Table Of Content

Discover offers a wide range of credit cards for people in all stages of life. The Discover It Cash-Back Card is a card for those with good to excellent credit that offers high percentage rates on select purchases.

Though this card requires a bit more effort than other cash-back cards, the incentive of higher cash-back earnings continues to draw potential owners in.

What Credit Score Is Required For the Discover It Cash Back?

The Discover It Cash Back Card requires a range of 670 to 850, 670 being the minimum credit score to be considered, and rumored that 700+ is the base requirement.

While the Discover website states this card is recommended for those with good to excellent credit, your chances are much better if your score is above 700.

- An anonymous user from MyFico with a score of 705 says, “I’m so very excited to finally have been approved for a decent card (anonymous)!”

- However, it is not impossible to gain approval with a score lower than 700.

- “Just got approved for $11,500 on the Discover It Cash Back card! Shocking, seeing that I’ve only been getting low limit approval,” says this guy with an Experian score of 683.

It can be overwhelming trying to understand why some people are approved while others are not- and why the credit line fluctuates with each approval. What we do know is that there are many factors considered during the credit card application process.

Additional Requirements to Get Discover It Cash Back

If your score is lower than 700, there are additional requirements you may need to provide in order to be eligible for the Discover Cash Back Card:

- Annual Income

There is no perfect formula for getting approved. You may have excellent credit but no income, leaving you at risk for rejection.

Your credit may fall between the fair to good range, but you make over 50k a year, granting you approval and a generous credit line. There is no legal amount of annual income required for credit card approval, but it does matter.

Discover uses this information to determine the amount of credit to issue you if any at all.

- Debt History

Discover will review your debt history, considering current and past debt.

Discover wants to know if their applicants tend to carry a balance if they have defaulted on any previous cards and if they have a history of paying off balances on time.

Practicing responsible money habits, low credit utilization, and a reasonable dent to income ratio will allow you more application approvals.

- Excess Card Applications

Many new card seekers don’t realize that the number of credit cards you apply for, and the number of cards you have recently opened within the last five months, are visible to card issuers.

Discover, and other credit card issuers see this as potential fraud or overuse, putting an application at risk for rejection. It is important to take your time when considering which credit cards you want to apply for.

Applying reasonably shows card issuers that you are responsible and want to use their cards.

Discover It Cash Back

Reward details

Current Offer

Credit Rating

Annual Fee

Which Documents Should I Provide When Applying?

Discover offers some tips on what you need to apply. The section lists all of the information and basic requirements needed for a credit card application. Most of the required information can be found on a few necessary documents:

- Social Security Card: Your social security number is found on your social security card. When applying for most credit cards, you’ll typically only need to provide the last four digits of your number. If you were born in the U.S., your legal guardian likely applied for your social security number when they completed your birth certificate. If you need help obtaining a social security number, you can visit your local social security office for assistance.

- State-Issued I.D.: State-Issued I.D.s acceptable for a credit card application are a driver's license, passport, Military I.D., citizenship card, or legal residency card. Your local DMV will be able to tell you what qualifies as a state-issued I.D. and how to get one if you don’t already have one.

- Proof of Address: To be approved for a Discover It Cash-Back Card, you must be a legal, U.S. resident. Whether your address is the same as the one listed on your State-Issued I.D. or different, you must be able to list it on your application. Military addresses are also acceptable.

Which Discover Cards Can I Get With A Credit Score of 650?

Although the cards listed below don’t have a specific minimum credit score for approval, many of them tend to favor applicants within a certain range. That said, some Discover cards are easier to get approved for than others, and there are even options that don’t require any prior credit history.

- Student Cash Back Credit Card: The Student Cash Back Credit Card does not require any credit history to apply.

- Student Chrome Card: The Student Chrome Card does not require a credit history to apply.

- Discover It Secured Card: The Discover It Secured Card does not specify that a credit history is necessary to apply but does have a trend of favoring applicants with a minimum credit score ranging from 600-640.

- Discover It chrome gas and restaurants: The Discover it Chrome Card for Gas and Restaurants favors applicants with a minimum credit score of 630.

All Discover cards offer pre-approval that potential applicants are encouraged to take advantage of before filling out an application.

