The American Express® Gold Cardand the Delta SkyMiles Reserve American Express Card are two popular travel credit cards that offer a variety of benefits to frequent travelers. However, there are some key differences between the two cards that may make one a better fit for you than the other.

Amex Gold vs. Delta Reserve: General Comparison

The Amex Gold Card is a more general-purpose travel card, offering rewards on a wider range of purchases, including restaurants, U.S. supermarkets, and airfare.

The Delta SkyMiles Reserve Card is a more airline-specific card, offering enhanced rewards on Delta purchases and a variety of Delta-specific benefits.

|

| |

|---|---|---|

Amex Gold Card | Delta SkyMiles Reserve | |

Annual Fee | $325. See Rates and Fees. | $650. See Rates and Fees. |

Rewards | 4X points at restaurants (including Uber Eats purchases in the U.S.) and U.S. supermarkets (up to $25,000 per year in purchases, then 1X points), 3X points on flights booked directly with airlines or on amextravel.com, 2X points on rental cars through amextravel.com and 1X points on all other purchases. Terms Apply. | 3X miles per dollar on eligible Delta flights and Delta Vacations® with 1X miles on all other purchases. Terms Apply. |

Welcome bonus | 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. | 125,000 Bonus Miles after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Offer Ends 10/29/2025.

|

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | None. See Rates and Fees. | $0. See Rates and Fees. |

Purchase APR | See Pay Over Time APR | 19.99%-28.99% Variable

|

Read Review | Read Review |

Compare Point Rewards: Which Card Wins?

Despite the lower annual fee, the Amex gold card offers a better rewards rate ratio in most categories. For consumers who spend a lot on supermarkets, the Gold card offer better rewards.

However, if you spend mainly on flights and hotels, the Delta Reserve card provides more points.

|

| |

|---|---|---|

Spend Per Category | Amex Gold Card | Delta SkyMiles Reserve |

$10,000 – U.S Supermarkets | 60,000 points | 10,000 miles |

$5,000 – Restaurants | 20,000 points | 5,000 miles |

$6,000 – Hotels | 6,000 points | 6,000 miles |

$8,000 – Airline

| 24,000 points | 24,000 miles |

$4,000 – Gas | 4,000 points | 4,000 miles |

Total Points | 114,000 points | 49,000 miles |

Estimated Redemption Value | 1 point ~ 1 – 1.5 cent | 1 point ~ 1.3 cents

|

Estimated Annual Value | $1,140 – $1,710 | $637 |

Amex Gold vs. Delta Reserve: Compare Travel Perks

Both cards come with additional perks catering to diverse needs. The Amex gold card stands out with its versatile credit statements, appealing to a range of customers.

Meanwhile, Delta focuses on airline-specific advantages, including access to Delta Sky Club, a 20% rebate on inflight purchases, an annual companion certificate, and other exclusive benefits.

Amex Gold Card

Up to $120 Uber Credit: Link your Amex Gold Card to your Uber account and relish a monthly $10 Uber Cash credit, applicable to Uber rides or UberEats orders, with a maximum annual value of $120.

Up to $120 Dining Credit: Elevate your dining experience with the Amex Gold Card, earning up to $10 in statement credit per month when dining at select establishments, including The Cheesecake Factory, Wine.com, Goldbelly, Shake Shack, and Milk Bar locations.

$100 Experience Credit: Indulge in a $100 experience credit when booking The Hotel Collection through American Express Travel for a getaway of at least two nights, the value varying based on your chosen property.

Global Entry or TSA PreCheck® Credit: Streamline your travels with a credit of up to $100 for Global Entry or up to $85 for TSA PreCheck.

Amex Entertainment: Immerse yourself in exclusive experiences and presale tickets for concerts, sports events, and theater performances through the American Express Gold Card Entertainment Access program, with availability varying.

Luxury Hotel Perks: Unlock the door to premium stays with the American Express Fine Hotels & Resorts program, offering benefits such as room upgrades, complimentary nights, and daily breakfast for two at participating hotels.

High-End Concierge Service: Access the Amex Gold Card's concierge service for assistance with travel and dining reservations, though availability may limit its ability to fulfill all requests.

Terms apply to American Express benefits and offers.

Delta SkyMiles Reserve

- Annual Companion Certificate: You’ll receive a round trip companion certificate for First Class, Delta Comfort+, or Main Cabin roundtrip flights in the U.S., Caribbean, or Central America—each year upon card renewal.

