Deciding between the Apple Card and the Chase Freedom Unlimited can be a tough choice for both Apple enthusiasts and savvy cashback enthusiasts.

Both cards offer enticing rewards programs, but they cater to different spending habits and financial goals. Here's a side by side comparison between them:

General Comparison

The Apple Card, introduced by Apple in partnership with Goldman Sachs, is renowned for its seamless integration with the Apple ecosystem. It offers competitive cashback rewards, particularly on Apple purchases and services.

On the other hand, the Chase Freedom Unlimited is known for its flexible rewards structure. It offers a flat-rate cashback on all purchases, along with higher rewards on travel, making it a great choice for those who prefer simplicity without the need to track spending categories. Additionally, it offers a 0% intro APR, which the Apple Card doesn't provide.

Chase Freedom Unlimited | Apple Credit Card | |

Annual Fee | $0 | $0 |

Rewards | 5% cash back on travel booked through Chase Ultimate Rewards, 3% on dining (including takeout and eligible delivery), 3% on drugstore purchases, and 1.5% on all other purchases. | 3% cash back at Apple and select Apple pay partners. 3% Daily Cash back at Ace Hardware, Duane Reade, Exxon, Mobil, Nike, Panera Bread, T-Mobile, Uber, Uber Eats, and Walgreens. 2% on other Apple pay purchases, and 1% on all other purchases |

Welcome bonus | Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening. | N/A |

0% Intro APR | 15 months on purchases and balance transfers , then 19.99 – 28.74% variable APR | N/A |

Foreign Transaction Fee | 3% | $0 |

Purchase APR | 19.99 – 28.74% variable | 15.99% – 26.99% Variable |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Simulation: Which Card Gives More Rewards?

In our analysis, we assumed all purchases were made using Apple Pay with the Apple Card.

Overall, there’s not a huge difference in cashback if your spending is focused on everyday purchases. However, if you spend more on travel, the Chase Freedom Unlimited is likely to offer higher cashback rewards compared to the Apple Card.

