Choosing between the American Express® Gold Card and Capital One Venture X is like picking between two gems in the credit card world.

The Amex Gold Card flaunts its golden perks with lucrative rewards on dining and groceries, coupled with statement credits and travel benefits. Meanwhile, the Capital One Venture X shines bright with versatile travel rewards, airport lounge access, and a sleek metal design.

Amex Gold vs. Venture X: General Comparison

The Venture X card, a luxury travel companion, outshines the Amex Gold card with superior points rewards and premium travel perks.

While it may offer fewer rewards, the Amex Gold card allure is a more budget-friendly annual fee, making it a sensible choice for those seeking a balance between good travel and everyday spending benefits, as well as an access to Amex membership benefits.

|

| |

|---|---|---|

Capital One Venture X | Amex Gold Card | |

Annual Fee | $395 | $325. See Rates and Fees. |

Rewards | 10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases | 4X points at restaurants (including Uber Eats purchases in the U.S.) and U.S. supermarkets (up to $25,000 per year in purchases, then 1X points), 3X points on flights booked directly with airlines or on amextravel.com, 2X points on rental cars through amextravel.com and 1X points on all other purchases. Terms Apply. |

Welcome bonus | 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening | 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. |

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | $0 | None. See Rates and Fees. |

Purchase APR | 19.99% – 29.74% (Variable) | See Pay Over Time APR |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Credit Card Points Battle: A Side-by-Side Analysis

Although the annual fees vary, the difference in point rewards earnings is minimal, especially when focusing on everyday purchases where the gap becomes smaller.

The Venture X card excels with a higher rewards rate for flights and hotels, while the Gold card offers consistent rewards across other spending categories.

|

| |

|---|---|---|

Spend Per Category | Capital One Venture X | Amex Gold Card |

$15,000 – U.S Supermarkets | 30,000 miles | 60,000 points |

$5,000 – Restaurants

| 10,000 miles | 20,000 points |

$5,000 – Airline | 25,000 miles | 15,000 points |

$5,000 – Hotels | 50,000 miles | 5,000 points |

$4,000 – Gas | 8,000 miles | 4,000 points |

Estimated Annual Value | 123,000 miles (About $1,230) | 104,000 points (About $624 – $1,664) |

