Table of Content

Both the The Platinum Card® from American Express and Chase Sapphire Reserve® are designed for those with excellent credit and both cards have an annual fee. However, this is reflected in the possible rewards, particularly for travelers. The reward structure is tailored to frequent travelers with higher tier rewards for flights and hotels.

But, there are some crucial differences between the two cards that we will look at in more detail to help you to decide which is the best option for you

General Comparison

|

| |

|---|---|---|

The Platinum Card® | Chase Sapphire Reserve® | |

Annual Fee | $695. See Rates and Fees. | $550 |

Rewards | 5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases. | 5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. |

Welcome bonus | 175,000 Membership Rewards® Points after spending $8,000 in eligible purchases on your new Card in your first 6 months of Membership. | 100,000 points + $500 Chase Travel℠ promo credit After you spend $5,000 in purchases in the first 3 months from account opening |

0% Intro APR | None | N/A |

Foreign Transaction Fee | $0 | |

Purchase APR | See Pay Over Time APR | 21.99% – 28.99% variable APR |

Read Review | Read Review |

Top Offers

Top Offers

Compare Rewards: Which Card Gives More?

We’ve compared the estimated annual value of each card's rewards based on similar spending across categories. The Amex Platinum offers more rewards for flights and airline purchases, while the Chase Sapphire Reserve shines when it comes to dining.

Ultimately, there’s no clear winner – the best choice really depends on your personal spending habits.

|

| |

|---|---|---|

Spend Per Category | The Platinum Card® | Chase Sapphire Reserve |

$10,000 – U.S Supermarkets | 10,000 points | 10,000 points |

$5,000 – Restaurants | 5,000 points | 15,000 points |

$6,000 – Hotels | 30,000 points | 60,000 points |

$6,000 – Airline

| 30,000 points | 18,000 points |

$4,000 – Gas | 4,000 points | 4,000 points |

Total Points | 79,000 points | 107,000 points |

Estimated Redemption Value | 1 point ~ 0.6 – 1.6 cents | 1 point ~ 1 – 1.5 cents |