Spend Per Category | Chase Freedom Unlimited | Apple Credit Card |

$15,000 – U.S Supermarkets | $225 | $300 |

$5,000 – Restaurants | $150 | $100 |

$4,000 – Apple Products | $60 | $120 |

$3,000 – Airline

| $150 | $60 |

$4,000 – Gas | $60 | $40 |

Estimated Annual Cashback | $645 | $620 |

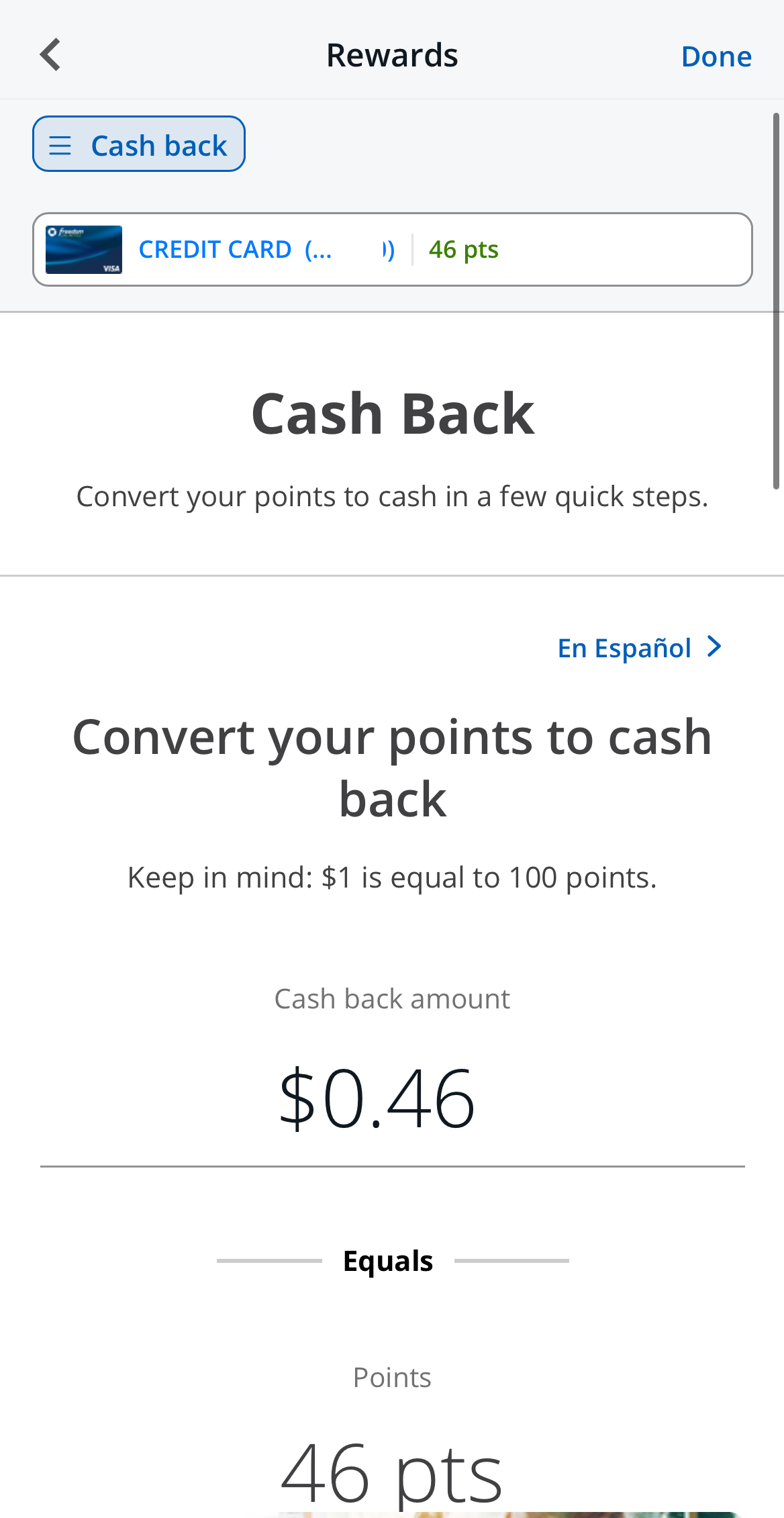

What Can You Do With Cashback And Points?