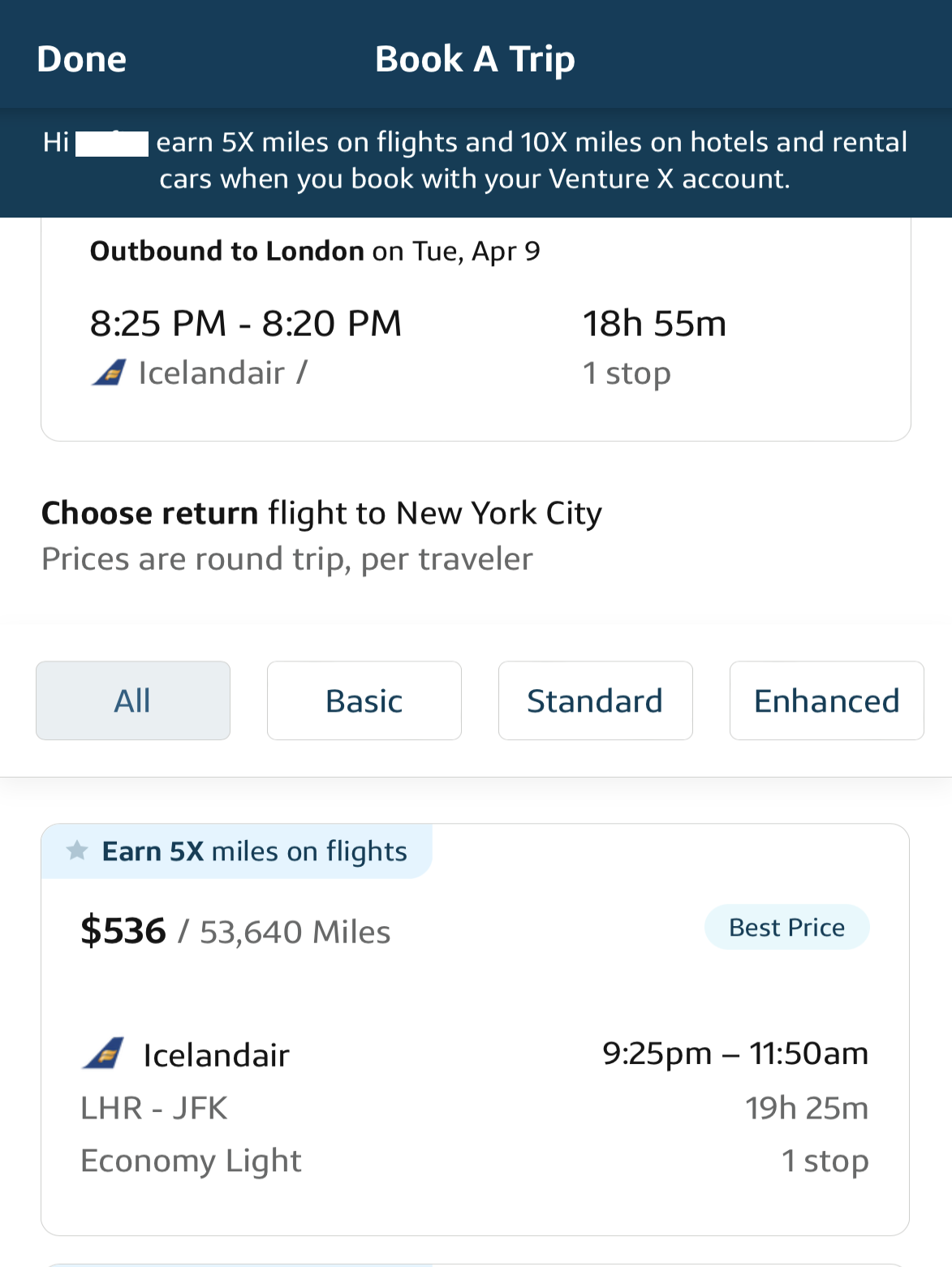

Miles you earn can be redeemed on travelon Chase Ultimate Rewards or Capital One Travel. For example, here's how to book a trip with miles on with the Capital One Venture X:

Additional Benefits: Amex Gold vs. Venture X

In addition to bonus points and welcome bonuses, both cards offer a range of extra perks. Cardholders can indulge in travel and insurance benefits that come with these enticing cards.

Capital One Venture X

- Capital One Dining and Entertainment: Enjoy exclusive reservations at award-winning restaurants and access to culinary experiences, as well as exclusive pre-sales, tickets, and more for music, sports, and dining events.

- Capital One Lounges: Cardholders can escape airport crowds by accessing all-inclusive Lounges with unlimited complimentary access for themselves and two guests per visit.

- Hertz Gold Plus Rewards President's Circle® status: Venture X cardholders are eligible for complimentary Hertz President’s Circle status, allowing them to skip the rental counter, choose from a wide selection of cars, and receive guaranteed upgrades.

- Global Entry or TSA PreCheck® Credit: Receive up to a $100 credit for Global Entry or TSA PreCheck®.

- Partner Lounge Network: Enjoy unlimited access for yourself and two guests to over 1,300 lounges worldwide from Priority Pass™ and Plaza Premium Group.