Estimated Annual Value | $474 – $1,264 | $1,070 – $1,605 |

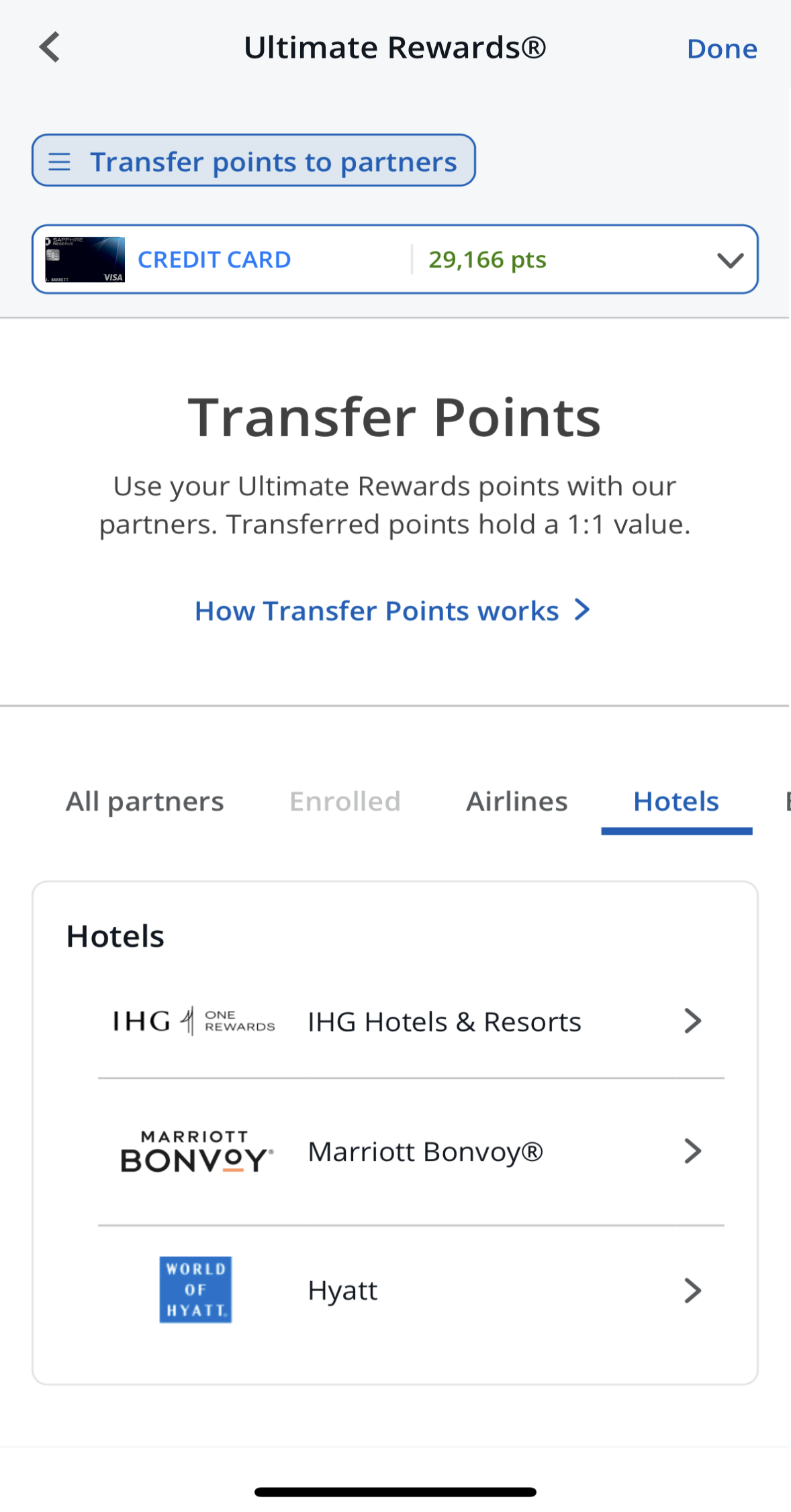

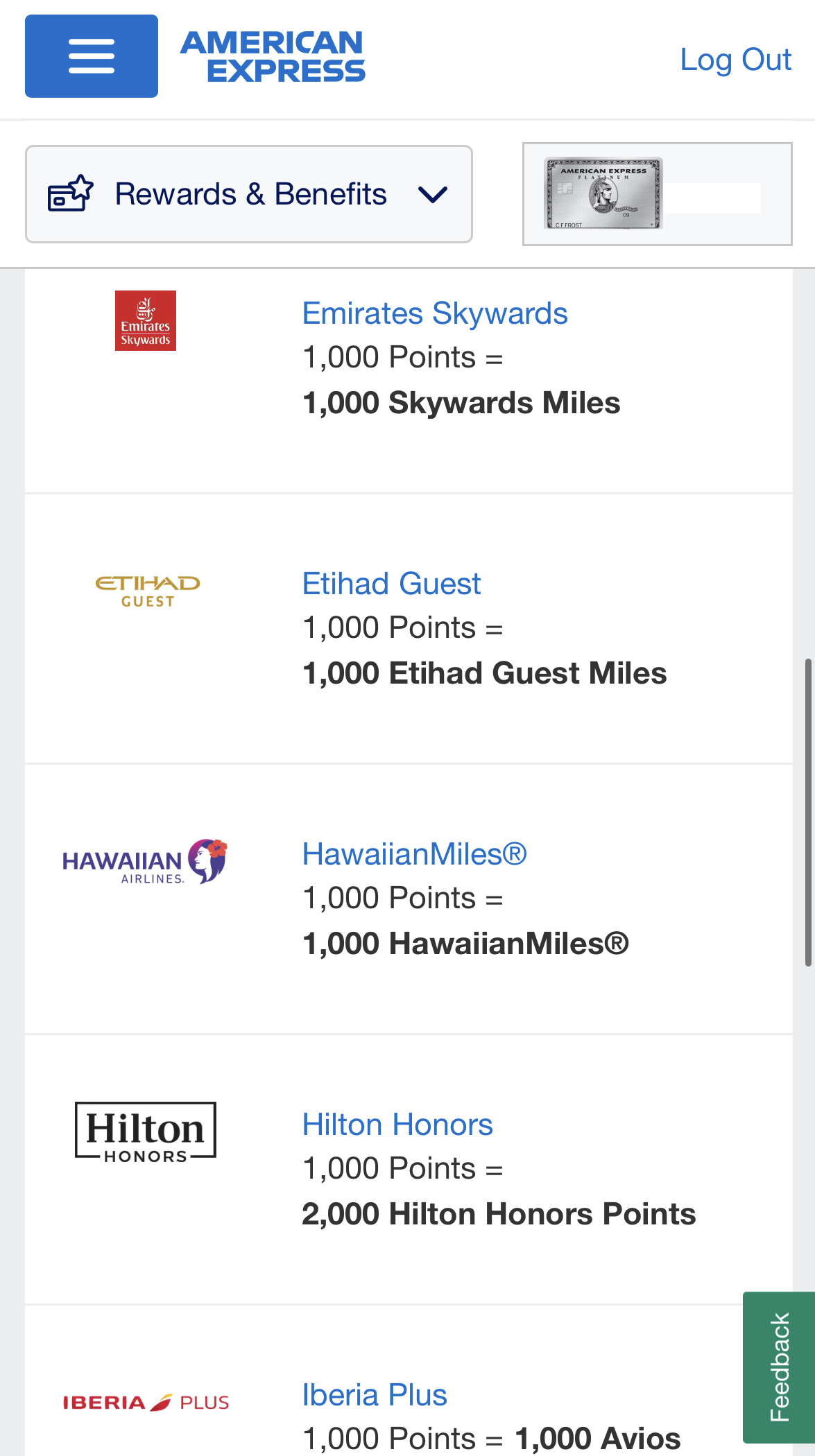

Transferring Amex Platinum and Chase Reserve points to airline and hotel partners is a popular and valuable use of rewards points:

Compare Welcome Bonus And Fees

Both cards have a generous introductory bonus. The Amex Platinum offers 175,000 Membership Rewards® Points after spending $8,000 in eligible purchases on your new Card in your first 6 months of Membership. This is worth approximately $2,000 to $2,500 depending on your redemption method.

The Chase Sapphire Reserve introductory bonus is not as generous. You’ll receive 100,000 points + $500 Chase Travel℠ promo credit After you spend $5,000 in purchases in the first 3 months from account opening. This is almost as much as you need to spend with Amex, but you have half the time to do it. The point conversion for Chase is also a little lower, so the bonus points have an approximate value of $750.

Both cards have an annual fee, but the Amex fee is higher at $695 and $195 for each additional Platinum user. Chase charges a $550 annual fee, but you’ll pay $75 for each additional authorized user.

Neither company charges foreign transaction fees with these cards and the late fees and cash advance fees are similar. One crucial fee difference is that while Chase charges a balance transfer fee of $5 or 5%, Amex does not permit balance transfers with this card.

Compare The Perks

American Express Platinum Card

- Up to $200 hotel credit in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings, which requires a minimum two-night stay, through American Express Travel when you pay with your Platinum Card®. Enrollment Required. Enrollment Required.

- Up to $240 or $20 per month in Digital Entertainment statement credit when you pay for one or more The New York Times, Peacock, or SiriusXM with your card. Enrollment Required.

- Up to $155 in Walmart+ credit. When you use your card to pay for your monthly Walmart+ membership, you’ll get the full cost back every month. Enrollment Required.

- Up to $200 in Uber Cash. You’ll get up to $15 credit each month via an exclusive Uber app experience, with a $20 bonus in December. You can also become an Uber VIP to be matched with top rated drivers without needing to meet any minimum ride requirements. Enrollment Required.

- Up to $200 in Airline fee credit per year when you charge incidental travel fees from selected airlines on your card. Enrollment Required.

- Up to $300 back every year in statement credit for eligible Equinox memberships when you enroll and pay using your card (auto-renewal).

