The United Explorer Card and the Delta SkyMiles® Gold American Express Card are both mid-tier airline credit cards that offer a variety of benefits to frequent travelers. Let's compare them side by side:

General Comparison

Both cards have similar annual fees and no foreign transaction fees. Each offers perks tailored to the airline they're linked to. The Delta Gold Card is ideal for earning points, while the United Explorer Card provides better bonuses for travel and airline-specific benefits.

Here’s a side-by-side comparison of the main features:

|

| |

|---|---|---|

Delta SkyMiles Gold | United Explorer | |

Annual Fee | $150, $0 intro first year. (See Rates and Fees.) | $95 ($0 first year) |

Rewards | 2X miles on delta purchases, at restaurants worldwide (including take-out and delivery in the U.S) and at U.S. supermarkets, and 1x miles on all other eligible purchases. | 2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases |

Welcome bonus | Earn 80,000 Bonus Miles after you spend $3,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Offer Ends 10/29/2025.

| Earn 60,000 bonus miles after qualifying purchases |

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | $0. See Rates and Fees. | $0 |

Purchase APR | 19.99%-28.99% Variable

| 20.24%–28.74% variable

|

Read Review | Read Review |

Points Rewards Analysis: Which Card Is Better?

If we look at how many points you can get for spending the same amount, the Delta SkyMiles Gold Card is the winner. It gives you more points for your money and offers better yearly rewards than the United Explorer card:

|

| |

|---|---|---|

Spend Per Category | Delta SkyMiles® Gold | United Explorer |

$10,000 – U.S Supermarkets | 20,000 miles | 10,000 miles |

$4,000 – Restaurants

| 8,000 miles | 8,000 miles |

$5,000 – Airline | 10,000 miles | 10,000 miles |

$4,000 – Hotels | 4,000 miles | 8,000 miles |

$4,000 – Gas | 4,000 miles | 4,000 miles |

Total Miles | 46,000 miles | 40,000 miles |

Redemption Value (Estimated) | 1 mile = ~1.3 cents

| 1 mile = ~1.2 cents

|

Estimated Annual Value | $598 | $480 |

Delta Gold Card holders can redeem miles for Delta flights, seat upgrades, and merchandise. Additionally, explore partner airlines, hotel stays, car rentals, and more. Access exclusive benefits, making the most of your Delta Gold Card rewards.

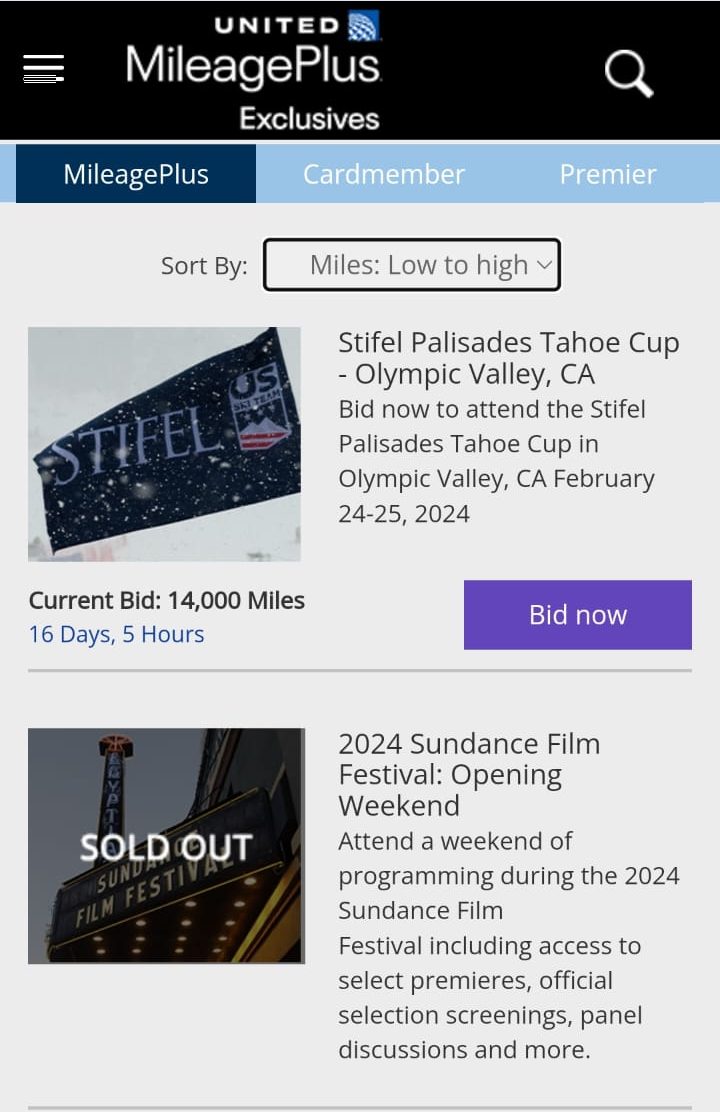

With the United Explorer Card, you can turn your miles into travel experiences. Use miles for flights with United or its partners, covering destinations worldwide. Additionally, explore options beyond flights, such as hotel stays, car rentals, and merchandise.