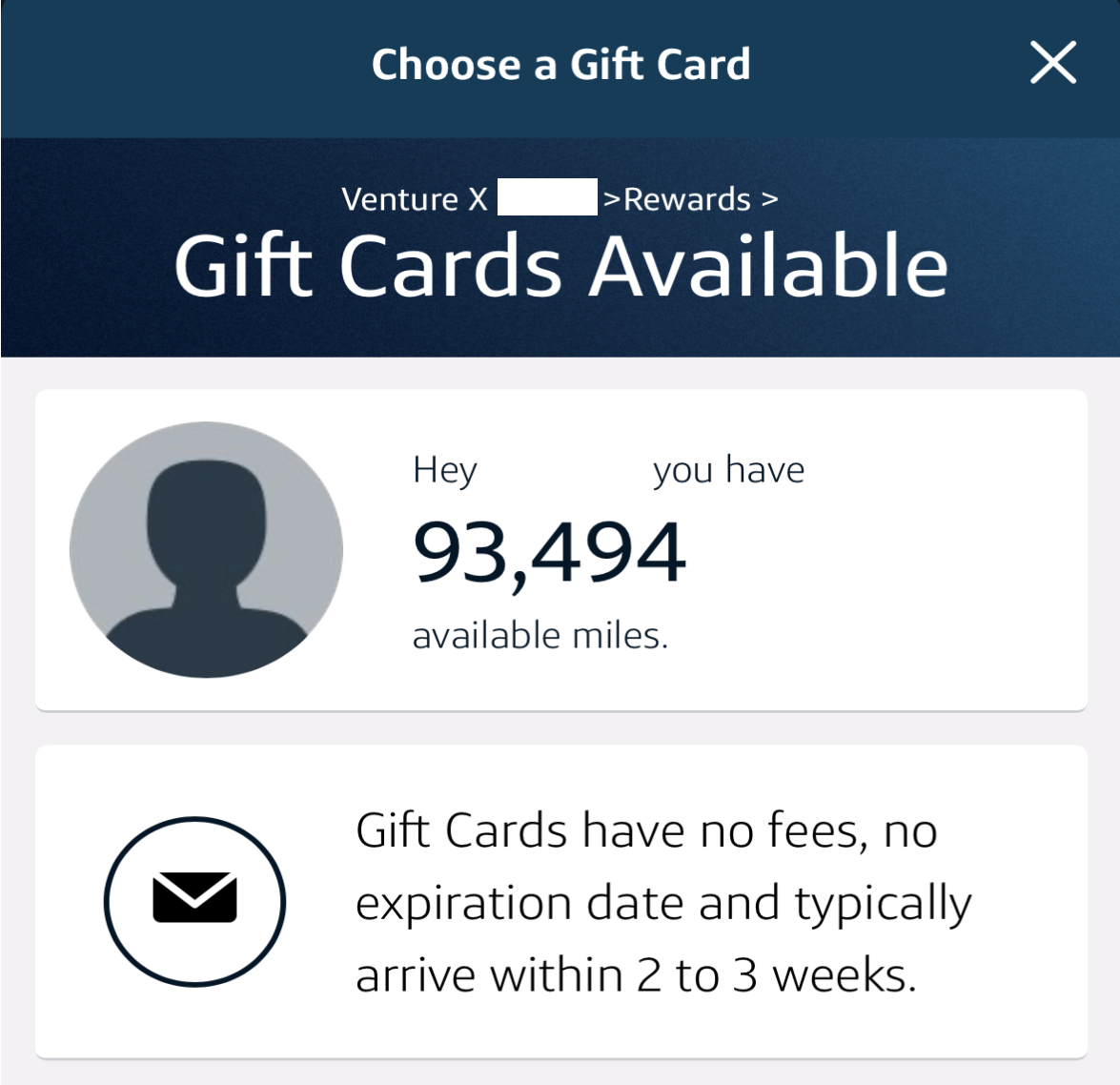

- Miles Redemption: Use your Capital One miles to cover various travel expenses, such as flights, hotels, rental cars, and transfer miles to a choice of 15+ travel loyalty programs. You can also add insurance with miles:

- Auto Rental Collision Damage Waiver: Enjoy primary coverage against theft and collision damage for most rental cars globally, provided you opt out of the rental company's insurance. Reimbursement extends up to the actual cash value of the vehicle.

- Annual Travel Credit: Get a $300 annual credit for bookings through Capital One Travel, offering competitive prices on a wide range of travel options.

- Premier Collection: With the Capital One Venture X card, you can enjoy a $100 experience credit, daily breakfast for two, and premium benefits, along with earning 10X miles on hotel stays booked through Capital One Travel.

- Complimentary PRIOR Subscription: Cardholders receive a complimentary PRIOR Subscription worth $149, offering access to extraordinary travel experiences and destination guides.

