Whether you're swaying to the simplicity of Chase Freedom Unlimited or orchestrating a masterpiece like the American Express® Gold Card, these cards are your instruments for financial harmony. Let's dive into the details and find the card that hits all the right notes for your daily financial groove.

General Comparison

The Chase Freedom Unlimited beckons with its simplicity and cash back rewards, offering a straightforward approach to earning and redeeming.

On the other hand, the Amex Gold Card exudes a touch of luxury, boasting robust rewards on dining and groceries, coupled with the prestige of the American Express brand.

|

| |

|---|---|---|

Chase Freedom Unlimited® | American Express® Gold Card | |

Annual Fee | $0 | $325. See Rates and Fees. |

Rewards | Earn 5% cash back on travel booked through Chase Ultimate Rewards, 3% on dining (including takeout and eligible delivery), 3% on drugstore purchases, and 1.5% on all other purchases. | 4X points at restaurants (including Uber Eats purchases in the U.S.) and U.S. supermarkets (up to $25,000 per year in purchases, then 1X points), 3X points on flights booked directly with airlines or on amextravel.com, 2X points on rental cars through amextravel.com and 1X points on all other purchases. Terms Apply. |

Welcome bonus | Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening. | 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. |

0% Intro APR | 15 months on purchases and balance transfers , then 18.74%–28.24% variable

APR | N/A |

Foreign Transaction Fee | 3% | None. See Rates and Fees. |

Purchase APR | 18.74%–28.24% variable

| See Pay Over Time APR |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Chase Unlimited vs.Amex Gold: Compare Rewards

When comparing credit card rewards, the Amex Gold Card stands out for its high rewards rates on U.S. supermarkets, restaurants, and flights.

On the other hand, the Freedom Unlimited card offers excellent cashback on travel purchases and provides a solid cashback rate overall, especially considering it has no annual fee.