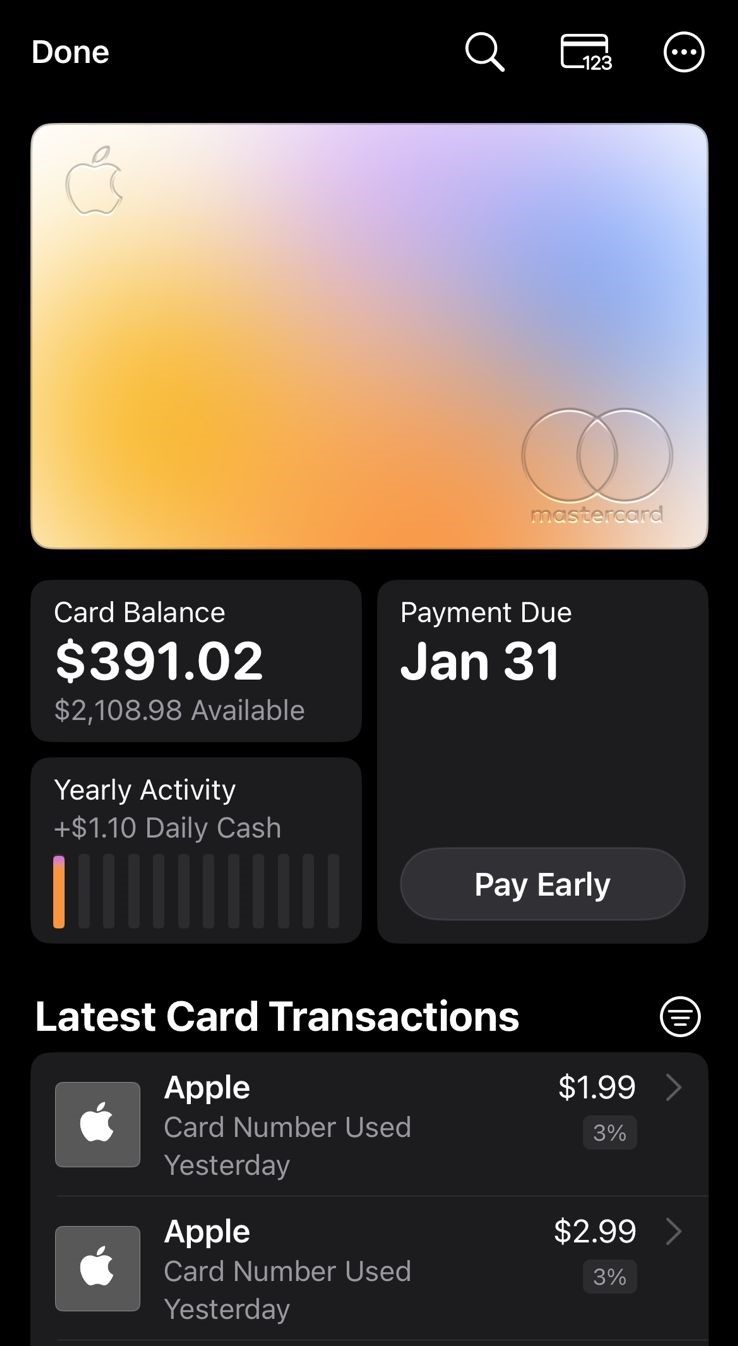

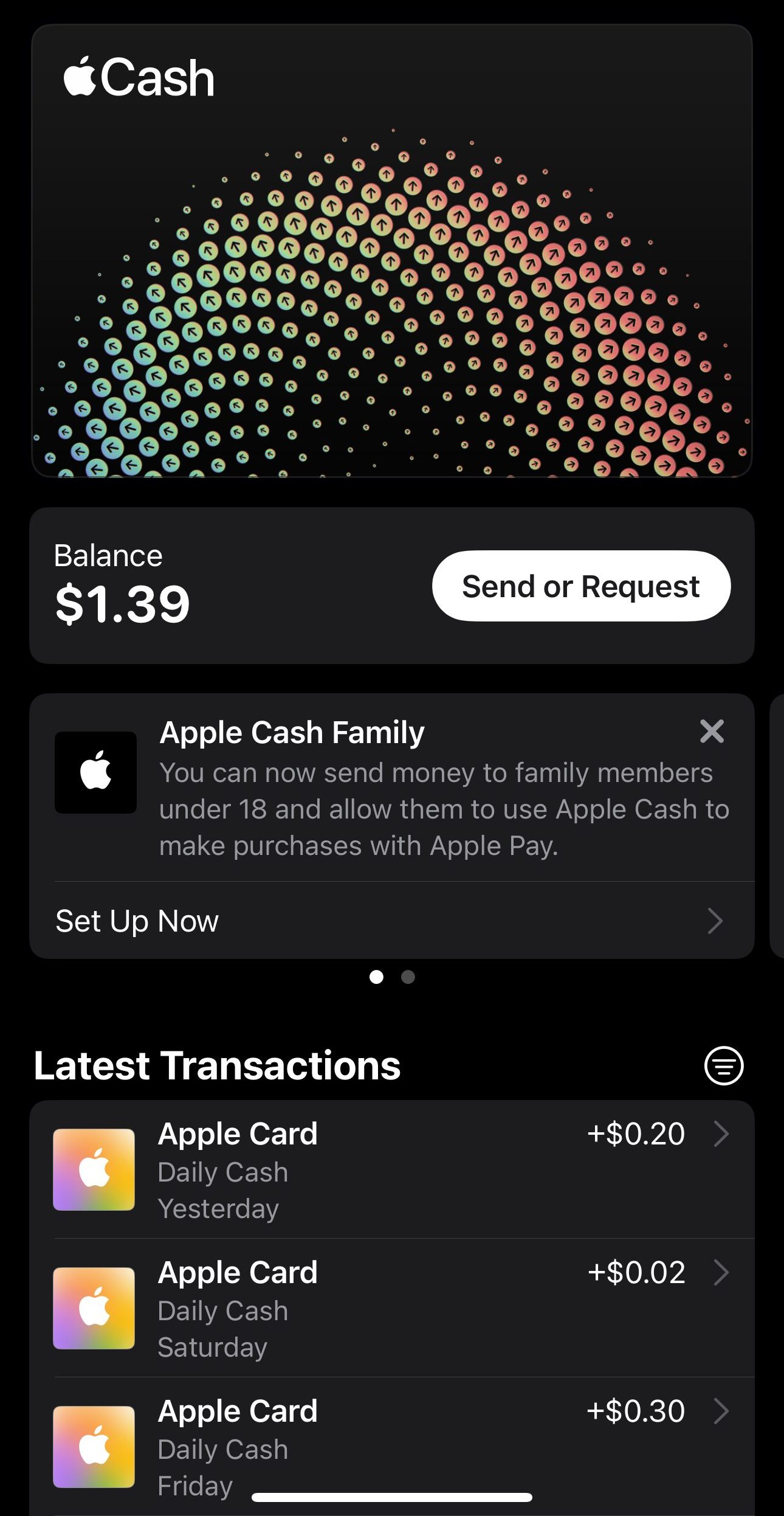

Apple Card presents a variety of flexible and rewarding options for redeeming your Daily Cash earnings. Seamlessly use your Daily Cash for Apple Pay purchases wherever accepted, ensuring a frictionless spending experience. For immediate relief and simplified finances, apply Daily Cash as a Statement Credit directly to your Apple Card balance.

Alternatively, enhance your savings growth by routing Daily Cash to your Apple Savings account, earning high-yield interest. Spread generosity by sharing Daily Cash with friends and family through Apple Pay Cash, adding a generous touch to your interactions and extending the benefits of your reward

