Table Of Content

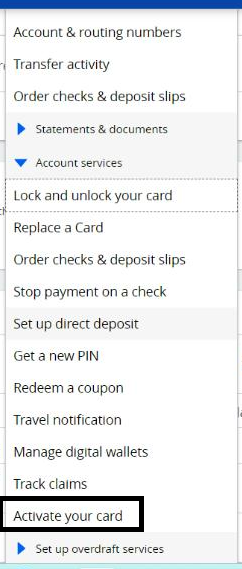

If you've applied for and been approved for a new Chase credit card, you’re probably looking forward to getting it in the mail. Before you can start using it, though, you'll need to activate the card.

Most Chase credit cards need to be activated, and you’ll find instructions on how to do this included in the envelope with your new card, along with a copy of your cardholder agreement.

There are different ways to activate your Chase credit card, so let’s take a closer look at the options.

How to Activate Your Chase Credit Card on Chase Website

One of the easiest ways to activate your Chase credit card is online via the Chase website. You can complete this process in a few simple steps.

1. Visit the Chase Verify webpage: You’ll find a sticker on your new credit card that features a secured website link. This will direct you to the Chase Verify website.

2. Enter Your Log In or Sign Up: Once you’re on the website, you’ll be prompted to log in or sign up if you are a new Chase customer. If you don't have a Chase bank account, you will need to provide your Social Security number and a few other personal details.

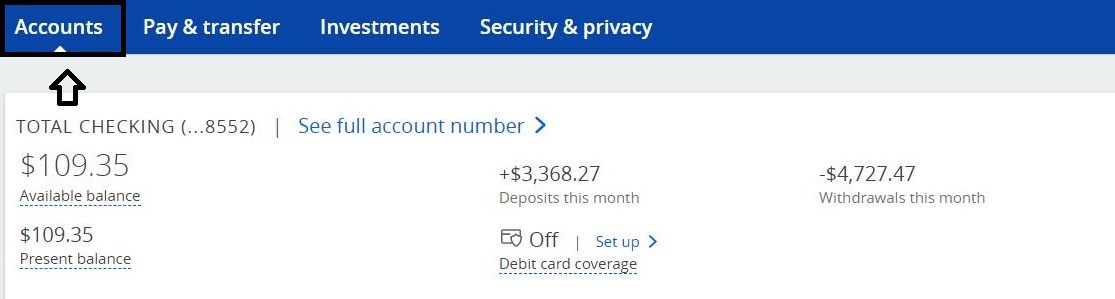

3.Click on My Accounts: You’ll need to find the tab marked “My Accounts” and once you click this, you can verify your card.

4. Choose “activate card” – in the menu drop down, choose activate card.

Select Your Card: You’ll need to select the new card; you can double check this by looking at the card number. Once you know it is the correct card, click the activation button.