|

| |

|---|---|---|

Spend Per Category | Chase Freedom Unlimited® | American Express® Gold Card |

$15,000 – U.S Supermarkets | $225 | 60,000 points |

$5,000 – Restaurants

| $150 | 20,000 points |

$4,000 – Airline | $200 | 12,000 points |

$3,000 – Hotels | $150 | 3,000 points |

$4,000 – Gas | $60 | 4,000 points |

Estimated Annual Value | $785 | 89,000 points ( $534 – $1,424) |

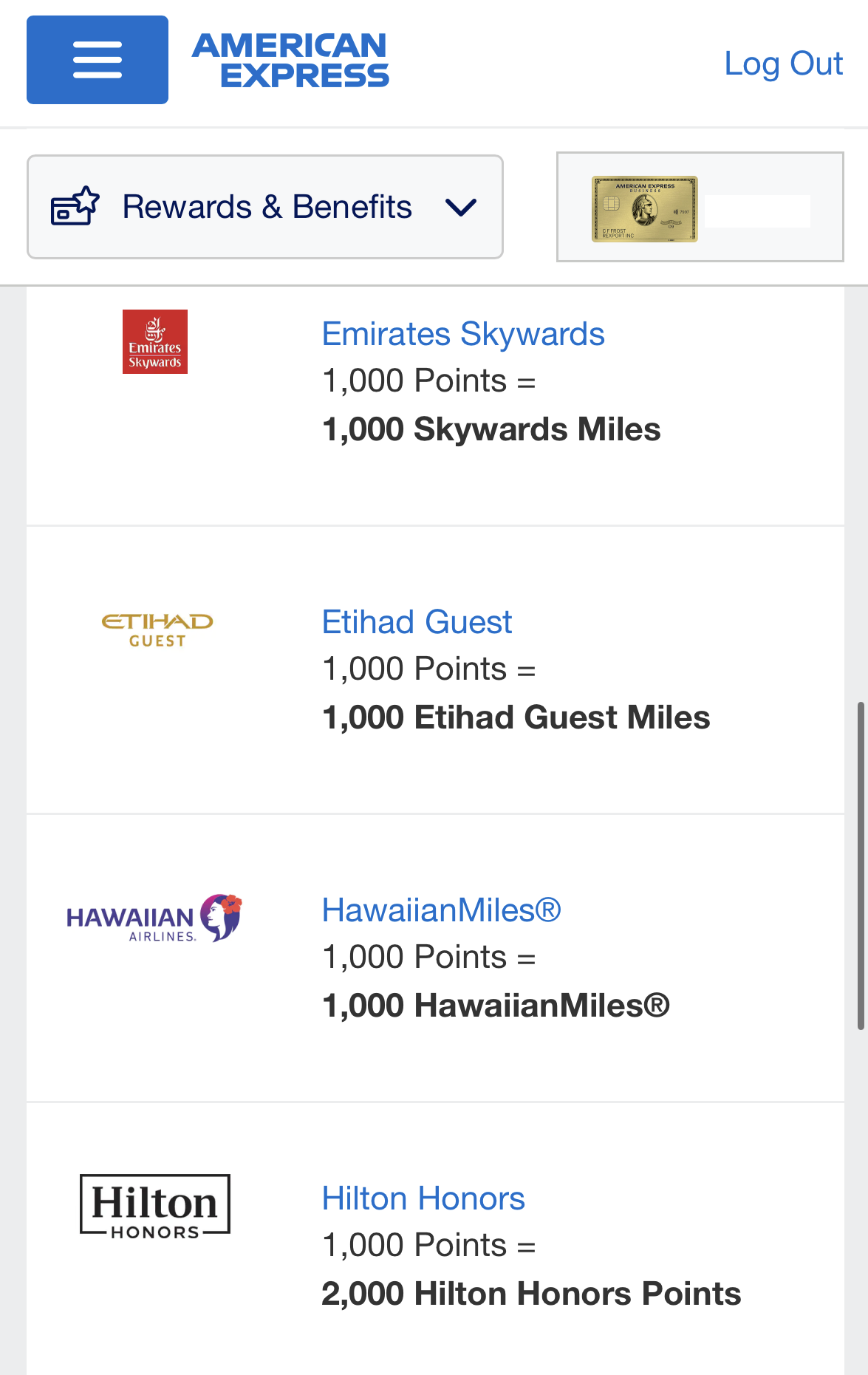

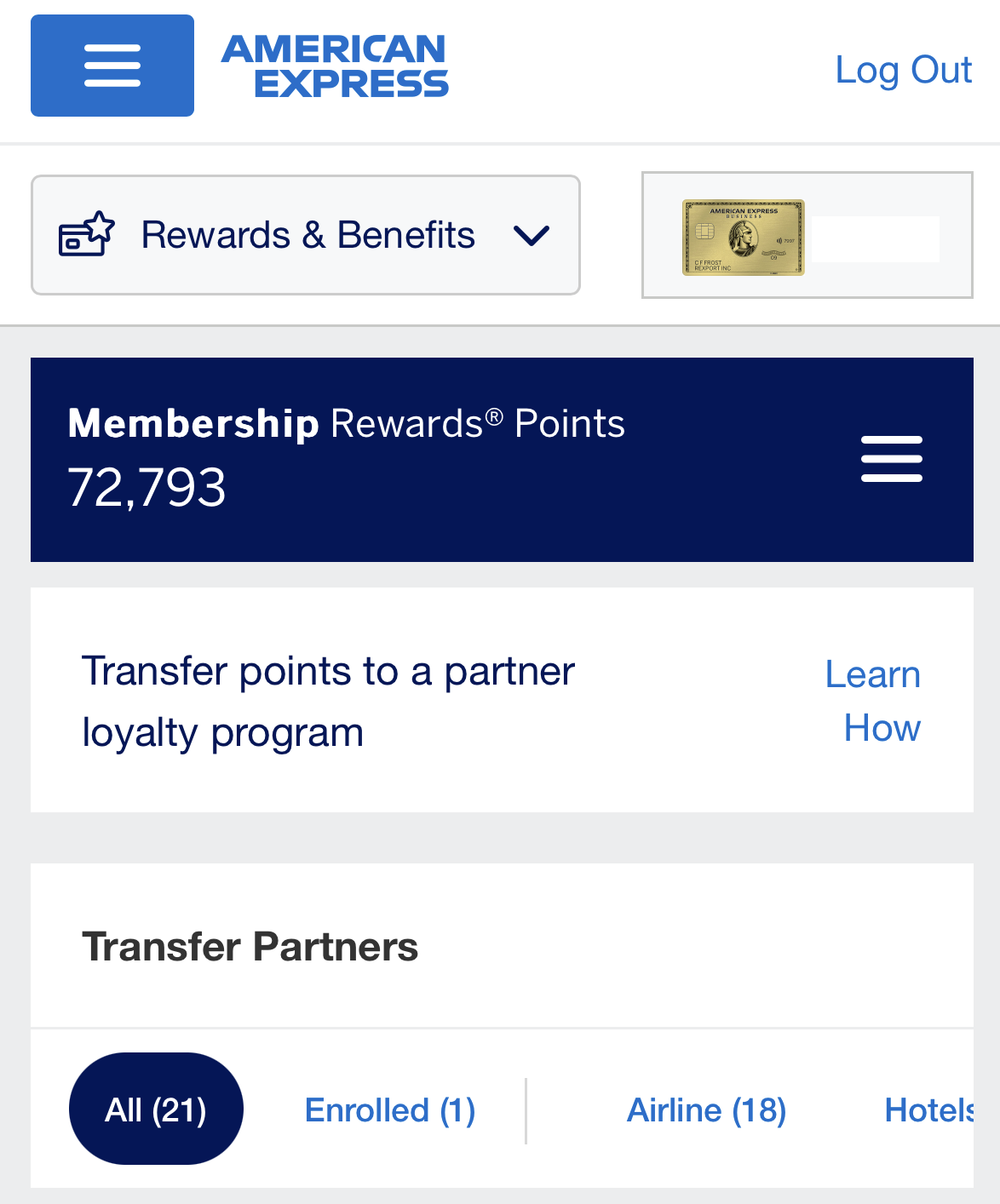

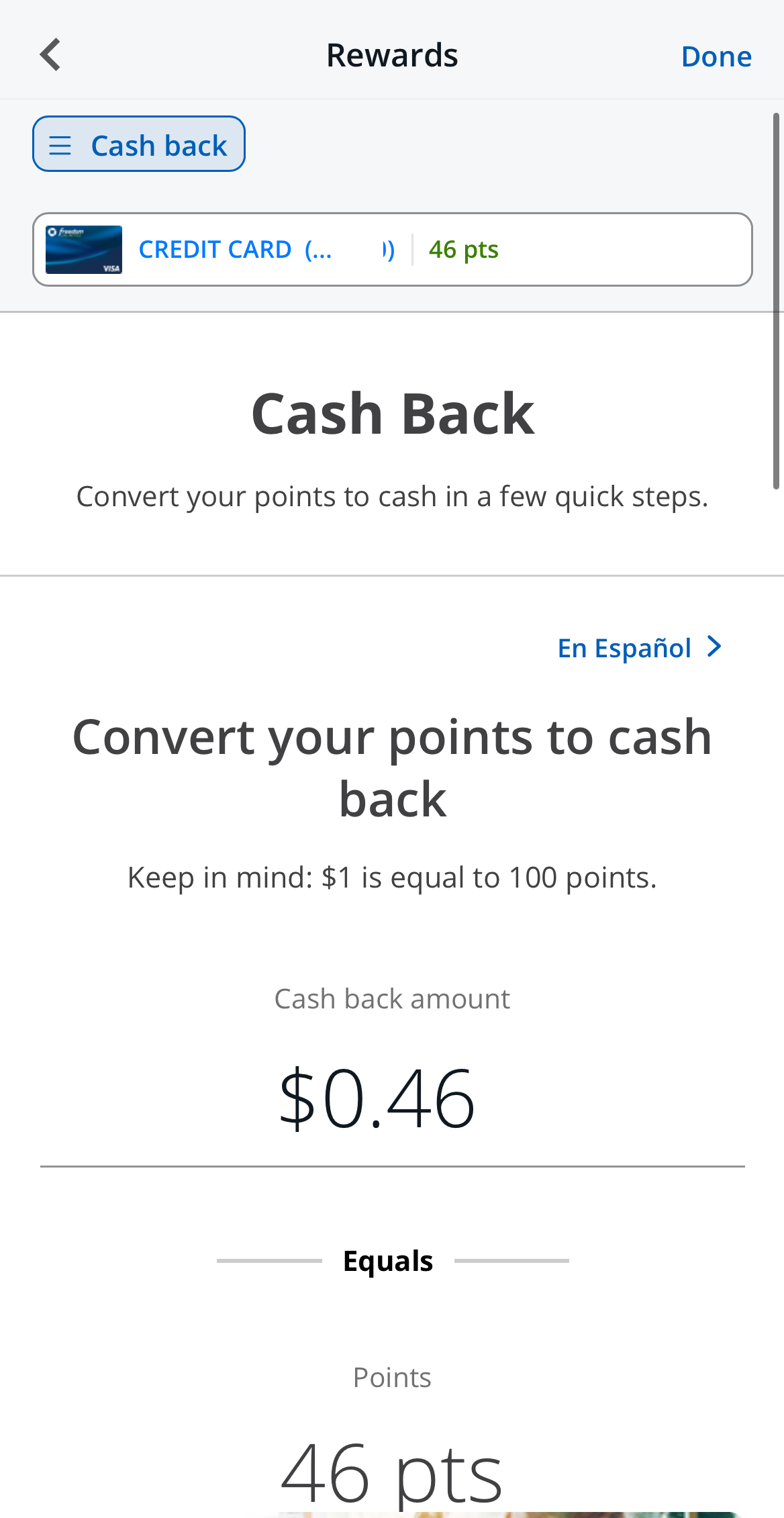

Both card rewards can be redeemed for statement credits, gift cards, and travel. With Amex gold, cardholders can also transfer points to travel partners:

Which Extra Benefits You'll Get With Each Card?

Besides the bonus points and welcome bonuses, both cards come packed with additional perks. Here, we can see why the Amex gold annual fee is higher – there are many statement credits and other travel benefits offered by the Gold card, which is not available through the Freedom Unlimited.

Chase Freedom Unlimited

- Auto Rental Collision Damage Waiver: Drive with confidence as you get coverage against theft and collision damage. Simply decline the rental company's insurance and charge the entire rental cost to your card. This coverage is applicable to most cars in the U.S. and abroad.

- Trip Cancellation/Interruption Insurance: Experience flexibility in your travel plans with reimbursement for pre-paid, non-refundable passenger fares. It covers up to $1,500 per person and $6,000 per trip in case your trip is canceled or interrupted due to covered situations.