Airline And Travel Benefits: Comparison

When it comes to extra travel and airline perks, the United Explorer card is the winner, mainly due to the broader protections it provides as well as TSA PreCheck reimbursement:

Delta SkyMiles® Gold

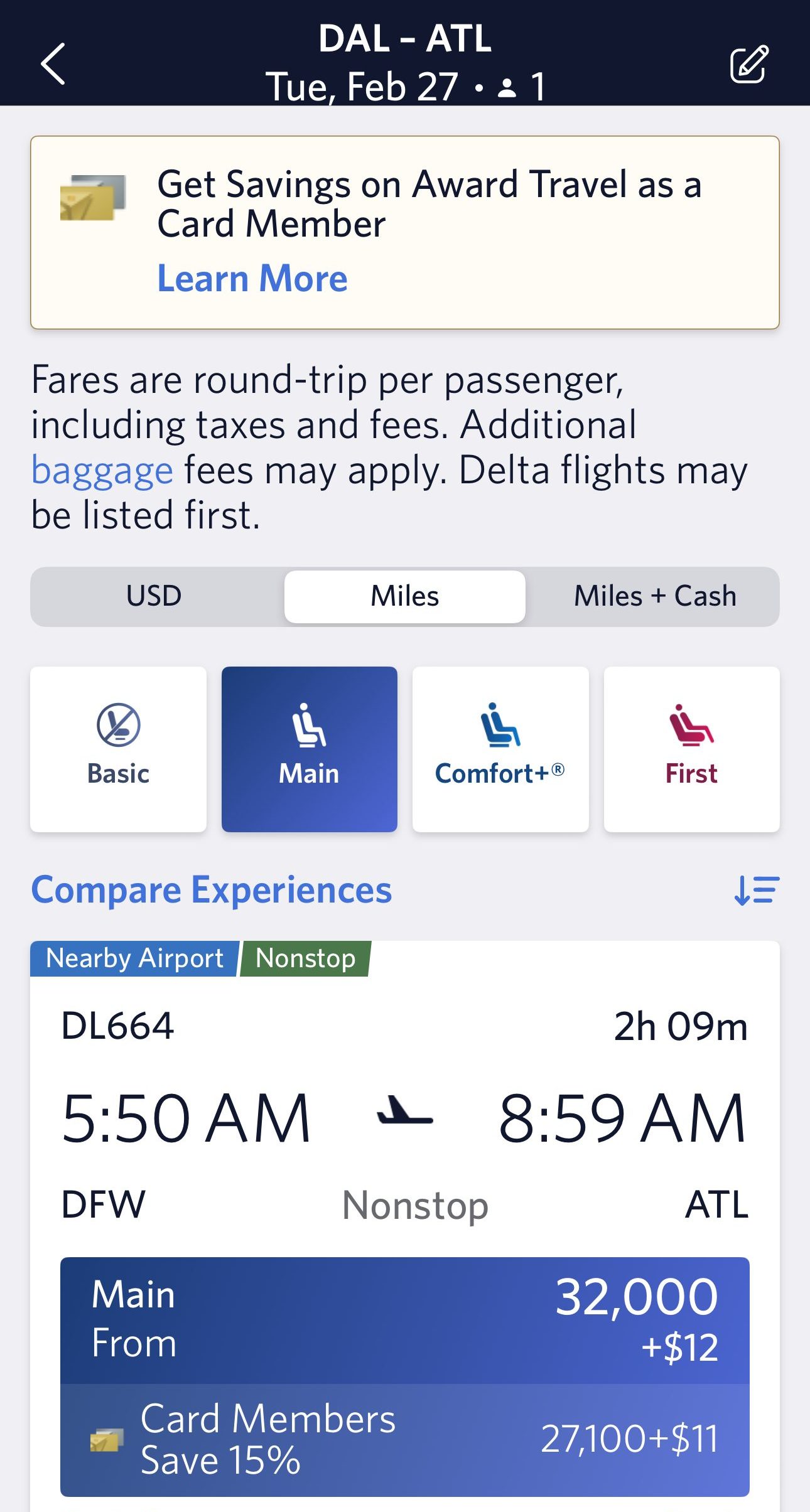

- TakeOff 15: Save 15% on Award Travel when booking Delta flights (excluding partner-operated flights and taxes/fees).

