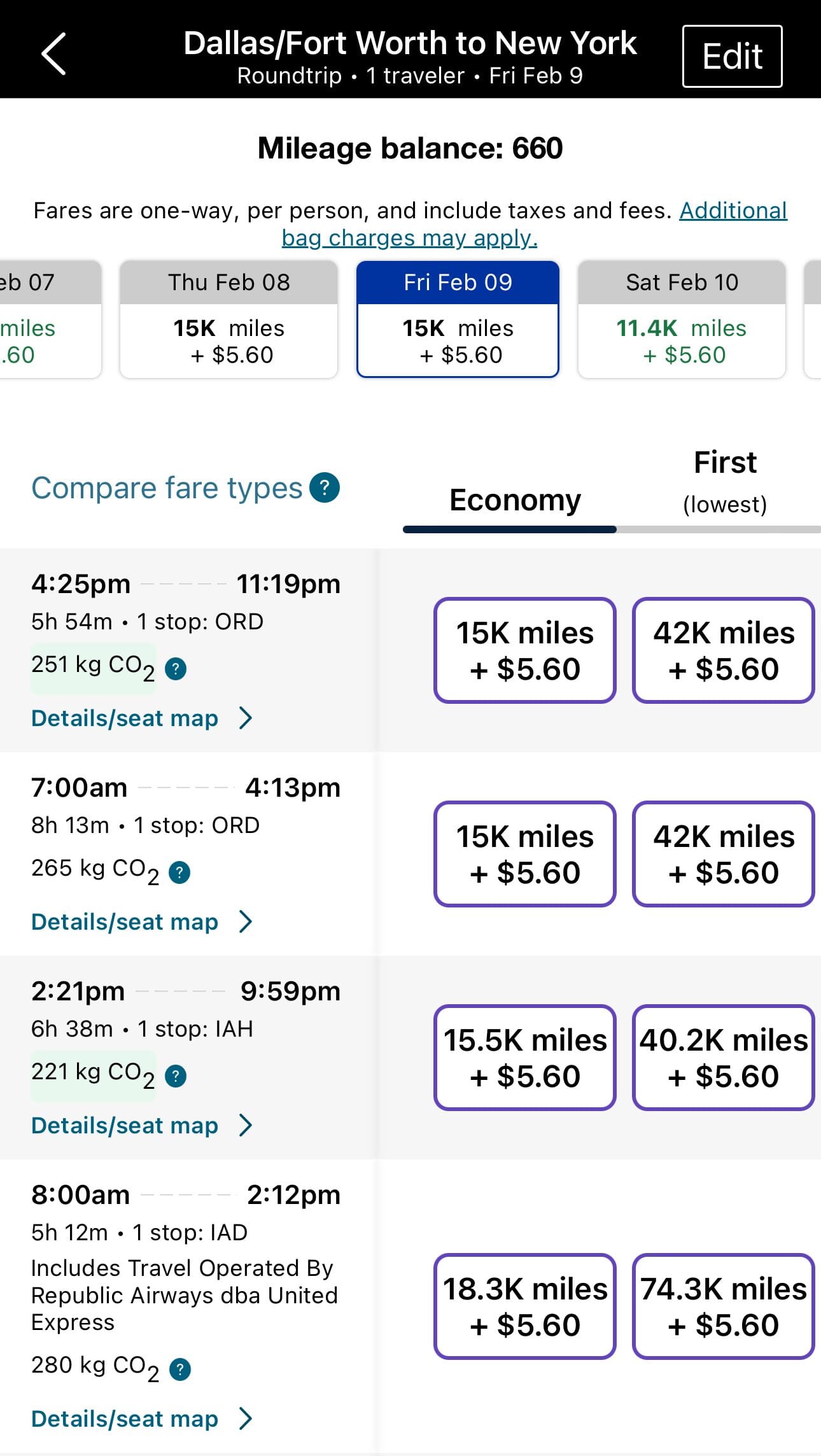

United Airlines' MileagePlus program offers diverse redemption options, allowing members to use miles for flights, upgrades, hotel stays, car rentals, and merchandise.