- Marriott Bonvoy Gold Elite Status: As a Platinum Card member, you have the opportunity to enroll in complimentary Bonvoy Gold Elite status.

- Priority Pass: Platinum Card members enjoy a complimentary membership in Priority Pass Select, granting them access to over 1,400 lounges across the globe. It's important to note that this membership does not include access to Priority Pass restaurant lounges

- Up to $189 back per year when you use your card to pay for a CLEAR® plus membership. Enrollment Required.

- When you travel more than 100 miles from home, the Global Assist® Hotline is available 24/7 for emergency assistance and coordination services

- Trip Delay Insurance and trip cancellation can help reimburse certain additional expenses purchased when a covered reason delays your trip for more than 6 hours. You can also get reimbursing for your non-refundable expenses*.

- Cardholders can talk to Amex Platinum Travel counselors – experts at creating personalized itineraries and making tailored recommendations to help make the most of your travels.

- You may be covered for Damage to or Theft of a Rental Vehicle in a Covered Territory

- When you book Hotels & Resorts with American Express Travel , you're eligible for extra perks and a $100 experience credit to savor something unique at each property.

- receive either a $100 statement credit for Global Entry or an up to $85 statement credit for TSA PreCheck® through any Authorized Enrollment Provider

Top Offers

Top Offers From Our Partners

Terms apply to American Express benefits and offers.

Chase Sapphire Reserve

- $300 annual travel credit. You’ll receive up to $300 statement credit for reimbursement on travel purchases charged to your card.

- Travel reimbursement for lost luggage up to $3,000 per passenger and if your carrier travel is delayed for more than 6 hours, up to $500 per ticket.

- Pay Yourself Back offers, which allow you to redeem points for current offers with a higher redemption value.