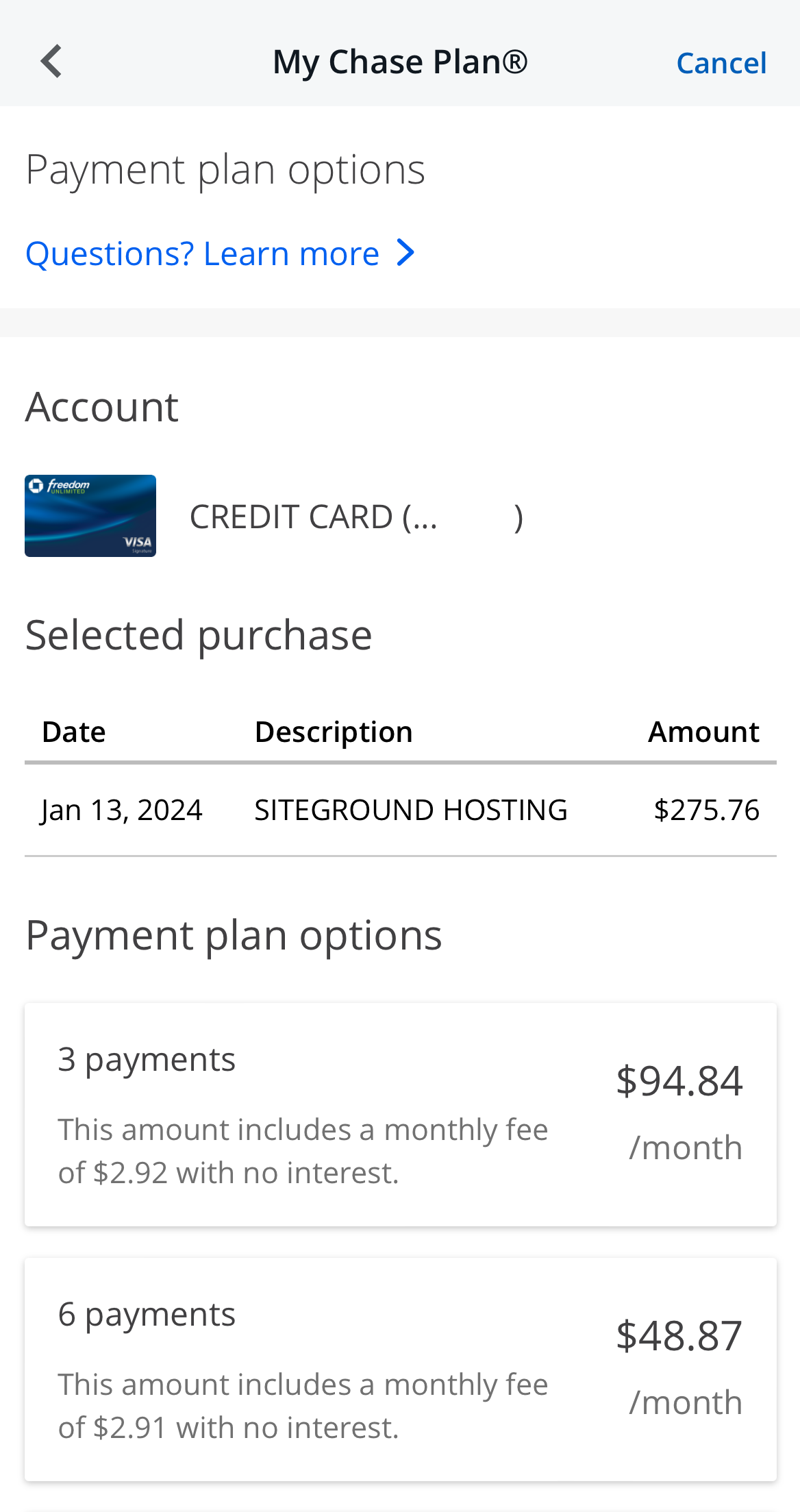

- My Chase Plan: Enjoy financial flexibility with My Chase Plan on the Unlimited card. Easily pay off eligible purchases of $100 or more in equal monthly payments with no interest, only a fixed monthly fee.

- Instacart+ Benefit: Enjoy a complimentary 3-month Instacart+ membership with bthe Freedom Unlimited, granting you unlimited deliveries at $0 delivery fees and reduced service fees on eligible orders.

- 5% Cash Back/5x Points on Lyft Rides: Elevate your Lyft experience with enhanced rewards on the card through March 31, 2025, providing 5% cash back or 5x points on all Lyft ride purchases.

- Cellular Telephone Protection: The Unlimited card ensures peace of mind with up to $600 in cell phone protection. Simply pay your monthly cell phone bill with the card, and enjoy coverage, subject to a $25 deductible.

- Purchase Protection: The card extends a safety net to your new purchases, offering 120 days of coverage against damage or theft. Benefit from up to $500 per claim and $50,000 per account.

- Extended Warranty Protection: Amplify your warranty with the Unlimited card, extending the U.S. manufacturer's warranty by an additional year on eligible warranties of three years or less.

