Table of Content

Depending on your specific card, Chase has many rewards and points available to you. Many people choose to use the Chase Sapphire Reserve card because of the spending rewards, amazing travel perks, travel credits that can add up to hundreds of dollars of savings, and more.

You pay an annual fee of $550 for this card, so you need to make sure you are maximizing the benefits in any way you can.

Here are ten ways you can quickly get the most out of your card.

1. Make Sure to Get the Sign-Up Bonus

Getting approved for the Reserve card may be challenging, but if you meet the requirements– you qualify for a nice sign-up bonus.

Chase Reserve sign-up bonus includes 100,000 points + $500 Chase Travel℠ promo credit After you spend $5,000 in purchases in the first 3 months from account opening) but a lower sign-up bonus compared to the Reserve card – 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

Maximize your purchases on the card while ensuring you can pay off the balance each month. Focus on spending in the dining and travel categories to earn bonus points. Just keep in mind that balance transfers won’t count toward your rewards.

Chase Sapphire Reserve®

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

On Chase Secure Website

2. Use Your Travel Credits

Since the Chase Sapphire Reserve Card is not associated with a specific airline or hotel, you can use the $300 annual credit towards any hotel or airline you want to travel with.

Since the annual fee is $550, you need to make sure you use the travel credit every year to help you make some of the money back. This is a very high credit compared to other premium cards, such as the Platinum Card from American Express, which offers an annual statement credit for up to $200 in airline incidental fees.

If the credit is unused, it doesn’t roll over to the new year, so make sure to find a way to use it before your card’s anniversary expires. The credit will automatically apply if you use it for travel, and you will even be able to get triple points on certain travel opportunities.

3. Transfer Points to Get More Value

While this might not offer the best value overall, it could be a better fit if you prefer a specific airline or hotel loyalty program. There may also be times, like during special promotions or certain times of the year, when you can get more value from this option.

You can transfer your Chase Ultimate Rewards to one of the partner airlines or hotels that work with Chase. For example, if you find a $500 flight on Air France for 25,000 points, you can use the 25,000 points that you have with Chase to purchase the flight. This keeps you from having to earn points with several different airlines to save money on flying.

Some partner airlines of Chase include Air France/KLM, Iberia, Southwest, United, Emirates, Iberia, and Aer Lingus, and British Airways. Hotel options include Hyatt, Marriott Bonvoy, and Intercontinental Hotels Group. Overall, Chase offers an extensive network compared to other credit cards portals such as the Capital One travel or Citi ThankYou program.

4. Try Not to Use Other Redemption Options

While it's considered one of the top travel cards, Chase does not offer many different redemption offers, and many of them are not as lucrative as redeeming all the credit you have for travel. For example, some redemption offers to include getting a statement credit or an automatic electronic deposit into your checking account.

While this might seem like a good idea if you are hard strapped for cash or need to lower your balance, it will not give you the same amount of perks as redeeming the same credit for travel.