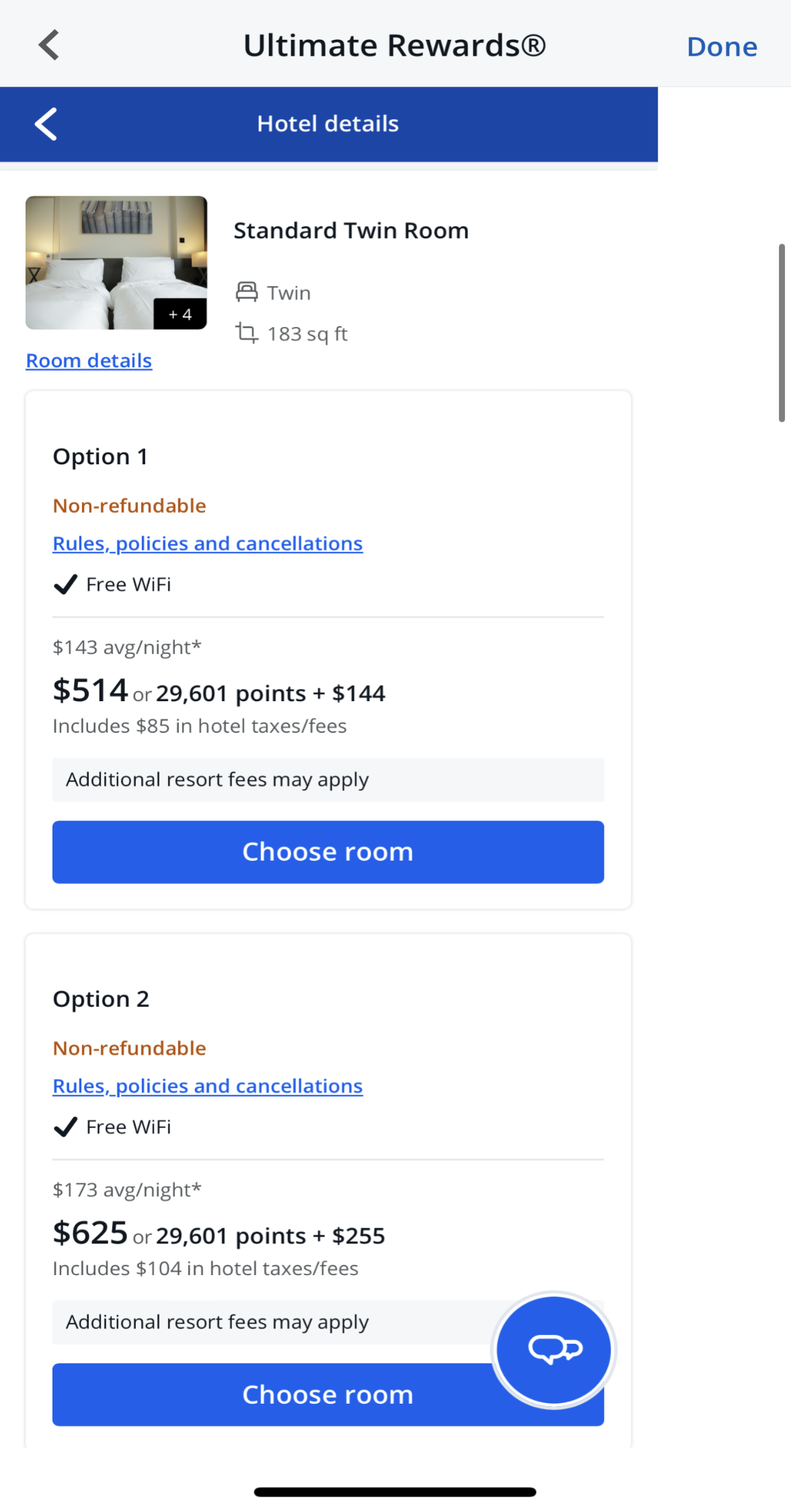

- Access to Chase Unlimited Rewards where your points are worth more in specific areas. For example, if you use your points for travel, 50,000 points are worth $750.

- Split purchases of $100+ into fixed monthly payments via the My Chase Plan feature.

- Complimentary access to VIP airport lounge access. There are over 1,000 lounges across 500+ cities around the world.

- The Chase Sapphire Reserve card will reimburse your application fee for TSA Precheck or Global Entry once every four years. This cost is usually around $85 to $100.

- 50% More Ultimate Chase Rewards – your points go further when you book through Ultimate Chase Rewards. These rewards include all things travel-related, such as flights, hotels, cruises, and car rentals.

- Cardholders Take advantage of exclusive benefits at a variety of hand-picked top hotels and resorts around the world, such as complimentary room upgrades, early check-in and late check-out.

- There are no dates when the points cannot be redeemed. They can be redeemed at any time of the year. There is also no expiration or use limits.

- Travel Interruption/Cancelation Insurance: If you book your trip with your card, you’ll be reimbursed up to $10,000 per person and $20,000 per trip if your trip is cut short or canceled due to covered situations.

- Baggage Delay Insurance: You’ll receive up to $100 per day for five days for essential purchases if your baggage is delayed by your passenger carrier. You’ll also get up to $500 per ticket if your common carrier travel is delayed for over 12 hours.

- Auto Collision Rental Damage Waiver: If you charge the entire cost of your rental to your card, you’ll have supplemental theft and collision damage cover for free.

- Purchase Protection: New purchases are covered for up to 120 days against theft or damage. There is a claim limit of $500 and $50,000 per account. You’ll also get extended warranty protection on eligible warranties. If you lost or misplaced your credit card, you can quickly lock it on Chase website.

Compare The Drawbacks

Of course, no credit card is perfect, so it is important to be aware of the potential drawbacks before you make your final card decision.

American Express Platinum Card

- Higher Annual Fee

American Express Platinum Card has higher annual fee. Cardholders pay $695 annually compared to $550 on Chase Sapphire Reserve.

- Balance Transfers Not Permitted

American Express does not allow balance transfers to its Platinum card. So, if you are looking for a card that will allow you to consolidate all your credit card balances, this is not the right card option for you.

- Not Popular in Some Areas of the World

Although the Amex Platinum card does have some great travel benefits with no foreign transaction fees, it is not a popular card network in every country in the world. Outside of Italy and the U.K, many retailers in European countries do not support Amex transactions. This means that if you’re a global traveler, you may not be able to use your card everywhere you go.