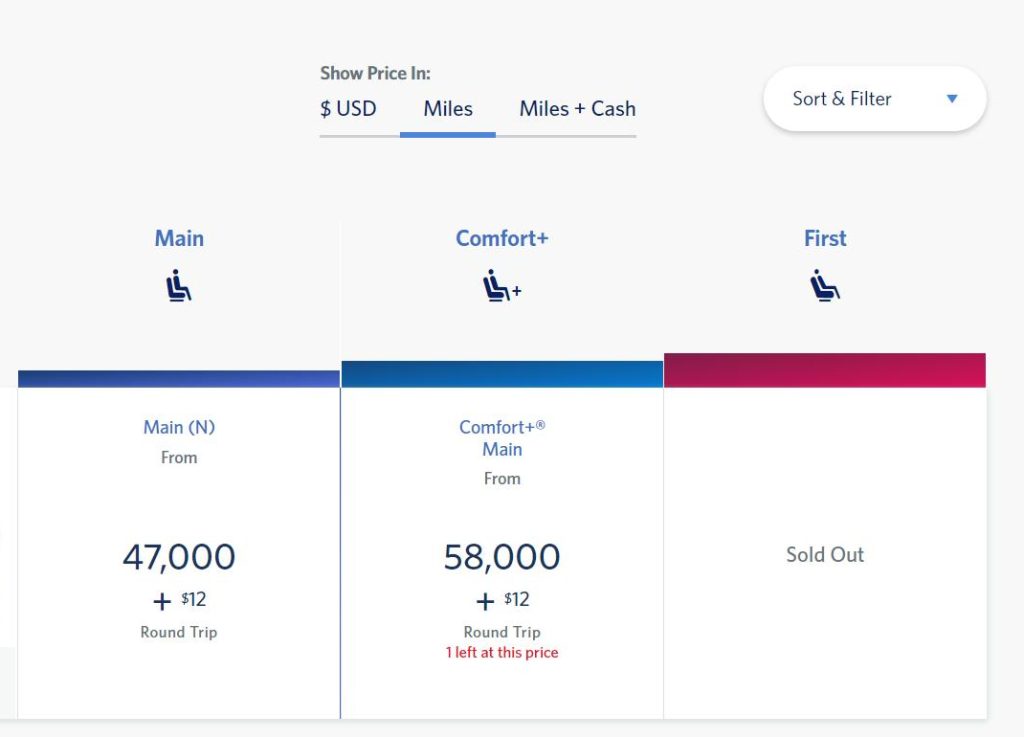

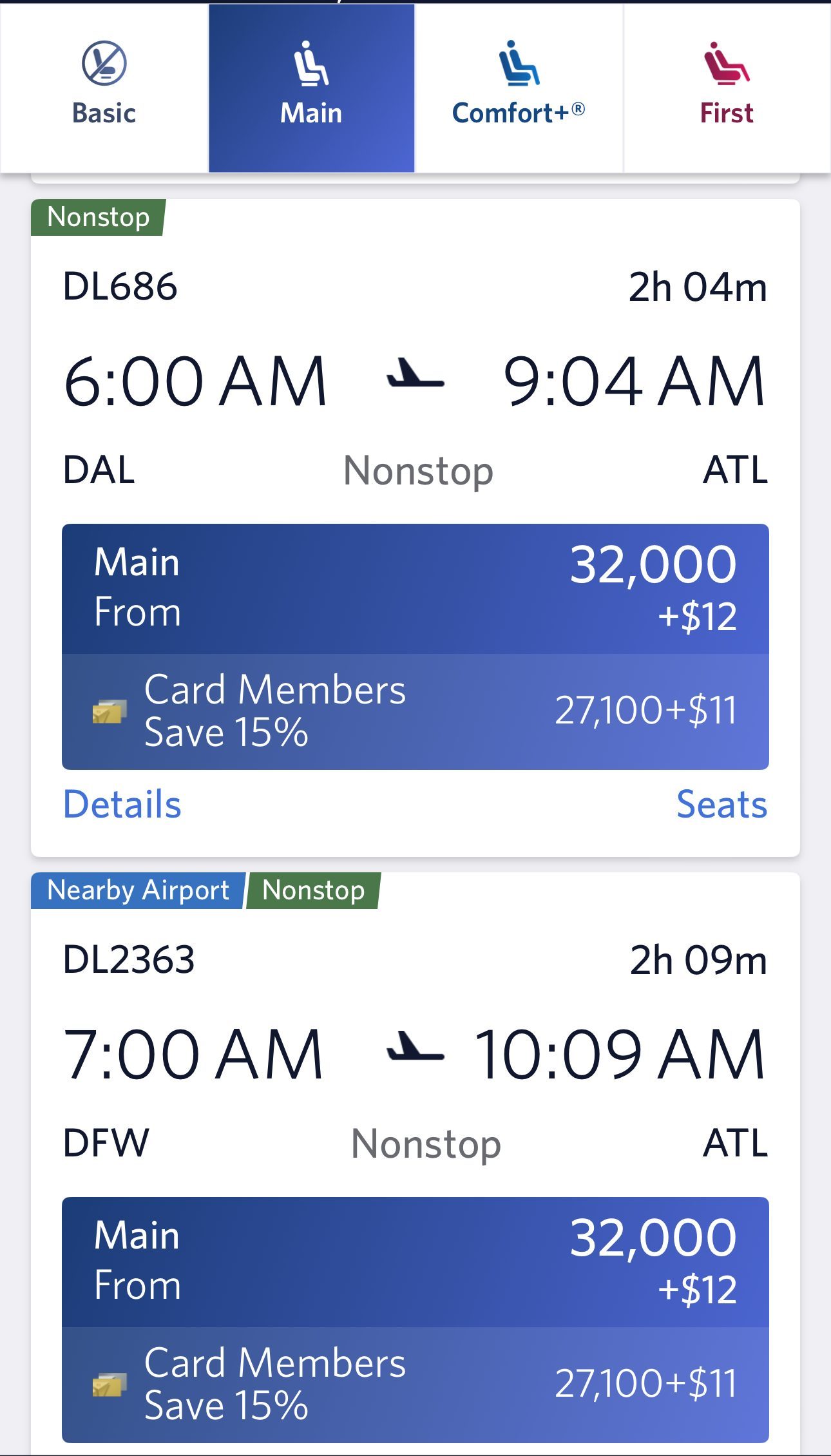

- TakeOff 15: Save 15% on Award Travel when booking Delta flights (excluding partner-operated flights and taxes/fees).

- First Checked Bag Free: Receive complimentary first checked bag on Delta flights.

- $100 Fee Credit for Global Entry or TSA PreCheck®: Get reimbursed for the application fee for Global Entry or TSA PreCheck every 4 years.

- 20% Back on In–flight Purchases: Receive a 20% statement credit on eligible Delta in-flight purchases of food and beverages.

- ShopRunner: Enjoy free 2-day shipping at 100+ online stores when you enroll in complimentary ShopRunner membership with your Delta Platinum card.

- Delta Sky Club® Access:

Get free entry to the Delta Sky Club when you fly on a Delta flight on the same day. You'll also get four guest passes each year. Effective 2/1/25, Reserve Card Members will receive 10 Visits per year to the Delta Sky Club; to earn an unlimited number of Visits each year starting on 2/1/25, the total eligible purchases on the Card must equal $75,000 or more between 1/1/24 and 12/31/24, and each calendar year thereafter.

- Priority Boarding: enjoy Main Cabin 1 Priority Boarding on their Delta flights, allowing them to board early, secure overhead bin space for their carry-on luggage, and have a more relaxed start to their journey.

