The Wells Fargo Active Cash Card and Chase Freedom Unlimited are popular cash-back credit cards offering different rewards structures and perks.

Whether one prioritizes a flat rate of cash back or enjoys the flexibility of bonus categories, these credit cards present compelling options in the competitive landscape of cash back rewards.

General Comparison

The Wells Fargo Active Cash card offers a simple and straightforward approach, giving unlimited 2% cash back on all purchases—perfect for those who prefer consistency in their rewards.

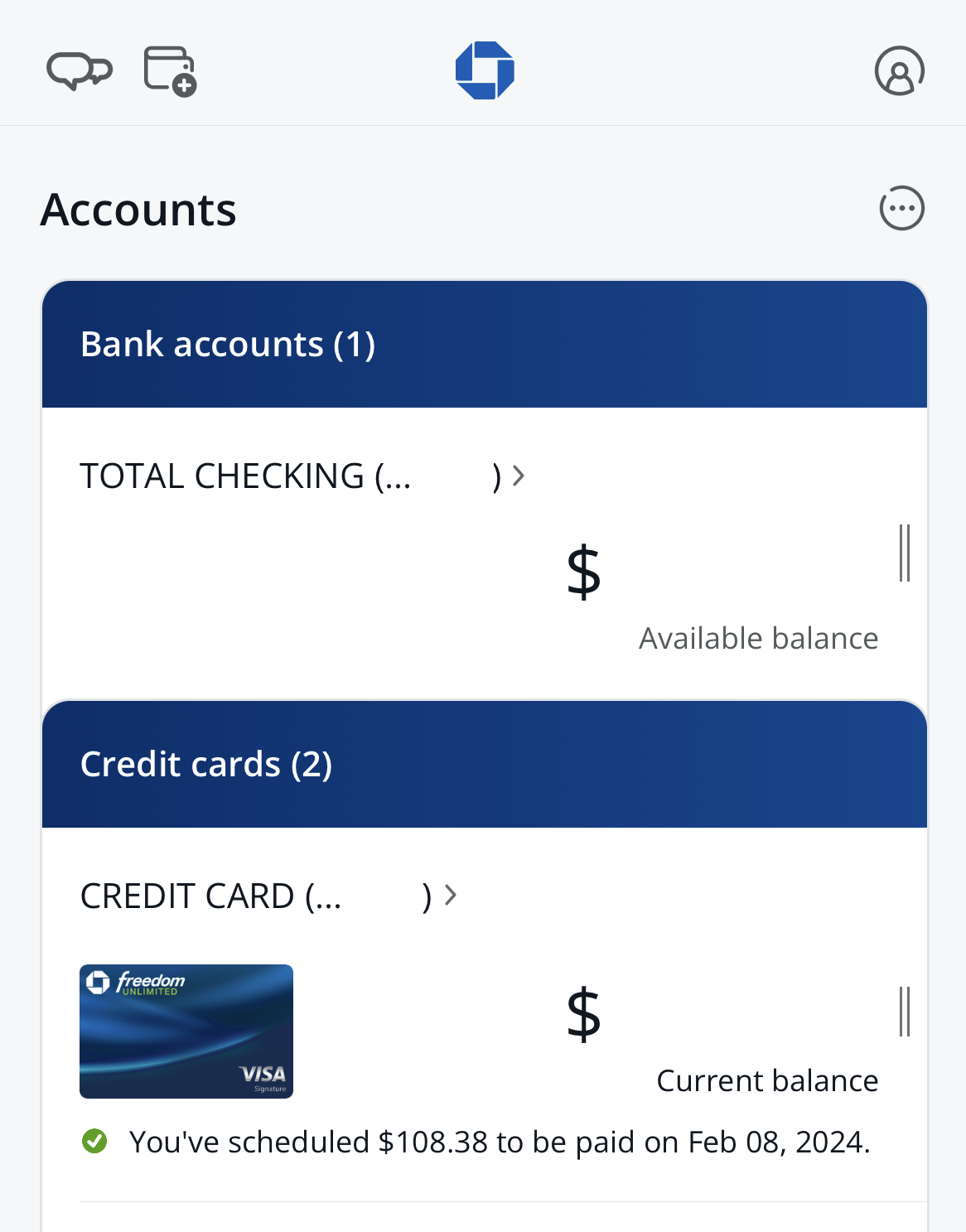

In contrast, the Chase Freedom Unlimited card features a more dynamic cash back structure, offering 1.5% back on all purchases, with higher rates on travel booked through Chase Ultimate Rewards, dining, and drugstore purchases.

