Table of Content

What Is The Amex Gold Card?

The American Express® Gold Card is great for those with good to excellent credit. Although the card has an annual fee, it provides great rewards and perks.

The Amex Gold is also a good choice for those who enjoy traveling, as the benefits package includes additional rewards for travel purchases and travel insurance.

However, if you’re looking to move a card balance to a new card, Amex Gold is not the right choice, as balance transfers are not permitted.

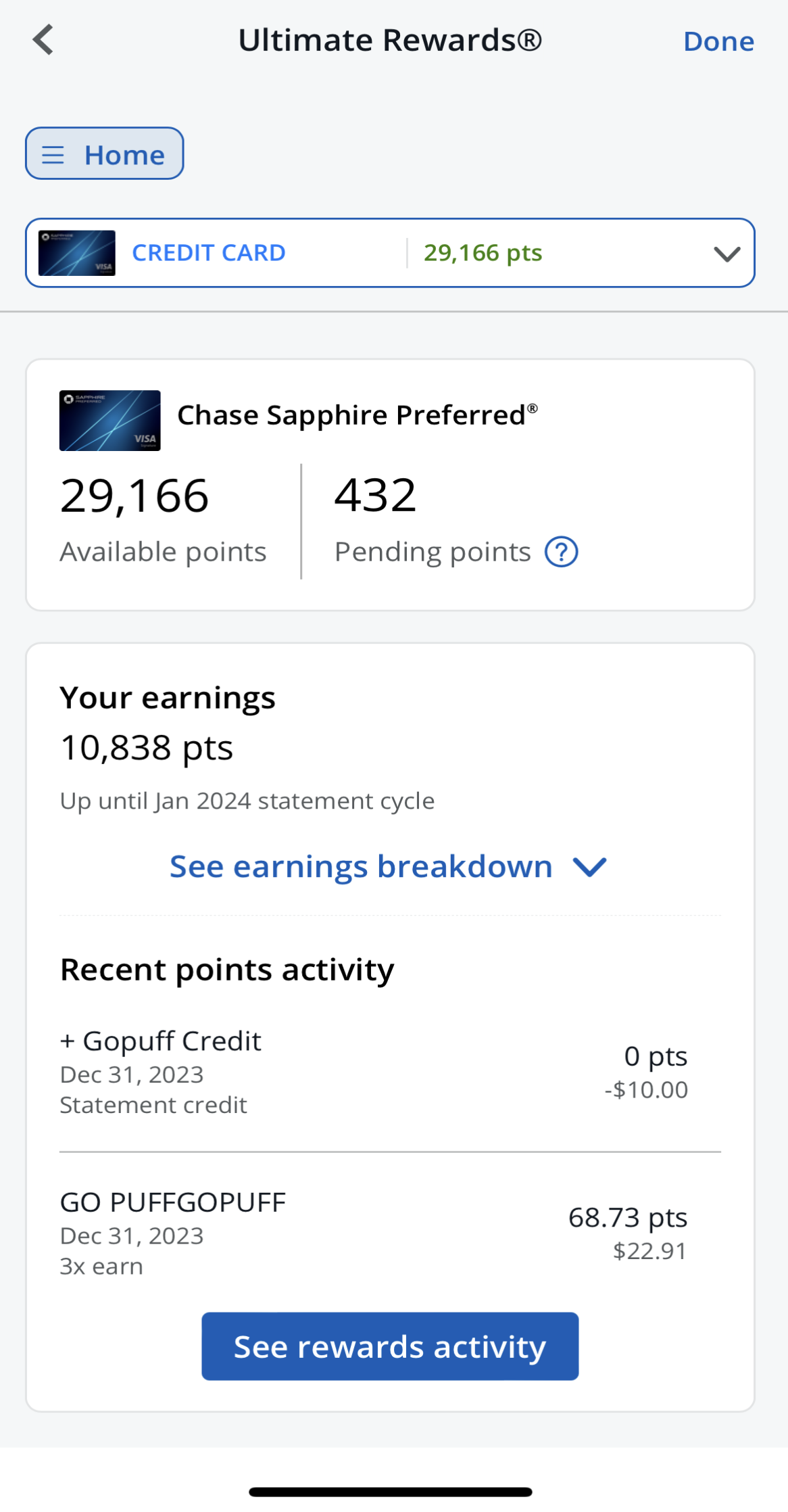

What is the Chase Sapphire Preferred?