Chase Sapphire Reserve

- Authorized Users Fee

The annual fee for the Chase Sapphire Reserve is $550 per year, which is high even for such great rewards and benefits. Furthermore, you’ll need to pay an extra $75 for each additional authorized user. So, if you want to share the card, your annual fee could quickly skyrocket.

Compare Redemption Options

Whether you seek elevated travel experiences, exclusive entertainment perks, or the flexibility of cash back and statement credits, both the American Express Platinum Card and Chase Sapphire Reserve offer a wealth of options tailored to your unique preferences.

- Amex Platinum Card

The Amex Platinum offers variety of redemption options via the Amex membership club:

Travel Redemptions: Use points to book flights, hotels, or car rentals through the Amex travel portal.

Transfer Partners: Transfer points to airline or hotel partners for potentially higher value and flexibility.

Statement Credits: Redeem points for statement credits against eligible purchases.

Gift Cards: Exchange points for gift cards from a variety of retailers and restaurants.

Shopping: Use points to shop for merchandise or services directly through the Membership Rewards portal.

Experiences: Redeem points for unique experiences or events.

- Chase Sapphire Reserve Card

Here are the main options when you want to redeem Chase Sapphire Reserve Card points:

Travel Portal: Use points to book flights, hotels, and car rentals through the Chase Ultimate Rewards travel portal.

Transfer Partners: Transfer points to airline or hotel partners for increased value and flexibility.

Cash Back: Redeem points for cash back as a statement credit or direct deposit.

Gift Cards: Exchange points for gift cards from a selection of retailers and restaurants.

Amazon and Apple Purchases: Use points to make purchases on Amazon or through the Apple Ultimate Rewards Store.

Pay Yourself Back: Redeem points for statement credits against eligible purchases in select categories.

How to Maximize Cards Benefits?

If you want to make the best use of your American Express Platinum Card, there are some tips to help you:

- Hit the intro bonus spend requirement: You’ll earn 175,000 Membership Rewards® Points after spending $8,000 in eligible purchases on your new Card in your first 6 months of Membership, so make sure you reach this spend requirement.

- Purchase hotel stays via American Express Travel to obtain up to $200 credit per year.

- Use your card for subscriptions and memberships. With credit for digital entertainment subscriptions, Walmart+, Equinox membership, and CLEAR® membership, make sure that you use your Platinum card to pay for these services. With all of these subscriptions and memberships, you could earn up to $874 per year in statement credit.

- Link your card to your Uber account. You’ll have access to an exclusive Uber app experience with Uber VIP status and up to $200 Uber Cash credit per year if you link your card to your account.

If you want to make the best use of your Chase Sapphire Reserve, there are some tips to help you:

- Meet this spending criteria: You’ll only receive the intro bonus points if you meet this spending criteria .

- Link your Gold Card to your Uber account: You can earn up to $120 per year, or $10 a month in Uber Credit when you link your card to your Uber account.

- Check the Dining Partner list: American Express has a list of participating dining partners and if you make purchases at these venues, you can qualify for up to $10 per month of statement credit.

- Book fares with your card: If you’re paying for train, bus, or airplane tickets, be sure to use your Gold Card and you’ll get free baggage insurance for up to $1,250 if your bags are lost, stolen, or damaged.

Customer Reviews: Which Card Wins?

American Express® Gold Card | Chase Sapphire Reserve® | |

|---|---|---|

App Rating (iOS)

| 4.9 | 4.8 |

App Rating (Android) | 4.2 | 4.4 |

BBB Rating (A-F) | A+ | B+ |

WalletHub | 4 | 3.5 |

Contect Options | phone/social | phone/social |

Availability | 24/7 | 7 AM – 11 PM |

Satisfied customers praise the travel benefits with this card and the high potential for earning rewards. With 5x points on flights and hotel stays booked through the Amex portal, you can quickly boost your rewards balance if you’re a frequent traveler. Other reviews highlight redemption possibilities with a diverse variety of partners.