|

| |

|---|---|---|

Wells Fargo Active Cash Card | Chase Freedom Unlimited | |

Annual Fee | $0 | $0 |

Rewards | 2% cash rewards on purchases (unlimited) | 5% cash back on travel booked through Chase Ultimate Rewards, 3% on dining (including takeout and eligible delivery), 3% on drugstore purchases, and 1.5% on all other purchases. |

Welcome bonus | $200 cash rewards bonus when you spend $500 in purchases in the first 3 months

| Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening. |

0% Intro APR | 15 months on purchases and qualifying balance transfers, then 19.49% – 29.49% Variable APR APR

| 15 months on purchases and balance transfers , then 19.99 – 28.74% variable APR |

Foreign Transaction Fee | 3% | 3% |

Purchase APR | 19.49% – 29.49% Variable APR | 19.99 – 28.74% variable |

Read Review | Read Review |

Cashback Rewards Battle: A Side-by-Side Analysis

When comparing cashback rewards, there is a clear winner – the Freedom Unlimited card.

However, if you tend to spend mainly on everyday purchases and not on travel (or if you have another travel card) – there is no significant difference between them.

|

| |

|---|---|---|

Spend Per Category | Wells Fargo Active Cash Card | Chase Freedom Unlimited |

$15,000 – U.S Supermarkets | $300 | $225 |

$5,000 – Restaurants

| $100 | $150 |

$5,000 – Airline | $100 | $250 |

$5,000 – Hotels | $100 | $250 |

$4,000 – Gas | $80 | $60 |

Estimated Annual Value | $680 | $935 |

Top Offers

Top Offers From Our Partners

Top Offers

Which Extra Benefits You'll Get With Each Card?

Beyond the bonus points and welcome offers, both cards include a range of supplementary perks. In terms of additional benefits and protections, the Chase Freedom Unlimited card outshines the Wells Fargo Active Cash Card.

Wells Fargo Active Cash Card

- Cellular Telephone Protection: Receive up to $600 in cell phone protection when paying your monthly cell phone bill with your Wells Fargo card, subject to a $25 deductible.

- My Wells Fargo Deals: Access personalized deals and earn cashback as an account credit when using your Wells Fargo credit card for shopping, dining, or experiences.

- Zero Liability Protection: Protection against unauthorized transactions when promptly reported.

- Credit Close-Up℠: Provides tools and insights to understand, track, raise, or maintain your FICO® Score.

Chase Freedom Unlimited

Instacart+ Benefit: The Unlimited card provides a complimentary 3-month Instacart+ membership, offering unlimited deliveries with $0 delivery fees and reduced service fees on eligible orders.

5% Cash Back/5x Points on Lyft Rides: It offers enhanced rewards for Lyft rides through March 31, 2025, giving you 5% cash back or 5x points on these purchases.

- Cellular Telephone Protection: The Unlimited card provides up to $600 in cell phone protection when you pay your monthly cell phone bill with the respective card, subject to a $25 deductible.

Trip Cancellation/Interruption Insurance: The card provide reimbursement for pre-paid, non-refundable passenger fares up to $1,500 per person and $6,000 per trip if your trip is canceled or interrupted due to covered situations.

My Chase Plan: It also offer the option to use My Chase Plan, allowing you to pay off eligible purchases of $100 or more in equal monthly payments with no interest, just a fixed monthly fee

Purchase Protection: The card offer purchase protection, covering your new purchases for 120 days against damage or theft, up to $500 per claim and $50,000 per account.

Extended Warranty Protection: The Freedom Unlimited card extends the time period of the U.S. manufacturer's warranty by an additional year on eligible warranties of three years or less.

Auto Rental Collision Damage Waiver: Get coverage for theft and collision damage when you decline the rental company's insurance and charge the entire rental cost to your card, applicable to most cars in the U.S. and abroad.

When You Might Want the Chase Freedom Unlimited Card?

Here are some situations where you might prefer the Chase Freedom Unlimited Card over the Wells Fargo Active Cash Card:

- You Spend Heavily On Travel And Dining. The Chase Freedom Unlimited Card offers higher cash back on travel booked through Chase Ultimate Rewards and dining, which are two common categories where people spend a lot of money. The Wells Fargo Active Cash Card, on the other hand, only offers a flat 2% cash back rate on all purchases.

- You Want Better Travel Protections: The Chase Freedom Unlimited Card provides rental car insurance, extended warranty protection, purchase protection, and other protections that enhance the overall cardholder experience.