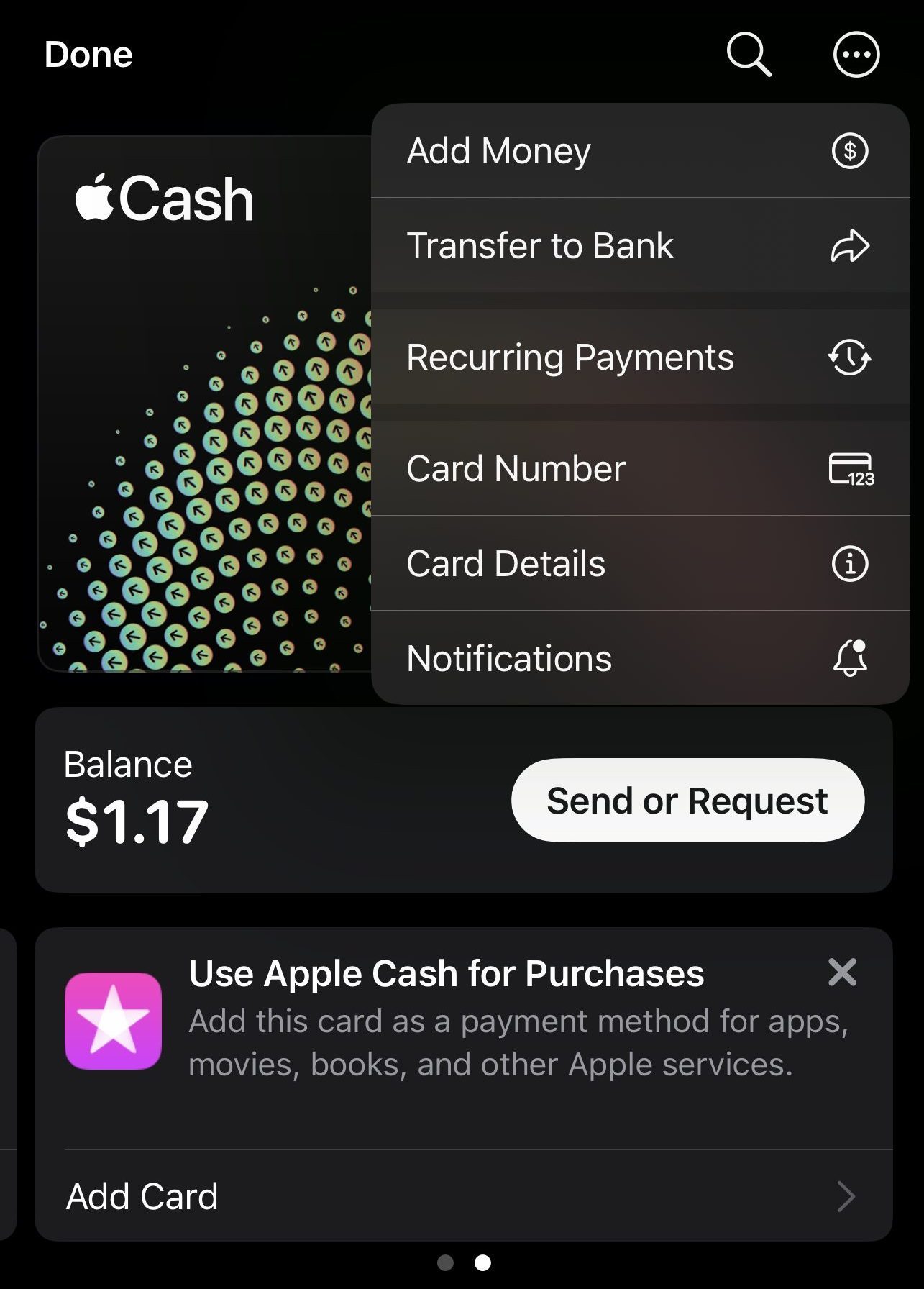

Chase Freedom Unlimited offers versatile redemption choices for its cash back rewards.

You can apply cash back as statement credits, opt for direct deposits to your bank account, redeem for gift cards, or use it for travel through the Chase Ultimate Rewards portal. Additionally, if you have other eligible Chase cards, you can transfer cash back for enhanced value when booking travel.

Another option is to link your card to Amazon and use the cash back to make purchases. This flexibility allows cardholders to tailor their redemptions to their preferences and financial needs.

Additional Benefits: Comparison

When it comes to extra benefits, the Freedom Unlimited card wins. It offers a variety of travel protections including rental car insurance, trip cancellation and a cell phone protection.

Chase Freedom Unlimited

Instacart+ Benefit: The Unlimited card provides a complimentary 3-month Instacart+ membership, offering unlimited deliveries with $0 delivery fees and reduced service fees on eligible orders.

5% Cash Back/5x Points on Lyft Rides: Both cards offer enhanced rewards for Lyft rides through March 31, 2025, giving you 5% cash back or 5x points on these purchases.

- Cellular Telephone Protection: The Unlimited card provides up to $600 in cell phone protection when you pay your monthly cell phone bill with the respective card, subject to a $25 deductible.

Purchase Protection: Both cards offer purchase protection, covering your new purchases for 120 days against damage or theft, up to $500 per claim and $50,000 per account.

Extended Warranty Protection: Both cards extend the time period of the U.S. manufacturer's warranty by an additional year on eligible warranties of three years or less.

Auto Rental Collision Damage Waiver: Both cards offer coverage for theft and collision damage when you decline the rental company's insurance and charge the entire rental cost to your card, applicable to most cars in the U.S. and abroad.

Trip Cancellation/Interruption Insurance: Both cards provide reimbursement for pre-paid, non-refundable passenger fares up to $1,500 per person and $6,000 per trip if your trip is canceled or interrupted due to covered situations.

My Chase Plan: Both cards offer the option to use My Chase Plan, allowing you to pay off eligible purchases of $100 or more in equal monthly payments with no interest, just a fixed monthly fee

Apple Credit Card

- No Fees: One of the standout benefits of the Apple Card is its fee structure. There are no annual fees, penalty fees, transaction fees, or any other hidden charges associated with the card. This transparency makes it an attractive option for those looking to avoid unnecessary costs while enjoying the benefits of a credit card.