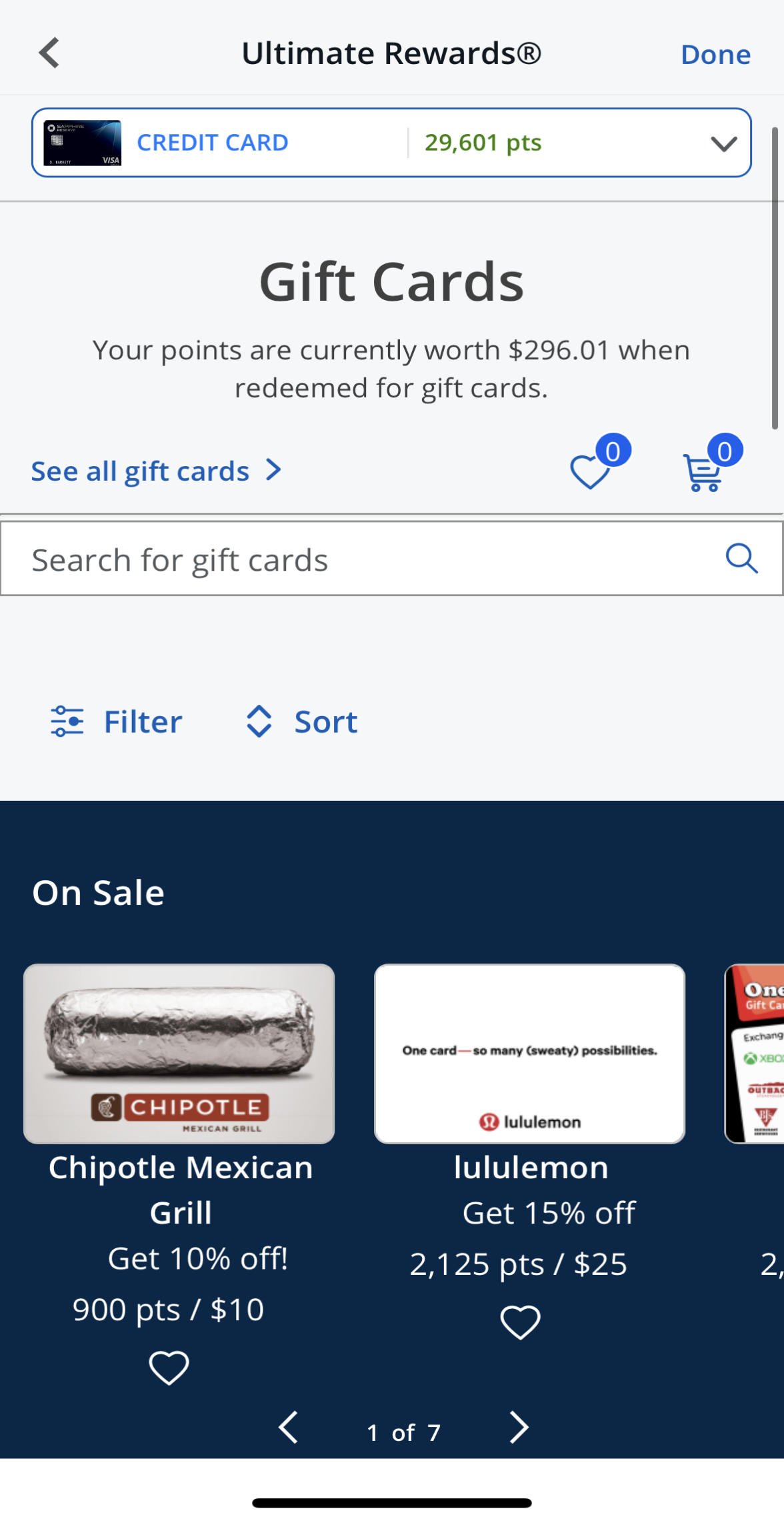

Try not to go for the gift cards either unless they are offered a discount or promotion. Otherwise, your points are only worth a penny each. Having a gift card might seem like a good plan, but you won’t earn enough money to travel or go on a vacation.

Consider not using points for Amazon shopping either. Points are only worth 0.8 cents each. This is not a good deal at all even though you might feel like you are getting free things from Amazon.

Sign Up for

Our Newsletter

and special member-only perks.

Sign Up for

Our Newsletter

and special member-only perks.