Negative reviews report some frustration that there are no rewards for everyday spending such as gas stations and U.S. supermarkets. Unlike the American Express® Gold, which offers 4X points on U.S. supermarkets (Terms Apply) this is not an Amex Platinum feature.

Satisfied borrowers report that the Sapphire Reserve offers a great reward package with lots of additional benefits. From free memberships to discounts and upgrades, members report that the benefits package easily negates the $550 membership fee.

Many users report getting upgrades on rental cars and get a great deal of use out of their Priority Pass program. Additionally, for frequent travelers, the $300 travel reimbursement is a great bonus.

Negative reviews report that the customer service needs improvement. There are a number of reviews complaining about long call hold waits and delays in response to queries or issues. There are also complaints about no rate negotiations.

Whether your credit has improved or you’re suffering from financial hardship, the standard reply appears to be that the agent “cannot do anything”.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Want the Amex Platinum Card?

The American Express Platinum Card is a flexible option that could be good if:

You’re a frequent traveler and you’re comfortable booking flights and hotel stays via the American Express portal. The card has no foreign transaction fees and you’ll earn 5x points on your flights and hotels.

You enjoy memberships and subscriptions. There is the potential for up to $874 credit per year when you use your card to pay for subscriptions and memberships such as Walmart+, Equinox, and CLEAR®.

You’re a frequent Uber customer. You’ll have access to exclusive Uber app experiences and Uber VIP status, plus up to $200 in Uber Cash per year if you link your card to your Uber account.

When the Chase Sapphire Reserve Wins?

The Chase Sapphire Reserve Card is a good choice if:

- You’re a very frequent traveler. You’ll earn 5x points on flights and 10x points on hotels and car rentals, plus get up to $300 in statement credits for travel purchase reimbursements. Enjoy access to VIP airport lounges in over 500 cities worldwide, along with added perks like reimbursement for lost luggage and carrier delays.

- You frequently rideshare: With a free Lyft Pink membership for a year and up to 15% off rides, this card offers some great rewards for Lyft users. For a limited time, you can also receive 10x points.

- Travel on top: If you like to travel in style, cardholders have access to over 1,000 VIP airport lounges around the world. You also receive free credits each year for services such as TSA Precheck or Global Entry.

Bottom Line

Both the Amex Platinum and Chase Sapphire Reserve offer some excellent rewards that should easily negate the annual fee. With strategic purchase planning, you can maximize your rewards, especially if you are a frequent traveler.

However, the differences between these two options will help you determine which is the best one for you.

Compare The Alternatives

Both cards are definitely considered as one of the best in the niche. However, there are always recommended alternatives to check out before applying:

Bank of America® Travel Rewards credit card | Capital One Venture Rewards Credit Card | Chase Sapphire Preferred® Card | |

Annual Fee | $0 | $95 | $95

|

Rewards |

1.5X

1.5 points for every $1 you spend on all purchases everywhere, every time and no expiration on points

|

2X – 5X

2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel

|

2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

|

Welcome bonus |

25,000 points

25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – which can be redeemed for a $250 statement credit toward travel purchases

|

75,000 miles

|

75,000 points

75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening

|

Foreign Transaction Fee | $0 | $0 | $0

|

Purchase APR | 18.24% – 28.24% Variable APR

| 19.99% – 29.74% (Variable)

| 19.99% – 28.24% variable APR

|

FAQ

You need to meet the credit score and income requirements when you are applying for an Amex Platinum card, which is higher than a lot of other cards.

Every type of purchase through the Amex Platinum card will earn cashback points. Therefore, you do not have to deal with any sort of exclusions.

Your points won’t expire once you keep the credit card account open. This means that you won’t be facing any sort of deadline in order to use up your rewards.

The usual minimum credit limit for this card is $10,000. The exact credit limit will be dependent on the answers that you provide in your application.

Compare Chase Sapphire Reserve Card

When it comes to the annual fee, there is a clear winner. But is it worth the exclusive travel rewards you'll get? Here's our analysis.

While Chase Sapphire Reserve offers better protections and redemption options, Venture X is cheaper and offers premium travel benefits.