$100 Delta Stays Credit: Members of the Delta SkyMiles® Gold American Express Card are eligible to receive an annual rebate of up to $100 on qualifying prepaid Delta Stays bookings made on delta.com.

$200 Delta Flight Credit: Upon reaching $10,000 in annual purchases, cardholders can enjoy a $200 Delta Flight Credit, applicable towards upcoming travel expenses.

- First Checked Bag Free: Receive complimentary first checked bag on Delta flights.

- Pay with Miles Discount: You can receive up to $50 off the cost of your Delta flight for every 5,000 miles you redeem.

- 20% Back on In–flight Purchases: Receive a 20% statement credit on eligible Delta in-flight purchases of food and beverages.

- ShopRunner: Enjoy free 2-day shipping at 100+ online stores when you enroll in complimentary ShopRunner membership with your Delta Platinum card.

- Purchase Protection: Your card can protect eligible purchases from theft or accidental damage for up to 90 days.

- Extended Warranty: Extend the manufacturer's warranty on eligible purchases by up to one extra year when you use your card.

- Car Rental Loss and Damage Insurance: If you use your card to book and pay for a rental car and choose to decline the collision damage waiver (CDW), you’re covered for any damage or theft of the vehicle in eligible areas.

- Baggage Insurance Plan: Travel worry-free knowing your baggage is covered for loss, damage, or theft when you buy a common carrier ticket with your card.

Terms apply to American Express benefits and offers.

United Explorer

- Global Entry/TSA Precheck® Reimbursement: You can receive up to $100 as a statement credit every four years to cover the application fee for Global Entry, TSA Precheck®, or NEXUS, making your airport security process faster and more convenient.

- 25% Back on In-Flight Purchases: You'll get a 25% statement credit on purchases of food, beverages, and Wi-Fi on United-operated flights when you pay with your Explorer Card, saving you money during your travels.

- Priority Boarding: You and your companions on the same reservation can board United-operated flights before the general boarding process.

- Earn Premier Qualifying Points (PQP): You can earn PQP to help you achieve MileagePlus Premier® status, enhancing your travel experience with United Airlines.

- Free First Checked Bag: You and a companion can save up to $140 per roundtrip by receiving a free checked bag when flying with United, reducing your travel expenses.

- Auto Rental Collision Damage Waiver: Decline the rental company's collision insurance and charge the entire rental cost to your card. This provides primary insurance coverage for theft and collision damage for most rental cars in the U.S. and abroad.

- Trip Cancellation/Interruption Insurance: You can be reimbursed for pre-paid, non-refundable passenger fares if your trip is canceled or cut short due to covered situations like sickness or severe weather.

- Trip Delay Reimbursement: If your common carrier travel is delayed over 12 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging.

- Visa Concierge: Enjoy complimentary access to Visa Signature® Concierge Service 24/7, helping you find tickets to events, make dinner reservations, and more.

Purchase Protection: Provides coverage for new purchases against damage or theft for 120 days.

Baggage Delay Insurance: Reimburses essential purchases like toiletries and clothing for baggage delays exceeding 6 hours by a passenger carrier.

Lost Luggage Reimbursement: Offers coverage for damaged or lost luggage when checked or carried on by you or an immediate family member.

When You Might Prefer The Delta SkyMiles Gold?

You might prefer the Delta SkyMiles Gold card in the following situations:

Dedicated Delta and SkyTeam Traveler: If you frequently fly with Delta Air Lines or other carriers within the SkyTeam alliance, the Delta SkyMiles Gold card is a better choice. It aligns with the perks and benefits of this specific alliance, optimizing your travel experience within its network.

Better Points Rewards Ratio: According to our analysis, the Delta Gold card offers more miles for the same spend, so if you're focused on accumulating miles, it may be a better card, depending on your spending habits.

When You Might Prefer The United Explorer?

You might prefer the United Explorer in the following situations:

You Fly United Most Often: If you fly United most often, then the United Explorer Card is a good option for you because you will earn double miles on all United purchases, including flights, vacation packages, and MileagePlus Club memberships. This will help you rack up miles quickly and redeem them for rewards faster.

You Want Better Travel Insurance And Coverage: The United Explorer offers trip cancellation insurance and trip delay reimbursement, as well as other travel perks that are not included in the Delta Gold card.