Card | Rewards | Bonus | Annual Fee | |

|---|---|---|---|---|

| 1-2%

2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter and 1% cash back on all your other purchases

| Cashback Match

Discover matches all cash back you earn at the end of your first year

| $0 | |

| 1.5X

unlimited 1.5x miles for every dollar spent on all purchases

| Discover Match®

Discover matches your first year miles automatically.

| $0 | |

| 1-2%

2% cashback at gas and restaurants (up to $1,000 every quarter) and 1% on groceries and other student related products

| Match Bonus

Discover will automatically match all the cash back you earn with your card at the end of your first year without a minimum spending requirement or maximum rewards.

| $0 | |

| 1-2%

2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter and unlimited 1% cash back on all other purchases

| Match Bonus

Discover will match all the cash back you’ve earned at the end of your first year.

| $0 |

Is the Credit Score Needed for an Discover It Cash Back Higher Than Capital One Quicksilver Card?

Based on our comparison, the credit score needed for the Capital One Quicksilver Card starts at 690, 20 points higher than the Discover It Cash Back Card. According to the Capital One website, it requires excellent credit.

Unlike the Discover It Cash-Back Card, the Capital One Quicksilver card is tiered. Capital One offers three other versions of the Quicksilver card, ranging from fair to good credit. So, if you look for the QuicksilverOne card, a fair credit score may be enough for approval.

While the Discover It Cash Back Card is a rotating categories card, meaning users must choose their categories and activate their rewards quarterly, the Capital One Quicksilver Card is a flat-rate rewards card offering lower percentage rates. There are no caps or spending categories.

|  |  | |

|---|---|---|---|

Discover It Cash Back | Capital One Quicksilver | Chase Freedom Flex | |

Annual Fee | $0 | $0 | $0 |

Rewards | 1-5%

5% cashback on up to $1,500 in rotating category purchases each quarter when you activate the bonus category (then 1%), as well 1% percent cash back on all other purchases

| 1.5% – 5%

5% percent cash back on hotels and rental cars booked through Capital One Travel and 1.5% cash back on all purchases everyday.

| 1-5%

|

Welcome bonus | Cashback Match

Automatic Cashback Match: Discover will match all the cash back you earn at the end of your first year.

| Earn 125,000 points after you spend $6,000 in purchases in the first 3 months from account opening

Earn 125,000 points after you spend $6,000 in purchases in the first 3 months from account opening

| $200

|

Minimum Score | 700 | 670 | 680 |

Is the Credit Score Needed for an Discover It Cash Back Higher Than Chase Freedom Flex Card?

The Credit Score needed for the Chase Freedom Flex Card is the same as the Discover It Cash Back Card.

A score ranging from 670-850 will find their application approved depending on annual income and previous debt history, though applicants with an excellent credit score have a higher chance of approval.

Both cards offer high cash back in specific categories, the biggest difference being that the Discover It Cash Back Card releases its selected category calendar for the whole year, while the Chase Freedom Flex Card releases its categories quarterly.

Things to Know Before Getting the Discover Cash Back Card

There are many factors to consider when choosing a credit card. Rewards and benefits are just the beginning.

A potential card owner should review the full terms and conditions and the perks a user receives beyond sign-on bonuses.