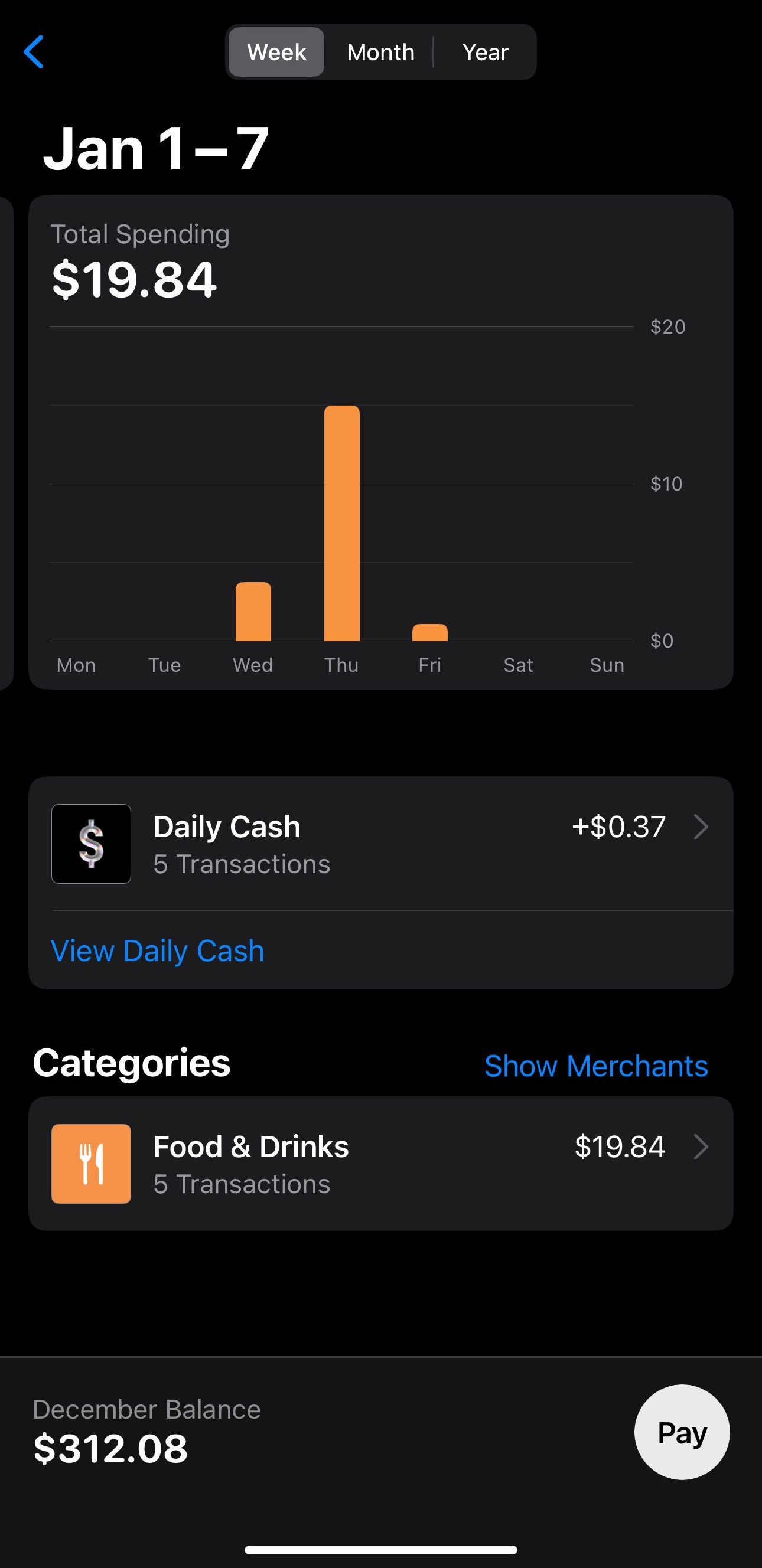

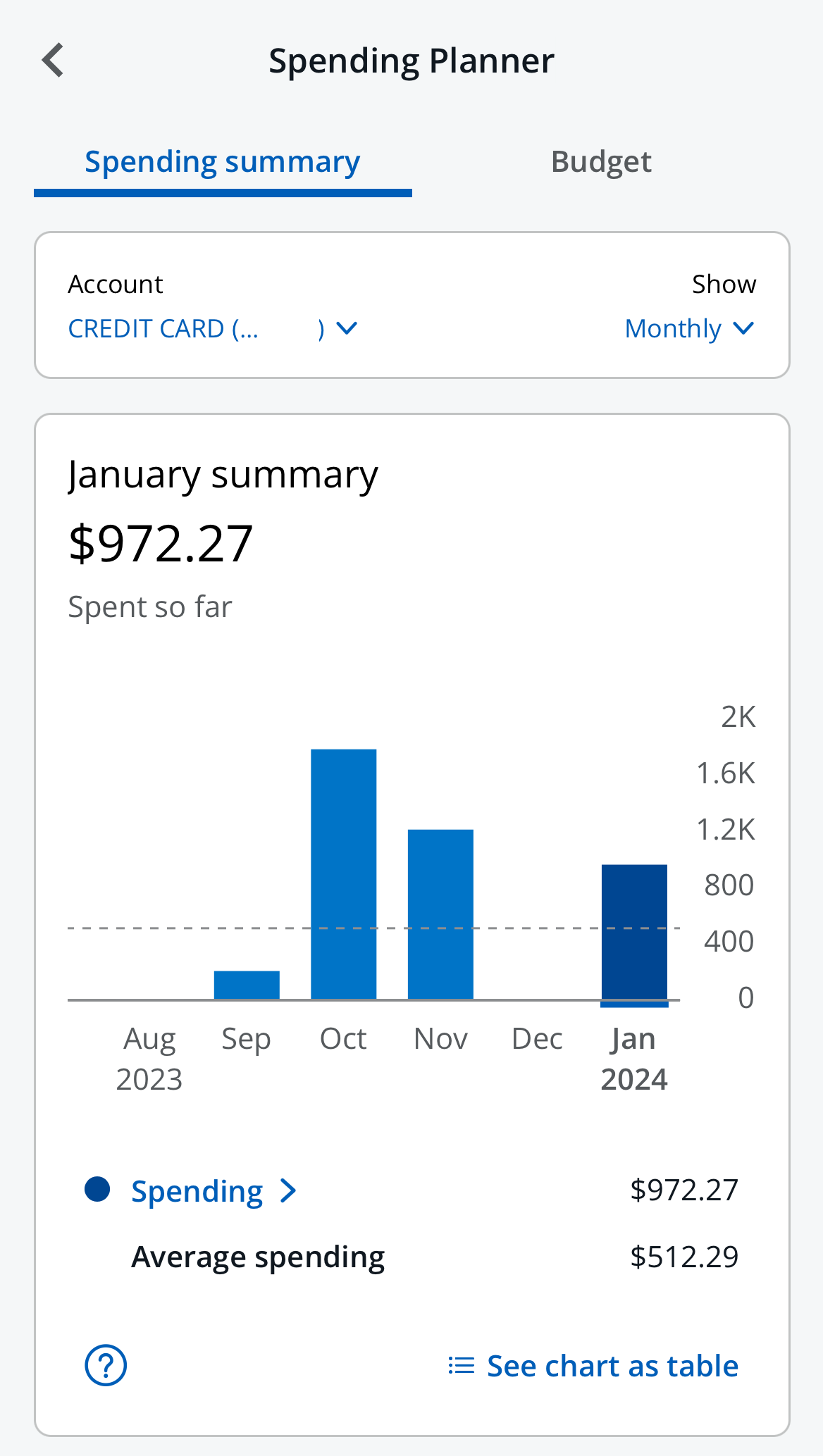

- Great Wallet App: The Apple Card provides robust tools for managing your debt and spending. The Wallet app offers a clear overview of your transactions, organizes them by category, and provides insights into your spending habits. It also offers payment suggestions to help you pay off your balance faster and more efficiently.

- Access to Apple Savings Account: cardholders can open an Apple savings account and direct Daily Cash to a Savings account.

Security: The Apple Card offers cutting-edge security features, including a unique card number for each purchase, biometric authentication (Face ID or Touch ID), and transaction alerts.

When You Might Prefer The Freedom Unlimited?

Opting for the Chase Freedom Unlimited over the Apple Card could make sense in several scenarios:

- You Need 0% Intro APR: If you're looking for a credit card with a 0% introductory APR for balance transfers or new purchases, the Chase Freedom Unlimited might be a better choice compared to the Apple Card, as it often offers such promotional periods.

- You Spend on Travel and Dining: The Chase Freedom Unlimited, with its inclusion in the Chase Ultimate Rewards program, is preferable if you frequently spend on travel and dining, offering additional flexibility and rewards in these categories.

- You Want a Welcome Bonus: If you're enticed by welcome bonuses, the Chase Freedom Unlimited often provides attractive sign-up bonuses, making it more appealing for those seeking immediate rewards when compared to the Apple Card.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Prefer to Choose The Apple Card?

You might prefer the Apple card in the following situations:

- High Spend On Apple Products: If you frequently purchase Apple products, such as iPhones, iPads, Macs, or accessories, you may prefer the Apple Card to maximize cashback in these specific categories.

- You Primarily Use Apple Pay For Your Purchases: The Apple Card is tightly integrated with Apple Pay, making it easy to use and earn cash back on your everyday purchases. You can even use your Apple Card for online purchases made through Apple Pay.

- You Want To Avoid Foreign Transaction Fees: The Apple Card does not charge foreign transaction fees, making it a good choice for travelers.