Chase Sapphire Reserve vs. Capital One Venture X: Comparison

If you're looking for travel rewards, there is a clear winner. But what about if you're looking for rewards on everyday spending?

American Express Gold Card vs Chase Sapphire Reserve: Which Card Is Best?

The Chase Sapphire Reserve offers more versatile travel rewards and redemption options. But if you need airline perks, the Delta Reserve wins.

Chase Sapphire Reserve vs. Delta SkyMiles Reserve: Comparison

While the Brilliant card focuses on benefits tailored to Marriott enthusiasts, the Chase Reserve focuses on general, luxury travel perks.

Marriott Bonvoy Brilliant vs. Chase Sapphire Reserve: How They Compare?

While both cards offer premium travel perks, the Chase Reserve is the winner as it provides better travel perks and more redemption options.

Bank of America Premium Rewards Elite vs. Chase Sapphire Reserve: Which Card Is Best?

The Chase Reserve wins on cashback rates, travel perks, and insurance. Is it worth the annual fee difference? We think it does – here's why.

Chase Sapphire Reserve vs. Delta SkyMiles Platinum: Side By Side Comparison

The Hilton Amex Aspire offers excellent value for hotel perks, while the Chase Reserve card is best for flexibility and redemption options.

Chase Sapphire Reserve vs. Hilton Amex Aspire: Side By Side Comparison

While having higher annual fee, the Chase Sapphire Reserve is a clear winner with much higher total cashback and better premium travel perks.

Both Citi/AAdvantage Executive and Chase Sapphire Reserve offer great cashback value, but the latter is our winner. Here's why:

Citi/AAdvantage Executive World Elite vs. Chase Sapphire Reserve: Which Card Is Best?

The Chase Sapphire Reserve card stands out as the superior choice, delivering greater annual cashback value and luxurious travel benefits.

Chase Sapphire Reserve vs. Emirates Skywards Premium World Elite Mastercard: Which Card Is Best?

Despite being a pricier card, the Chase Sapphire Reserve is our top choice because of its generous cashback system and luxury travel perks.

U.S. Bank Altitude Reserve Visa Infinite vs. Chase Sapphire Reserve: How They Compare?

Top Offers

Top Offers

Top Offers From Our Partners

Compare American Express Platinum Card

If you're looking for everyday spending rewards, the Amex Gold Card offers more. But for travel rewards benefits, there is a clear winner.

The Infinite Card is tailored for frequent United flyers, while the Amex Platinum offers a more lucrative, comprehensive rewards program.

While the Amex Platinum offers extensive travel perks and redemption options, the Marriott Brilliant Card has better hotel-specific perks.

While the Amex Platinum Card offers extensive travel perks and redemption options, the Delta Reserve Card has better airline-specific perks.

Amex Platinum Card vs. Delta SkyMiles Reserve: Which Luxury Card Is Best?

The Amex Platinum wins when it comes to redemption options and protections, but the Venture X is cheaper and offers great travel benefits.

Amex Platinum Card vs. Capital One Venture X: Which Luxury Card Is Best?

The Hilton Aspire is surprising with its higher estimated annual cashback value, but the Platinum card wins at premium travel perks.

Amex Platinum Card vs. Hilton Amex Aspire: Side By Side Comparison

If you need premium travel perks and versatility – the Amex Platinum wins. Need airline benefits and lower fees? Consider the Delta Platinum.

Amex Platinum Card vs. Delta SkyMiles Platinum: Which Luxury Card Is Best?

The AAdvantage Executive card offers higher cashback value, but when it comes to premium travel perks, the Amex Platinum is the winner.

Citi/AAdvantage Executive World Elite vs. Amex Platinum Card

The Amex Platinum card is a clear winner as it offers much higher annual cashback value, luxury travel perks, and various travel protections.

Amex Platinum Card vs. Emirates Skywards Premium World Elite Mastercard: How They Compare?

The Amex Platinum is our winner due to its higher annual cashback value, redemption options, and better luxury perks than the Altitude Reserve.

U.S. Bank Altitude Reserve Visa Infinite vs. Amex Platinum Card: How They Compare?

Review Travel Credit Cards

- Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.