American Express Gold Card

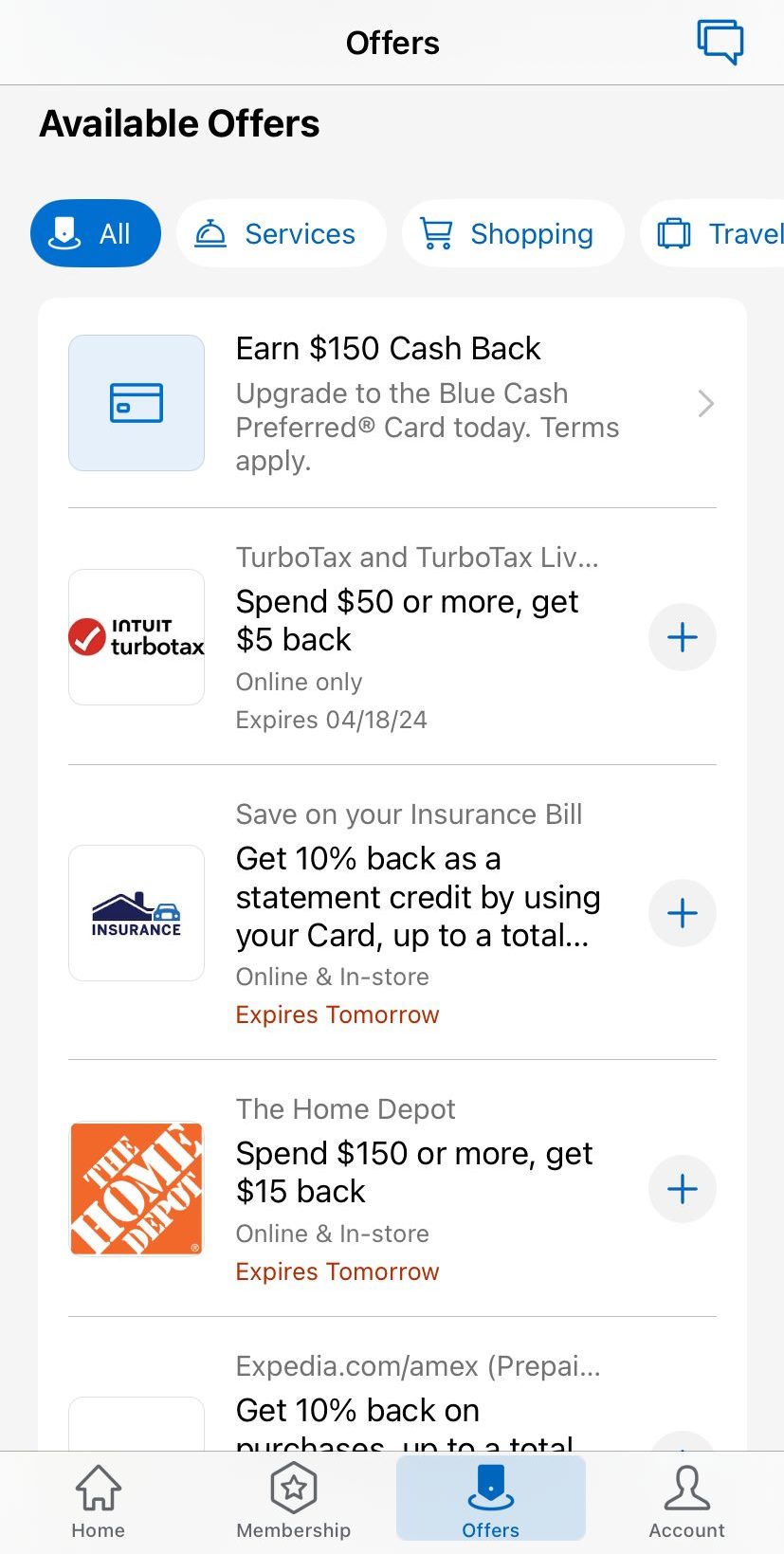

- Up to $120 Uber Credit: Link your new Gold Card to your Uber account to enjoy an automatic monthly Uber Cash credit of $10, which can be used for Uber rides or UberEats orders, up to a maximum annual value of $120.

- Up to $120 Dining Credit: When you use your Amex Gold Card to pay for dining out at select establishments, including The Cheesecake Factory, Wine.com, Goldbelly, Shake Shack, and Milk Bar locations, you can receive up to $10 in statement credit per month.