The Chase Sapphire Preferred is also a great card for travelers, offering various travel perks and one of the best credit cards for travel.

The annual fee on the Chase Sapphire Preferred is lower than that of the Amex Gold, but you can still enjoy excellent rewards. One major advantage of the Chase Sapphire Preferred is that it allows balance transfers.

If you’re looking for a card that offers solid rewards and the flexibility to transfer balances, the Chase Sapphire Preferred is definitely worth considering.

General Comparison

|

| |

|---|---|---|

American Express® Gold Card | Chase Sapphire Preferred® Card | |

Annual Fee | $325. See Rates and Fees. | $95

|

Rewards | 4X points at restaurants (including Uber Eats purchases in the U.S.) and U.S. supermarkets (up to $25,000 per year in purchases, then 1X points), 3X points on flights booked directly with airlines or on amextravel.com, 2X points on rental cars through amextravel.com and 1X points on all other purchases. Terms Apply. | 5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

|

Welcome bonus | 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. | 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening |

0% Intro APR | N/A | N/A

|

Foreign Transaction Fee | None. See Rates and Fees. | $0 |

Purchase APR | See Pay Over Time APR | N/A

|

Read Review | Read Review |

Compare Rewards: Which Card Gives More?

The Amex gold card is much more relevant when it comes to everyday spending. The high rewards rate on restaurants and U.S. supermarkets makes it best for everyday spending.

On the other hand, the Sapphire Preferred card is best for travelers and those looking for a travel card more than an everyday one. Every purchase via Chase Ultimate rewards can significantly increase your earnings.

|

| |

|---|---|---|

Spend Per Category | American Express® Gold Card | Chase Sapphire Preferred® Card |

$15,000 – U.S Supermarkets | 60,000 points | 45,000 points |

$5,000 – Restaurants | 20,000 points | 10,000 points |

$4,000 – Hotels | 4,000 points | 20,000 points |

$3,000 – Airline

| 9,000 points | 15,000 points |

$4,000 – Gas | 4,000 points | 4,000 points |

Total Points | 97,000 points | 94,000 points |

Estimated Redemption Value | 1 point ~ 0.6 – 1.6 cents | 1 point ~ 1 – 1.25 cents |

Estimated Annual Value | $582 – $1,552 | $940 – $1,175 |

Editorial Note: Terms apply to American Express benefits and offers. Enrollments may be required for select benefits. Visit americanexpress.com to learn more

There are main ways to redeem Amex Gold and Chase Preferred points:

Compare Requirements: How Hard Is To Get Them?

The Amex Gold card is available for those with good to excellent credit, while the Chase Sapphire Preferred requires excellent credit. This means that you will need to have a minimum FICO score of at least 670.

Additionally, American Express and Chase will check your income-to-debt ratio, credit utilization, and other factors to determine your eligibility.

If you are interested in either card, you can apply online via the official American Express or Chase website. However, both companies offer pre-approval. So, if you’re unsure if you would qualify, you can complete the pre-approval form on the website without impacting your credit. You can also check your credit score:

Which Card Costs You More?

There are some crucial differences between the fees and charges for these cards. The most obvious difference is the annual fee. While the Chase Sapphire Preferred has a reasonable $95 annual fee, the Amex Gold annual fee is $325.

Both cards have no foreign transaction fees, and while Amex does not allow balance transfers, Chase applies a 3% fee to balance transfers. The rates are determined by your credit profile, but the typical range for both cards is very similar.

Since the day to day charges on the cards are so similar, it is the annual fee that is the deciding factor on which card costs more. Since the Amex Gold has a higher annual fee, it means that it is the more costly card.

Compare The Perks

Amex Gold | Chase Sapphire Preferred |

|---|---|

Uber Credit | Anniversary Statement Credit |

Dining Credit | Travel Bonus |

Baggage Insurance |

Anniversary Bonus |

Global Assist Hotline | Trip Cancelation and Interruption Insurance |

Car Rental Coverage | Baggage Delay Cover |

Signature Perks | Rental Car Coverage |

Purchase Protections | |

DoorDash Perks/Lyft Rides/GoPuff Credit | |

Emergency and Travel Assistance |

American Express Gold Card

- Get $120 Uber Credit: Connect your Amex Gold Card to your Uber account for a monthly $10 Uber Cash bonus. Use it for Uber rides or UberEats orders, with a maximum yearly value of $120.