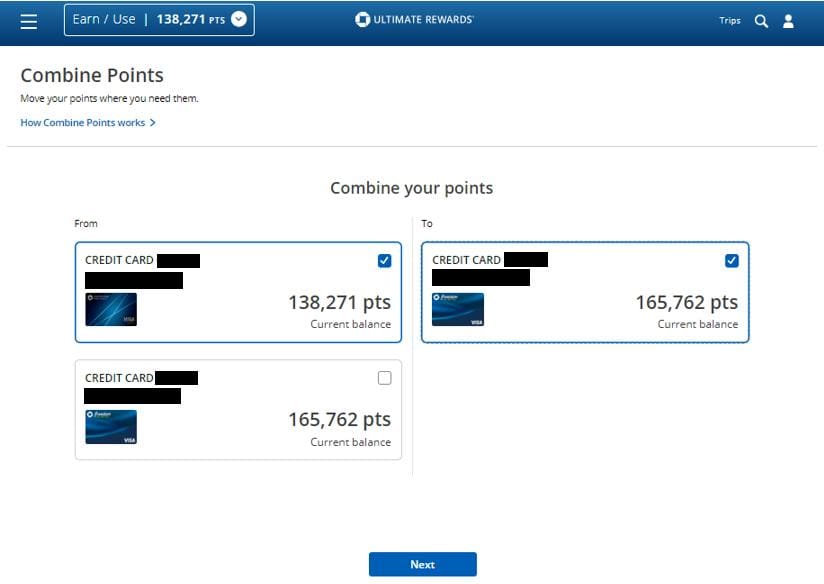

5. Combine the Offers with Another Chase Card

With the Chase Sapphire Reserve card, you have ample opportunity to earn Chase Ultimate Rewards. If you combine the offers and rewards with another Chase card though, you’ll find yourself getting even more points and rewards.

There are two other options from Chase that give you Chase Ultimate Rewards Points including the Chase Freedom Flex and the Chase Freedom Unlimited. These cards are advertised as cashback cards, but you can still earn reward points and transfer them to the Chase Sapphire Reserve.

The Chase Freedom Flex earns .

Chase Freedom Unlimited earns 55% cash back on travel booked through Chase Ultimate Rewards, 3% on dining (including takeout and eligible delivery), 3% on drugstore purchases, and 1.5% on all other purchases.

6. Get as Many Reward Points as You Can

With the Chase Sapphire Reserve Card, earning as many reward points as possible is the key. The easiest way to earn points is to spend most of your money on travel and restaurants. For every $1 spent you get 3 Chase Ultimate Rewards points. If you book through Chase Ultimate Rewards, you get even more points.

You’ll earn 5 points for every dollar spent on travel and 10 points for hotels, dining, and car rentals. Remember that the triple points don’t just mean airfare and hotels. Other qualifying purchases include train fares, taxi rides, and fees you might pay for parking garages or parking lots.

Dining points also include fast food and fast-casual, so every time you eat out you need to hand the worker your Chase Sapphire Reserve card. You can also earn points on Lyft rides.

However, there are no a lot of rewards on everyday spending compared to the Amex Gold card, for example, which offers 4X points at restaurants (including Uber Eats purchases in the U.S.) and U.S. supermarkets (up to $25,000 per year in purchases, then 1X points), 3X points on flights booked directly with airlines or on amextravel.com, 2X points on rental cars through amextravel.com and 1X points on all other purchases.