With no blackout dates, miles can be flexibly utilized for travel worldwide, and elite members enjoy additional perks. United's partner network and extensive route map enhance the program's flexibility, providing various ways for members to maximize the value of their MileagePlus miles.

Benefits You'll Get On Both Cards

Since both cards are United focused, they share many common benefits:

- Global Entry/TSA Precheck® Reimbursement: Get a $100 statement credit every four years to cover Global Entry, TSA Precheck®, or NEXUS application fees, expediting your airport security experience.

- 25% Back on In-Flight Purchases: Enjoy a 25% statement credit on food, beverages, and Wi-Fi purchases during United-operated flights when you pay with your Explorer Card, saving you money on in-flight expenses.

- Priority Boarding: Board United-operated flights with priority, along with your travel companions on the same reservation, ensuring you secure overhead bin space and settle into your seats comfortably.

- Free First Checked Bag: Receive a complimentary checked bag for you and a companion when flying with United, saving you up to $140 per roundtrip and reducing travel costs.

- Auto Rental Collision Damage Waiver: Decline rental company collision insurance and charge the rental cost to your card for primary insurance coverage against theft and collision damage for most rental cars in the U.S. and abroad.

- Baggage Delay Insurance: If your baggage is delayed by a passenger carrier for over 6 hours, get reimbursed for essential purchases like toiletries and clothing, up to $100 a day for 3 days.

- Lost Luggage Reimbursement: Receive coverage up to $3,000 per passenger or immediate family member for damaged or lost luggage by the carrier.

- Trip Cancellation/Interruption Insurance: Be reimbursed for pre-paid, non-refundable passenger fares (up to $1,500 per person and $6,000 per trip) in case your trip is canceled or cut short due to covered situations like illness or severe weather.

- Earn Premier Qualifying Points (PQP): Accumulate PQP to advance your MileagePlus Premier® status with United Airlines, enhancing your travel privileges such as earning United Plus Points, upgrades, and more.

- Trip Delay Reimbursement: Get coverage for unreimbursed expenses such as meals and lodging, up to $500 per ticket, if your common carrier travel is delayed over 12 hours or requires an overnight stay.

- Purchase Protection: Enjoy coverage for new purchases against damage or theft for 120 days, with limits up to $10,000 per claim and $50,000 per year.

- Visa Concierge: Access complimentary 24/7 Visa Signature® Concierge Service to assist with finding event tickets, making dinner reservations, and more.

- Extended Warranty Protection: Extend eligible warranties of three years or less by an additional year.

- DoorDash: Receive one year of complimentary DashPass membership for unlimited deliveries with $0 delivery fees and lower service fees on eligible orders.

Top Offers

Top Offers From Our Partners

Top Offers

Exclusive Benefits Of The Infinite Card

It's not a secret – the Infinite card is more luxurious than the Explorer card and, therefore, offers premium airline and travel benefits. Here's what you can get exclusively on the Infinite card:

- Free First and Second Checked Bags: Save up to $320 per roundtrip on checked baggage fees for you and a companion when flying with United.

- Earn up to 8,000 Premier Qualifying Points (PQP): Get 500 PQP for every $12,000 spent on purchases with your United Club Card (up to 8,000 PQP in a calendar year) to advance your Premier status qualification, up to Premier 1K® level.

- Premier Access® Travel Services: Enjoy priority check-in, security screening, boarding, and baggage handling privileges, making your airport experience smoother and more convenient.

- United Club Membership: Access United Club locations and affiliated Star Alliance™ lounges worldwide, offering a comfortable space with complimentary snacks, beverages, and work areas, worth up to $650 annually.

- Avis President's Club: Avis President's Club, available to the primary Cardmember of the United ClubSM Card, offers complimentary two-car class upgrades, guaranteed car availability, expedited rental service, and more.

IHG One Rewards Platinum Elite status: IHG One Rewards Platinum Elite status, granted to the primary Cardmember, includes perks like complimentary room upgrades, extended check-out when available, and the ability to earn points for free nights and elite points with no expiration.

When You Might Prefer The United Infinite Card?