- Enjoy $120 Dining Credit: Elevate your dining with the Amex Gold Card. Get up to $10 in statement credit monthly when dining at places like The Cheesecake Factory, Wine.com, Goldbelly, Shake Shack, and Milk Bar.

- Score $100 Experience Credit: Book The Hotel Collection through Amex Travel for a getaway of at least two nights and get a $100 experience credit. The value varies based on your chosen property.

- Amex Entertainment: Dive into exclusive experiences and get presale tickets for concerts, sports, and theater events through the Amex Gold Card Entertainment Access program. Availability varies.

- Travel Easy with Global Entry or TSA PreCheck® Credit: Get up to $100 for Global Entry or up to $85 for TSA PreCheck to breeze through airport security.

- Luxury Hotel Perks: Enjoy premium stays with the Amex Fine Hotels & Resorts program. Get perks like room upgrades, complimentary nights, and daily breakfast for two at participating hotels.

- Top-Notch Concierge Service: Access the Amex Gold Card's concierge service for help with travel and dining reservations, though availability may limit its ability to fulfill all requests.

Terms apply to American Express benefits and offers.

Chase Sapphire Preferred® Card

- Anniversary Statement Credit: You can earn up to $50 per anniversary year in statement credit for hotel stays that you purchased via the Chase Ultimate Rewards portal.

- Travel Bonus: You can receive 25% more value when you redeem your reward points for travel via the Chase Ultimate Rewards portal.

- Anniversary Bonus: Chase gives a 10% anniversary bonus on your total purchases from your previous year. This means that if you earned 20,000 points across year one, you would get a 2,000 point bonus in year two.

- DoorDash Perks: When you register, you can get a one year DoorDash subscription. Your DashPass will offer reduced services fees and $0 delivery fees on orders over $12.

- Lyft Rides: You’ll earn additional points on Lyft rides for the promotional period, which currently ends March 2025.

- Instacart+ Subscription: Instacart allows you to have your groceries delivered to your door. When you link your card, you can receive six months of Instacart+ for free, and as an Instacart+ member, you can earn up to $15 in statement credit per quarter until July 2024.

- GoPuff Credit: You can receive up to $10 in statement credit per month when you order snacks, drinks and household essentials to your doorstep using your card. This promotion is in place until December 2023.

Top Offers

Top Offers

Top Offers From Our Partners

Redemption Options

From elevated travel experiences and exclusive entertainment perks to the flexibility of cash back and statement credits, the American Express Gold Card and Chase Sapphire Preferred bring a wealth of options to cater to your unique preferences.