Frequent Star Alliance Travelers: If you often fly with airlines within the Star Alliance network, including United Airlines and its partners, the United Explorer card is preferable

Compare The Alternatives

If you're looking for an airline credit card with travel rewards – there are some good alternatives you may want to consider:

|

|

| |

|---|---|---|---|

The JetBlue Plus Card | Southwest Rapid Rewards® Premier Credit Card | Citi/AAdvantage Platinum Select World Elite | |

Annual Fee | $99 | $99 | $99 (waived for the first 12 months)

|

Rewards | 1X – 6X

6X points on JetBlue purchases, 2X points at restaurants and grocery stores and 1X points on all other purchases

| 1X – 3X

3X points on Southwest® purchases,2X on Rapid Rewards® hotel and car partners, local transit and commuting, including rideshare, internet, cable, phone services, and select streaming and 1X points on all other purchases.

|

1X – 2X

Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases and 1 AAdvantage® mile for every $1 spent on other purchases. Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases.

|

Welcome bonus | 50,000 points

50,000 bonus points after spending $1,000 on purchases and paying the annual fee in full, both within the first 90 days

| 50,000 points

50,000 bonus points after you spend $1,000 in the first 3 months from account opening.

|

50,000 miles

50,000 American Airlines AAdvantage® bonus miles after spending $2,500 in purchases within the first 3 months of account opening.

|

Foreign Transaction Fee | $0 | $0 | $0 |

Purchase APR | 19.99% to 29.99% variable

| 19.74%–28.24% variable

| 19.99% – 29.99% (Variable)

|

Compare United Explorer Card

The United Gateway and Explorer are two co-branded credit cards offered by Chase in partnership with United Airlines. Here's our winner.

The Quest card has recently launched in order to provide a premium alternative to the old Explorer card. How they compared & is it worth it?

United℠ Explorer Card vs United Quest℠ Card: Which is Better?

In this comparison, we will delve into the key features, benefits, and considerations of both the United Explorer and Infinite Card.

The Chase Sapphire Preferred is more versatile and offers better travel rewards than the Explorer card. But what if you're loyal to United?

United Explorer Card vs Chase Sapphire Preferred: Side By Side Comparison

The United Explorer and the Southwest Premier card have numerous shared features. Let's explore the distinctive strengths of each card.

Southwest Rapid Rewards Premier vs. United Explorer: Comparison

While the AAdvantage Platinum Select and the United Explorer Card have many common features, the Explorer card is our winner. Here's why.

Citi/AAdvantage Platinum Select vs. United Explorer: How They Compare?

The Alaska Visa offers higher annual cashback value than United Explorer, but the latter takes the lead when it comes to airline perks.

Alaska Visa Signature vs United Explorer: Side By Side Comparison

Compare Delta SkyMiles Gold Card

The Delta SkyMiles Gold offers higher annual cashback and better perks than the Delta Blue card. But is it worth the annual fee? It depends.

Delta SkyMiles Blue vs Delta SkyMiles Gold: How They Compare?

The Delta SkyMiles Platinum is more expensive but offers more premium benefits than the Delta Gold. Here's our complete comparison.

If you're looking for airline travel rewards, there is a clear winner. But what about other premium travel benefits? Here's our comparison.

Delta SkyMiles Gold vs Southwest Rapid Rewards Priority: Which Gives You More?

If you're a dedicated Delta traveler, the Delta SkyMiles Gold may be your top pick, while the Amex Gold offers a broader range of benefits.

The Delta SkyMiles Platinum is more expensive but offers more premium benefits than the Delta Gold. Here's our complete comparison.

While the Delta SkyMiles Gold extra perks are better, the JetBlue Plus Card is our winner in this comparison due to its higher cashback value.

The JetBlue Plus Card vs Delta SkyMiles Gold: Side By Side Comparison

The Delta Gold and AAdvantage Platinum Select offer similar cashback value, but the Delta card is the winner due to its diverse travel perks.

Delta SkyMiles Gold vs. Citi/ AAdvantage Platinum Select: Which Card Wins?

While Alaska Visa Signature card offers higher miles rewards ratio on airline, the Delta SkyMiles Gold is our winner. Here's why.

Alaska Visa Signature vs Delta SkyMiles Gold: Side By Side Comparison

Both Hawaiian and Delta SkyMiles Gold have similar annual cashback values and diverse airline benefits, so there is no clear winner.

Hawaiian World Elite Mastercard vs. Delta SkyMiles Gold: Side By Side Comparison