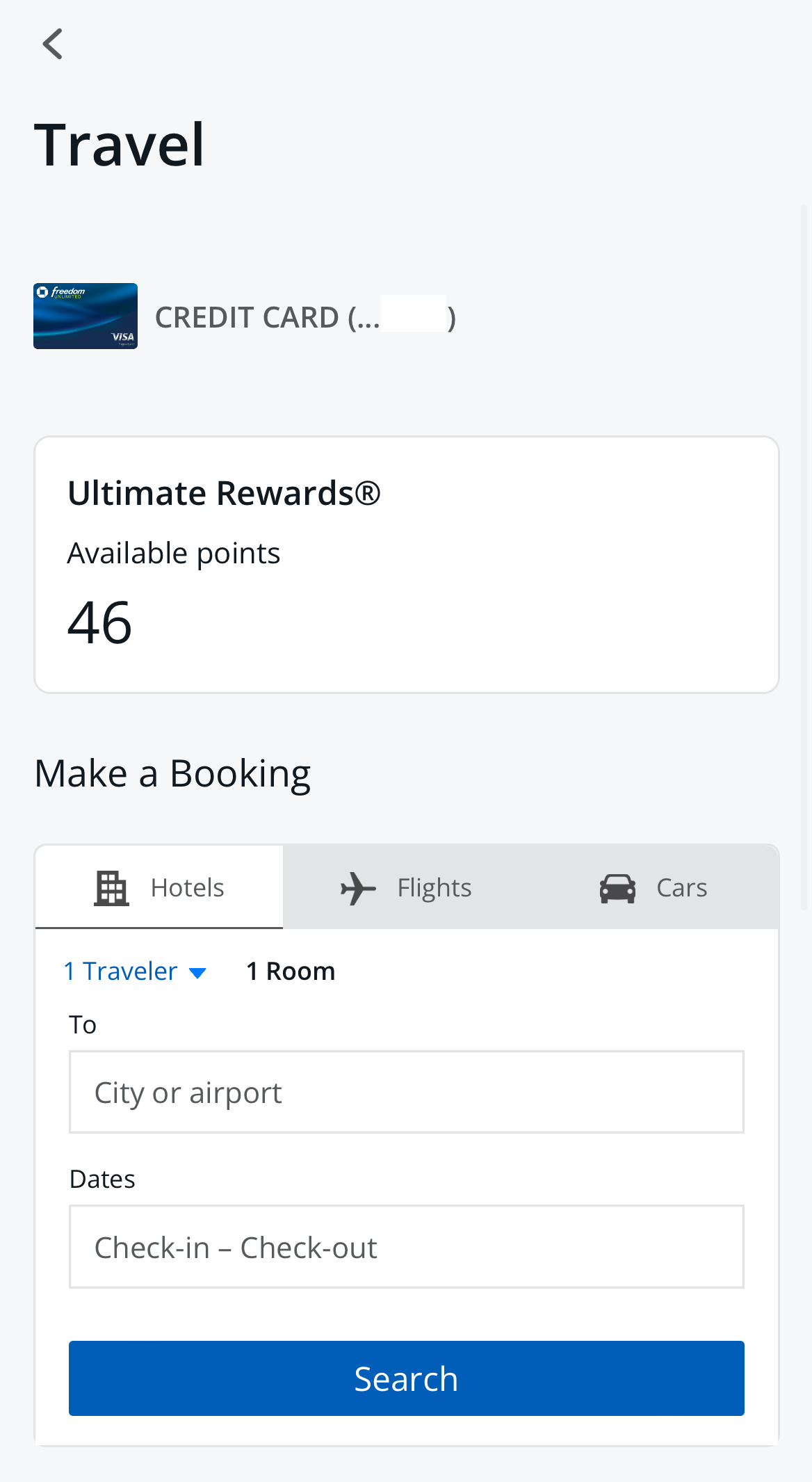

- You Prefer The Chase Ultimate Rewards: The Ultimate Rewards program offer a variety of redemption offers and has much Broader options than Wells Fargo redemption site/

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Want the Wells Fargo Active Cash Card?

The Wells Fargo Active Cash card might be a better fit over the Chase Freedom Unlimited in the following situations:

Flat-Rate Rewards Simplicity: If you prefer a straightforward rewards system, the Active Cash card is ideal. The 2% cash back on all purchases makes it simple and easy, without the need to keep track of bonus categories.

You Have Another Travel Card: The Chase Freedom Unlimited excels with its travel perks and higher cash back on travel-related expenses. However, if you're mainly using your new card for everyday purchases, the Active Cash card could be a more practical choice.