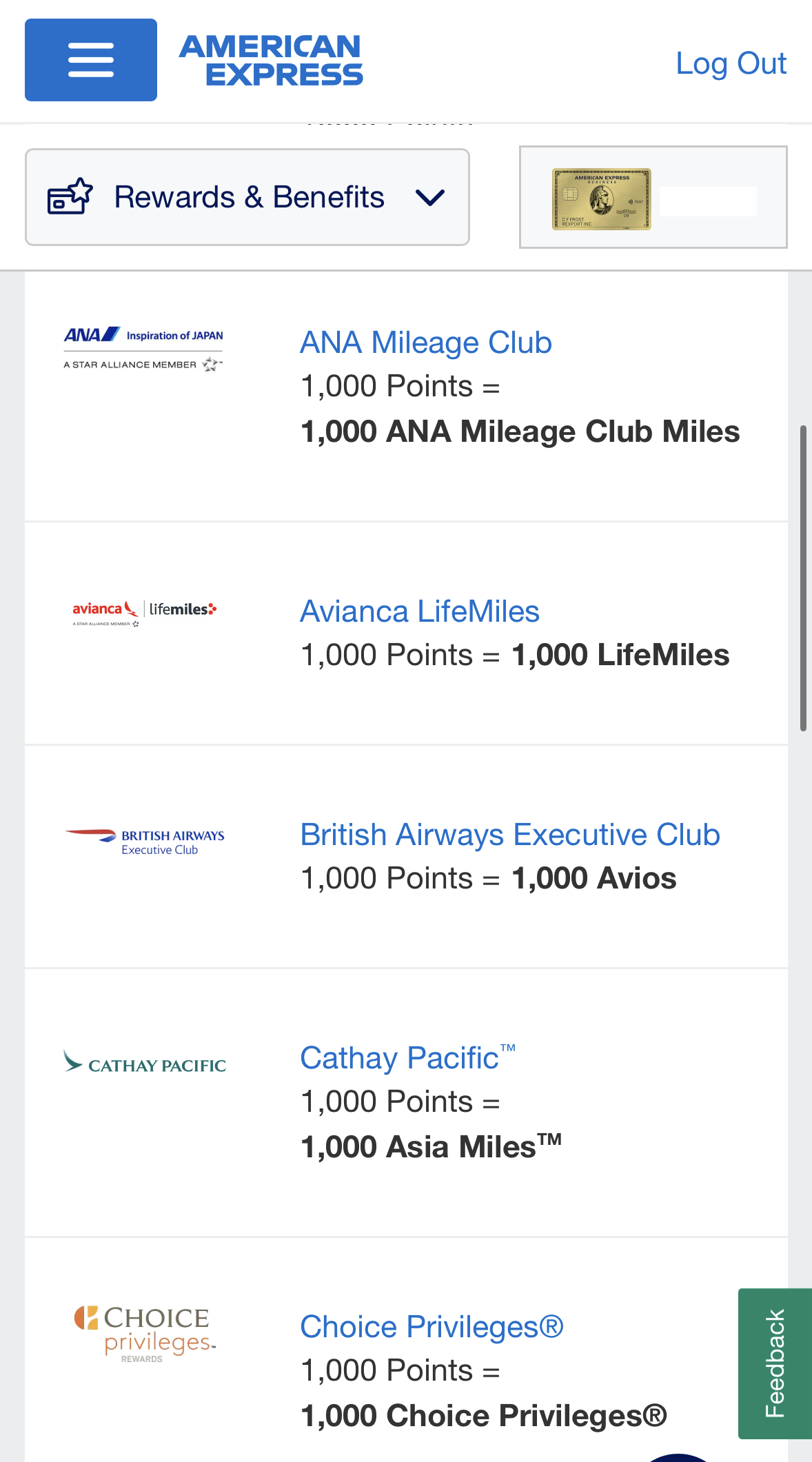

- American Express Gold Card

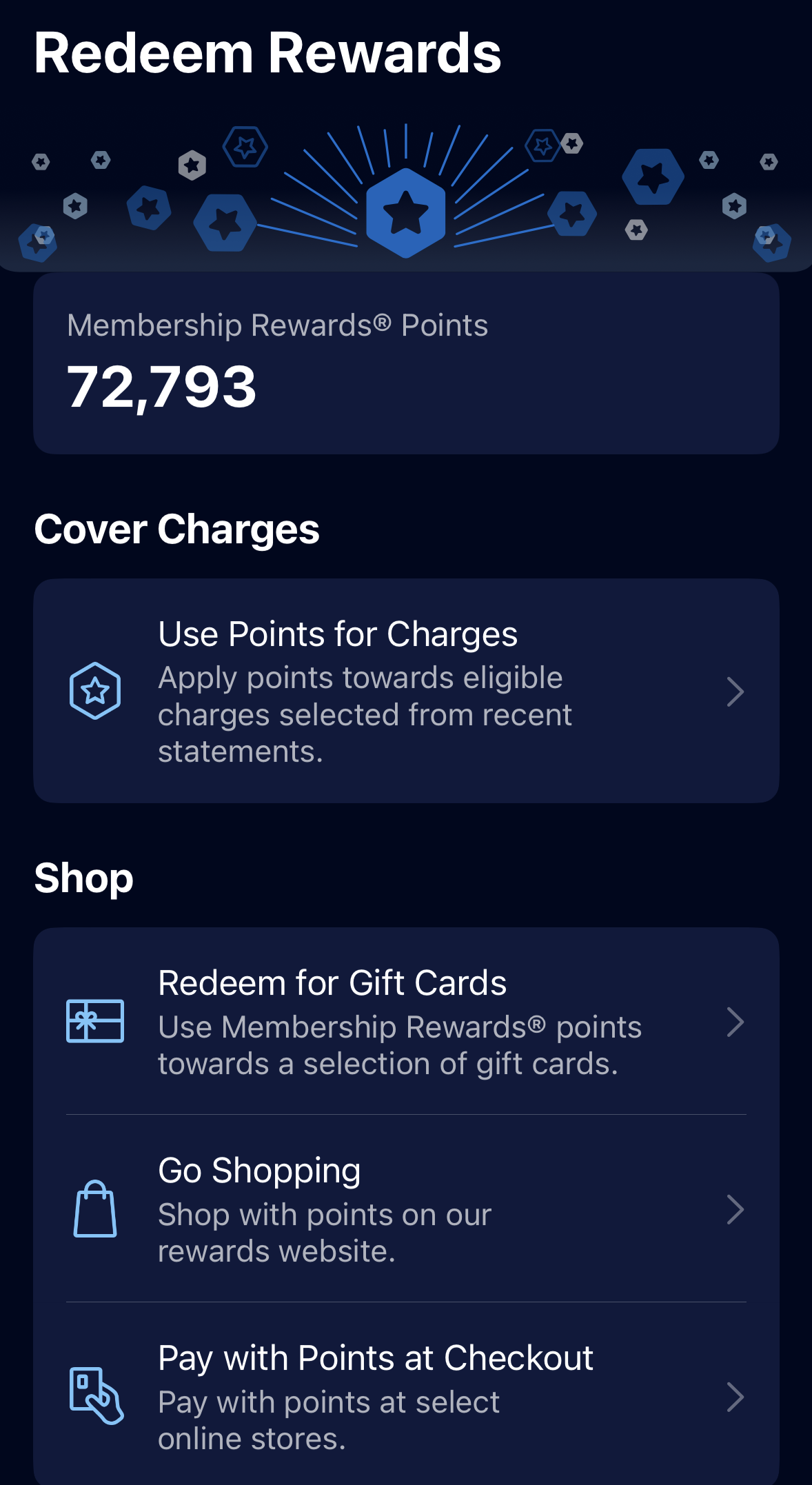

The Amex Gold card provides a range of ways to redeem your points through the Amex Membership Rewards program:

Travel Redemptions: Use points to book flights, hotels, or car rentals through the Amex travel portal.

Transfer Partners: Transfer points to airline or hotel partners for potentially more value and flexibility.

Statement Credits: Redeem points for statement credits to offset eligible purchases.

Gift Cards: Swap points for gift cards from various retailers and restaurants.

Shopping: Use points to purchase merchandise or services directly through the Membership Rewards portal.

Experiences: Redeem points for exclusive experiences or events.

- Chase Sapphire Preferred® Card

Here are the main options when you want to redeem Chase Sapphire Preferred® Card points:

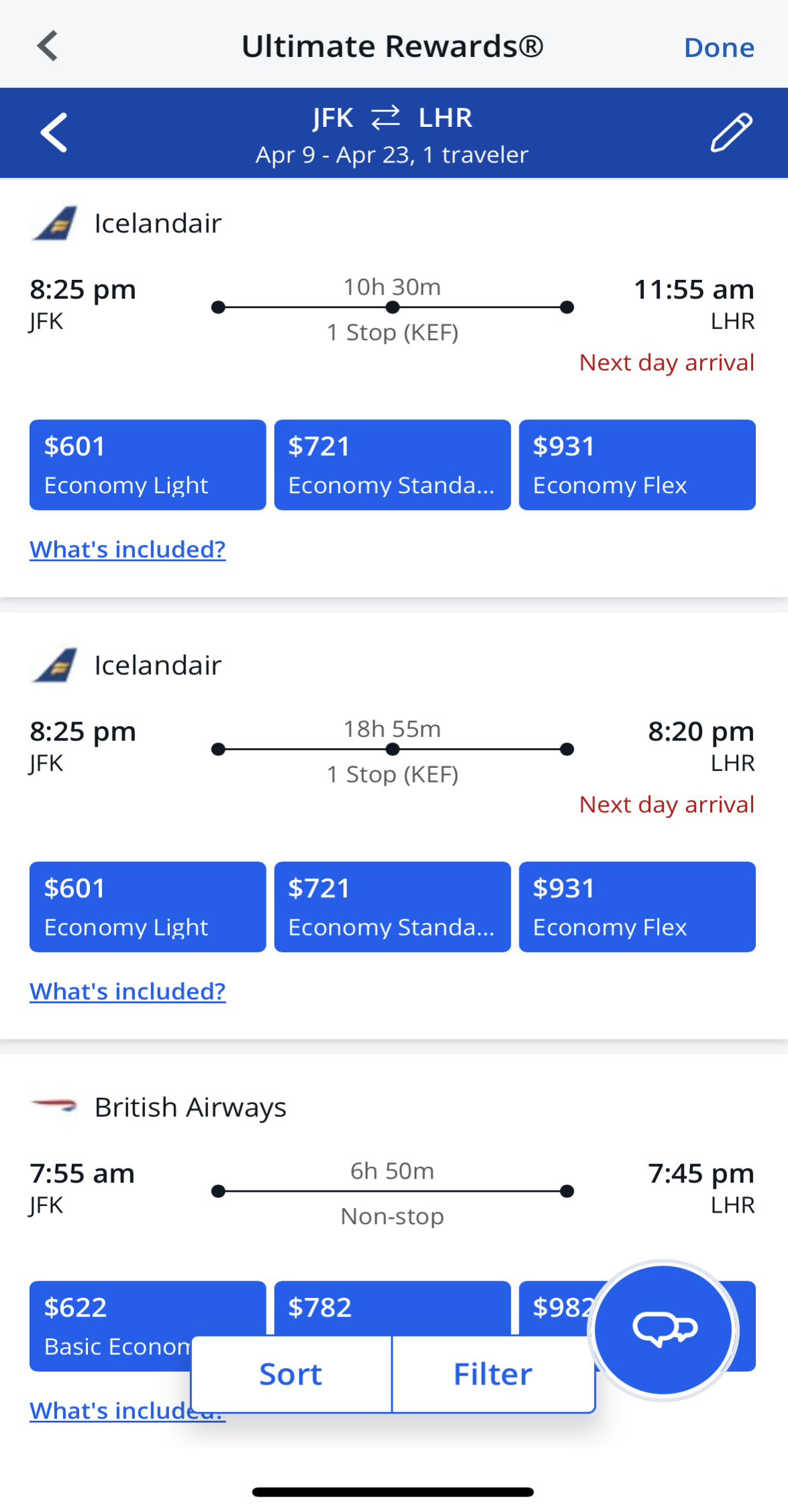

Travel Portal: Use points to book flights, hotels, and car rentals through the Chase Ultimate Rewards travel portal.

Transfer Partners: Transfer points to airline or hotel partners for increased value and flexibility.

Cash Back: Redeem points for cash back as a statement credit or direct deposit.

Gift Cards: Exchange points for gift cards from a selection of retailers and restaurants.

Amazon and Apple Purchases: Use points to make purchases on Amazon or through the Apple Ultimate Rewards Store.

Pay Yourself Back: Redeem points for statement credits against eligible purchases in select categories.

How To Maximize Card Perks?

American Express Gold Card

- Link Your Uber Account: When you link your Gold card to your Uber account, you can receive up to $10 per month in credit to use for food delivery or rides, up to a maximum of $120 per year.

- Book all Fares With Your Gold Card: If you’re traveling by bus, train or plane, make sure that you use your Gold card to pay for your fares. This will ensure that you have free baggage insurance should any of your bags be lost, damaged or stolen.

- Consult the Dining Partner List: If you are in the mood to eat out but don’t have a particular restaurant in mind, be sure to consult the dining partner list. Amex has a list of participating partners and when you make purchases at these restaurants with your card, you can get up to $10 of statement credit per month.

Terms apply to American Express benefits and offers.

Chase Sapphire Preferred® Card

- Book All Your Travel Via Chase: As we touched on earlier, you’ll get the maximum rewards and maximum redemption rates via the Chase travel portal. So, if you’re planning any travel, be sure to check the flights, fares and hotels on the platform for your chosen dates and destination.

- Check the Extended Warranty Protection: This coverage is only available for certain eligible products, but if you’re planning a major purchase, it could save you plenty of cash compared to buying an extended warranty from the retailer.