Top Offers

Top Offers From Our Partners

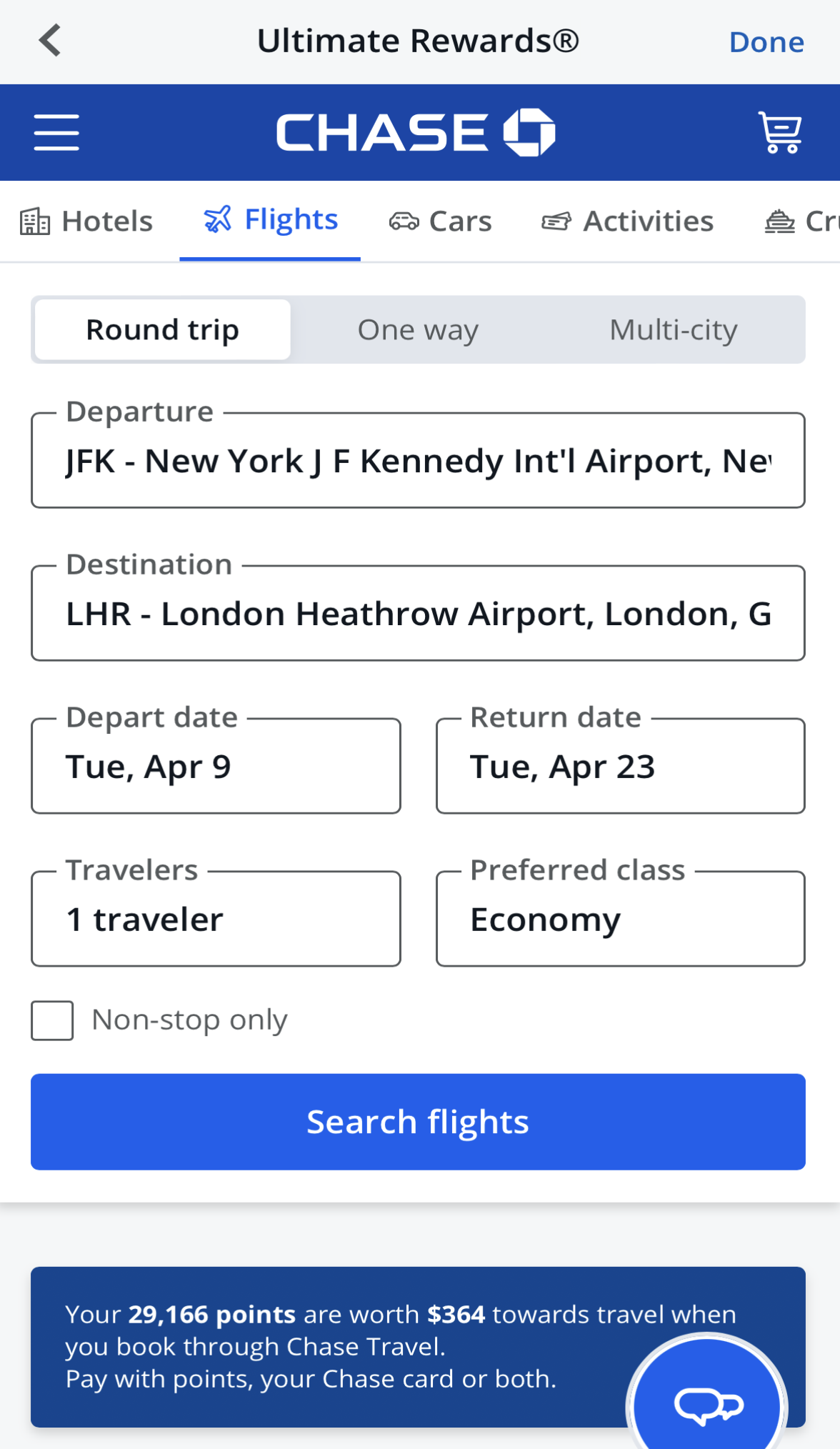

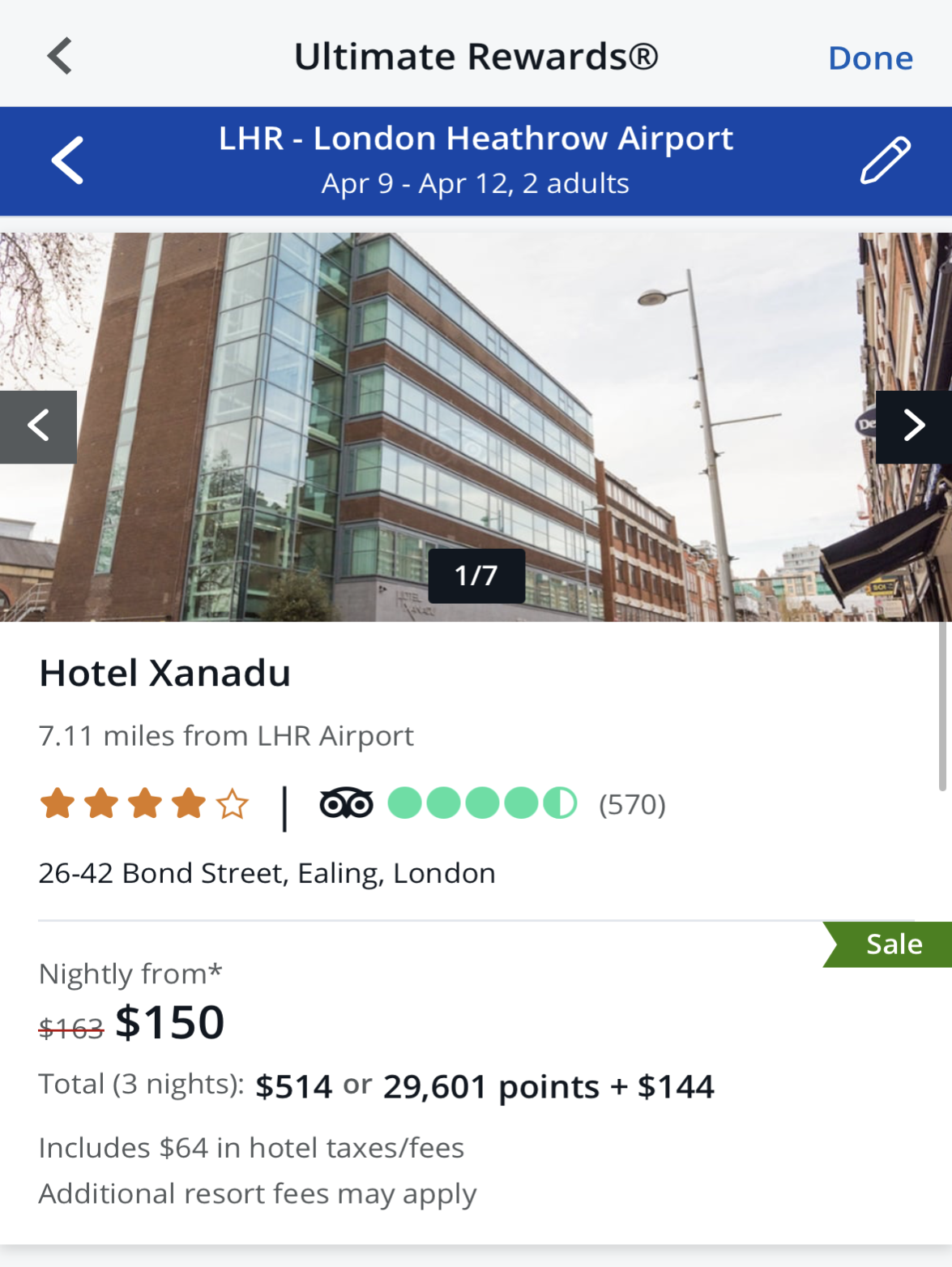

7. Redeem Your Travel Points Through Chase Directly

Similar to other portals, such as the Amex membership rewards, you can use your rewards points through gift cards or cashback or redeem them for travel. Redeeming them through travel is often the most beneficial option, especially if you plan a long-haul trip or need to book an extended stay at a hotel. Points for travel are worth 1.5 cents each which is 50% more than their cash value.

So, when you use your travel reward points, you get 3% to 4.5% of your money back rather than just a gift card or cashback. When you book through Chase, you also don’t have any blackout dates like you would if you were directly spending points through the airlines.

If you earn the sign-up bonus and use your points to book travel, you’ve already covered your high annual fee to use the card for at least one year. This should make you feel better about paying a hefty fee for a card.

8. Take Advantage of Food Delivery Perks

Chase has now had a partnership with DoorDash since January 2020. This means Chase Sapphire Reserve cardholders will get a $60 DoorDash credit. This works the same as the travel credit. Every time you spend money at Door Dash, you will automatically get reimbursed until you have reached $60. You can use it all at one time or on several different transactions. Whatever works for you.

You also get a free DashPass subscription. This means you will never pay to deliver fees over orders that are over $12. You still have the service fees though and you still need to tip the driver. Delivery fees are pretty steep though especially if you are far away from the restaurant you are ordering from.

This means you will save $4 or $5 every time you order food. It might not seem like too much at first, but if you order food even a few times a week, you will be saving beaucoup bucks.