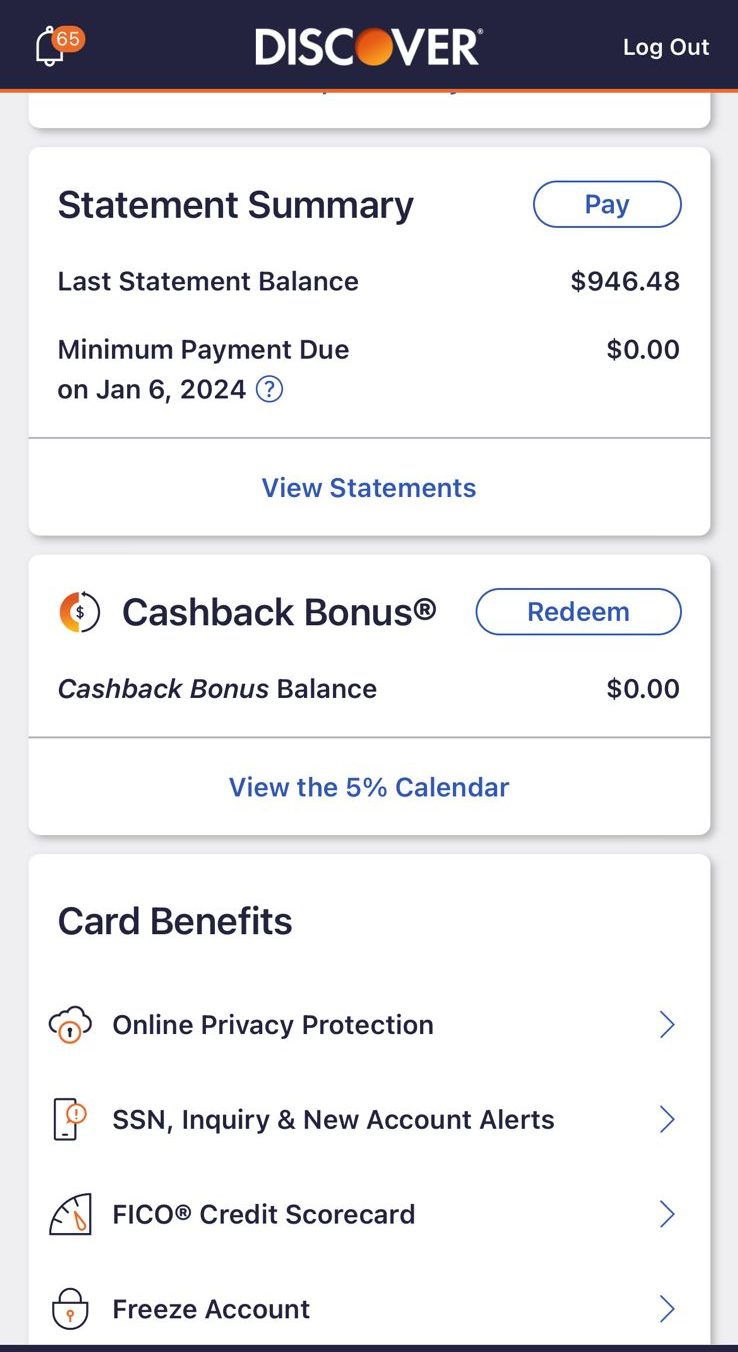

- Rewards Rate: The Discover It Cash Back Credit Card offers an exciting rate of 5% cashback on up to $1,500 in rotating category purchases each quarter when you activate the bonus category (then 1%), as well 1% percent cash back on all other purchases, makes it one of our best cash back card choices for 2025. Cash back rewards can be redeemed in several ways, including but not limited to: statement credit, electronic deposit, and pay with cash back at select merchants.

- Cash back Match: Discover will match your overall cash-back earnings for the first year. There is no limit on the amount they will match.

- 0% Intro APR: Cardholders will receive an intro APR rate of 0% for the first 15 months on purchases and balance transfers . 0% intro APR can be very useful if you carry debt or need to pay for a large purchase.

- Protection: Discover offers a wide range of protection for users of the Discover It Cash Back Card, according to the website:

- Online Privacy Protection

- Free Social Security Number Alerts

- Turn your account on/off with Freeze It

- 0% Fraud Liability Guarantee

- Customer Service: Discover has outstanding customer service, 100% based in the U.S. Cardholders can request overnight card replacements and check their FICO score whenever they want, for free.

- Rewards Never Expire: Your Discover It Cash Back Cards cash back rewards will never expire. As long as your account is active and in good standing, your rewards will remain accessible and redeemable however you deem fit.

Why Was My Discover Card Application Rejected?

According to the Discover, there are several reasons why your application may have been rejected:

- Low Credit Score

- No Credit History

- Income and Expenses

- Your Age

If your application was rejected, confirm that the information you’ve provided is correct. If your application was rejected due to any of the reasons listed above, Discover offers a few solutions to hasten future approval.

Denied applicants are encouraged to apply for a secured card, become an authorized user of a friend or family member's card, or get a store card to begin establishing, or building credit.

Top Offers

Top Offers

Top Offers From Our Partners

FAQs

Yes. Discover offers pre-approval on all of their cards, along with a list of requirements and information necessary to be considered for approval.

Applying for a credit card requires a hard pull on your credit, causing your credit score to drop by a few points, but typically your score will go back up through good usage.

That is why most card issuers offer pre-approval, which is a soft pull.

The Discover It Cash Back Card is not a travel card, but cash back rewards redeemed in cash can be used on travel if you so choose.

If travel is your priority, adding the Discover It Miles Card to your wallet is a great way to optimize rewards from both cards.

Yes, the Discover It Cash Back Card is good for gas, but not one of the best credit cards for gas. Though the categories change quarterly, the Discover calendar does have gas listed as one of the select categories each calendar year.

This card also offers a flat rate of 1% on all other purchases, so even though gas may not be this quarter's selected category, users will still earn cash back.

Review Cash Back Credit Cards

Chase Freedom Flex