How to Activate Your Chase Credit Card on the Chase App

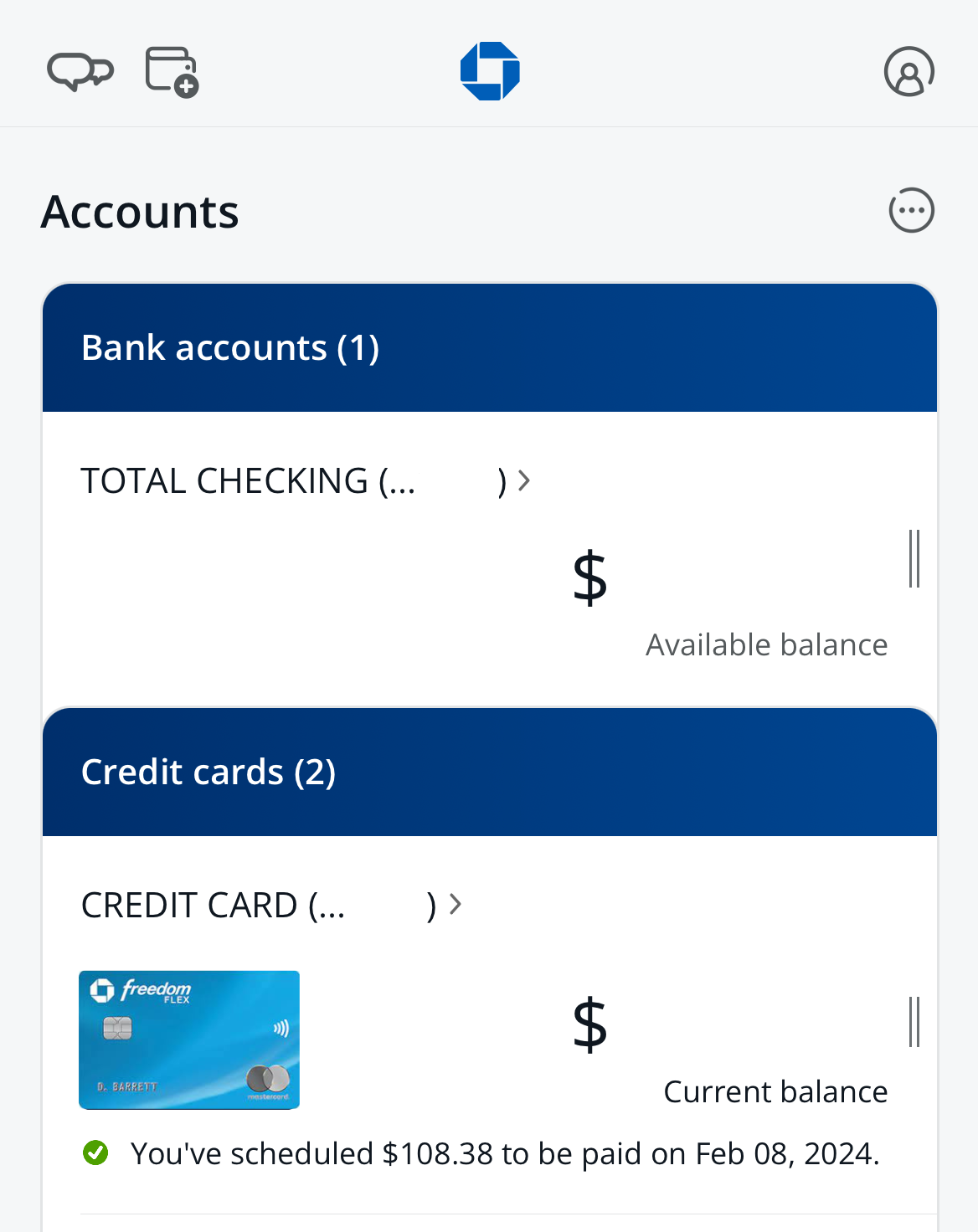

You can also activate your new Chase credit card using the Chase app. You can download the app for your iOS or Android device and this can be an easy way to manage all aspects of your account including activating your card.

- Open the App: Obviously, the first step is to open the app on your device.

- Tap the Chase Logo: You’ll see the Chase logo on the home page near the top. Tap on this icon to launch the appropriate menu.

- Tap Activate: You should then see an icon to “activate” your card.

- Confirm the Card Details: You will need to confirm the card and Chase requires that you confirm that you have received your new card. It should only be activated once the card has been safely delivered and is in your possession.

How to Activate Your Chase Credit Card by Phone

The final way to activate your new Chase credit card is by phone. On the sticker that is on your new credit card, you should see a phone number to call to activate your card. This is a toll free number and it is a quick and easy way to activate the card.