- Free Additional Cardholders: Add cardholders to your account for free, allowing them to enjoy benefits while you earn rewards on their spending.

- 10,000 Miles Anniversary Bonus: Cardholders receive 10,000 bonus miles (equal to $100 towards travel) every year, starting on their first anniversary.

- Visa Infinite concierge: A Visa Infinite concierge will help make the reservation and more, like line up live stage shows, music or sporting event tickets.

- Referrals Bonus: Refer friends and family to apply for a Venture X card and earn up to 100,000 bonus miles when they're approved.

- Lifestyle Collection: Unlock premium benefits with every hotel stay, including a $50 experience credit, room upgrades when available, and earning 10X miles on hotel stays booked through Capital One Travel.

American Express Gold Card

- Up to $120 Uber Credit: Link your new Gold Card to your Uber account to enjoy an automatic monthly Uber Cash credit of $10, which can be used for Uber rides or UberEats orders, up to a maximum annual value of $120.

- Up to $120 Dining Credit: When you use your Amex Gold Card to pay for dining out at select establishments, including The Cheesecake Factory, Wine.com, Goldbelly, Shake Shack, and Milk Bar locations, you can receive up to $10 in statement credit per month.

- Baggage Insurance: When you purchase your entire fare for a Common Carrier Vehicle using your Gold card, you are eligible for baggage insurance. This coverage provides up to $500 for checked bags and $1,250 for carry-on bags in case they are stolen, lost, or damaged (with certain limitations in New York State).

- Entertainment Benefits: Enjoy exclusive experiences and presale tickets for concerts, sports events, and theater performances through the American Express® Gold Card Entertainment Access program, though availability may vary.

- $100 Experience Credit: Enjoy a $100 experience credit when you book The Hotel Collection through American Express Travel for a getaway of at least two nights. The value of the experience credit may vary based on your chosen property.

- Global Entry or TSA PreCheck® Credit: Unlock smoother travels with a credit of up to $100 for Global Entry or up to $85 for TSA PreCheck.

- Car Rental Coverage: When you use your Gold Card to reserve and pay for your entire car rental, you can decline the rental company's collision damage waiver. This coverage protects against theft and damage to the rental vehicle in eligible locations, though certain restrictions and exclusions may apply.

Luxury hotel perks: Access the American Express Fine Hotels & Resorts program as a cardholder, unlocking benefits like room upgrades, complimentary nights, and daily breakfast for two at participating hotels.

High-end concierge service: The Amex Gold Card provides a concierge service for assistance with travel and dining reservations, but availability may limit its ability to fulfill all requests.

Terms apply to American Express benefits and offers.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Want the Capital One Venture X?

If you're a frequent traveler with a taste for luxury, a desire for exclusive experiences, and an appreciation for ongoing rewards, the Venture X card stands out as:

- You Want Better Rewards Ratio On Travel: Consider opting for the Venture X card over the Amex Gold Card if you desire a superior rewards ratio on travel. With its high ratio on flights and hotels, the Venture X card outshines in this aspect, making it an ideal choice for avid travelers seeking optimal rewards.

You Want A Lounge Access And Better Travel Perks: If access to airport lounges is a priority for you, the Venture X card takes the lead. It offers lounge access, providing a luxurious and comfortable pre-flight experience that the Amex Gold Card doesn't provide. - You Want An Authorized User: The inclusion of free additional cardholders makes the Venture X card a standout choice if you want to extend the premium benefits to your loved ones at no extra cost.

When You Might Want the Amex Gold Card?

You may want to get the Amex Gold Card over the venture X card if:

You Want Better Rewards Ratio on Supermarkets: If you prioritize grocery shopping, the Gold card offers a superior rewards ratio on supermarket purchases compared to the Venture X card.

You Can Leverage Statement Credits: The Amex Gold Card might be a great fit for you. It offers opportunities to offset costs with credits for specific services, providing extra financial benefits.

You Want Lower Annual Fee: The Amex Gold Card is a solid choice. It offers a more affordable option while still delivering a variety of valuable rewards and benefits.