9. Use Other Travel Perks

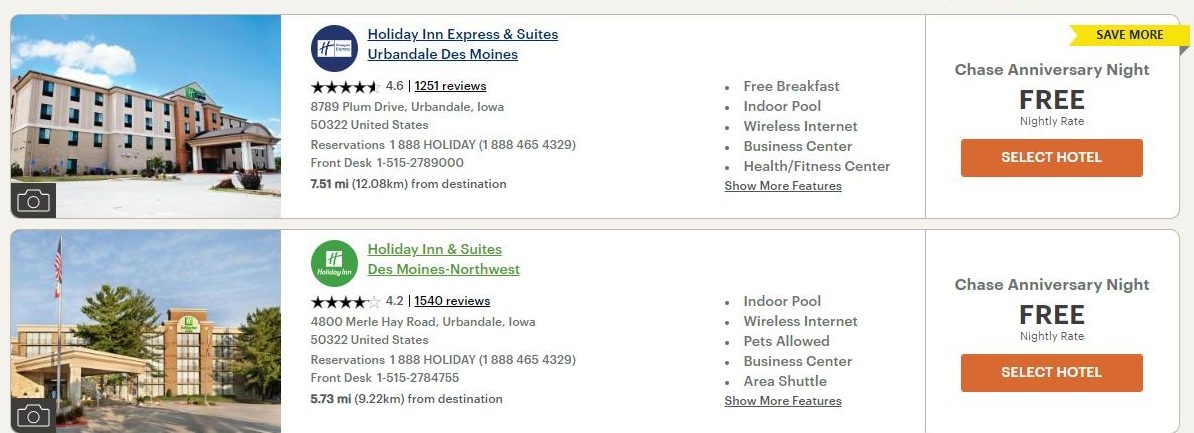

The Chase Sapphire Reserve card has more travel perks than just travel reimbursement. When you sign up for the Priority Pass Select, you get free lounge access to more than 1,000 lounges worldwide. You can also get more hotel perks if you sign up for the Luxury Hotel and Resort Collection Program.

These benefits include free room upgrades, free breakfast, and late or early check-in. If you book more than 3 nights, you will get the fourth one for free as well as a $30 hotel credit. It's pretty similar to the most attractive hotel credit cards available.

10. Leverage International Travel Perks

Along with basic travel perks, you also get special international travel perks. The card automatically has travel assistance and concierge service along with no foreign transaction fees and travel and purchase protection. Keep in mind that you might still face cash back fees when it comes to using the card at international ATMs.

The Reserve card is also one of the top cards for Global Entry or TSA precheck since it provides a credit of up to $100. If you have Global Entry, you will be able to have the membership for 5 years. You are also eligible for reimbursement every time you renew if you still have the Chase card and have paid the annual fee.

To be reimbursed, you need to charge the fee to your Chase Sapphire Reserve card. Make sure not to use another card. This allows you to enter back into the United States without having to wait in the long immigration lines.

Top Offers

Top Offers

Top Offers From Our Partners

FAQ

When it's better to skip the Chase Reserve card?

In case you don't travel frequently or don't want to pay the high annual fee. People who travel frequently can earn some fantastic rewards from this card

How difficult is it to obtain a Sapphire Reserve card?

This card is more difficult to obtain than some of the other Chase credit cards. However, if you have a credit score of at least 720, you will have a good chance of approval.

How do I use my Sapphire Reserve card to get cash back?

Through the Chase credit card reward portal, you can redeem your points in a variety of ways. Cash, travel credit, statement credit, and gift cards are among the benefits available.

What types of purchases do not qualify for cash back

With this card, you will receive cashback on all purchases. This means that it can be convenient and predictable when used for everyday purchases.

Should You Upgrade to the Sapphire Reserve Card?

If you travel frequently, this is an excellent choice. It provides a plethora of fantastic travel-related rewards that can enhance your road trip experience.

Can I get pre-approved?

Yes, you can get pre-approved for the Reserve card This allows you to avoid a hard credit check only to find out that you are not able to qualify for this card.