- Baggage Insurance: When you purchase your entire fare for a Common Carrier Vehicle using your Gold card, you are eligible for baggage insurance. This coverage provides up to $500 for checked bags and $1,250 for carry-on bags in case they are stolen, lost, or damaged (with certain limitations in New York State).

- Up to $100 Experience Credit: Enjoy a $100 experience credit when you book The Hotel Collection through American Express Travel for a getaway of at least two nights. The value of the experience credit may vary based on your chosen property.

- Global Entry or TSA PreCheck® Credit: Unlock smoother travels with a credit of up to $100 for Global Entry or up to $85 for TSA PreCheck.

- Car Rental Coverage: When you use your Gold Card to reserve and pay for your entire car rental, you can decline the rental company's collision damage waiver. This coverage protects against theft and damage to the rental vehicle in eligible locations, though certain restrictions and exclusions may apply.

Entertainment benefits: Enjoy exclusive experiences and presale tickets for concerts, sports events, and theater performances through the American Express® Gold Card Entertainment Access program, though availability may vary.

Luxury hotel perks: As an Amex Gold Cardholder, you can access the American Express Fine Hotels & Resorts program, which offers benefits like room upgrades, complimentary nights, and daily breakfast for two at participating hotels.

High-end concierge service: The Amex Gold Card also includes concierge services to help with travel and dining reservations. However, availability may limit the ability to fulfill all requests.

Terms apply to American Express benefits and offers.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Want the Amex Gold Card?

There are a few situations where you might want to consider the American Express Gold Card over the Chase Freedom Unlimited Card:

- You spend a lot on dining and groceries. The Amex Gold Card earns much higher rewards ratio at U.S. restaurants and up to $25,000 per calendar year in purchases. The Chase Freedom Unlimited Card only earns 1.5x points on all purchases.

- You want to transfer points to airline or hotel partners. Amex Membership Rewards points can be transferred to a variety of airline and hotel partners, giving you more flexibility in how you redeem your points. Chase Ultimate Rewards points can also be transferred to airline and hotel partners, but the transfer ratios are not as favorable.

- You want access to additional benefits, such as Uber Cash, dining credits, and airport lounge access. The Amex Gold Card offers a number of additional benefits, such as $10 monthly Uber Cash, up to $120 annual dining credits, and access to American Express Centurion Lounges. The Chase Freedom Unlimited Card does not offer any additional benefits.

When You Might Want the Chase Freedom Unlimited Card?

You might want the Chase Freedom Unlimited over the Amex Gold card in the following cases:

- You want a card with no annual fee. The Chase Freedom Unlimited Card has a $0 annual fee, while the Amex Gold Card has a $325 annual fee. If you're on a budget, the Chase Freedom Unlimited Card is a better option.

- Cashback is King: If you prioritize cash back over points and enjoy the flexibility of using your rewards however you please, the Chase Freedom Unlimited shines as a reliable companion, allowing you to easily redeem your cash rewards without restrictions.

Compare The Alternatives

|

|

| |

|---|---|---|---|

Bank of America® Travel Rewards credit card | Capital One Venture Rewards Credit Card | Wells Fargo Autograph℠ Card | |

Annual Fee | $0 | $95 | $0

|

Rewards |

1.5X

1.5 points for every $1 you spend on all purchases everywhere, every time and no expiration on points

|

2X – 5X

2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel

| 1X – 3X

3X points on restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Also, earn 1X points on other purchases

|

Welcome bonus |

25,000 points

25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – which can be redeemed for a $250 statement credit toward travel purchases

|

75,000 miles

| 20,000 Points

20,000 bonus points when you spend $1,000 in purchases in the first 3 months – that's a $200 cash redemption value.

|

Foreign Transaction Fee | $0 | $0 | $0

|

Purchase APR | 17.99% – 27.99% Variable

| 19.99% – 28.99% (Variable)

| 18.99%, 23.99%, or 28.99% Variable

|

Compare Chase Freedom Unlimited

While both cards offer great cash back rewards and considered among the best Chase cards, there are some major differences. Which is better?

Chase Freedom Flex vs Chase Freedom Unlimited: Which Card Is Best?