- Link all Your Subscriptions: Your Sapphire Preferred perks package includes benefits with DoorDash, Lyft, Instacart and GoPuff. So, if you don’t already use these services, sign up as soon as possible. Linking your card with your subscription accounts can offer statement credit and other freebies that will maximize the potential of your new card.

Customer Reviews: Which Card Wins?

American Express® Gold Card | Chase Sapphire Preferred® | |

|---|---|---|

App Rating (iOS)

| 4.9 | 4.8 |

App Rating (Android) | 4.2 | 4.4 |

BBB Rating (A-F) | A+ | B+ |

WalletHub | 4 | 4 |

Contect Options | phone/social | phone/social |

Availability | 24/7 | 7 AM – 11 PM |

Generally, the Amex Gold card has a solid reputation as one of the generous Amex cards. Many customers appreciate the possibility of earning very high rewards with everyday spending. With the rising cost of groceries, having this as a top-tier reward category will help to offset the price increases.

Other positive reviews highlight the sheer variety of redemption partners and the generous welcome bonus if you meet the achievable spending requirement.

The Chase Sapphire Preferred card is particularly praised for its traveler benefits and rewards. The card offers some decent travel insurance coverages, and you can earn great rewards using the Chase travel portal. Considering the modest annual fee, the insurance alone should offset the cost even if you’re not a frequent traveler.

However, there are some negative reviews about the standard of customer service from Chase Travel. Since this is a third-party company, consumers often find the experience of trying to resolve an issue quite frustrating.

When You Might Want the Amex Gold Card?

The Amex Gold card may be a good option for you if:

- You travel regularly. If you’re happy paying for your fare with your Gold card, you can get a higher tier reward on your flights and also benefit from baggage insurance. Additionally, since the card has no foreign transaction fees, you can use it when you’re away from home. If you are willing to pay an annual fee and much better rewards, compare it with the Platinum Card® From American Express.

- You enjoy dining out: Restaurants and other dining purchases are in the top reward tier, so this card is a great option for foodies. There is also statement credit when you dine with some of the participating partners.

- You enjoy a finer travel experience: As an Amex Gold cardholder, you can access the signature perks from the Amex Hotel Collection. This provides access to preferred seating, upgrades at upscale hotels and more to take your vacation to the next level.

Top Offers

Top Offers From Our Partners

When the Chase Sapphire Reserve Card Wins?

The Chase Sapphire Preferred card is also a flexible option that may appeal to you if:

- You are comfortable using the Chase Travel Portal: The Chase Travel Portal will provide the highest tier rewards and the best points redemption values. So, if you are comfortable using the platform, which works like Expedia and other travel portals, you can get the best value from your card. If you are willing to pay an annual fee and much better rewards, compare it with the Reserve Card.

- You’re a frequent traveler: While the card does not have lounge access, it has various travel perks that frequent travelers are sure to appreciate, particularly since the card has a modest annual fee.

- You enjoy subscription services: This is a great card option for you if you want to get products and services delivered to your door. From high-tier rewards for certain streaming services to perks from DoorDash, Instacart, and more, you’ll find this card offers some excellent benefits.

Compare The Alternatives

Both cards are definitely considered as one of the best in the niche. However, there are always recommended alternatives to check out before applying:

|

|

| |

|---|---|---|---|

The Platinum Card® from American Express | Chase Sapphire Reserve® | Capital One Venture X Rewards | |

Annual Fee | $695. See Rates & Fees | $550 | $395 |

Rewards |

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

| 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

Welcome bonus |

175,000 points

175,000 Membership Rewards® Points after spending $8,000 in eligible purchases on your new Card in your first 6 months of Membership

|

Earn 125,000 points after you spend $6,000 in purchases in the first 3 months from account opening

Earn 125,000 points after you spend $6,000 in purchases in the first 3 months from account opening

| 75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

|

Foreign Transaction Fee | $0. See Rates & Fees | $0 | $0

|

Purchase APR | See Pay Over Time APR | 19.99%–28.49% variable

| 19.99% – 28.99% (Variable)

|

Compare Chase Sapphire Preferred

When it comes to the annual fee, there is a clear winner. But is it worth the exclusive travel rewards you'll get? Here's our analysis.