- Upgrade Priority – When you use your Delta SkyMiles Reserve American Express Card, you will have priority over other Medallion members in the same Medallion level and fare class grouping.

- Access to Complimentary Upgrades – If you do not have Medallion Status, your Card automatically adds you to the Complimentary Upgrade list, which is prioritized over Medallion Members.

- $200 Delta Stays Credit: Every year, enjoy a $200 credit for eligible prepaid Delta Stays bookings on delta.com.

- Hertz President’s Circle Status: Join the Hertz Gold Plus Rewards program and enjoy the benefits of Hertz Five Star Status.

- $240 Resy Credit: Get a $240 credit for Resy, earning up to $20 in monthly credits on eligible Resy purchases.

- $120 Rideshare Credit: Get a $120 credit for rideshare services, with up to $10 back each month on U.S. rideshare purchases when using your Delta SkyMiles Reserve American Express Card. Enrollment is required.

- MQD Boost: Earn $2,500 Medallion Qualification Dollars each year, getting you closer to elite status with MQD Headstart.

- MQD on Purchases: Earn $1 Medallion Qualification Dollar for every $10 you spend on your Delta SkyMiles Reserve American Express Card in a calendar year, helping you reach a higher Medallion Status for the next year.

Terms apply to American Express benefits and offers.