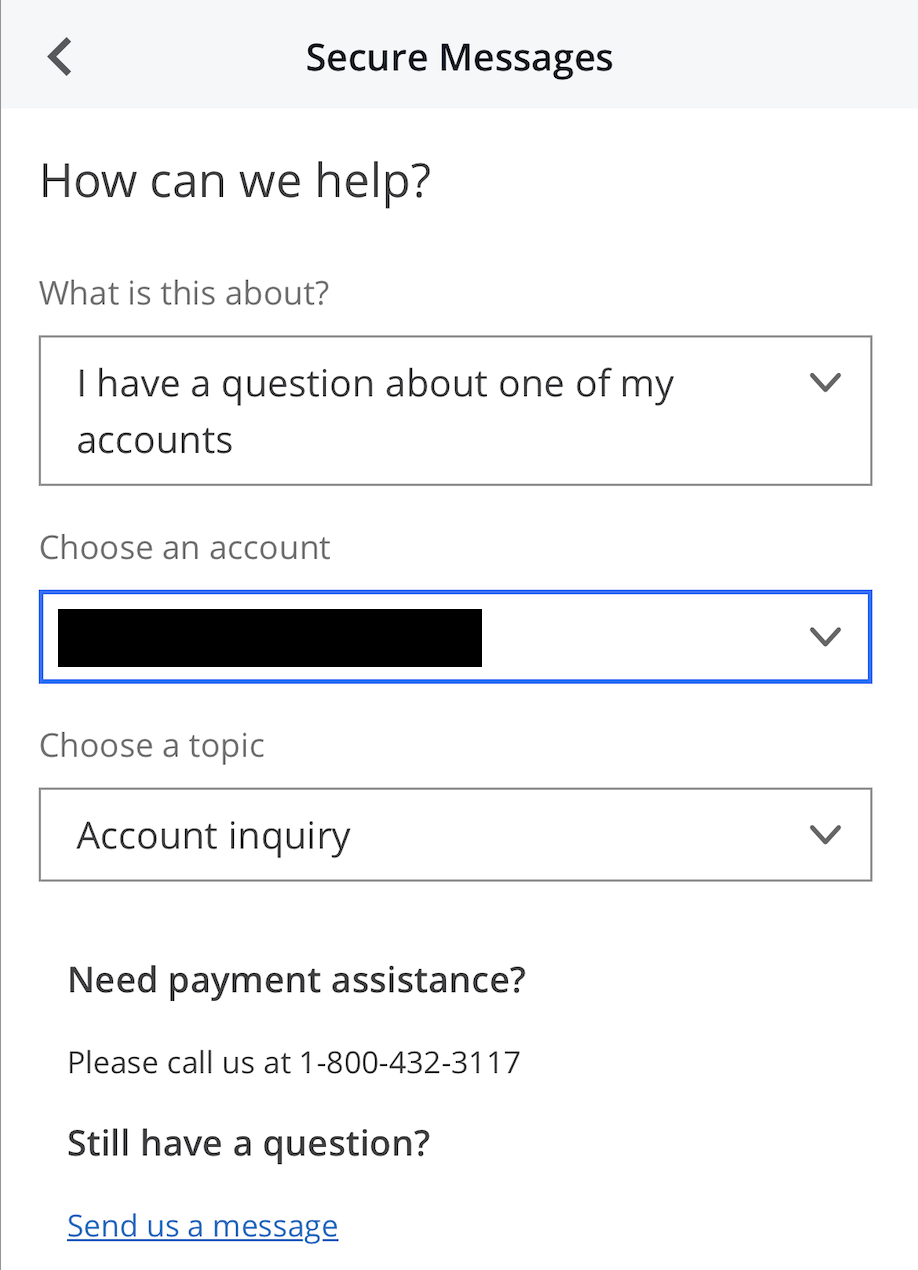

- Call the Phone Number: You should call the number on the sticker. This line is available 24/7, so you can do it at any time. You can also call 1-800-432-3117.

- Enter your Card Details: You’ll need to enter the last four digits of your credit card number

- Follow the Prompts: You can then follow the prompts to activate your new card. This is an automated line and it will confirm when the activation is complete.

Sign Up for

Our Newsletter

and special member-only perks.

How Do I Know If My Chase Credit Card is Activated?

If you're not sure whether your new credit card has been activated, you can easily confirm it by calling Chase customer support. The number can be found on your credit card and account documents, or you can reach out to their helpline at 1-800-432-3117. While you might have to wait on hold for a few minutes, this is the most straightforward way to check your card status.

Alternatively, you could try making a small purchase with your card, but keep in mind that if it’s not activated, you could face the embarrassment of having your card declined.

What Happens If I Decide Not to Activate a Chase Credit Card?

Your account will still be open if you decide not to activate your new Chase credit card. However, since the credit card will not be used, there will be minimal impact to your credit score as there will be no payment history.

However, since your card has a credit limit that you are not using, your credit utilization ratio will be lower, which will give you a credit score boost. Just bear in mind that if your card has an annual fee, this will still apply even if you have not activated the card.

This means that the annual fee will be billed to your account and you’ll need to make sure that you clear this to avoid accumulating interest and other charges on your account.

What To Do After Activating Your Chase Credit Card

After you’ve activated your new Chase credit card, there are a few things that you should do. These include:

- Verify the Welcome Bonus Requirements: If your new credit card has a welcome bonus, it is a good idea to familiarize yourself with the requirements to earn your bonus. You can then ensure that you have a plan to meet the minimum spend requirement within the promotional period.

- Check the Card Perks: Now your new card is activated, you should also check what perks and benefits come with your card, so you can maximize your Chase credit card.

- Download the App: The Chase mobile app is a great tool to monitor your account, track your rewards, activate offers and make payments. So, now is a good time to download the app from the Apple Store or Google Play.

- Enroll in Online Banking: The Chase online banking portal is also helpful to manage your account. It will also make it easier to redeem your rewards. To enroll, you will need to provide some personal details including your mobile number, bank account details and your Social Security Number. You can start the process on the Chase website and simply follow the prompts.

- Set Your Pin: If you want to reset the PIN from the one issued with your new card, you can call the toll free number and follow the automated prompts to set a new one.

- Set Up Autopay: Finally, it is a good idea to set up automated payments for your new card. This will ensure that the minimum balance due is paid every month on time to avoid any penalties. You can always make manual payments during the month if you want to pay more

FAQs

What information do you need to activate a Chase credit card?

You’ll need the last four digits of your new credit card and you may also need to answer some basic security questions.

Do you need a PIN to activate a credit card?

Not necessarily. You can answer the security questions or you may be able to enter your PIN to activate the card.

What number do I call to activate my Chase card?

You can call the Chase Helpline at 1-800-432-3117 or the phone number listed on the sticker on your new card.

How long do you have to activate a Chase credit card?

There is no timeframe to activate your new card, but it is a good idea to complete the process as soon as your new card has arrived safely.

Do I have to call and activate my Chase credit card?

You can call to activate your card or activate it online or via the app.

Can I activate my Chase card at an ATM?

Yes, you can activate Chase debit cards at your local Chase ATM.

Top Offers

Top Offers From Our Partners

Top Offers

Related Posts

Top Offers