While both cards offer decent cash back rewards with no annual fee, there is a clear winner between the two. And here's why we think so.

American Express Everyday® Card vs Chase Freedom Unlimited®: Which Card Wins?

While both cards offer great cash back rewards and considered among the best Chase cards, there are some major differences. Which is better?

Chase Freedom Flex vs Chase Freedom Unlimited: Which Card Is Best?

The flat rate cash back on Citi Double Cash Card is higher – but usually, it may not be the best option. Here's The Smart Investor analysis.

Citi Double Cash Card vs Chase Freedom Unlimited: Which Card Wins?

The Chase Sapphire Preferred offers costs more and offer more benefits than the Freedom Unlimited. Is it worth the annual fee?

Chase Freedom Unlimited Vs. Sapphire Preferred: Compare Side By Side

The Amex Blue Cash Everyday is the winner if you need gas and grocery purchases, while the Freedom Unlimited offers better travel rewards

Amex Blue Cash Everyday vs. Chase Freedom Unlimited: Which Card Wins?

When it comes to cashback potential, the Chase Freedom Unlimited wins, especially for those who frequently engage in travel-related expenses.

Chase Freedom Unlimited vs. Citi Custom Cash Card: Which Card Wins?

The Savor card is ideal for dining out and entertainment, while the Freedom Unlimited is best for travelers and those who need 0% intro APR.

Capital One Savor vs. Chase Freedom Unlimited: Side By Side Comparison

The BofA Customized Cash Rewards is more flexible, but the Chase Unlimited card will drive more rewards and benefits. Here's why.

Bank of America Customized Cash Rewards vs Chase Freedom Unlimited: Which Card Wins?

The Active Cash card offers flat-rate cashback, while the Unlimited card is the winner for travel. Here's a side-by-side comparison

Wells Fargo Active Cash vs. Chase Freedom Unlimited: Which Card Wins?

The Apple Card offers competitive cashback rewards on Apple purchases and services – but if you travel frequently, the Unlimited card wins.

The Costco Card is a great for Costco shoppers, gas and grocery purchases, while the Freedom Unlimited stands out for its travel benefits.

Costco Anywhere Visa Card vs Chase Freedom Unlimited: Comparison

Compare American Express Gold Card

If you're looking for everyday spending rewards, the Amex Gold Card offers more. But for travel rewards benefits, there is a clear winner.

The Amex Gold Card may be more appealing if you dine out frequently and value premium travel perks than the Apple card.

While the Amex Gold Card is more expensive than the Blue Cash Preferred, its rewards program and other benefits are more lucrative.

The Autograph is great for travelers who want to stay on budget, while Amex Gold provides premium travel benefits and redemption options.

If you're a dedicated Delta traveler, the Delta SkyMiles Gold may be your top pick, while the Amex Gold offers a broader range of benefits.

While Amex Gold Card offers statements credits and everyday spending benefits, the Venture card is cheaper and include decent travel perks.

The Venture X offers better travel rewards than the Amex Gold but is less appealing if you're looking for everyday spending rewards.

Amex Gold Card vs. Capital One Venture X : Which Premium Card Is Best?

The Amex Gold Card focused on everyday spending and general travel rewards, the Delta SkyMiles Reserve Card offer premium airline benefits.

Amex Gold Card vs. Delta SkyMiles Reserve: Side By Side Comparison

The Amex Gold Card focuses on everyday spending rewards, while the Delta SkyMiles Platinum is tailored for frequent Delta travelers.

Amex Gold Card vs. Delta SkyMiles Platinum: Side By Side Comparison

The Hilton Honors Surpass wins at estimated cashback, while the Amex Gold card is the winner for everyday spending and extra benefits.

If you're looking for travel rewards, there is a clear winner. But what about if you're looking for rewards on everyday spending?

American Express Gold Card vs Chase Sapphire Reserve: Which Premium Card Is Best?

While the Amex gold card is best for everyday spending, the Chase sapphire preferred may be better as a travel card. Here's our comparison.

American Express Gold Card Vs. Chase Sapphire Preferred: Which Is Best?

Related Posts

Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.