You might prefer the United Infinite Card over the Explorer Card in the following situations:

- Frequent Traveler Across Multiple Airlines: If you often travel with various airlines, not just United, the Infinite Card's versatility in earning and redeeming rewards across different carriers can be more appealing. It provides more flexibility in terms of travel options.

- Wider Range of Travel Benefits: The Infinite Card typically offers a broader array of premium travel benefits such as airport lounge access which can enhance your overall travel experience beyond what the Explorer Card provides.

- Frequent United Airlines flyer: The United Infinite Card could be a better fit for you. It allows you to earn up to 8,000 Premier Qualifying Points (PQP), which is a big step up from the Explorer Card's 1,000 PQP limit. This higher PQP potential can make a real difference for travelers who want to achieve or maintain a higher Premier status in the United MileagePlus program.

When You Might Prefer the United Explorer Card?

You might prefer the United Explorer Card over the United Infinite Card in the following situations:

- Cost-Conscious Traveler: The Explorer Card usually has a lower annual fee compared to the United Infinite Card. If you want the advantages of a United co-branded card without the higher annual costs, the Explorer Card is a solid option.

- Occasional Traveler: For those who don’t travel often and don’t need the premium perks of the United Infinite Card, the Explorer Card still offers great benefits like free checked bags, priority boarding, and limited access to United Club lounges.

Compare The Alternatives

There are other travel cards worth mentioning, here are some of our best premium travel credit cards:

|

|

| |

|---|---|---|---|

The Platinum Card® from American Express | Chase Sapphire Reserve® | Capital One Venture X Rewards | |

Annual Fee | $695. See Rates & Fees | $550 | $395 |

Rewards |

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

| 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

Welcome bonus |

175,000 points

175,000 Membership Rewards® Points after spending $8,000 in eligible purchases on your new Card in your first 6 months of Membership

|

100,000 points + $500 Chase Travel℠ promo credit

100,000 points + $500 Chase Travel℠ promo credit After you spend $5,000 in purchases in the first 3 months from account opening

| 75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

|

Foreign Transaction Fee | $0. See Rates & Fees | $0 | $0

|

Purchase APR | See Pay Over Time APR | 21.99% – 28.99% variable APR | 19.99% – 29.74% (Variable) |

Compare United Explorer Card

The United Gateway and Explorer are two co-branded credit cards offered by Chase in partnership with United Airlines. Here's our winner.

The Quest card has recently launched in order to provide a premium alternative to the old Explorer card. How they compared & is it worth it?

United℠ Explorer Card vs United Quest℠ Card: Which is Better?

The Chase Sapphire Preferred is more versatile and offers better travel rewards than the Explorer card. But what if you're loyal to United?

United Explorer Card vs Chase Sapphire Preferred: Side By Side Comparison

The United Explorer and the Southwest Premier card have numerous shared features. Let's explore the distinctive strengths of each card.

Southwest Rapid Rewards Premier vs. United Explorer: Comparison

While the AAdvantage Platinum Select and the United Explorer Card have many common features, the Explorer card is our winner. Here's why.

Citi/AAdvantage Platinum Select vs. United Explorer: How They Compare?

The Delta SkyMiles Gold and the United Explorer Card offer airline benefits and similar fees. The SkyMiles Gold is our winner – here's why.

United Explorer vs Delta SkyMiles Gold: Side By Side Comparison

The Alaska Visa offers higher annual cashback value than United Explorer, but the latter takes the lead when it comes to airline perks.

Alaska Visa Signature vs United Explorer: Side By Side Comparison

Compare United Club Infinite Card

The United Infinite card offers luxury benefits that the Quest card doesn't, but for most consumers, it is not worth the higher annual fee.

These two are considered as one of the best exclusive airline cards out there. What are the differences between them and is it worth it?

United Club Infinite vs Delta SkyMiles® Reserve: Which Gives You More?

When it comes to premium travel cards, these two offer nice perks and benefits. But who is the winner between the two? Here's our analysis.

United Club Infinite vs AAdvantage Executive Elite Mastercard: Which Card Is Best?

The Infinite Card is tailored for frequent United flyers, while the Amex Platinum offers a more lucrative, comprehensive rewards program.