Compare The Alternatives

If you're looking for a credit card with everyday purchase rewards – there are some good alternatives you may want to consider:

| |||

|---|---|---|---|

Chase Freedom Flex℠ Card | Amazon Prime Rewards Visa Signature Card | American Express EveryDay® Card | |

Annual Fee | $0

| $0 ($139 Amazon Prime subscription required)

| $95 ($0 intro for the first year) |

Rewards |

1-5%

|

1-5%

5% back on Amazon.com, Amazon Fresh, Whole Foods Market, and Chase Travel purchases. Plus, you’ll get 2% back at gas stations, restaurants, and on local transit, and 1% on all other purchases

|

1-6%

6% cash back at U.S. supermarkets (up to $6,000 per year in purchases, then 1%) and selected U.S. streaming subscriptions, 3% cash back on transit

and U.S. gas stations, 1% cash back on other purchases

|

Welcome bonus |

$200

|

$200

Get a $150 Amazon Gift Card

|

$250

$250 statement credit after you spend $3,000 in purchases on your new Card within the first 6 months

|

Foreign Transaction Fee | 3%

| $0

| 2.70%

|

Purchase APR | 19.99% – 28.74% variable

| 19.49% – 28.24% Variable

| 20.24%-29.24% Variable |

Compare Chase Freedom Unlimited

While both cards offer great cash back rewards and considered among the best Chase cards, there are some major differences. Which is better?

Chase Freedom Flex vs Chase Freedom Unlimited: Which Card Is Best?

While both cards offer decent cash back rewards with no annual fee, there is a clear winner between the two. And here's why we think so.

American Express Everyday® Card vs Chase Freedom Unlimited®: Which Card Wins?

While both cards offer great cash back rewards and considered among the best Chase cards, there are some major differences. Which is better?

Chase Freedom Flex vs Chase Freedom Unlimited: Which Card Is Best?

The flat rate cash back on Citi Double Cash Card is higher – but usually, it may not be the best option. Here's The Smart Investor analysis.

Citi Double Cash Card vs Chase Freedom Unlimited: Which Card Wins?

The Chase Sapphire Preferred offers costs more and offer more benefits than the Freedom Unlimited. Is it worth the annual fee?

Chase Freedom Unlimited Vs. Sapphire Preferred: Compare Side By Side

The Freedom Unlimited beckons with its cash-back rewards, but the Amex Gold exudes luxury, boasting robust rewards on dining and groceries.

Chase Freedom Unlimited vs. Amex Gold Card: Which Card Wins?

The Amex Blue Cash Everyday is the winner if you need gas and grocery purchases, while the Freedom Unlimited offers better travel rewards

Amex Blue Cash Everyday vs. Chase Freedom Unlimited: Which Card Wins?

When it comes to cashback potential, the Chase Freedom Unlimited wins, especially for those who frequently engage in travel-related expenses.

Chase Freedom Unlimited vs. Citi Custom Cash Card: Which Card Wins?

The Savor card is ideal for dining out and entertainment, while the Freedom Unlimited is best for travelers and those who need 0% intro APR.

Capital One Savor vs. Chase Freedom Unlimited: Side By Side Comparison

The BofA Customized Cash Rewards is more flexible, but the Chase Unlimited card will drive more rewards and benefits. Here's why.

Bank of America Customized Cash Rewards vs Chase Freedom Unlimited: Which Card Wins?

The Active Cash card offers flat-rate cashback, while the Unlimited card is the winner for travel. Here's a side-by-side comparison

Wells Fargo Active Cash vs. Chase Freedom Unlimited: Which Card Wins?

The Costco Card is a great for Costco shoppers, gas and grocery purchases, while the Freedom Unlimited stands out for its travel benefits.

Costco Anywhere Visa Card vs Chase Freedom Unlimited: Comparison

Compare Apple Card

If you're a geek of both Amazon and Apple and not sure which card is better for your needs, we think we can help – there is a clear winner.

The Amex Gold Card may be more appealing if you dine out frequently and value premium travel perks than the Apple card.

The Costco card stands out with substantial cashback rewards on gas, dining, and Costco shopping. In which cases the Apple card may be better?

The Apple Card offers high cashback on Apple products, while the Best Buy card wins when it comes to gas and BestBuy purchases. Let's compare.