Compare The Alternatives

It's always a good idea to be aware of other options before determining the most suitable choice for your needs.

| |||

|---|---|---|---|

Capital One Quicksilver Cash Rewards Credit Card | Blue Cash Preferred® Card from American Express | Chase Sapphire Preferred® Card | |

Annual Fee | $0

| $95 ($0 intro for the first year)

| $95

|

Rewards |

1.5% – 5%

5% percent cash back on hotels and rental cars booked through Capital One Travel and 1.5% cash back on all purchases everyday.

|

1-6%

6% cash back at U.S. supermarkets (up to $6,000 per year in purchases, then 1%) and selected U.S. streaming subscriptions, 3% cash back on transit

and U.S. gas stations, 1% cash back on other purchases

|

2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

|

Welcome bonus |

$200

$200 cash bonus once you spend $500 on purchases within 3 months from account opening

|

$250

$250 statement credit after you spend $3,000 in purchases on your new Card within the first 6 months

|

75,000 points

75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening

|

Foreign Transaction Fee | $0 | 2.70% | $0

|

Purchase APR | 19.74% – 29.74% (Variable)

| 20.24%-29.24% Variable

| 19.99% – 28.24% variable APR

|

Compare Chase Freedom Unlimited

While both cards offer great cash back rewards and considered among the best Chase cards, there are some major differences. Which is better?

Chase Freedom Flex vs Chase Freedom Unlimited: Which Card Is Best?

While both cards offer decent cash back rewards with no annual fee, there is a clear winner between the two. And here's why we think so.

American Express Everyday® Card vs Chase Freedom Unlimited®: Which Card Wins?

While both cards offer great cash back rewards and considered among the best Chase cards, there are some major differences. Which is better?

Chase Freedom Flex vs Chase Freedom Unlimited: Which Card Is Best?

The flat rate cash back on Citi Double Cash Card is higher – but usually, it may not be the best option. Here's The Smart Investor analysis.

Citi Double Cash Card vs Chase Freedom Unlimited: Which Card Wins?

The Chase Sapphire Preferred offers costs more and offer more benefits than the Freedom Unlimited. Is it worth the annual fee?

Chase Freedom Unlimited Vs. Sapphire Preferred: Compare Side By Side

The Freedom Unlimited beckons with its cash-back rewards, but the Amex Gold exudes luxury, boasting robust rewards on dining and groceries.

Chase Freedom Unlimited vs. Amex Gold Card: Which Card Wins?

The Amex Blue Cash Everyday is the winner if you need gas and grocery purchases, while the Freedom Unlimited offers better travel rewards

Amex Blue Cash Everyday vs. Chase Freedom Unlimited: Which Card Wins?

When it comes to cashback potential, the Chase Freedom Unlimited wins, especially for those who frequently engage in travel-related expenses.

Chase Freedom Unlimited vs. Citi Custom Cash Card: Which Card Wins?

The Savor card is ideal for dining out and entertainment, while the Freedom Unlimited is best for travelers and those who need 0% intro APR.

Capital One Savor vs. Chase Freedom Unlimited: Side By Side Comparison

The BofA Customized Cash Rewards is more flexible, but the Chase Unlimited card will drive more rewards and benefits. Here's why.

Bank of America Customized Cash Rewards vs Chase Freedom Unlimited: Which Card Wins?

The Apple Card offers competitive cashback rewards on Apple purchases and services – but if you travel frequently, the Unlimited card wins.

The Costco Card is a great for Costco shoppers, gas and grocery purchases, while the Freedom Unlimited stands out for its travel benefits.

Costco Anywhere Visa Card vs Chase Freedom Unlimited: Comparison

Compare Wells Fargo Active Cash

Wells Fargo has recently launched a new set of credit cards, and these two are at the top of the list. Which of them offers more and is it worth it?

When both cards offer the same flat rate cashback, we should see beyond it. Which card is better? Here's The Smart Investor full analysis.

Citi Double Cash vs Wells Fargo Active Cash: Which Card Wins?

The Wells Fargo Active Cash is best for cashback and everyday spending, while the Autograph is a clear winner when it comes to travel rewards.

Wells Fargo Active Cash vs. Autograph Card: How They Compare?

While the Quicksilver card offers unlimited flat-rate cashback rewards, the Active Cash card offers a higher cashback ratio. Let's compare.

While Discover it Cash Back offers higher cashback rewards for some categories, the Active Cash card is our winner. Here's why.

Discover it Cash Back vs Wells Fargo Active Cash: Side By Side Comparison