When it comes to travel benefits, there is a clear winner. But what about if you're looking for rewards on everyday spending?

Amex Blue Cash Preferred vs Chase Sapphire Preferred: Which Card Is Best?

While the Chase Sapphire Preferred Card has more benefits, the Capital One Venture card offers unique features. Which travel card is better?

Capital One Venture vs Chase Sapphire Preferred: Which Card Is Best?

The Chase Sapphire Preferred offers better travel perks and protections, but unlike the Autograph card – you'll need to pay an annual fee.

Wells Fargo Autograph Vs. Chase Sapphire Preferred: Which Card Is Best?

The Chase Sapphire Preferred offers costs more and offer more benefits than the Freedom Unlimited. Is it worth the annual fee?

Chase Freedom Unlimited Vs. Sapphire Preferred: Compare Side By Side

The Chase Sapphire Preferred is more versatile and offers better travel rewards than the Explorer card. But what if you're loyal to United?

United Explorer Card vs Chase Sapphire Preferred: Side By Side Comparison

The Venture X card offers better travel perks than the Sapphire Preferred, such as annual credit and lounge access. But is it worth the fee?

Capital One Venture X vs. Chase Sapphire Preferred: Comparison

The Marriott Boundless offers great perks for Marriot lovers, while the Preferred card wins when it comes to general travel-related rewards.

Marriott Bonvoy Boundless vs. Chase Sapphire Preferred: Comparison

The Capital One Savor is better for everyday spending, but the Chase Preferred card is the winner when it comes to travel and protections.

Chase Preferred card is the clear winner as it offers better travel rewards than the BofA Premium Rewards and variety of travel protections

Bank of America Premium Rewards vs. Chase Sapphire Preferred: Which Card Wins

While the Chase Sapphire Preferred is our winner due to its various perks, the Aeroplan card offers high cashback value and airline perks.

Chase Sapphire Preferred vs. Air Canada Aeroplan Card: How They Compare?

The Chase Sapphire Preferred is our winner due to its higher annual cashback value and various redemption options compared to Alaska card

Chase Sapphire Preferred vs. Alaska Airlines Visa Signature Card: How They Compare?

While we really like both cards, the Chase Sapphire Preferred is our winner due to its diverse redemption options and high rewards rate.

Chase Sapphire Preferred vs. JetBlue Plus Card: Side By Side Comparison

Compare American Express Gold Card

If you're looking for everyday spending rewards, the Amex Gold Card offers more. But for travel rewards benefits, there is a clear winner.

The Amex Gold Card may be more appealing if you dine out frequently and value premium travel perks than the Apple card.

While the Amex Gold Card is more expensive than the Blue Cash Preferred, its rewards program and other benefits are more lucrative.

The Autograph is great for travelers who want to stay on budget, while Amex Gold provides premium travel benefits and redemption options.

If you're a dedicated Delta traveler, the Delta SkyMiles Gold may be your top pick, while the Amex Gold offers a broader range of benefits.

While Amex Gold Card offers statements credits and everyday spending benefits, the Venture card is cheaper and include decent travel perks.

The Venture X offers better travel rewards than the Amex Gold but is less appealing if you're looking for everyday spending rewards.

Amex Gold Card vs. Capital One Venture X : Which Premium Card Is Best?

The Amex Gold Card focused on everyday spending and general travel rewards, the Delta SkyMiles Reserve Card offer premium airline benefits.

Amex Gold Card vs. Delta SkyMiles Reserve: Side By Side Comparison

The Freedom Unlimited beckons with its cash-back rewards, but the Amex Gold exudes luxury, boasting robust rewards on dining and groceries.

Chase Freedom Unlimited vs. Amex Gold Card: Which Card Wins?

The Amex Gold Card focuses on everyday spending rewards, while the Delta SkyMiles Platinum is tailored for frequent Delta travelers.

Amex Gold Card vs. Delta SkyMiles Platinum: Side By Side Comparison

The Hilton Honors Surpass wins at estimated cashback, while the Amex Gold card is the winner for everyday spending and extra benefits.

If you're looking for travel rewards, there is a clear winner. But what about if you're looking for rewards on everyday spending?

American Express Gold Card vs Chase Sapphire Reserve: Which Premium Card Is Best?

Related Posts

Review Travel Credit Cards

- Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.