Compare The Alternatives

If you're looking for a travel rewards credit card– there are some excellent alternatives you may want to consider:

| |||

|---|---|---|---|

Marriott Bonvoy Brilliant® American Express® Card

| Chase Sapphire Reserve® | Delta SkyMiles® Reserve American Express | |

Annual Fee | $650. See Rates & Fees | $550 | $650. See Rates & Fees |

Rewards | 2X – 6X

6 Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in the Marriott Bonvoy™ program, 3 points at Worldwide restaurants and on flights booked directly with airlines and 2 points on all other eligible purchases

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

| 1X – 3X

3X miles per dollar on eligible Delta flights and Delta Vacations® with 1X miles on all other purchases

|

Welcome bonus | 180,000 points

185,000 Marriott Bonvoy® bonus points after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership

|

100,000 points + $500 Chase Travel℠ promo credit

100,000 points + $500 Chase Travel℠ promo credit After you spend $5,000 in purchases in the first 3 months from account opening

| 70,000 miles

70,000 Bonus Miles after you spend $5,000 in eligible purchases on your new Card in your first 6 months of Card Membership

|

Foreign Transaction Fee | $0 | $0 | $0

|

Purchase APR | 20.24% – 29.24% Variable | 21.99% – 28.99% variable APR | 20.24% – 29.24% Variable |

Compare Capital One Venture X Card

The Venture X card outshines the Venture card with superior rewards and premium travel perks. Is It worth the annual fee difference?

The Amex Platinum wins when it comes to redemption options and protections, but the Venture X is cheaper and offers great travel benefits.

Amex Platinum Card vs. Capital One Venture X: Which Card Is Best?

While Chase Sapphire Reserve offers better protections and redemption options, Venture X is cheaper and offers premium travel benefits.

Chase Sapphire Reserve vs. Capital One Venture X: Which Card Is Best?

The Venture X card offers better travel perks than the Sapphire Preferred, such as annual credit and lounge access. But is it worth the fee?

Capital One Venture X vs. Chase Sapphire Preferred: Which Card Is Best?

While having the similar annual fees, the Capital One Venture X offers more cashback for the same spend and better travel perks

U.S. Bank Altitude Reserve Visa Infinite vs. Capital One Venture X: How They Compare?

Compare American Express Gold Card

If you're looking for everyday spending rewards, the Amex Gold Card offers more. But for travel rewards benefits, there is a clear winner.

The Amex Gold Card may be more appealing if you dine out frequently and value premium travel perks than the Apple card.

While the Amex Gold Card is more expensive than the Blue Cash Preferred, its rewards program and other benefits are more lucrative.

The Autograph is great for travelers who want to stay on budget, while Amex Gold provides premium travel benefits and redemption options.

If you're a dedicated Delta traveler, the Delta SkyMiles Gold may be your top pick, while the Amex Gold offers a broader range of benefits.

While Amex Gold Card offers statements credits and everyday spending benefits, the Venture card is cheaper and include decent travel perks.

The Amex Gold Card focused on everyday spending and general travel rewards, the Delta SkyMiles Reserve Card offer premium airline benefits.

Amex Gold Card vs. Delta SkyMiles Reserve: Side By Side Comparison

The Freedom Unlimited beckons with its cash-back rewards, but the Amex Gold exudes luxury, boasting robust rewards on dining and groceries.

Chase Freedom Unlimited vs. Amex Gold Card: Which Card Wins?

The Amex Gold Card focuses on everyday spending rewards, while the Delta SkyMiles Platinum is tailored for frequent Delta travelers.

Amex Gold Card vs. Delta SkyMiles Platinum: Side By Side Comparison

The Hilton Honors Surpass wins at estimated cashback, while the Amex Gold card is the winner for everyday spending and extra benefits.

If you're looking for travel rewards, there is a clear winner. But what about if you're looking for rewards on everyday spending?

American Express Gold Card vs Chase Sapphire Reserve: Which Premium Card Is Best?

While the Amex gold card is best for everyday spending, the Chase sapphire preferred may be better as a travel card. Here's our comparison.

American Express Gold Card Vs. Chase Sapphire Preferred: Which Is Best?

Related Posts

Review Travel Credit Cards

Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.