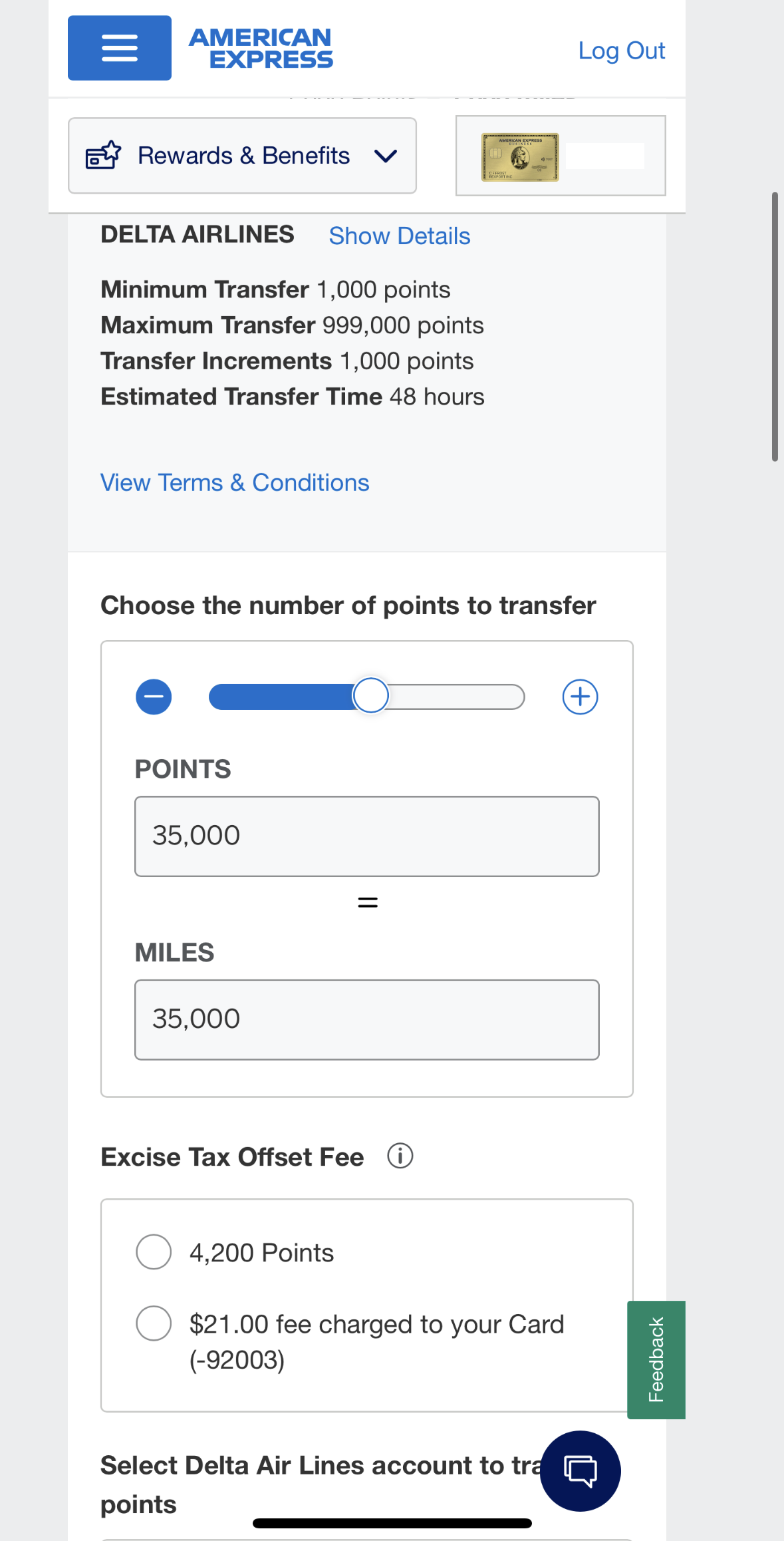

Can I Transfer Amex Gold Points To Delta?

Yes, you can transfer American Express Gold points to Delta SkyMiles at a 1:1 ratio, with a minimum transfer of 1,000 points. American Express partners with several airlines, and Delta is one of them.

To transfer points, you’ll need both a Delta SkyMiles account and a linked American Express Gold Card account. You can easily transfer points online or by reaching out to American Express customer service.

When You Might Want the Delta SkyMiles Reserve?

Here are some scenarios where the Delta SkyMiles Reserve might be the preferred choice:

- Frequent Delta Flyers: If you find yourself consistently flying with Delta, the SkyMiles Reserve can offer tailored benefits like complimentary Delta Sky Club access and Priority Boarding.

- Delta Elite Status: The SkyMiles Reserve provides an opportunity to earn Medallion Qualification Miles (MQMs) towards Delta elite status, which can be crucial for travelers who prioritize airline status perks.

- Delta-specific Perks: The SkyMiles Reserve offers unique perks tied to Delta, such as access to Delta Sky Club lounges, priority boarding, free checked bags, a companion certificate and other airline-related benefits that might not be as prominent with the Amex Gold Card.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Want the Amex Gold?

The Amex Gold Card could be the preferred choice over the Delta SkyMiles Reserve in several scenarios:

- More Airline And Hotel Partners: Membership Rewards points earned with the Amex Gold Card are transferable to multiple airline and hotel partners, providing flexibility in choosing how to use your rewards. This versatility can be advantageous if you prefer not to be tied to a single airline like Delta.

- Dining and Grocery Rewards: The Amex Gold Card is a great choice if you often dine out or shop for groceries, as it offers excellent points earning rates in these categories, providing solid benefits for food-related spending.

- Diverse Travel Interests: If you prefer flexibility in your travel rewards and like the option to redeem them with different airline and hotel partners, the Amex Gold Card's Membership Rewards program offers more versatility, making it a great fit for a variety of travel preferences.

Compare The Alternatives

If you're looking for a travel rewards credit card– there are some excellent alternatives you may want to consider:

|

|

| |

|---|---|---|---|

The Platinum Card® from American Express | Chase Sapphire Preferred® Card | Capital One Venture X Rewards | |

Annual Fee | $695. See Rates & Fees | $95

| $395 |

Rewards |

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

| 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

Welcome bonus |

175,000 points

175,000 Membership Rewards® Points after spending $8,000 in eligible purchases on your new Card in your first 6 months of Membership

|

75,000 points

75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening

| 75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

|

Foreign Transaction Fee | $0. See Rates & Fees | $0

| $0

|

Purchase APR | See Pay Over Time APR | 19.74%–27.99% variable

| 19.99% – 28.99% (Variable)

|

Compare Delta SkyMiles Reserve Card

While the Delta SkyMiles Reserve card has a high annual fee, it offers better airline and travel benefits than the Platinum card.

These two are considered as one of the best exclusive airline cards out there. What are the differences between them and is it worth it?

United Club℠ Infinite vs Delta SkyMiles® Reserve: Which Gives You More?

While the Amex Platinum Card offers extensive travel perks and redemption options, the Delta Reserve Card has better airline-specific perks.

Amex Platinum Card vs. Delta SkyMiles Reserve: Which Luxury Travel Card Is Best?

The Chase Sapphire Reserve offers more versatile travel rewards and redemption options. But if you need airline perks, the Delta Reserve wins.

Chase Sapphire Reserve vs. Delta SkyMiles Reserve: Which Luxury Travel Card Is Best?

The AAdvantage Executive is a clear winner when it comes to cashback value. But the Delta SkyMiles Reserve wins at premium airline perks

Citi/AAdvantage Executive World Elite vs. Delta SkyMiles Reserve: Which Luxury Airline Card Is Best?

Compare American Express Gold Card

If you're looking for everyday spending rewards, the Amex Gold Card offers more. But for travel rewards benefits, there is a clear winner.

The Amex Gold Card may be more appealing if you dine out frequently and value premium travel perks than the Apple card.

While the Amex Gold Card is more expensive than the Blue Cash Preferred, its rewards program and other benefits are more lucrative.

The Autograph is great for travelers who want to stay on budget, while Amex Gold provides premium travel benefits and redemption options.

If you're a dedicated Delta traveler, the Delta SkyMiles Gold may be your top pick, while the Amex Gold offers a broader range of benefits.

While Amex Gold Card offers statements credits and everyday spending benefits, the Venture card is cheaper and include decent travel perks.

The Venture X offers better travel rewards than the Amex Gold but is less appealing if you're looking for everyday spending rewards.

Amex Gold Card vs. Capital One Venture X : Which Premium Card Is Best?

The Freedom Unlimited beckons with its cash-back rewards, but the Amex Gold exudes luxury, boasting robust rewards on dining and groceries.

Chase Freedom Unlimited vs. Amex Gold Card: Which Card Wins?

The Amex Gold Card focuses on everyday spending rewards, while the Delta SkyMiles Platinum is tailored for frequent Delta travelers.

Amex Gold Card vs. Delta SkyMiles Platinum: Side By Side Comparison

The Hilton Honors Surpass wins at estimated cashback, while the Amex Gold card is the winner for everyday spending and extra benefits.

If you're looking for travel rewards, there is a clear winner. But what about if you're looking for rewards on everyday spending?

American Express Gold Card vs Chase Sapphire Reserve: Which Premium Card Is Best?

While the Amex gold card is best for everyday spending, the Chase sapphire preferred may be better as a travel card. Here's our comparison.

American Express Gold Card Vs. Chase Sapphire Preferred: Which Is Best?

Related Posts

Review Travel Credit Cards

Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.